In this post I will publish the results of the homework given by professor @reddileep.

1- Define VuManChu Cipher B Indicator in your own words.

For a trader, using technical analysis before starting a trade is a must. And most traders will also carry out technical analysis by combining several indicators at once to get the perfect result. However, there are also several technical indicators that were developed by combining several indicators at once to become a single indicator, one of which is the VuManChu Chiper B indicator.

VuManChu Chiper B is a very unique indicator, because it is a combination of RSI, Money Flow, Volume, Momentum and signal divergence. Basically, this indicator was created because it was inspired by the Market Cipher B indicator. But to be able to use Market Cipher B we have to pay for it first, yes it is a premium indicator.

VuManChu Cipher B has a clear resemblance to Market Cipher B, but this VuManChu is a free version that can be used by anyone. Even this indicator is designed in an open source manner which makes it easier for traders to access.

The main focus of VuManChu Chiper B is detecting trend waves, so this indicator can show us impulse waves. So this indicator can be used to predict the direction of the trend, uptrend or downtrend in a variety of different time frames, so this indicator is very useful for various types of trading strategies.

At first glance the indicator looks very attractive with different colors, but this becomes a hassle for novice traders. This is not the case for traders who are used to this, because this indicator is very useful for reading trends, confirming signals, and also determining entry and exit points.

This indicator can also be customized according to the needs of the trader, so that the indicator can be used in various time frames and can also be used for various types of trading as mentioned earlier.

2- How to customize the VuManChu Cipher B Indicator according to our requirements? (Screenshots required)

Added Indicators VuManChu Chiper B

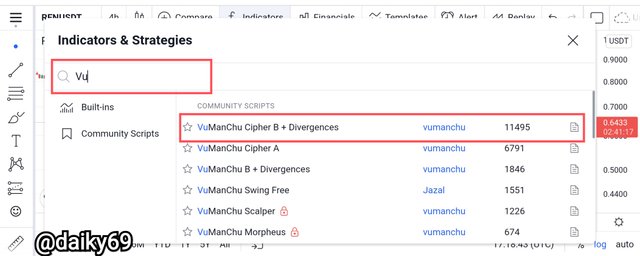

Now we have to add the VuManChu Chiper B indicator to the chart so that we can customize it, the steps are quite simple.

First we have to go to TradingView, then go straight to the chart. For the steps to add an indicator, we just need to click on the indicator.

Then a list of indicator options will appear that we can choose from, if VuManChu Chiper B is not there, then we have to look for it by typing the name of VU in the search field. When the VuManChu indicator is visible, then click on the indicator to add it to the chart.

Next, for indicator adjustment or configuration. We have to click on settings first on the VuManChu Chiper B indicator.

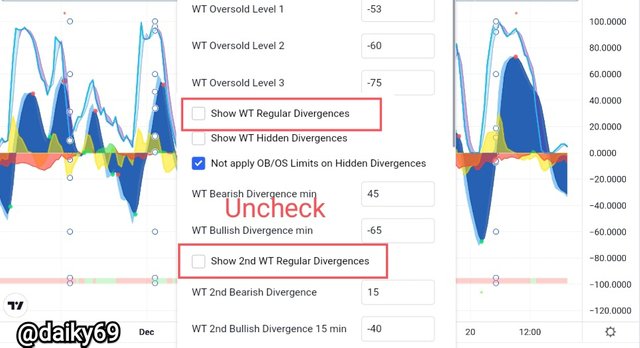

Indicator configuration

In the inputs menu, I will uncheck "Show WT Regular divergences", and also "Show 2nd WT Regular Divergences". Because it will not use divergence signals, so we will omit this option to make the indicator easier to understand.

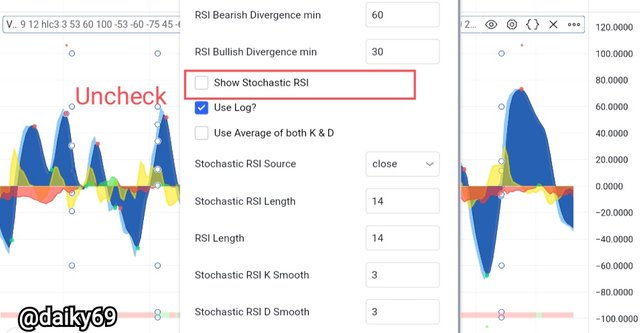

Next, we will also uncheck "Show Stochastic RSI", this is an option to see the current market phase, so I don't think we really need this.

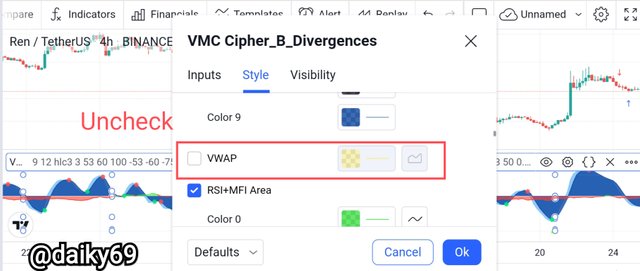

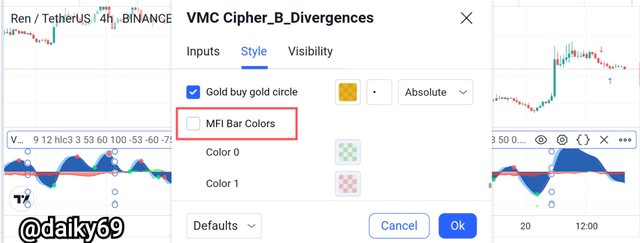

We will now move on to the "Style" setting, the one we will uncheck here is "VWAP", which is a move that we won't be using in this analysis.

Finally we will also uncheck the "MFI Bar Colors" checkbox. This color I think is not very important in the analysis.

Now we have got the VuManChu Chiper B indicator in a simpler form, making it easier to read signals from this indicator.

3- Explain the appearance of the VuManChu Cipher B Indicator through screenshots. (You should Highlight each important part of this indicator by explaining their purpose)

Now we will highlight some parts of the VuManChu Chiper B indicator, because if we don't understand the signals that are on the indicator, then this will be a failure for us.

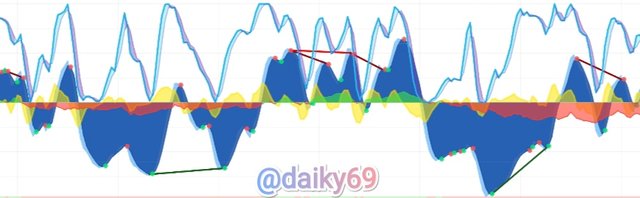

Wave Trend

The first thing to highlight about this indicator is the impulse wave of the indicator, basically it is also an indicator adopted from the Trend Wave. So that we can highlight the impulse waves present on the indicator in dark blue and light blue. The signals generated from these two colors are uptrend and downtrend.

Red and Green Dot

Next we are also faced with red and green dots. The dots show market changes, where the red dots indicate the market is going to go down soon. While the green dot indicates the market will rise again. These are two uptrend and downtrend signals that we can refer to as entry and exit points in the market.

Lastly, Money Flow Cloud

This cloud is the presence of money in an asset, if the Money flow cloud is red then this indicates an exit from the asset market. However, the color of the money flows cloud is green, so this indicates an entry into the asset market. In simple terms this can be understood as the flow of money flowing in the asset, the red color indicates money is out of the market or in other words an asset sale is taking place. While the green color represents the entry of money into the market, in other words, people are buying the asset.

Thus, we can say that the green color of the money flows cloud is a sign that the market is in a bullish state. While the red color of the money flows cloud is a signal or a sign that the market is in a bearish state.

4- Demonstrate your preparation for the Trading Strategy combining other indicators. (Instead of showing the addition of indicators to the chart, you should explain the purpose of each indicator for this trading strategy.)

A trader is always recommended to do a technical analysis first before starting to trade, besides that we are also recommended to use several indicators at once to do the analysis, because it is not uncommon for indicators to give false signals.

Therefore, we will use the help of the Exponential Moving Average (EMA) indicator to confirm the signal generated by the VuManChu Chiper B indicator. As we know that the EMA indicator is an indicator that shows the average price movement of an asset, as well as a trend reversal signal. by combining two EMAs at once with different periods.

By combining these two indicators, we can do extra confirmation on the signal generated by one of the indicators, so that we can filter out false signals. For that, pay attention to the chart below so that I can explain in more detail my trading strategy using these two indicators.

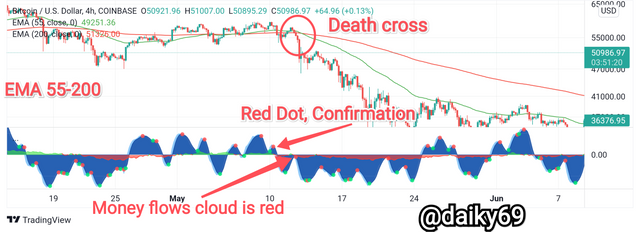

When the EMA crosses over a shorter period to a longer one, this is a signal of a trend change from bullish to bearish. Therefore, if the individual VuManChu Chiper B marks it with a red dot, then this signal is very valid. Coupled with the red money flows cloud, it will strengthen the bearish signal that will take effect soon. The opposite holds true for bullish signals marked by the green dot on the VuManChu Chiper B and the EMA-55 cross above the EMA-200.

5- Graphically explain how to use VuManChu Cipher B Indicator for Successful Trading. (Screenshots required)

To be able to make successful trades with the VuManChu Chiper B indicator, we must pay attention to the points that I have mentioned above. In short, we have to wait for the death cross signal especially on the EMA indicator, then if it is confirmed by the VuManChu Chiper B Indicator with a red dot and the money flow cloud turns red, then a sell order should be placed immediately.

For buy orders, we can wait for the death cross signal first on the EMA indicator, then wait for confirmation with the green dot on VuManChu Chiper B and the money flows cloud turns green, then immediately place a buy order. For more details, take a look at the graph below.

Buy order

First, wait for the death cross signal on the EMA then if it is confirmed by VuManChu Chiper B with a green dot (or vice versa, a green dot especially after a death cross has just occurred) and the money flow cloud is green, then it's a good time to place an order.

In the chart above, I have illustrated how to trade using a combination of the VuManChu Chiper B and EMA indicators. It can be seen that the EMA-55 crossed above the EMA-200, then a green dot was seen on VuManChu Chiper B with green money flows cloud. Buy orders should be placed immediately after receiving a confirmation signal from the indicator. If a red dot is seen, then immediately exit the market, it is the right take profit point. Stop loss should be placed slightly below the EMA line which is dynamic support.

Sell order

The opposite applies when we are dealing with sell orders. If the EMA-55 drops below the EMA-200 which is confirmed by the red dot on VuManChu and the Money flow cloud is red, then a sell order should be placed immediately.

As an illustration, we can see in the graph above that the death cross occurred with a red dot confirmation on VuManChu Chiper B and also a red money flow cloud. Orders should be placed immediately after receiving a confirmation signal from the indicator. We must immediately exit the market if we have involved green dot on VuManChu, or in other words this is a take profit point. The stop loss should be placed slightly above the EMA line because it is a dynamic resistance level.

6- Using the knowledge gained from previous lessons, do a better Technical Analysis combining this trading Strategy and make a real buy or sell order in a verified exchange. (You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines or any other trading pattern)

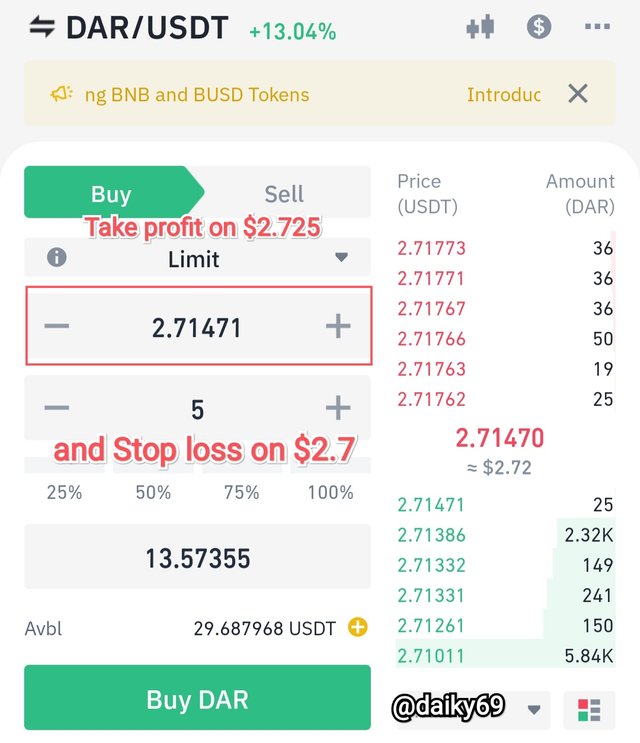

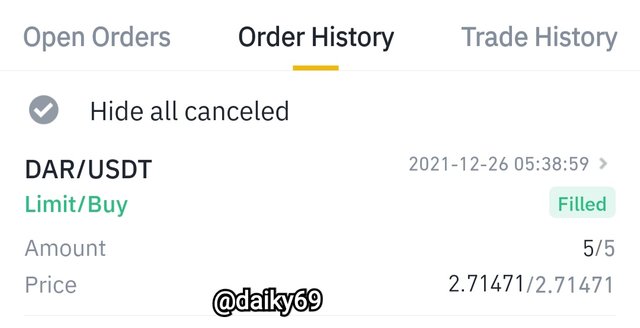

Alright, to do this task I chose DAR/USDT to make real purchases on the binance app. But before I make a purchase, I have to first analyze the token to get valid signals to enter the trade.

I saw a death cross that occurred in the DAR token some time ago, and it was confirmed by VuManChu with a green dot, then a red dot was seen but not long after that the green dot reappeared.

After two candles formed after the green dot appeared, I immediately placed a buy order, or rather at $2.71471, because I chose the short term so I used a 1:1 risk ratio. So I will place Take profit at the level of $2,725 and stop loss at $2.7.

If I want to follow the instructions from VuManChu or the EMA, then I should place my stop loss at a dynamic support level, which is exactly at the EMA-200 line. But because I have to hunt for time to complete this task, then I do not take the risk.

Only until here is our meeting in my post this time, I apologize for all the shortcomings of this post. Because some time ago I had a little incident on the highway so I had to catch up on time to complete this task. A big thank you to professor @reddileep who has given us his knowledge.