Hello Professor @awesononso, I'm grateful for the opportunity to learn from you once again. I really enjoyed your lecture. Here's my homework post, I hope you like it.

1.Properly explain the Bid-Ask Spread.

The Bid-Ask Spread also known as Sell Spread or simply Spread is the difference between what a seller is asking for an asset (willing to sell an asset) and how much a buyer is willing to pay for it(bid). It can be seen as an ongoing negotiation for an asset as varying ask and bid prices are offered for a particular asset within a trading period. Another way to see it is this; The Bid-Ask Spread is the amount by which the ask price of an asset exceeds the bid price for that asset.

The highest bid price offered however, is used to calculate the Spread. The Bid-Ask Spread can be used as a measure of supply and demand of an asset; where bid is the demand and ask refers to the supply of that asset. It's mostly used and regarded to be important because it helps determine liquidity.

The Bid-Ask Spread is mathematically expressed as;

Bid-Ask Spread = Ask price - Bid price

It can also be expressed as a percentage with this formula;

%Spread = (Spread/Ask Price) x 100

OR

%Spread = [(Ask price - Bid price)/Ask Price] x 100

For example, if the bid price for a particular asset is $4 and the ask price is $5, the Spread would then be $1.

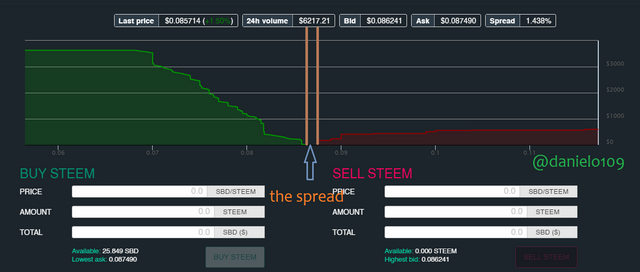

screenshot from Steem wallet

In the image above, the green graph represents the Bid Side and the red represents the Ask Side. The gap in between is what we call the Bid-Ask Spread and at the time of capture, it was at 1.438% or 0.00126 with the Ask and Bid being $0.087490 and $0.086241 respectively.

2.Why is the Bid-Ask Spread important in a market?

The Bid-Ask Spread is important in markets, most especially, the crypto market because it helps determine the liquidity of an asset or an asset pair.

Liquidity is simply how easily an asset and be traded or turned to cash. This relates to supply and demand of an asset; where supply refers to the availability of that asset and demand is the willingness to purchase the asset. If the relationship between supply and demand is well balanced, it means that trades that occur within this frame would be executed quickly and thus the asset is termed to be liquid.

This enables traders to make informed decisions when buying or selling because you're able to tell if the asset is readily available.

source

The spread here is 0.28. Comparing this to the previous image, Steem is has more liquidity as it's Spread is smaller.

3.If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Bid price = $5

Ask price = $5.20

a. Bid-Ask price = Ask price - Bid price

= $5.20 - $5

= $0.20.

b. %Spread = (Spread/Ask Price) x 100

= (0.20/5.20) x 100

= 0.0385 x 100

= 3.845%.

4.If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Bid price = $8.40

Ask price = $8.80

a. Bid-Ask price = Ask price - Bid price

= $8.80 - $8.40

= $0.40.

b. %Spread = (Spread/Ask Price) x 100

= (0.40/8.80) x 100

= 0.0455 x 100

= 4.55%.

5.In one statement, which of the assets above has the higher liquidity and why?

Deduction

Crypto X has a higher liquidity compared to Crypto Y because the spread in Crypto X is much smaller, this is true because the wider the spread, the more illiquid an asset is and vice versa.

6.Explain Slippage.

Slippage

In trading of assets, there are certain orders we put in place to facilitate the buying or selling of assets and in doing so limit and market orders are used. With limit orders , the trader sets a price different from the current normal price, that, when the market price reaches, the order would be executed. Our focus here is on the market order.

With market orders, the order is executed at the current market price. With the volatility of cryptocurrency prices it is possible that the order will be executed at a different price than the trader intended as prices can change at any moment.

Slippage is simply the difference between the exepected price of a trade and the price at which the trade occurred. It is observed when an order is executed a different price than intended and occurs in markets with a wide Bid-Ask Spread. This is as a result of low liquidity and as such orders might not always go as expected.

Suppose I made a market order for TRX at $10 and after the execution I end up with $11, that means the slippage here is;

= $11-$10

= $1.

7.Explain Positive Slippage and Negative slippage with price illustrations for each .

Positive & Negative Slippage

Positive Slippage:

A postive slippage occurs when an order is executed at a price that is favourable at to the trader.

For a buy order, this is when an order is executed at a lower price than intended. If I were to place an order for ADA to be bought at $100 and the trade was executed at $98, the Positive Slippage would be;

= $100 - $98.5

= $1.5.For a sell order, it would mean that the order was executed at a higher price than imagined. If I were to place an order for USDT to be sold at $150 and the trade was executed at $151, the Positive Slippage would be;

= $151 - $150

= $1.

Negative Slippage:

A negative slippage occurs when an order is executed at a less favourable price.

For a buy order, this is when an order is executed at a higher price than intended. If I were to place an order for ADA to be bought at $100 and the trade was executed at $100.5, the Negative Slippage would be;

= $100.5 - $100

= $0.5.For a sell order, it would mean that the order was executed at a lower price than imagined. If I were to place an order for USDT to be sold at $98 and the trade was executed at $97.5, the Negative Slippage would be;

= $98 - $97.5

= $0.5.

Concusion

The Bid-Ask Spread is a topic all traders should know and understand. Utilizing it enables one to escape certain minor losses in trading. The Spread helps us know the liquidity of an asset which then gives us an idea of what we as traders are getting ourselves into.

Slippage is really good as it gives us an idea of how far of we are from our intended price value.

Hello @danielo109,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Some parts need to be clearer.

Some points are missing on the topic.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit