Hello everyone, this is week 2 of season 4 of Steemit Crypto Academy. It's a shame I'm a little late in doing the assignment given by professor @reminiscence01, even though his lessons this week are very good and useful for all of us. So on this occasion, I will do my homework from professor @reminiscence01 as best I can.

1)A.- Explain Technical indicators and why it is a good technical analysis tool

Maybe most people are very familiar with the word technical indicators, but not for some people who are new to the cryptocurrency market, stocks or other financial markets. Long before the cryptocurrency market existed, the word technical indicators was very familiar among financial market investors and traders.

Technical indicators are often used because they are able to provide statistical images such as graphics and mathematical formulas to read trends, price movement patterns and trading volume over time. Technical indicators will also describe the movement of the market that is in a buy position or a sell position that has not been closed in the derivatives market.

By taking advantage of the use of technical indicators, traders can read market conditions and the future price of an asset. This is done in order to be able to determine the right time to enter or exit on the market for a particular asset, be it crypto, stocks, or other financial markets. Although not all results presented by technical indicators are 100% accurate, at least this tool can help traders or investor for trading

Technical indicators work by collecting and processing historical data on the price of an asset in the past to predict the price of that asset in the future, because basically market conditions always repeat, this is based on market psychology and trading psychology which makes market conditions repeat.

1)B.- Are technical indicators good for cryptocurrency analysis?

Obviously this is very good for cryptocurrency analysis, millions of people have proven that decision making using technical indicator analysis is better than without using them. As the saying goes in my area, "It's better to squint/strabismus than the blind eye", meaning what, it's better to trade with help than without help even though the help it's not 100% accurate.

The use of signals given by technical indicators maybe right and wrong, this is understandable because this is only a tool to help us in trading. Professional traders always use indicators in trading, this proves the need for indicators for decision making in the cryptocurrency market. As with earthquake, weather, and so on, sometimes these tools are able to predict correctly or incorrectly, but our need for these tools is undeniable, as well as technical indicators.

1)C.- Illustrate how to add indicators on the chart and also how to configure them

To add indicators to the charts, the first thing we have to do is of course open the site TradingView, or you can use charts provided by other sites, I personally use charts from TradingView. After opening the TradingView site, click on the chart it will appear as shown below.

Step 1:- Click on the indicator as shown in the image.

Step 2:- Select the indicator you want to add, for convenience we can write the name of the indicator, then click on the indicator to add it to the chart.

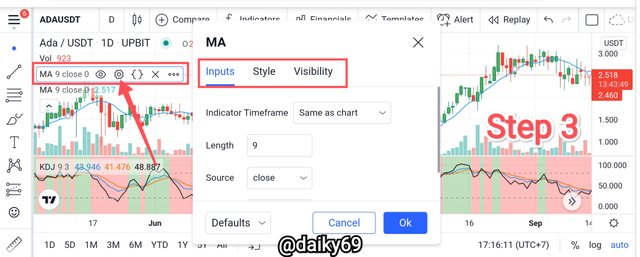

Step 3:- To configure, Click the ring gear logo like on the screenshot.

Then a pop up menu will appear that displays inputs, styles, and visibility. We can adjust as desired, be it in inputs, style, and visibility. Or we can also add other indicators to the charts and also configure as needed.

2)A.- Explain the different categories of Technical indicators and give an example of each category. Also, show the indicators used as an example on your chart

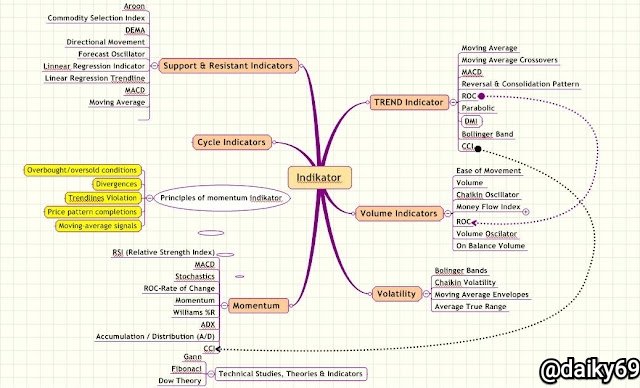

Broadly speaking, technical indicators are divided into three parts, indicators to read the direction of the trend, indicators to read momentum, and finally volatility indicators.

There is a bullish trend and a bearish trend in the cryptocurrency market, if there is no trend then the market is sideways. Now there are several indicators that specifically predict the direction of the trend, indicators like this are commonly used to identify the beginning and end of a trend or when a trend will change direction.

In this way, traders can identify the best time to enter the market, whether in terms of buying or selling. There are many indicators based, call it the Simple Moving Average (SMA) indicator, the Average Directional Index (ADX), and many more.

In the example above, it can be ascertained that the ADA coin is sideways, meaning that there is no trend. We can say the coin is in a strong trend if the ADX line is between 25-100, but if the ADX line is below 25, this indicates that it is not trending or is weak. Because ADX gives a scale of 0-100 in reading the trend, if the line is on a scale of 0-25 indicating no trend or weakness, 25-50 strong and so on until very strong.

In the cryptocurrency market, there is sometimes a momentum to sell or buy crypto coins. As was the case some time ago when almost all crypto assets recorded all-time highs, this happened because of excessive market euphoria that made the market overbought. Or it could be oversold when some people withdraw from crypto ownership due to state regulations or so on as happened in China some time ago.

We can identify oversold or overbought situations to gain momentum by using some momentum based indicators or oscillators. Another plus, this indicator can also be used to analyze a trend that will continue or is getting weaker. There are several indicators that can be used to see momentum in the cryptocurrency market, including the Relative Strength Index (RSI) and Momentum (MOM) or more precisely the Chande Momentum Oscillator.

The RSI indicator has a scale of 0-100, if the RSI value shows 30 below then it is a sign that the market is oversold, while if the value is above 70 then the market is overbought. In the chart I show the RSI value for the ADA/USDT coin is 49.38 which indicates the market has not been overbought or oversold, and there is still a possibility that the market will go up or down again. We can take buying momentum when the coin is oversold and sell it when the coin is overbought.

Cryptocurrency prices are very volatile, so the use of indicators based on Volatility can be used to see market strength in terms of price fluctuations in a certain period of time. The market has high volatility if price movements go up and down sharply or are very volatile and there is a large price difference between the highest and lowest prices. By using an indicator like this, we can predict when the market is in a swing low and a swing high so that we can buy assets at low prices and sell them at high prices, among the volatility indicators, namely Bollinger bands and Average True Range (ATR).

Notice in the chart above, the ATR value of the ADA coin at that time was 0.369 and this value is our reference in determining the stop loss level and can also be used for take profit. 0.369 is the average price range for ADA which is 369 pips, there is a multiplication that is quite complicated to determine the stop loss level but for convenience we just multiply that value by two, namely 369x2 = 738.

For example, if we place a coin sell order at the current position of $2.42, then we can place a stop loss level of 738 pips above $2.42 which is $2.78. Here else, this indicator can also predict price swings, as in the example above the ATR value of ADA is 0.369, it could be that the price of ADA moves up 0.369 pips so that the price becomes $2.78 or moves down 0.369 pips so that it becomes $2.05.

2)B.- Briefly explain the reason why indicators are not advisable to be used as a standalone tool for technical analysis

Each indicator has its own special expertise, making it difficult for traders to make decisions due to the limited data that can be presented by one indicator. All indicators also have advantages and disadvantages, traders are required to be wiser in making decisions so that they use several indicators at once for better results.

If we trade only using the ATR indicator then we will have difficulty determining the current market trend due to the limited data from the ATR indicator, and vice versa so that it requires traders to use several indicators at once to get information and all the necessary data before plunging into the market, this is also aims to get better results. These are some of the reasons why indicators are not recommended to be used as stand-alone tools.

2)C.- Explain how an investor can increase the success rate of a technical indicator signal

Learning from experience and continuously improving skills in using technical indicators is mandatory for investors who increase the success rate of indicator signals. Also by combining several indicators at once to get information and data that is not available on certain indicators.

Investors must also be able to find indicators that are suitable and appropriate for their needs, thus investors can increase the success of an indicator's signal. Configuring the indicator according to its needs is also mandatory if you want the signal to be obtained on the indicator to be more accurate.

By using several indicators at once, investors can determine data that is not found in an indicator. With experience investors can indicate false signals or the right signals to invest. The latter determines the indicators with their needs so that investors do not go wrong in investing so that they can increase the success rate of the signal.

Hello @daiky69, I’m glad you participated in the 2nd week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Great Job!

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit