Hello everyone, this is my homework post for @reminiscence01 on Trading with Price Action. This course is very important when it comes to trading with Technical Analysis. I enjoyed reading his post because he stated facts about trading that I could relate to. You can check it out here. I believe you'd also enjoy reading and acquiring useful knowledge.

Without wasting much time, let's begin. I'd first state the questions, and answer them based on my knowledge and research. I hope you enjoy reading this post.

1- Explain your understanding of price action.

What is Price Action?

Technical analysis is built on Price Action. Price Action basically studies the behaviour of the price of an asset over time. This is based on the historical data of the asset's price movement. With Price Action, you can look at charts and make predictions as to where the price would move using simple markings or identifying patterns.

While Technical Analysis is a derivative of Price Action, it is good to know that they are similar but not the same. Technical indicators and theories are built using Price Action. What I'm driving at is, without Price Action, Technical analysis isn't possible.

Price Action is the basics of Trading using Charts. Without it, you'd just be aimlessly moving about in the market taking huge losses and getting depressed every time you trade. The price of an asset after a long study would teach you a lot. You would see similar movements that resulted in certain outcomes. This is what Price Action is simply about. The price moves in an unpredictable way creating patterns or touching levels which allow traders to predict the next movement.

The main factors considered with price action are support, resistance, patterns, market structure, volumes and sometimes indicators. It is also important to note that what drives the price of assets is the emotion and psychology of traders. The price of assets would not move without traders. Based on their emotions and psychology, they either buy or sell causing an asset to rise and fall. For this reason, the emotions and psychology of traders are key factors to trading with Price action.

When the price movement creates patterns or reaches certain levels of support and resistance, it makes sense to assume the price would move in a particular direction because the majority of traders in the market expect it to go that way. As such, the price ends up moving where you predicted, and this is because of Price Action. The demand and supply of an asset increases or decreases based on the psychology and emotions of traders. Let's take a look at a simple chart pattern.

The pattern above is a double top. This pattern signals a bearish reversal. From the image above you can see how the price violently came down after hitting the resistance a second time. You can make assumptions that the price came down because of the pattern, and this is because of Price Action.

With Price Action, you can trade with less risk by spotting good entry points and using support and resistance to take profit and stop losses.

2- What is the importance of price action? Will, you chose any other form of technical analysis apart from price action? Give reasons for your answer.

The Importance of Price Action

Price Action is very important. Like I said earlier, Technical analysis is a derivative of Price Action, and so you can't be a technical analysis trader without good knowledge about Price Action. In the above section, we saw how patterns influenced the direction of price. We further explained how this relates to the emotions and psychology of traders in the market. This is just to say that knowing the signals that price gives by its movement provides a great opportunity to make profits. Below are some of the importance of Price Action.

Price Action allows you to make meaning out of the price movement on the chart. This improves your understanding of the price movement and enhances your prediction skills.

This helps you to identify trends easily and spot reversals in the market trend.

Price Action enables traders to identify good entry and exit points in the market.

Trading with Price Action reduces the riskiness of trades. This can be done with support and resistance levels.

Will you choose any other form of technical analysis apart from price action?

The answer to this question is "No." There are two main types of technical analysis. These are chart patterns and technical indicators. As explained earlier, Price action is the basics of Technical analysis. Most often I prefer using just price action to trade. I do this by marking the support and resistance levels; the weak, strong and possible levels. I then wait for patterns and signals to make good entries. At times looking at the chart and the price movement, I scalp using limit orders. I use price action to identify the current trend and then I mark possible entry points and place limit orders. The price reaches the mark, triggers the order and then a reversal occurs. With this strategy, I barely see losses after taking positions. The exit point is also set the same way.

I don't often use technical indicators to trade. The main reason is that they are not reliable. They either give signals too early or late and have to be used together with other indicators to cover their faults. This is because they are based on formulas and are calculated using historical data of the price. They can also lead to distractions at times and so I avoid them.

Personally, Price Action is suitable for me. I have used other strategies and they weren't good for me. Price Action makes me conscious of the movement of the price and also understand the demand and supply in the market. I find myself thinking quickly and making fast decisions and sticking to plans until I notice a sudden change in the market. The image below shows what my chart looks like most of the time.

.png)

The strong support and resistance levels have been marked with thick lines. The faint lines were mostly set for entry and exit positions. I check out the larger timeframes, mark the support and resistance levels and zoom in to the smaller timeframes, mark the weak support and resistance levels with faint lines to spot good entry and exit positions.

3- Explain the Japanese candlestick chart and its importance in technical analysis. Would you prefer any other technical chart apart from the candlestick chart?

The Japanese Candlestick Chart

The Japanese candlestick shows a graphical representation of the emotions of traders in a market. With it, you can see the interaction between buyers and sellers in the market represented by candlesticks. This chart was discovered by Munehisa Homma in the 1700s.

.png)

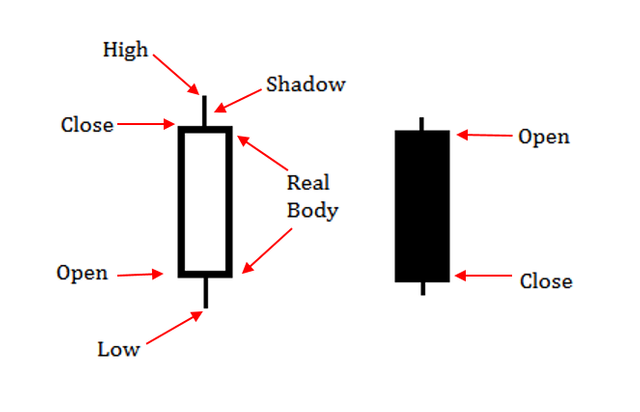

The candlesticks record the price movement of an asset within a particular timeframe. From the image above you can see two different candlesticks on the chart. These are the two types of candlesticks; bullish and bearish candlesticks. Normally the bullish candles have colours of either green or white while the bearish candles appear as either red or black. The image below shows the anatomy of the bullish and bearish candlesticks.

The bullish candle is on the left, and on the right, the bearish candle. The parts of the candle have been labelled in the image above. You can check out my post on Introduction to Charts for more details on the anatomy of the candlestick. The key difference to note about the bullish and bearish candlesticks is the open and close price of the candle. For the bullish candle, the open is below the close while for the bearish candle the close is below the open.

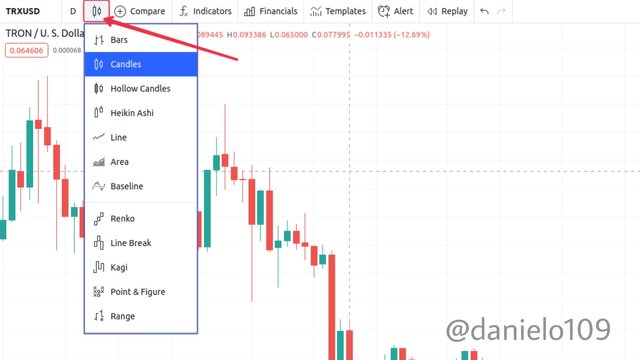

The Japanese candlestick chart is the most used chart with Technical analysis. There are different types of charts. Some examples can be seen in the image below.

Line, bars and Heikin Ashi are the commonly used ones. The Japanese candlestick chart is mostly used because it provides a good and clear representation of the price movement of an asset. You can make markings on the chart and still have an attractive chart.

It also provides traders with enough details unlike other charts like the line chart which provides traders with price movement based on just the closing price within a period of time. The candlestick records the open, close, high and lowest price within a specified period. This allows you to analyse the supply and demand of the asset and make good predictions.

4- What do you understand by multi-timeframe analysis? State the importance of multi-timeframe analysis.

What is Multi-timeframe Analysis?

Multi-timeframe analysis is the use of two or more different timeframes in analyzing the price movement on a chart. The timeframe refers to a specified period of the recorded price movement of an asset. They are represented with candlesticks on the Japanese Candlestick chart.

.png)

There are different timeframes available on charts. We have as low as 1 second and as high as 1 month. With every timeframe selected, each candlestick represents the movement of price within that unit of time. Let's take the chart below as an example. This chart is on a 1-day timeframe. Thus, every candlestick represents the price movement recorded for a specific day.

.png)

This chart is on a 1-day timeframe. Thus, every candlestick represents the price movement recorded for a specific day. If you change the timeframe to 5 minutes, you would have the recorded price movement after every 5 minutes. It is important to note that the timeframe is based on UCT.

The Importance of Multi-timeframe Analysis

Multi-timeframe analysis is very important when trading. We've identified that price moves in a similar pattern and it is controlled by the demand and supply of the people in the market. The use of multi-timeframes allows you to analyse the price movement within specific units of time and this has a lot of benefits. Below are some of the main importance of multi-timeframe analysis.

Identifying strong support and resistance levels using higher timeframes.

Identifying weak support and resistance levels with lower timeframes.

Identifying the direction of trends with higher timeframes like the 1-day timeframe.

Identifying reversals with lower timeframes.

Identifying good entry and exit positions with both lower and higher timeframes.

Setting tight stop loss and take profit with lower timeframes.

Working with different timeframes is the best. There are supply and demand zones that have to be identified with the various timeframes to enable you to trade with the trend. You can use the higher timeframes to identify the current trend and the lower timeframes for spotting reversals in the trend. The support and resistance levels for the different timeframes should be identified also. This would allow you to be conscious of the supply and demand zones so that you do not go against the emotions and psychology of the mass traders in the market.

It is also important to note that there are strong hands in the market. These types of traders are called whales. They manipulate traders into taking wrong positions in order to harvest their funds. Using multi-timeframe analysis helps you to cancel out all the noise and identify the manipulative signals in the market.

Let's take a look at how to utilize multi-timeframe analysis using the images below.

.png)

With the 1 day timeframe, you can identify the direction of the trend and trade accordingly. In the chart above, I marked the support and resistance lines to identify the long term demand and supply zones. You can notice how there was an uptrend, followed by a reversal and then the downtrend. The price broke support and found another support level, and it's currently above the previous support level. You can see a pattern like the double button which led to the increase in demand and price. After the reversal and hitting the current support level, you can notice a pattern similar to the double top. This shows that the price is expected to decrease.

For long term traders, this could be enough to trade, but for short term traders, we would have to zoom in to the lower timeframes. This would also help long term traders find good entry and exit positions.

.png)

The chart above is a 2-hour timeframe chart of ETH/USDT. As you can see this has given clarity to what was happening after hitting support. You can see the price break in the uptrend line. This often signals a reversal. It simply means the momentum of the buyers has decreased and the sellers are taking control over the market.

.png)

Zooming into the 15 minutes timeframe, you can see a pattern similar to that of a descending triangle. This pattern signals a bearish reversal. You can see that the price continually decreased after the pattern.

Multi-timeframe analysis is very important. In the next section, we're going to see how to identify good entry and exit positions using multi-timeframe analysis.

5- With the aid of a crypto chart, explain how we can get a better entry position and tight stop loss using multi-timeframe analysis. You can use any timeframe of your choice.

How to Identify good Enty or Exit points with Multi-timeframe Analysis

To find good entry and exit points, you first have to start from higher timeframes and zoom in to the lower timeframes. This is because the higher timeframes help you to identify the current trend and the main support and resistance levels. The lower timeframes help you identify signals of possible reversals or continuation in trends. They help you know the current behaviour and psychology of the market.

.png)

From the day timeframe chart, you can see the way the price moved down violently after hitting a high supply zone. You can identify a pattern similar to the double top. The strong support and resistance levels have been marked with a black line. As you can see, the price has broken one of the strong support lines. To get more insights as to what is going on let's zoom in to a smaller timeframe.

.png)

From this timeframe, you can see more movements of price within the day's period. You can also see the reaction of price as it hit the levels of support and resistance. With this, you can identify good entry and exit positions.

.png)

From the 1 hour timeframe, you can see clearly the direction of the trend and identify weak resistance pr support levels. I marked the current resistance level with a red trendline. As you can see, the price has broken the strong support level with strong momentum.

.png)

With this information, a good entry point to sell would be the support level that was broken. The take profit would be the low strong support level or a little less. The stop loss can be in level with the current resistance. Most often I increase the stop loss a little bit and decrease the take profit because of manipulations. Placing very tight stop losses could kick you out of a trade before it gets started. This is mostly due to the manipulations by whales and other strong hands in the market.

.png)

After the price hits the last support level, you can expect the price to move in the opposite direction. With this, you take a buy long position. With this instance, the stop loss should be a bit tighter. This is because the price might continue violently in the same direction which could amount to huge losses. The take profit can be the previous support or a little less than that. This is because that level could be considered a new resistance level.

6- Carry out a multi-timeframe analysis on any crypto pair identifying support and resistance levels. Execute a buy or sell order using any demo account. (Explain your entry and exit strategies. Also, show proof of transaction).

Demo Trade with Price Action and Multi-timeframe Analysis

The asset used for this trade is SHIB/USDT. I first checked the day timeframe to identify the support and resistance level.

.png)

After marking the support and resistance levels, I switched to a lower timeframe to identify the current behaviour of the market.

.png)

I marked the support and resistance levels in the 4 hours time frame. From the image above, you can see that the price of the asset had increased greatly within a short period. I switched to the 30 minutes timeframe and took an entry.

.png)

From this view, I identified a new support level. Price had hit the support level and was heading to the resistance level.

.png)

I quickly took a long position. The stop loss is the yellow line while the green line is the take profit.

.png)

Later on, I zoomed in to the 1-minute timeframe to notice signs of reversals. After noticing the long bearish candle I quickly exited the position. This trade was based on scalping and the use of price action. I closed the trade just to be safe and take the small profits I had made.

.png)

The image above shows the trade history.

Conclusion

Price Action is very important in trading. I've been using it together with some fundamental analysis and it has proven reliable. It is very important to consider fundamental analysis in trading also. Most long term traders trade with this type of analysis. As a technical analysis trader, if some major developments pertaining to the asset you're trading is out and you have no idea, it could cost you a lot.

As a crypto trader, I'd advise other traders to keep tabs on bitcoin as they trade other cryptocurrencies. Within this week, you can notice a correlation of the movement of prices of other assets with Bitcoin. This is mainly because of its dominance in the crypto market. You'd notice a rise in Bitcoin causes a significant rise in the other assets. The same applies to when the price is falling.