The cryptocurrency market is showing signs of recovery this week. After Bitcoin tested the $45,000 support on Monday, buyers seized the initiative and once again managed to push the price back above the $48,000 mark.

This reversal brought optimism to the market, sparking hopes about the resumption of an uptrend with the target at $100,000 resistance.

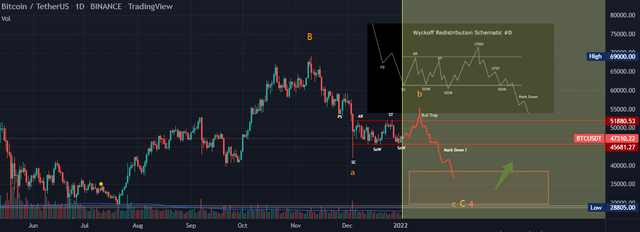

However, if we objectively assess the general market conditions, we'll get a different picture. Since the news backdrop hasn't changed, the current recovery looks more like a correction, which could be followed by another wave in the market sell-off.

The market remains under pressure due to the latest remarks by Gary Gensler, the Chair of the Securities and Exchange Commission (SEC), who said that since cryptocurrency exchanges have direct access to client funds, investors need serious protection.

Market participants interpreted such rhetoric as an intention to tighten the regulation of cryptocurrency exchanges. Later, Federal Reserve Chair Jerome Powell elaborated on this topic, noting,

"Stablecoins can be a useful, efficient, consumer-serving part of the financial system if they're properly regulated"

Pressure on the cryptocurrency market comes from the Federal Reserve Chair's rhetoric alone and from the regulator's actual actions to tighten monetary policy. Let us recall that following the results of the FOMC meeting, which took place last week, the bank's management decided to take a more proactive stance in fighting inflation.

For this purpose, the Fed intends to accelerate its initial tapering schedule and end its bond purchases in March 2022. In addition, most FOMC members said they expected at least three interest rate rises next year, while just three months ago, most of them had projected only one rate hike.

The acceleration in the pace of bond-buying taper, coupled with the high probability of the first-rate hike in the first quarter of 2022, will help the US dollar strengthen its positions against all risky assets, including cryptocurrencies.

In addition, market sentiment deteriorated significantly amid the growing number of new Omicron coronavirus cases worldwide. To prevent the spread of Omicron, Europe has already introduced lockdowns and travel bans.

US public health officials have warned that the arrival of the omicron variant could be a disaster for already overwhelmed hospitals in the coming weeks.

President Biden's chief medical adviser Anthony Fauci said he expected to see record numbers of COVID-19 cases this winter and urged Americans to get booster shots. The Omicron variant was detected in 90 countries, and the number of cases is doubling in 1.5 to 3 days in areas with community transmission.

Against this backdrop, market participants prefer to keep off risk, moving their capital into defensive assets. With that said, Bitcoin still has the potential to drop to $ 30,000.