Hello Professor @yohan2on, I'm glad to be part of your lecture. I learnt came across new things and I like how you simplified everything. Here's my homework post, I hope you like it.

1- Define the following Trading terminologies;(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

source

Buy stop order is when one decides to buy a stock or a security at a specific price above its current market price. With this, the investor sets a price he'd want to buy a stock at in advance so as to not miss that price when the value of the security gets to that point or the chance buy a stock that might have a good return. Once the level or strike specified is reached, the buy stop order becomes either a limit or market order. It's anticipated here that the market price will keep moving in an uptrend after the order is executed.

source

A sell stop is used when a trader decides to place a sell price below the market price in hopes that the market price will descend and hit that set price to trigger the market sell order. It's used when selling and known to be one of the quickest ways to exit a trade. It's anticipated here that the market price will keep moving in an downtrend after the order is executed.

A buy limit order is an order to buy an asset at a price below the current market price and allowing traders to control how much they pay. This limit will only trigger if the market reaches the set price and also implies the market will rebound upwards after the order is triggered. If the the market never reaches that price specified, the order will never be executed or it might also be missed if the price moves too quickly through the limit price. As a result it can result in a lot of missed chances in fast moving markets.

Buy orders are considered day orders as they tend to expire at the end of the day.

source

Using a buy limit order to make a purchase guarantees the investor will pay the set price or lesser than that.

A sell limit is an order placed above the current market price. The sell limit anticipates a rebound downwards after the order is triggered. It's the direct opposite of a buy limit. As it is a limit order, the order will never execute is the market never reaches the price specified or the price quickly moves through the limit price. The market is expected to rebound downwards after the order is triggered.

source

Sell limit orders are necessary because you'll be able to short sell at a precise and higher price .

Stop loss is an order type that helps manage risk by specifying a point where your trade will close if the price goes against you. Using this ensures losses are limited and they remain in effect till cancelled or the user is liquidated.

A trailing stop loss is a risk management tool or order type and works similar to an ordinary stop loss. The difference here is that a stop loss is set at a percentage below an asset's market price instead of a set value. The stop loss then follows the price as it moves. The plus of using this is that your able to lock in profits while keeping the trade open till you trailing stop level is met. Then, your stop loss is triggered and your trade will be closed.

This is very useful when trading a volatile currency pair with erratic patterns. One other one is if the market price is moving in your favour but then reverses, your stop loss would follow the favourable price but not will not move in the reversed direction.

When going long or making a buy trade, the trailing stop would have to be placed below the market price and when going short or selling, your trailing stop loss would have to be placed above the market price. And to exit at a particular price, instead of the next market price, you'd have to set a guaranteed stop loss order

A margin call is indication that the equity or value of an investor's margin account has fallen below the required amount given by the broker. A margin account contains securities bought with money borrowed from a broker or atimes a combination of the trader's and broker's money which is termed buying on margin. The money provided by the investor is the investor's equity and is equal to the market value of the securities not including the amount lent by the broker.

A margin call is a broker's demand that an investor deposit additional money or securities to bring the margin account to at least the minimum value also known as maintenance margin as a result of a decrease in the investor's equity. Margin calls can also be issued when one or more of the securities in the margin account has decreased in value.

If the investor is unable to deposit funds, brokers may force him to sell assets regardless of the market price so as to meet the margin call. Brokers can decide to sell any of the available assets which is termed liquidating the account without consulting the trader to met the maintenance margin

2 - Practically demonstrate your understanding of Risk management in Trading.

*Briefly talk about Risk management

*Be creative (I will expect some illustrations)

*Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

Risk Management

Risk management refers to the various methods, strategies and analysis employed to reduce uncertainties and losses of a trade and maximize profits in trades as well. This is important because risks cannot be completely eliminated but they can be suppressed so they have little or no effects on us and our transactions as well.

One must be prepared to lose some to make more money thus, planning your trades is one way to effectively manage risks. Applying strategies like the 1% risk rule as well as stop loss and take profit are sure ways to safe guard your trades.

The 1% Risk Rule

This is one rule in risk management that must be strictly observed by traders if they seek to minimize the losses they make on bad days. Since not every trade promises to be profitable, implementing this will help safeguard your account from making heavy loses.

To do this, you must be willing to lose 1% some traders do go for 2% though. This implies that for every trade, you're willing to lose up to 1%. So if you have $3,000 as capital the you're only willing to lose $30 per trade and for those who choose the 2%, $60.

Keeping this in mind is a surefire way to limiting loses.

Stop Loss & Take Profit

Setting up the stop loss and take profit for every trade is very vital in risk management. Without these you could register some really big losses and lose money.

Stop loss is a point we set when entering a trade to opt out of the trade when it's not going in our favour. This helps us escape large losses in the trade.

In setting up the stop loss, it's ideal to set it 5-10 pips below the recent swing low of a buy entry trade or 5-10 pips above the recent swing high for a sell entry trade. This is done to give breathing space for the trade to play out and avoid being taken out early.

Take Profit shows how much you're willing to make as a profit and helps you lock-in whatever you've earned within a trade and close it.

Moving Averages (MA)

Moving averages are really useful indicators and can be used to identify long bullish or bearish trends. It smooths out the price trends by taking out the little price fluctuations to give a general overlook of the price trend. This can be used by traders to determine how the market price of and asset is likely to move in and determine its support and resistance levels. Application of Moving Averages also gives rise to Death Cross and Golden Cross which are used to identify long bullish or bearish trends.

- Death cross is used to identify a long-term downtrend or bearish market and occurs when a 50-day MA crosses from above and goes below a 200-day MA.

- Golden Cross signals a long-term uptrend or bullish market and occurs when a 50-day MA(short-term MA) crosses from below and goes above a 200-day MA(long-term MA).

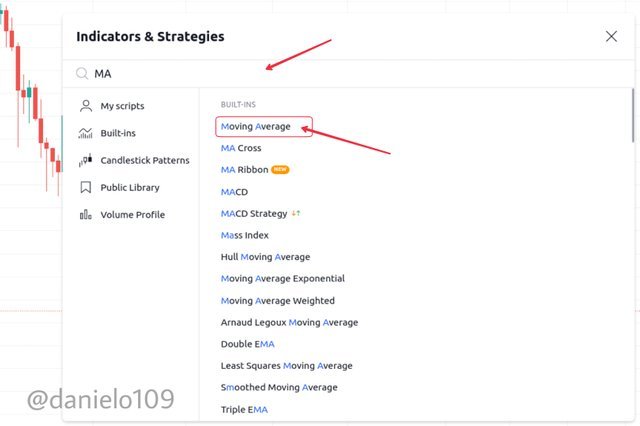

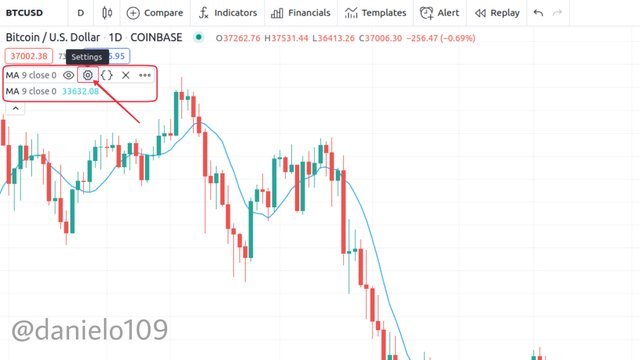

Over here I'm using the TradingView chart to view the BTCUSD pair.

To add the Moving Average, we click on the fx indicators. And search for the moving average then click on it to add it to the chart. We need two for this demonstration so we'll click on it twice.

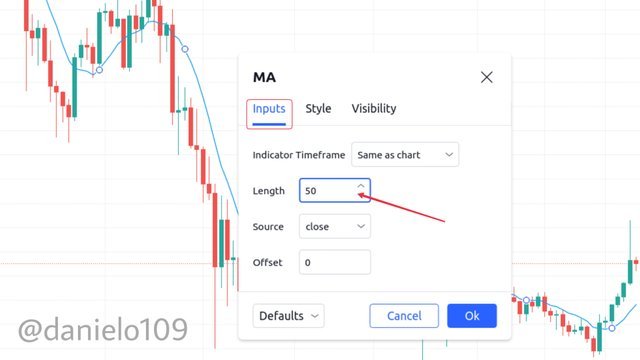

We head on to the settings sign indicated below to input our settings for the two moving averages.

We need a 50-day(short-term) MA and a 200-day(long-term) MA and in order on to confuse ourselves, we'd need to change the colours as well.

I made the 50-day MA green and the 200-day MA red for easy identification.

The chart shows two death crosses. The death cross is used to signal a long-term downtrend market but as we see from the chart that's not true for the second. This implies there are times where the death cross can give a false signal.

With the first death cross, you'd see that the market was in a downtrend, then the short-term moving average reacted to the change in trend and began to move downwards before the death cross occurred. This is the confirmed the long-term downtrend. The short-term MA reacted to the change and began to move up for a golden cross to occur.

The golden cross is seen as indicated. The short-term MA crossed and went above the long-term MA and this is an indication of a long-term uptrend market. This is as a result of trend going on a long period.

The short-term MA was quick to react to the trend reversal as can be seen. It took a while for a death cross to occur afterwards.

It's important to note that after every death cross, there's a golden cross and vice versa. It's also possible that they would give false signals so it pays to be careful.

Conclusion

Knowing the differences between buy stop, sell stop, buy limit and sell limit orders and how they work is very essential to trading. Without knowledge on these, trading would be next to impossible.

Risk management is also needful in trading and it's the one thing that enables traders to reap profits and minimize losses. Practicing risk management is sure to push one to the top as a trader and utilizing indicators and tools like the moving average can help you go a long way.

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content though you missed out on the demonstration of the Stop Loss and Take profit on charts

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit