Hello friends, it is my pleasure to participate in this week's academy lectures, thanks to Professor @imagin for such a beautiful lecture.

1 Perform a complete analysis of the currency of some exchange. Not allowed: BNB, KuCoin, Cake and Uniswap.

With regards to this, I will be running my analysis using the HUOBI Exchange currency.

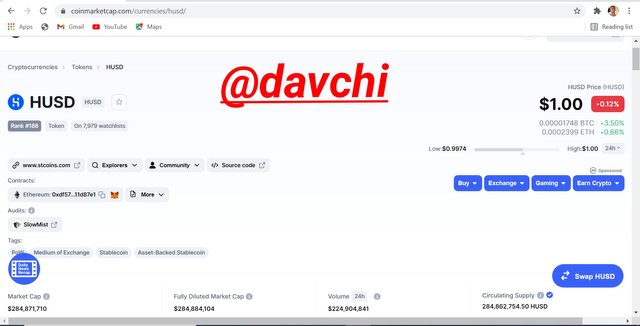

The HUOBI Exchange Currency (HUSD)

HUSD was founded in 2019 by Frank Zhang also known to be the CEO of Stable Universal with some other of his cartel like Claude Gu ( team member ) who is also a senior Operation manager in stable universal and also Shi Deng who is the financial founder of HUSD He is also a Compliance Director in stable universal.

The HUOBI Exchange inventors announced the creation of the HUSD which is the local token of the exchange in 2019 and it was released the same year in accordance with the US legal requirements. The developers also try to provide reliable and safe service to customers as acclaimed by them.

HUSD is issued on the Ethereum Blockchain technology as ERC-20 token and backed with the ratio 1:1 of the USD. Further, Paxos Trust Company also holds the HUSD in their internal reserves. It is circulated that the HUSD is being audited by a US Auditing firm every month to ensure equilibrium between the USD and the HUSD.

The HUSD is actually a reliable fiat collateralized stable coin which amalgamates the efficiency of the block chain and also the fixed nature of the Dollar (USD) where it is also pegged at a dollar. The HUSD give it's users the advantage of minimizing the loses caused by market volatility. Hence the focus of Zhang and his friends with regards to this token is to provide stability, convenience, security and liquidity to traders in the market.

HUSD follows the transactional smart contract provided by ERC - 20 network and some trusted exchanges where one can buy HUSD includes but aren't limited to: MDEX, Hotbit, BHEX, Gate.io etc.

As of the time of making this post and also from the screenshot above, the HUSD has a pegged dollar value that is $1.00, Trading volume of $224,904,841, Circulating supply of 284,862,754.50HUSD and a fully diluted market cap of $284,884,104

From the chart above, HUSD has performed a little bit above the USD with price at $1.0007 but still below performance as it is on the red stochastic phase of the chart.

2 Make a purchase equal to at least US $ 10 of the currency you explained above. You must make some movement with that currency within the exchange that created that currency. Show screenshots and explain in detail the steps to follow. Example: transfer of funds, Staking, participation in a Launchpad, trading in futures, etc. Indicate the reasons why you chose that option (operation) on that platform.

With regards to this, I will be manipulating through this using my Huobi account and I will also be making a stake of my token in the flexible Earn account as to confirm my movement within the exchange.

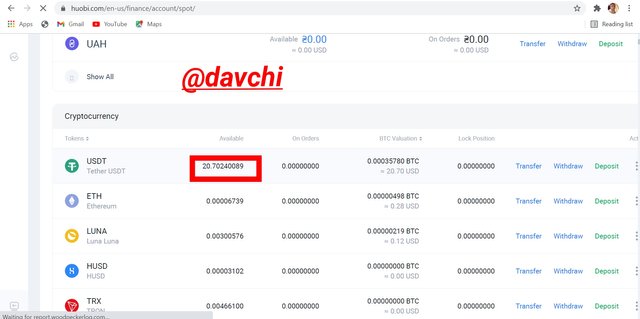

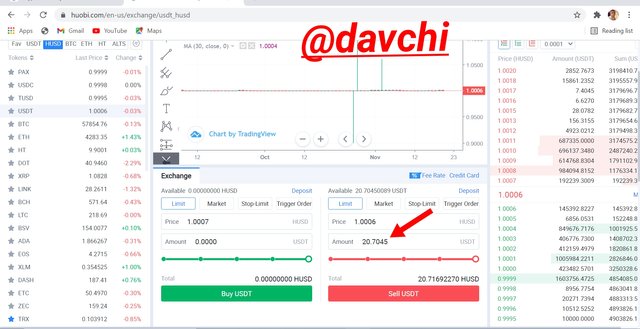

From my wallet screenshot above, it is obvious that I have 20.704 USDT amount and with this, I will be purchasing the HUSD which is the local token of HUOBI Exchange.

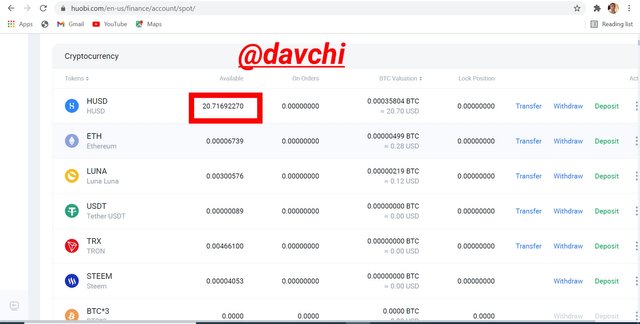

A confirmation of the HUSD purchases using 20.704 USDT which is my wallet balance.

Next I will be making a 0 to 48hrs movement with this asset. Hence I wish to stake in the Huobi Earn to see the productive capacity of my asset but to do this, HUOBI Exchange does not have HUSD as a preference in it's flexible Earn pack so this will prompt me in re-exchanging the HUSD to USDT again as to stake in the HUOBI flexible Earn pack.

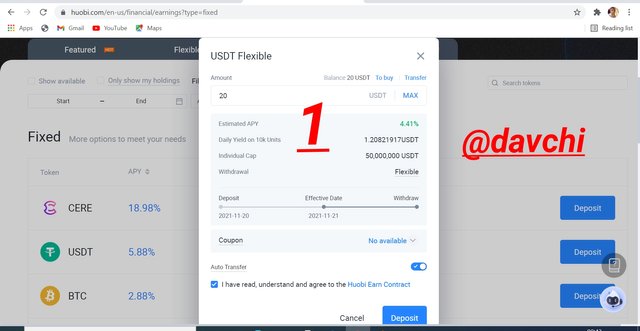

After exchanging it, I then go to the series of Earn packages which includes Featured Hot, Flexible, Fixed and First-timer New and then I will be selecting USDT, since this is the asset I wish to invest in and from the screenshot below, we can see that I have invested in USDT using 20 values of it.

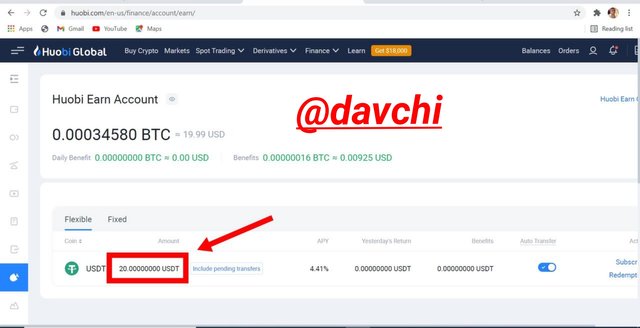

First I will provide the amount I wish to be staking in the Flexible Earn pack, of which I decided to go with $20

Source

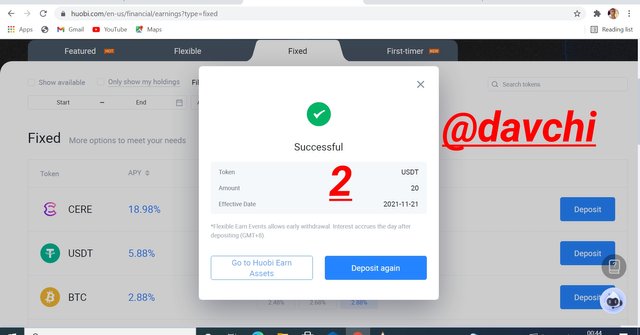

Next is to confirm the staking which can start and end in any date as you wish.

Source

Finally we can see the $20 worth of my asset in flexible Huobi Earn pack

This is actually how to stake your assets in Huobi Earn pack, based on any ones preference, you can choose any of the packs but it is a bit risky to go with fixed option as you may not be able to un-stake your asset If probably their is a market deepening so it is better to stake in the flexible Earn so as to redeem your profit and capital once you're satisfied with the performance of your asset.

- Reasons For Choosing The USDT Flexible Earn

I actually chose this pack first, against price fluctuation which is a norm in cryptocurrencies.

Although the USDT isn't that too volatile as to earn me some reasonable income within the shortest possible period, I also chose it to appreciate my dormant token given the 5.88 APY which would have given me a greater and higher income if I had a reasonable amount of it.

Finally I choose the flexible Earn option so as to easily vacate the market on time should there is a little bit deepening and more so to take my profit on time if probably price should appreciate a little above $1

3.) Show the return on investment in time frames of 0, 24 and 48 hours from the moment you bought. Take screenshots where you can see the price of the asset and the date of capture.

From my investment within the 48 hour period, the following were observed.

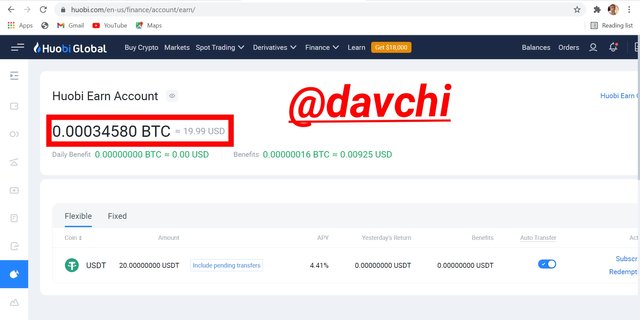

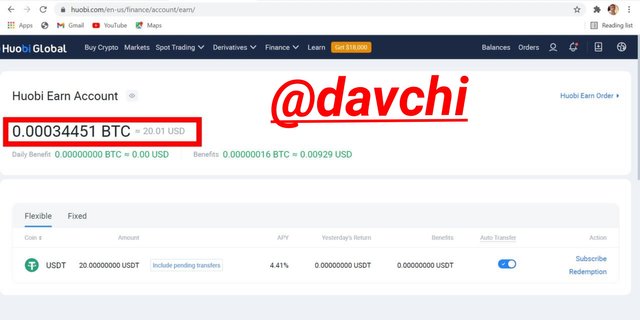

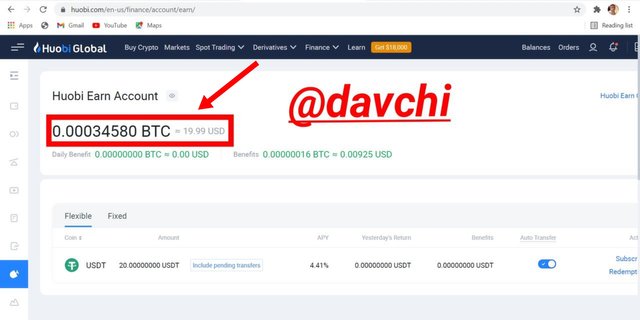

At the inception of my investment, my asset was valued at 19.99 USD which was after some obvious deductions were made from my staking and this can be seen from the screenshot above.

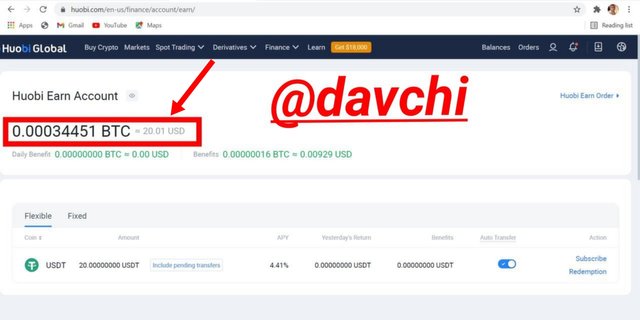

In a 24 hour period, there was a little increase in my investment from 19.99 USD to 20.01USD valued at 0.00034451 BTC, This is also shown in the screenshot above and I believe there would have been a more greater increament if this was to be an unstable coin like BTC.

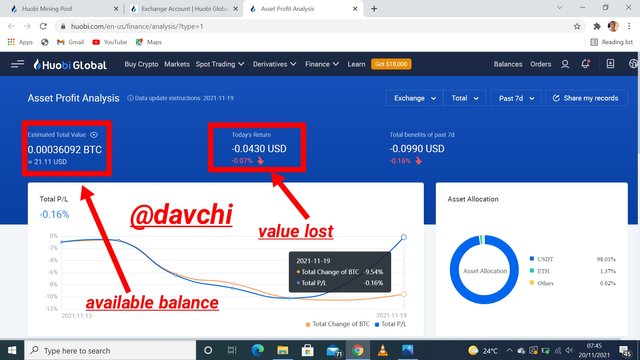

Within this period, there was a little drop in price which also affected my staking where I lost about 0.07% of my investment which is about -0.0430USD and the final stage of my investment is actualized despite the loss.

3.1) Has the asset's price acted independently or does its price strictly follow the correlation with Bitcoin?

You can add the information you want, creativity will be taken into account.

The asset price did not act independent of the BTC as it has its price in a comparative and simultaneous movement with the BTC.

Really from my observation, a shift in the price of my staked USDT causes a corresponding shift in it's BTC value for instance at the inception of my staking which is confirmed from the screenshot above, there is a downwards shift in the value of my USDT stated at 19.99 USDT while the BTC values was at 0.00034580

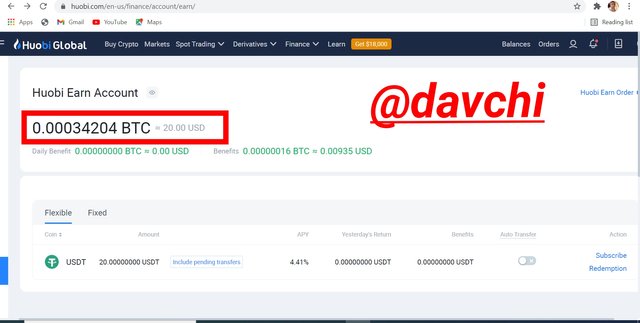

More so at an approximated value of 20 USD, BTC price changed to 0.00034204 as shown in the screenshot above which is still a confirmation of price correlation

On the other hand, as we can see from the screenshot above, when the price increased a little bit to 20.1USD, BTC value also increased to 0.00034451 which is a confirmation that there is a correlation and simultaneous increase or decrease in the value of my staked asset to the BTC price.

4.) What are futures trading?

Future trading is a special financial contract that allows a trader to buy or sell an asset at a predetermined limit. This helps in hedging price changes which could have led to irrelevant trade losses.

Nevertheless future traders are always in advantage of entering the market at any time, whether the market is either going on the bull or in the bear run.

Future trading also helps in leveraging some percentages over your invested capital which you can also lose if paradventure the trend turns against your prediction.

In future trading, traders are not allowed to easily exit or enter the market as they can only enter or exit through an already specified limit option.

Finally the beauty of trading in futures is a sideless restriction of trading option as one can sell short or buy long at any time depending on the current market trend although this is not without risk because you can lose all your investment within a second if the market has to go against your prediction depending on the percentage of risk you leveraged as it is wise to use 5% or less when the trend is not too obvious and to increase your leverage when there is an obvious favourable trend of your prediction.

5.) What is the margin market?

The margin market is a special market where a trader is required to deposit some quantities of an asset that will help in maintaining a leveraged position over a period of time. For instance if a trader wishes to trade on the Ethereum but does not have upto one Ethereum to trade with, he will be on advantage of trading a certain high percentage that is greater than his possession by depositing a certain fraction of his asset in maintaining the margin position.

In a simple word we can acclaim margin to be a spare amount given to cover certain contingencies while trading.

Nevertheless, there are two types of margin Viz: cross and isolated margin.

When trading using the cross margin option which is the riskiest kind of margin trade, all your assets balances are liquidated once your trade has gone below the maintenance margin position.

This is also a risky but a safer margin option in trades and this intends that at positions where the trade has turned against you, the only position to be liquidated should be restricted to the open position alone and not to all your staked margin maintenance balances.

Finally margin trade is very risky especially trading it in cryptocurrencies which is a volatile asset so it is better not to trade on margin than to trade without understanding how it works.

6.) What happens to the cryptocurrencies of an exchange when they suffer from a hack or it turns out to be a fraud? Present at least 2 real life examples.

Unlike our normal centralized Banks where values are stored, these banks are protected and backed with a certain amount of their reserves ratio with the central bank in every country if they should go short of funds either by theftry or by any other means and there are also the possible means of tracing and reversing lost funds.

Nevertheless, this scenario does not apply to crypto exchanges. In the virtual exchanges any lost token is lost forever whether it was done by hacking or any form of fraud although it will be recorded in the public ledger of the operational network that the asset is aligned with but it can never be tracked to the hacker or fraudster that perpetuated such an act.

For instance in 2019, Upbit which is a crypto exchange that is based in Korea lost 342,000 ETH to hackers and this was value at $51m and till date this has not been recovered despite all measures put in place and this made the exchange to go into a major security update that was completed in January 2020.

Another scenario is the case of Binance, one of the major players in the crypto world. Binance lost 7,000 BTC to hackers in may 2019 and this was valued at $40m and till date no trace has been made about it.

Finally cryptocurrencies that are lost in Exchanges are like smoke in the tin air that can't be recovered perpetually.

It is good for a trader to take a good analysis of the performance of an exchange before investing in it since most of the exchanges do not have a credible security to protect the interest of its customers and funds. Besides, traders should also take proper technical and fundamental analysis of a token before investing into it.

With respect to trade, it is wise for traders to trade with caution especially to trade on spots against irrational trade loss and for upcoming traders it is not wise to use the margin or future trade option if it's features and measures are not well familiar to him, gracias profesor @imagen

Cc: @imagen