1. Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable according to your opinion. (Binace is not allowed)

Staking is the art of holding or locking cryptocurrencies in a wallet to support the security and operations of a blockchain. These locked/ staked cryptocurrency assets acts as validators to ensure integrity, security and overall existence of a decentralized network. In return, investors receive staking rewards.

It is possible to use certain crypto wallets such as atomic wallet and trust wallet to stake crypto assets. One can also opt to use exchanges such as Binance, Kraken, PoloniEx and KuCoin. Generally, most of the the existing exchanges provide staking service. There is one other method very common for staking crypto assets- the use of staking-as-a-service platforms. These are platforms which help crypto investors stake their crypto assets via a third-party service which takes care of the technicalities associated with the staking process. This means that those without the technical knowledge can still be part of the growing staking economy. Examples of common staking-as-a-service platform include MyContainer, StakeCapital, StakeFish, Figment, Staked and Staking Lab.

In this task, the two staking platforms I will be discussing on are the Kraken Exchange and Figment.io.

Kraken:

Kraken is a cryptocurrency exchange platform based in San Francisco, United States. It was founded by Jesse Powell in July 28, 2011 majorly to ease the cryptocurrency-to-fiat money trading and it is doing a good job till date. Kraken is listed as the 4th largest exchange by trading volume according to recent studies.

In the year 2019, Kraken joined the league of exchanges which provide staking service to its users. Now, it is not only possible to stake cryptocurrencies but also fiat currencies on Kraken. Some of the stakeable assets on Kraken include : Ethereum (ETH), Tezos (XTZ), Kava (KAVA), Cosmos (ATOM), Polkadot (DOT), Kusama (KSM), Flow (FLOW), Cardano (ADA), Euro (EUR), US- Dollar (USD) and Bitcoin (BTC).

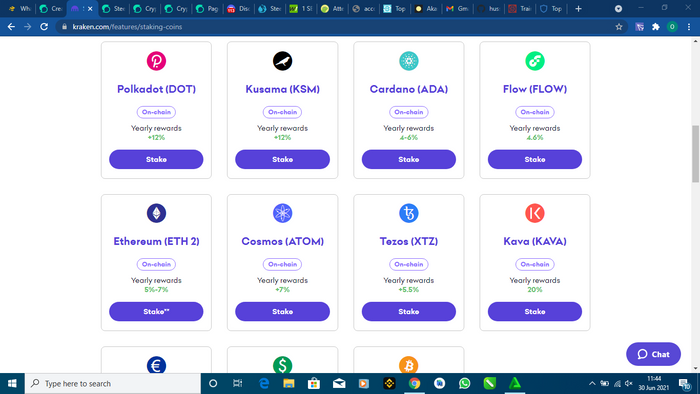

Screenshot of the Kraken staking webpage

Screenshot of the Kraken staking webpageAs at the time of this writing, below is a table of all the stakeable assets on Kraken and their yearly staking rewards.

| Stakeable Assets | Yearly Reward in percentage |

|---|---|

| Ethereum (ETH), | 5 - 7% |

| Tezos (XTZ) | 5.5% |

| Kava (KAVA) | 20% |

| Cosmos (ATOM) | 7% |

| Polkadot (DOT) | 12% |

| Kusama (KSM) | 12% |

| Flow (FLOW) | 4.6% |

| Cardano (ADA) | 4-6% |

| Euro (EUR) | 1.5% |

| US- Dollar (USD) | 2% |

| Bitcoin (BTC) | 0.25% |

This is a Link to the Kraken staking page. The staking on kraken according to their support webpage says there are no fees for staking and unstaking of crypto assets.

Figment:

Figment is a blockchain infrastructure and service provider founded by co-founders Matt Harrop, Andrew Cronk and Loren Gabel in the year 2018. The main purpose of the platform is to support and enhance the adoption, growth and the overall long term success of the Web 3.0 ecosystem. The web 3.0 originally called semantic web is simply described as a network where data connection is decentralized. When compared to the current Web 2.0 where data is stored in a centralized repositories, web 3.0 will not be centralized.

Figment.io simplify the building of the next generation artificial intelligence (AI) and blockchain technology. They offer different blockchain services including staking of assets. It is a staking-as-a-service platform with a staking fee of between 0 - 15%. The protocols / stakeable assets available on Figment.io include: Akash, Audius, Avalache, Brand protocol, Casper, Celo, Cosmos, E-Money, Ethereum, Flow, Helium, Injective protocol, IRISnet, KAVA, KEEP, Kusama, LIvepeer, Mina, NEAR protocol, NuCypher, Oasis Network, Osmosis, Pesistence, Polkadot, Secret Network, Sentinel, SKALE, Solana, Terra and The graph.

As at the time of this writing, below is a table of some of the stakeable assets on Figment and their yearly staking rewards.

| Stakeable Assets | Yearly Reward in percentage |

|---|---|

| Akash | 53.36% |

| Audius | 1.84% |

| Avalache | 10.87% |

| Brand protocol | 11.55% |

| Celo | 5.98% |

| Cosmos | 9.05% |

| E-Money | 25% |

| IRISnet | 6.09% |

| KAVA | 28.57% |

| Kusama | 10.61% |

| LIvepeer | 22% |

| Mina | 10.86% |

| NEAR protocol | 10.19% |

| Oasis Network | 14.38% |

| Pesistence | 30.7% |

| Polkadot | 20% |

| Secret Network | 25.57% |

| Sentinel | 52.07% |

| SKALE | 8.12% |

| Solana | 6.7% |

| Terra | 12.12% |

| The graph | 14.67% |

This is a Link to the Figment staking page. The staking fee on Figment.io varies between 0 and 15% of total staking rewards.

Comparison Between Kraken and Figment

- It does not require staking and unstaking fee

- It includes very popular coins to be staked

- It has the option to stake Fiat Currency

- The company has a good reputation and has been in existence for a long time

I prefer to stake using Figment.io because it is more profitable:

- It offers more stakeable assets

- Staking rewards are higher

- It is a new platform so there are a lot of opportunities to gain from it

2. What is Impermanent Loss?

Imperial loss is simply the loss in dollar value of coins and token added to a liquidity pool compared to when it was first deposited. In essence, your initial coin or token deposit has lost value. This value change usually happens as a result of arbitrage traders who cause spikes and drop in coins and token value. The bigger the value change, the more exposed a liquidity provider is exposed to imperial losses. Stable coins and other wrapped version of a coin are far less prone to imperial loss due to their relatively stable Dollar value.

3. What is Delegated Proof of Stake (DPoS)?

To understand what Delegated Proof of Stake (DPOS) is, we need to fully understand the concept of Proof of Stake. Proof of stake is a consensus algorithm that was invented to replace the Proof of Work (PoW) algorithm. In stead of solving hash problems in order to gain the opportunity to mine new blocks in the blockchain as in the case of Proof of Work, Proof of Stake requires participants to lock/stake some coins in order to gain this opportunity. When participants lock/stake their coins, the protocol will randomly assign one of them the right to create and validate the next block within the blockchain. The chances of being chosen to validate the next block is proportional to the amount of coins staked. The higher the amount of coins you stake, the higher your chances of being picked at random to validate the next block.

Delegated Proof of Stake (DPOS) works like indirect democracy. This consensus algorithm differs from Proof of Stake in that users stake their coin in order to gain voting power to now select a smaller circle of delegates to participate in validating blocks within the blockchain. The voting power of users used to chose delegates is proportional to the number of coins held. The votes by user is used to elects a small circle known as delegates who manage the blockchain security and consensus on behalf of their voters. At the end, the staking reward are distributed to these delegates who afterwards distribute fractions of their reward to their voters according to their individual contributions.

DPOS was developed in the year 2014 by Daniel Larimer. This began a revolution as the consensus algorithm was first integrated by Bitshare and then Steem and EOS. One major benefit of the DPOS model is that it allows consensus to be reached with a lower number of validating nodes. Consensus is reached swiftly with this method lowering transaction time. However, this model can lower the degree of decentralization in the blockchain due to the fact that the blockchain network depends on a small group of validating nodes. Even at this, the merits of the Model outweighs its risks and demerits.

4. Conclusion

Staking is one of the trending ways of earning more assets in the decentralized economy. This is especially true as people who can't afford sophisticated mining equipment can still earn through staking and delegated proof of stake. A lot of platforms now exist which we can pick from to stake the coin we have instead of the old traditional method of holding them that do not yield any returns.However, when staking coins to provide liquidity, one should take note of the concept of imperial loss which can affect deposited assets.

Hola @damzxyno

Gracias por participar en la primera semana de la tercera temporada de la Academia Cripto de Steemit.

Buen trabajo, me gustó bastante la tabla que hiciste del APY que ofrece cada plataforma, puedes agregar más imágenes a la tarea, alguna imagen que facilite el entendimiento del DPoS hubiese estado bien, pudiste haber agregado ejemplos además del concepto de Impermanent Loss, recuerda que tu creatividad hará que resaltes entre las otras tareas. Falta profundidad en la conclusión

Éxitos en tus próximas tareas.

Calificación: 8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your welcome

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit