Hello everyone, it is another great week in the crypto academy as i have been able to learn more about what Bitcoin halving is. All thanks to Prof. @imagen

Source

Question 1

How many times has halving been performed on Bitcoin? When is the next one expected? What is the current amount that Bitcoin miners receive? Name at least 2 cryptocurrencies that perform or have performed halving.

Before I talk about Bitcoin halving, it is pertinent to understand a bit about mining.

In the Bitcoin network, there are persons known as miners who are responsible for keeping the blockchain updated. They do this by solving some complex equations which is created by the bitcoin protocol.

Any miner that is able to successfully solve the equation is then rewarded with some Bitcoin. This reward is always referred to as a block reward. This block reward is to incentivize the miners so that they continue to dedicate their time and computing power to keep the Bitcoin network secured. But this Bitcoin reward do not always remain fixed or constant forever.

This now leads to where I will describe what Bitcoin halving is.

Bitcoin halving is the moment at which the block rewards of the Bitcoin miners is being divided into two. This halving is known to occur after every 210,000 blocks have been mined or after a period of 4 years.

Bitcoin has so far been halved for three times. The first occurred in November 28th, 2012, when the block reward of Bitcoin was reduced or halved from 50 Btc per block to 25 Btc. The second halving occurred in July 11th, 2016 when the block was again reduced to 12.5 Btc per block. The third occurred in May 5th 2020 when the block reward was again halved to 6.25 Btc. This therefore means that Bitcoin has so far been halved for three times and the next halving is expected to happen in 2024 and the block reward will be 3.125 Btc.

The reason why halving is ideal is so that the number Bitcoin in circulation will be reduced and the value of Bitcoin will increase. This is in fulfilment of the law of demand and supply. This therefore means that the halving is done in order to keep inflation under control because when Bitcoin is in limited supply, its value is bound to increase and inflation will be subjected to full checks and balance.

Currently, Bitcoin miners receive block reward of 6.25 Btc.

Two other cryptocurrencies that has experienced the halving event are Litecoin and ZCASH (ZEC)

Litecoin initially started rewarding its miners with 50 Ltc. The 50 Ltc was later halved to 25 Ltc and currently, the block reward for miners of Ltc is 12.5 Ltc.

ZCASH (ZEC) is another halves every four years just like Bitcoin, with a maximum supply of 21 million ZEC. The first halving even of ZEC occurred in 2020 and the block reward for miners was reduced from 6.25 ZEC to 3.125 ZEC.

Question 2

What are consensus mechanisms and how do Proof-of-Work and Proof-of-Staking differ?

Consensus mechanism is simply an agreement among nodes in the decentralized network to keep record of every transaction in the decentralized ledger also know as blockchain.

It is the consensus mechanism that is responsible for verifying validating blocks in the chain, keep track of every transaction data, and as well determine the rewards of miners of the blockchain.

How PoW Differ From PoS

PoW consensus protocol is one whereby there is an assemblage of transactions into a unified pool giving freedom to miners to access these transactions for validation. So, miners can randomly pick up these transactions and work on them to solve the cryptographic algorithm. Their successful solving which is a product of how much computing power they employ and there analytic skills, gives a miner the right to add enter the transaction into the blockchain. Proof of Work consensus protocol does not depend on any third party. It was developed by the developer of bitcoin, Satoshi Nakamoto.

In PoW, the miner has to show sufficient evidences that he did some level of work. It is more hardware dependent.

While

PoS protocol requires that consensus is reached by alloting mining rights to miners based on the possession of some qualifications, in this case, the quantity of stake or units of the currency owned. Here, transactions are assigned to miners for validation based on the quantity of stake they posses. Thus, the higher the portion of defined stake owned, the higher the chances of being assigned transactions for validation. Proof is stake is a protocol that Scott Nadal and Sunny King invented back in the year 2012.

| PoW | PoS |

|---|---|

| It more energy intensive even though there is greater freedom. It make us of huge energy consumption | it is more energy efficient though there is less freedom of selection. Miners are not choosen randomly but based on stakes. |

| Miners spend more money in acquiring needed hardware as it requires specialized equipment. It is more capital intensive and expensive. | Proof of stake is less expensive and more cost effective as standard server grade unit of computing power is more than. |

| PoW protocol miners are more concerned about investing in hardware. PoW depends on computer's processing power and speed. | In PoS, a validator's concern is how much he or she has as investment in a blockchain. |

| The first successful miner earns mining rewards in forms of units of the currency | The rewards does not go to the first successful miner but rather he or she is given a transaction fee |

| Longer length of time is needed to operate PoW | PoS does not take as much time and runs much faster. |

| There is no consideration of portion of stake controlled by a particular miner as a requirement for participation in the mining process | Consideration is given to how much stake either in ownership of native coin or voting power a miner posseses prior to being assigned transactions for verification and validation. |

Question 3

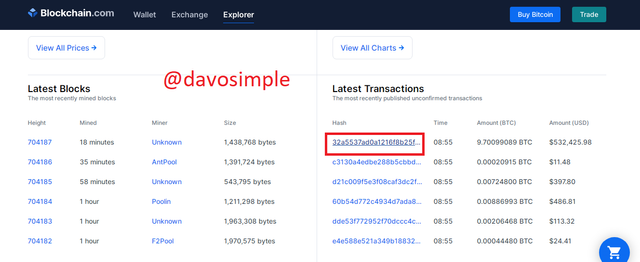

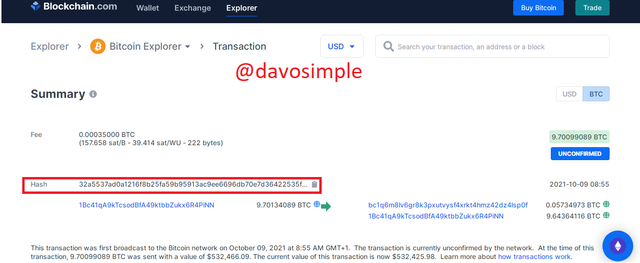

Enter the Bitcoin browser and enter the hash corresponding to the last transaction. Show Screenshot.

For this task, I will be exploring the Blockchain Explorer

Blockchain Explorer

Blockchain Explorer

Below are the transaction details.

| Txn | Txn Details |

|---|---|

| Hash | 32a5537ad0a1216f8b25fa59b95913ac9ee6696db70e7d36422535f876d6cf56 |

| Fee | 0.00035000 BTC |

| Date | 2021-10-09 |

| Time | 08:55 |

| Status | Unconfirmed |

| Amount sent | 9.70099089 BTC |

Question 4

What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Reason your answer.

Altcoin season is the season where alternative coins outstrip Bitcoin in performance. During this season, alternative coins have an increase in their trading volume and their market capitalization increase while that of Bitcoin tends to be decreasing.

It is believed that during Altcoin season, alternative coins, precisely, the top 50 have an increase in performance to at least 75%.

![PicsArt_10-09-11.43.06[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmdHFYpWqisEFBibm28atsR7qcXfkfWwL4jaQVHZcMFWqB/PicsArt_10-09-11.43.06[1].jpg)

Blockchaincenter.com

According to Blockchaincenter.net, the Altcoin season index as at the time of creating this post is 51. This means that we are not in Altcoin season.

![PicsArt_10-09-11.42.27[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmT1rdVtLLCGLD6Fu75g661oA8CLSVEEuW4k1cpHNLhaK6/PicsArt_10-09-11.42.27[1].jpg)

Blockchaincenter.com

I will love to talk about 2 coins which are FTM and AXS.

![PicsArt_10-09-11.41.53[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmV5Cpz1iskyt4RczCRRX1BggnhLfUEnyMkm22FFpoM2Tg/PicsArt_10-09-11.41.53[1].jpg)

coingecko

FTM ranked top performing altcoin with a percentage growth of 846.9%. As at March 13, 2020, FTM was trading at $0.00190227 and it has spiked from that price to $2.15. FTM has increased over 100,000% in price within the past months. It currently has a trading volume of $2,611,497,566 and a market cap. of $5,477,011,464.

![PicsArt_10-09-11.40.51[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmcjxRmrHWYByh9G1MnVnNNHc4JDqJkzAv9AZvrMM655cz/PicsArt_10-09-11.40.51[1].jpg)

coingecko

AXS ranked second at 616.4% growth. As at 11 months ago, AXS was trading at $0.123718 but as at now, it is trading at $126.11 meaning it performed so well in the last season with a percentage increase of about 616.4%. Its current market cap is $7,685,265,426 with a trading volume of $1,137,822,408.

Question 5

Make a purchase from your verified account of the exchange of your choice of at least 15 USD in any currency that is not in the top 25 of Cornmarket (SBD, tron or steem are not allowed). Why did you choose this currency? What is the goal or purpose behind this project? Who are its founders/developers? Indicate ATH of the coin and its current price. Reason your answers. Show screenshots.

For this question, I will be making a purchase of NEO coin.

NEO is the native token of the Neo network.

![PicsArt_10-09-11.39.07[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmdqJamuxAbSGWyiGeQLyxD3BP3tLnu9oYo64pyKj6Yxef/PicsArt_10-09-11.39.07[1].jpg)

Coingecko

It is currently trading at $48.66 and it is ranked #52 in the coinmarket. It has a market cap of $3,430,701,766 and a trading volume of $292,434,907. It all time high was on the 15th of January 2018, over three years ago and its all time high was on the 21st, 2016.

I made this purchase using Binance exchange.

![PicsArt_10-09-11.37.32[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmX5g2h9jihvFLuEjWw8QF6rgaWnkUT4mh8SmcF3WvbXdX/PicsArt_10-09-11.37.32[1].jpg)

![PicsArt_10-09-11.36.24[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmbdgzrEE36YvvX4KU9b6mUvjSS33287VamsUS4Dkm6v68/PicsArt_10-09-11.36.24[1].jpg)

Reason for choosing NEO

Neo is a fast growing project which was launched in February 2014 as AntShares and rebranded in June 2017 as Neo. It is the Chinese first-ever public blockchain.

It has a clear goal of becoming the foundation of the next generation's Internet where users will have complete control of their own data and their digital assets via smart contract.

They offer supports grassroot developers, institutions, businesses etc.

Neo Founders

The Neo founders and the Neo predecessor are Da Hongfei and Erik Zhang. They both are the chairmen of the Neo Foundation.

Goal or Purpose of the Project

The major goal of the NEO project is to automate complete control of digital assets with the aid of smart contract algorithm and also to develop a smart economy system where management authority is distributed to everyone in the network.

Conclusion

Bitcoin Halving is a phenomenal criterion for the value of BTC to be truly unveiled. Since do that value of an asset to be unveiled, the law of supply and demand has to be met, it therefore pertinent that the block reward of miners be halved.

It has been a wonderful class with Prof. @imagen and I have learnt a lot.

Thanks for having me .

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Gracias prof @imagen por esta hermosa reseña. Pero después de todo este gran y satisfactorio comentario, ¿cómo terminé con 7.5?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit