And this week the professor tells us a little about the worlds of CeFi, DeFi and Yield Farming, where we will investigate in depth on this interesting topic, and we will present our task, I hope you like it.

1) What is the importance of the DeFi system?

The decentralized finance system has come to renew the world, presenting us with incredible projects in which we can perform multiple operations within the blockchain network, because it is a system that works independently, it does not need to be monitored by large regulatory entities their uses and operations in any project or smart contract they have.

It is a very large and comprehensive system, where we can find thousands of projects to make use of each of them, as well as have better control of our finances, but in a more private and secure way. So this system has multiple benefits for our use, and one of them are:

• Without intermediaries: One of the main objectives of the decentralized system is to give users the advantage of not having any type of intermediary to regulate their movements, thus giving them more security when having their finances.

• Security: Being totally decentralized it is less prone to security problems, rather on the contrary, security is reinforced in this system, which guarantees the total security of the user or investor who wishes to implement each of its services.

• Transparency: What characterizes the decentralized system from the conventional one is the transparency it has in each of its projects, since there are no central entities that regulate it, users will feel freer to carry out any operation to its use and benefit, as long as it is under your responsibility.

• Privacy: Privacy plays an important role, since important information that may affect the user, such as personal data, telephone numbers, identity registration, verifications, etc., will not be entered in the decentralized system.

• Speed and efficiency: In the case of finances, the operations and transactions carried out in the DeFi, will be executed in a faster way, since there are no central entities that confirm the validation of a node, it will act alone, without the need to wait so long, which will reduce time and be more efficient for the user.

• Availability: We all know that most central finances do not work full time, they usually have a particular schedule, and we have to depend on someone to carry out any operation. In the case of decentralized finances, the same does not happen, since here we can carry out thousands of operations at any time of the day, without a specific time or date, since as we do not depend on central entities, we do not need approval from anyone to carry out a operation.

We know that the world of decentralized finance covers many areas, that is why I want to share with you some projects that he presents to us in various areas of finance:

• Loan platforms:

Yearn Finance

Maker Dao

Compoud

• Exchanges (DEX):

Uniswap

PancakeSwap

Kyber Network

• Wallets:

Argent

Eidoo

Alpha wallet

The DeFi help the blockchain network to decongest and be more organized, therefore more and more users and investors decide to implement each of their projects for our use and benefit, since it gives us greater specialization AND better performance. on your system.

2) Defects in centralized finances.

We all know centralized finance, since it is the most common method that we have all come to use, however, we can see how they have some defects that leave us at a disadvantage, some of them are:

• Centralization: As its name says, they are finances that are centered or governed by large authorities, therefore we, the users or investors, do not have total control of each of our assets and operations that we carry out, since they will always be watched by third parties.

• Public: In the central financial systems, they are totally public, therefore, we must enter all our personal data, such as date of birth, telephone numbers, card numbers, etc., the verification process is also mandatory.

This in many cases can be a risk, since we are exempt from the loss of our assets and our personal data.

• Intermediaries: As we know, when carrying out an operation through centralized finances, we have to go through many verification processes before that operation is completed successfully, therefore, we lose a lot of time, which does not allow us it agrees.

• Restriction: When executing a transaction in a centralized system, it asks us for certain parameters and restrictions, such as the maximum or minimum amount that we must transfer, that is why this can be a major defect, and put us at a disadvantage.

Like we also have restrictions on sending or receiving a certain amount of money daily, which is not favorable for us.

• The importance of using personal data: In centralized systems our personal data is very important, without them we are depriving ourselves of carrying out operations with large sums of money, or even accessing other types of tools that benefit us.

In the DeFi this does not happen, since it is not necessary to enter our personal data, since it is a totally decentralized system.

So we can see how each of the defects mentioned above can put us at a great disadvantage when using this type of centralized finances.

3) DeFi Products:

There are many DeFi projects that exist and that provide us with great advantages, however, this time I will talk a little about 2 of them, which will be an Exchange and a loan platform:

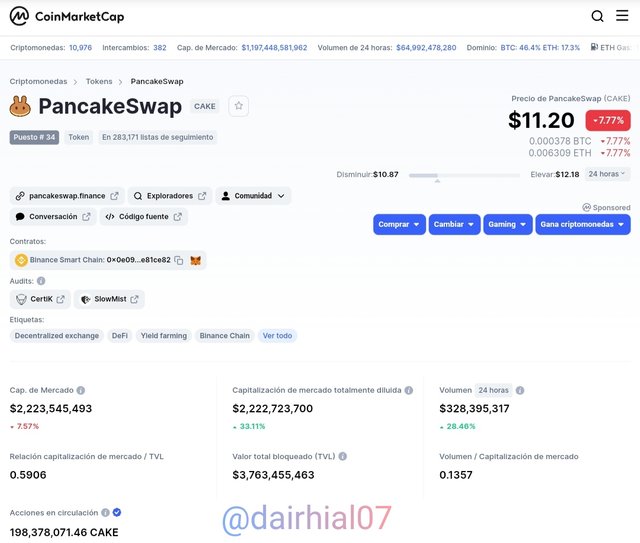

• Exchange "Pancakeswap":

PancakeSwap is one of the largest decentralized exchanges that currently exist, despite being launched in 2020, it has shown that it can offer us multiple tools and options to generate income, as well as the exchange of other types of tokens.

Since its inception, it has been based on Binance Smart Chain, and it presents us with an unusual market model of the conventional one, which is known as (AMM), where thanks to it there is no purchase and sale order book that we are used to. Let's see, if not that it is in charge of creating liquidity groups that help the platform.

This exchange (DEX) serves us for the use and exchange of tokens such as the BEP-20, in addition, PancakeSwap presents us with a fun and innovative presentation, full of many colors and originality, since it is based on sweets, and therefore, who does not love sweets ?.

It currently has three types of tokens that are used for its use and operation within the exchange, such as:

• Flip Token: When users and investors decide to provide liquidity support to the liquidity groups that the exchange has available, they will automatically be rewarded with this type of tokens (LP).

Which brings as a benefit that people are encouraged to support Liquidity to the groups, since they will be duly rewarded with this type of tokens.

• Cake Token: This token is used to use the different income methods offered by the platform, such as lotteries, bets, offer proposals to the ecosystem, etc.

If we wish, we can contribute our LP tokens to obtain ** CAKE ** tokens

• Syrup Token: Those who have this type of token at their disposal, will be able to receive a small part of the rewards of the CAKE blocks, and the availability of obtaining new tokens from contracts that are carried out in Binance Smart Chain.

This incredible decentralized exchange offers us multiple options to generate income, and at the same time obtain its tokens, such as:

• Lotteries: To participate in this type of method, we must only have tokens such as CAKE, therefore to start participating in the lottery we must pay for a CAKE, which is equivalent to 11.20 $ USTD.

Once we have bought our ticket to the lottery, we will be participating in the draws that are being presented at that time, which have a duration of 6 hours, while at the same time we can also buy tickets in the middle of the draws, which we gives a great advantage, however they can only be bought 50 times.

• Initial Farm Offering (IFO): This method is rewarded in tokens by users or investors who decide to participate in the yield farming method. Here tokens such as (LP), (CAKE) and (BNB) will be used, and by their participation they will be able to obtain the new tokens that are launched on the PancakeSwap platform.

• Yield Farming: Here we can obtain rewards in tokens such as (CAKE), and by collecting them we can exchange them for (LP) and participate in lottery games or another method within the platform.

• Predictions: In the PancakeSwap exchange, we have at our disposal a prediction method that helps us generate income, we only have to predict the price of the token (BNB) in a specific period of time, and with it achieve to obtain tokens.

However, we must commit a part of the money of our prediction, to be able to participate in this method, therefore we will be winning and losing at the same time.

How can we see PancakeSwap is a very complete decentralized exchange, where it offers us multiple tools for our use and disposition, in addition to exchanging tokens, we can also customize our profiles to our liking and disposition, however to achieve this we must pay 1.5 CAKE, to achieve a colorful and creative profile.

With its multiple methods to generate income, it helps us to obtain tokens that are available within the platform, so that we can achieve a better development in our finances, but in a totally decentralized way

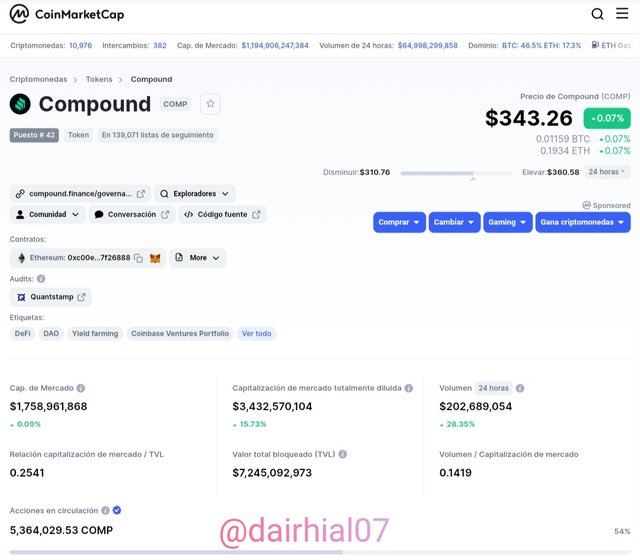

• "Compound" loan system:

One of the loan systems that has caused a stir in the world of DeFi, is Compound, a method that helps us generate income in the following way:

It is a system of loans and finances, where we can deposit or lend a certain amount of money, and it will be rewarded with a percentage of commission in our favor. Compound is based on the Ethereum network, and is responsible for creating smart contracts that can offer us benefits once we provide liquidity to your projects.

Thanks to this DApp we can request loans and also grant them, receiving an interest percentage depending on the currency with which you work, and the blocks extracted, however we must know that once the lenders or borrowers decide to implement their services, the Money balance will be blocked, but can be withdrawn at any time.

Currently it allows us to work with currencies such as (ETH), (ZRX), (DAI), (REP), (USDC), (WBTC), and with its native token within the platform which is (COMP), also having other types of internal tokens that help the development within Compound, such as its cTokens, which gives us the advantage of earning this type of tokens when we initiate a loan within the platform, that is, if we enter ETH in the loan system, we can Obtain cETH tokens at our disposal, which gives us a double advantage, since we will obtain the rewards obtained for our loans and also the cTokens.

We obtain these ctTokens automatically when we generate a loan within the platform, and they can be easily exchanged for the same currencies, that is, if I entered DAI, I receive cDAI and I can exchange them again for my DAI once the contract ends. We can also collect them and pass them to wallets like Metamask or any Ethereum wallet, since they are ERC-20 tokens, therefore we can also use them in other applications.

One of the great things that Compound is characterized by is the value of the guarantee that it offers us once we decide to implement its services, since it gives us the provision that the contract is automatically canceled, once the value of the price for which we invest collapses too much, which gives us the advantage of not losing our investment too much, and preventing an impermanent loss from occurring.

This decentralized project has brought many benefits to the world of DeFi, therefore it has become one of the most ambitious projects in a while, since it seeks to give more access and flexibility to users to have a broader control on their finances, since we can invest our money (that we do not need in the long term) to generate more value and multiply it, while we are also helping to develop large smart contracts through the liquidity pools that the platform offers us.

So Compound is a feasible platform for lenders and borrowers, where we can obtain multiple benefits through the rewards obtained for our service.

4) Risk involved in DeFi.

However, we must know that there are also some risks that may affect us, when we decide to work with this type of decentralized finance, some of them are:

• Fraudulent theft: Being a decentralized system, as we already know, it is not governed by a central entity that monitors its activities, therefore it allows malicious people who want to make transactions with money that is not yours, and by not having to present personal data, they will not be at risk of being exposed.

• Low liquidity: Being a slightly more regulated market, in the exchanges (DEX) it does not have sufficient liquidity like the (CEX) which can put them at a great disadvantage, also causing their commission costs are slightly higher for security and decentralization reasons.

• Smart Contract: Although it happens very rarely, the case of presenting an error in smart contracts can happen, either due to the risk of hacking, or due to some susceptibility that the program presents, which puts in enormous risk to the entire team and investors who want to provide liquidity to their projects, causing you to lose all your investment.

• Risk of impermanent loss: As we know the market for crypto assets is extremely volatile, therefore, when we decide to provide liquidity to a smart project, we are prone to our investment changing the initial value with which we started Therefore, when we withdraw our funds, we can be exempt from not receiving the same that we entered, and we would be going through a moment of impermanent loss.

• Total responsibility: As we know, in decentralized finances we ourselves are solely responsible for the actions we carry out, that is, if by some mistake we lose our wallet, exchange, etc, we would lose everything the value we have within them, and we could not recover them, since here there is no central entity that can help us to manage our keys again, so it can present a great loss for us.

Here are some risks to consider before we start dealing with decentralized finance.

5) What is yield farming?

This is one of the most used methods in decentralized exchanges and DeFi finances, since it is responsible for generating income in a passive way, we only have to provide some liquidity to a smart contract, and we will receive in exchange accumulated interest for our investment , as I mentioned in the *** Yield farming *** of PancakeSwap and in Compound, we can obtain other benefits, such as other tokens that the platform we are working with has available, therefore, we would be obtaining double rewards, since we will receive our interest on our loans, plus the accumulation of tokens offered by the platform for our participation, which has the advantage that more and more investors decide to support the liquidity pools of smart contracts.

We must take into account that to invest in this method, it must be with money that we do not need in the long term, since the investment can last a long time, where we will be exempt from the high volatility that the market may present and the risks that this may present. can present us, however, it is a method that can help us to improve our finances effectively, therefore it is a good way to generate income, since it makes us produce our money without doing anything, and at the same time we are helping for smart contracts to develop, so both parties would benefit.

If we have money saved and we do not know what to do with it, the Yield farming method is an excellent idea to develop our money, and obtain feasible profits, but as long as we have previously investigated the pros and cons that they can offer us.

6) How does yield farming work?

This method works very easily, the first thing we have to do is choose a platform where we can do it, which is safe and reliable, and that of course meets the required expectations, after doing exhaustive research on the percentages of earnings and available currencies offered by the page, we can start financing the project.

• We must look for an asset that provides us with sufficient liquidity for the project that we are going to finance.

• Once we have selected our contract, they will automatically indicate the rates, the amounts, and the profits that we will obtain in the stipulated period of time.

• Then our investment will be blocked for a specific time in the smart contract in which we are working.

• When we execute a loan in a smart contract, we automatically receive a guarantee for it, which we then have to return once the contract ends, in order to obtain our accumulated rewards.

• We must have a wallet compatible with the tokens that we are going to receive, for example if we receive ERC-20 tokens, we can use wallets that accept this type of tokens, such as Metamask

• The earnings will depend on the currencies that you present on the platform, and the conditions that you provide us.

• Our earnings will depend on how much liquidity we decide to contribute to the project.

• The tokens that we obtain as a reward can be entered into the liquidity pools again.

• To obtain a greater incentive, most of the platforms that work with this method, grant tokens as rewards (Outside of their interests) to investors, for the creation of a new block.

The Yield farming method presents us with a new alternative to generate income passively, we can obtain great benefits if we know how to take advantage of them in the correct way, for example, if we start investing in a project that is just beginning, we can be prone to its value increases, and thus be able to obtain more profits, however we must also take into account other factors that may affect us, such as the risk of impermanent loss, which is to obtain much less than what we invested in the smart contract.

That is why before starting to operate with this method, let us take into account many aspects, investigate and analyze what is most feasible for us, since although it is true it can provide us with more interests than the traditional finances of which we are Accustomed, therefore, the world of DeFi continues to provide us with incredible methods to improve our finances.

7) What are the best performance agricultural rigs and why are they the best?

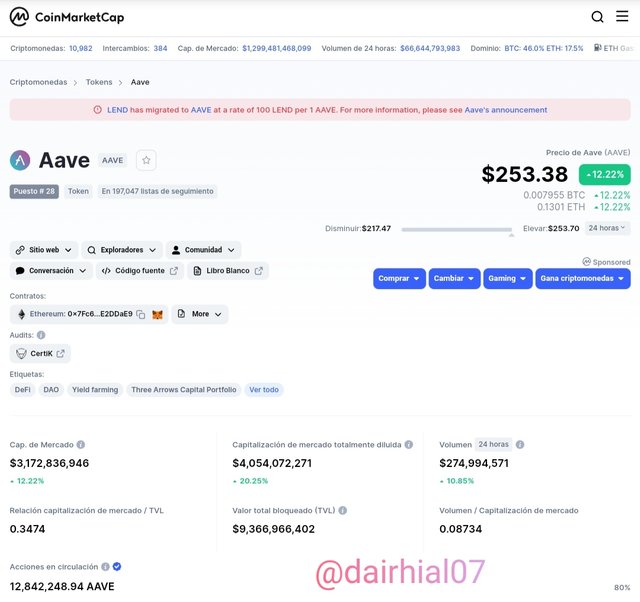

• AAVE loan platform:

In this case we will talk about AAVE, better known in other years as** ETHLend**, a decentralized platform for lenders and borrowers, where it offers thousands of benefits to obtain passive income, through its liquidity pools that we offers.

One of the great mechanisms that drew the attention of the thousands of investors to work with AAVE, is its implementation to grant loans, and to allow other users to provide their services to smart contracts, since then the platform has evolved little by little. little of 2018 until the sun today.

This platform seeks to create more feasible alternatives for the needs of users or investors, and of course that adjust to market conditions, therefore:

• It allows us to help smart contracts through its liquidity pools, while we receive our interests in the form of a reward.

• It gives us the option of obtaining loans through its platform, with the only condition of leaving a part of the value as collateral, which will be returned once we have paid our loan.

AAVE is a safe and totally reliable platform where we can make various options, such as those mentioned above, therefore, it gives us the freedom to choose what we want to do, whether to be a lender or to be a borrower.

• Characteristics:

• One of the conditions that the platform specifies when making a loan is to grant an amount of value, offering as a guarantee that we will pay what we are asking for and when our loan ends, it will be returned to us again.

• It is totally decentralized, there are no third parties or focused entities.

• When we make a loan, it does not mean that we sold our assets, simply that they will be blocked and will be repaid in greater amounts when the established time expires.

• AAVE currently works with currencies such as DAI, TrueUSD, USDT, ETH, USCD, LINK, YFI, BAT, EnjinCoin, KNC, BUSD, Mana, MKR, REP, ZRX, wBTC, sUSD.

• Its native token is called (AAVE) and it currently has a market valuation of $ 253.65, with a dominance of 0.25%.

• When we provide Liquidity to a project in AAVA, we receive a portion of the reward in tokens from the platform, this will depend on market trends and how much liquidity we contribute to the project.

AAVE offers us a system where we can protect the value of our loans from market volatility, since it has at its disposal a very safe method, which is called Safety Module (SM), which works with various components to guarantee our investment:

• Staking module: It ensures that the volatility of the market does not affect our investment in a possible market breakdown.

• Auction module: Automatically converts our tokens that are in the project, in future price drops.

• Backstop module: Automatically sell our investment tokens and keep them in a stable currency to avoid losses

• Ecosystem reserve: The platform offers us an internal system to protect losses in the project.

• Oracles: The system has at your disposal decentralized Oracles that provide external information about market prices. (Obtained from Chainlink)

Thanks to this security method in AAVE, we can maintain a regular position of our blocked tokens, in case the market obtains a downtrend, which gives us the possibility to protect ourselves from the risk of impermanent loss.

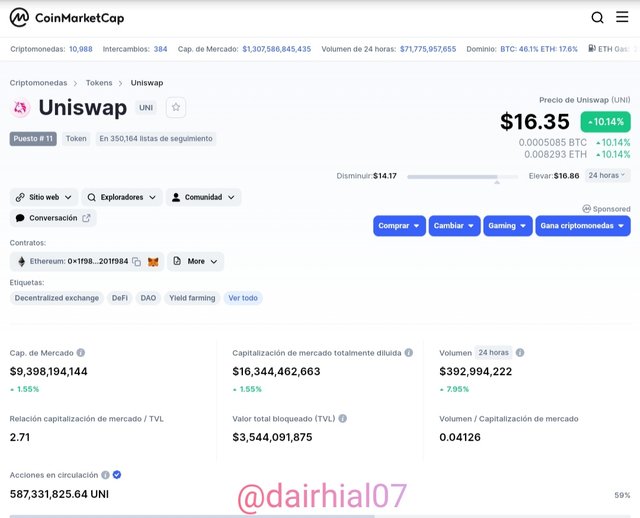

• Exchanges "Uniswap":

One of the great decentralized exchanges that has penetrated the world of DeFi, is Uniswap, presented in 2018 and since then its project has impacted decentralized finance, thanks to its multiple tools and methods that presents us to generate income.

However, Uniswap works beyond the basic needs that an exchange (DEX) can offer us, since it also offers us the possibility of being liquidity providers in smart contracts, under the (AMM) system, like the one I explained in PancakeSwap. However, it also works with another design for its network, such as the Constant Product Market Maker (CPMM), where it helps us to be able to negotiate quickly and efficiently in the liquidity groups of smart contracts.

You have at your disposal a wide variety of ERC-20 tokens so that we can use them within the Exchange, and exchange them for other currencies that the platform has available, of course under our full responsibility, since it is a fully decentralized exchange.

When we decide to provide liquidity in smart contracts, Uniswap rewards us a percentage of commission for it, therefore, it makes investors enthusiastic about collaborating with the projects, while they earn a separate profit on their investment. However, one of the main requirements before providing liquidity to the pools is to introduce two types of tokens, one ERC-20 or any Ethereum token, in order to achieve balance and accessibility within the platform, for all users. and investors around the world.

• Characteristics:

• Being a fully decentralized exchange, there is no buy and sell order book, therefore Uniswap governs prices through an algorithm that regulates the price.

• Uniswap seeks to offer a balanced balance in the value of its tokens, therefore, its value will be governed by the volume of people who buy or sell on the exchange.

• It currently has an improved version of the exchange, which is Uniswap V2, where it allows us to make direct operations from ERC-20 tokens to ETH.

• It has its own native token is what it is (UNI) and which currently has a market valuation of $ 15.35, with a domain of 0.73%.

• The rewards obtained from tokens for the contribution of Liquidity to a project are in UNI tokens.

• It is compatible with Ethereum wallets, such as Metamask, where we can mint our tokens obtained by liquidity.

Uniswap is an open source exchange, very beneficial for our finances, in addition it presents an incredible fun and innovative design, full of colors and life, through its logo in the shape of a unicorn, where we can do "Swap" or " Swap ". This exchange allows us to carry out multiple operations to generate income, as well as provide Liquidity to smart contracts while we generate their governance token.

8) The method of calculation in the yield of agriculture.

When we start to perform this method, first of all it is important that we calculate how much we can earn, and for this we have two methods, which are:

• (APR) - Annual percentage rate: It is the percentage of our total investment for one year without interest, whether we have to pay for the loan obtained, or we have to charge our interest, for example :

In a hypothetical case, I invested $ 200 with an APR of 90%, therefore to calculate our annual percentage rate, we will do the following:

(Principal amount + interest rate + Time in years.), Then it would be:

(APR): 200 ×90%/100 ×1= 180

Now as we know my initial investment is 200 + 180 (APR), it is equal to = 380

Then after one year I will get a total of $ 380 as a guarantee (200 of my initial investment, plus 180 of my APR).

• (APY) - Annual yield percentage: The annual yield percentage, we use it to calculate the total of our investment but with the interest included, through the following formula:

(1 + r / N) n -1

• R: Interest rate

• N: Interest rate

• n: Period of time (365)

That is, if hypothetically speaking, investing $ 1000 in a project for a year, for an interest rate of 90%, would be:

(1 + 90%/356) ³⁶⁵ - 1 =

(1+ 0,00247) ³⁶⁵ - 1

(1,00247) ³⁶⁵ - 1

(2,457) - 1

= 1.457

APY = 1.457 + 1000= 2.457$

Therefore my annual percentage return would be $ 2,457, which is double my investment.

9) Advantages and disadvantages of yield farming.

• Advantage:

• Generate income: Yield farming is a passive method of generating income, which can help us improve our finances, but in a totally decentralized way. In this method we can put to work our money that we are not needing, therefore, we only have to keep our assets blocked for a long period of time and we will obtain good benefits. (If we do it the right way).

• Availability to all users: Any user who has the necessary experience and the necessary money, can participate in this method, since they do not require strict parameters to participate, it is open to everyone in the world of the DeFi. In addition, we do not have to go through the tedious problem of verifying identities, data, etc.

• Long-term benefits: The benefits that we obtain in the long term when we get involved with this method are extremely high and potential, so it is a good way to take advantage to put our money to reproduce.

• Extra rewards: In most of the platforms where we can perform this method, they offer us reward tokens for our participation, therefore, we would be obtaining double income, 1 of the rewarded tokens for our participation, and 2 for the total investment sample commission. (This motivates more and more users to participate)

• Disadvantages:

• Lack of experience and knowledge: When we do not have the necessary knowledge and experience required to operate with this method, we may not obtain the rewards we want, since this can deprive us of knowing certain guidelines that we would have done in advance, such as:

✓ Account for our APR and APY

✓ Find a suitable platform to protect our investment in the event of a market breakdown.

✓ Find a currency that generates enough income.

✓ Invest in a sufficiently solid project that gives us benefits.

• Volatibility: We know that the world of crypto assets is extremely volatile, therefore, this factor greatly influences when we decide to get involved with this method, since at the end of our investment we may have less than we invest in the beginning, which can be a great loss.

• Risk of impermanent loss: This is a risk that we can all go through when we get involved with this method, since nothing assures us that the market price remains stable, therefore it may happen that at the end of our investment we obtain less profit than we invest, and we will be going through an impermanent loss.

• Risks in smart contracts: As we know, we work to bring liquidity to smart contracts, and if due to some error they come to present failures in their network by malicious entities and any attack, investors would be prone to a large loss from our locked assets.

Conclusion

The world of DeFi has evolved in such a way that little by little it has become the new dependency of our finances, and more and more users decide to implement their services in them, since they provide us with incredible benefits for the economy of our finances, and that is why every day they have made more effort to provide new projects for the improvement of the blockchain network.

And thanks to the DeFi, investors can obtain a more feasible and viable way to generate income, as is the case of Yield farming, which gives us the opportunity to multiply our money in a long time, while we obtain other types of rewards. Because of our participation, that is why it has become so profitable and popular in the world of decentralized finance as it is a new way to generate income on a large scale.

Of course, I recommend doing research before starting to operate with this method, since we must analyze what is most feasible for our economy, therefore, we must be cautious and cautious before putting our money at stake.

I thank the teacher @stream4u for such an incredible class this week, where we were able to develop in detail the world of CeFi - DeFi - Yield, and we could note the pros and cons that both offer us, as well as the best platforms that offer us their services to operate with the Yield farming method.

Greetings, until next time.

Hi @dairhial07

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Un saludo profesor, gracias por corregirme mi tarea, hasta la próxima, fue un honor!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit