Special thanks to Prof reminiscence01 for this great lectures about tokens. It really is a great lecture.

.jpeg)

Source

1 What Is Token And Five Examples Of Tokens And The Blockchain It Is Built On

Tokens are digital asset created and built on a blockchain. It can be transferable, held or traded with other crypto tokens or distributed through the standard initial company offering process (ICP), often used to raise fund for project development. Tokens are created by digital asset companies or programmers to fund raise a project, investors who finds the project quite attractive and promising places a stake in the company’s share or purchase the token for various reason which includes access to product and services.

Example of five tokens and the blockchain its built on

| TOKENS | PLATFORM |

|---|---|

| BTCB (Betcoin BEP2) | Binance Chain |

| SHIB (Shiba Inu) | Ethereum |

| BUSD (Binance USD) | Ethereum, Binance smart chain and Binance Chain |

| SAFEMOON | Binance smart chain |

| BAT(Basic attention) | Ethereum |

2. What Is The Difference Between A Token And A Coin

Coins are digital asset equivalent to legal tender and used as a method of payment. It possesses similar characteristic as money. It is acceptable, limited in supply, portable and durable and serves the purpose as a means of exchange.

Coins can function independently such as using a coin to buy or sell a token but not vice versa.

Tokens are digital assets that are issued by smart contracts who come up or launch incentive project that would attract investors for specific function within the project’s ecosystem.

Below is a summary of the difference between coins and tokens.

| Coin | Token |

|---|---|

| A coin is a native digital currency of a blockchain. | A token is built on a blockchain that has already existed. |

| It can be used a means of payment | It is mostly used as incentives |

| Creating a coin is a laborious task. | Tokens can be easily created by anyone who has knowledge of blockchain network that is already in existence |

3. Utility tokens, Security tokens, Equity tokens, Non-fungible token (NFT).

Utility Token

Utility token is a token that promise the future access of a company specific products or services, and they are investment that helps in financing a project for startups. Certain risk is accompanied during initial coin offering, because some tokens will lack value in a case the project fails or dumped or never sees the light of the day once a specific amount is raised.

Features of Utility token

It gives access to a future product or services through ICOs

Unregulated fast and easy way to fundraise a project but prone to scam.

Security Token

Security token is a tradable financial asset verified in the blockchain which ensures profit share, revenue share or dividend. In US, the Howey test is brought into consideration to ensure that a token is a security token and it states that “A transaction is considered a security sale if a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party.” ref

Features of Security token

It is an investment protected by STOs to avoid fraud or scam.

Regulated financial market where all participant are investors.

Equity Token

Equity token just like a share, is a form of security asset that entitles his holders to decision making, voting right and other beneficial entitlement. By these, investors directly or indirectly are involved in the growth of a project on the blockchain and rewarded on the bases of its performance in the financial market.

Features of Equity Token

They are managed by regulatory body

Maintenance of value and ensures investors interest

Access to information and activities as a stake or shareholder

Non-Fungible Token

Non-Fungible token are digital artefacts that reflects the real world assets and cannot be exchanged unlike bitcoin, ethereum, dollars that has equivalent when compared to other asset or substituted due to its unique feature or attribute on the blockchain, these digital assets represent its own kind with authenticity and can’t be easily duplicated such as games, sport cards, arts and videos. It can be processed, sold and bought digitally.

Features of Non-Fungible token

It exist on a decentralized platform

Transaction are recorded on the digital ledger

4. My Research On Safemoon

.jpeg)

Source

Safemoon is a BEP-20 token launched on the binance smart chain on the 8th of March 2021. John Karony is the CEO of safemoon followed by Thomas Smith (CBO), Hank Wyatt (CTO), Jacob Smith (Web developer) and charles Karony (Executive assistant).

Safemoon is one of the fastest growing altcoin in the crypto space.

Within the short period that Safemoon has been in existence, more than 2 million users have been added to the project's protocol and more than 45% of the token token supply have been burned.

The coin was created with the aim of addressing the prevailing issue of impermanent loss faced by many crypto investors, and also to promote the "buy and hold" method of investment.

This means that safemoon rewards everyone that holds the token for a longer period of time and not sell it. So the longer the hold, the more incentives the holder gets.

This "buy and hold" strategy issued by the project's developers is to make the price of the token get a better drive in the price.

This idea of imposing a buy and hold rule on the token has oriented the token with so many criticism by some critics that the token is a scam token.

Safemoon Tokenomics

Each sale of safemoon incurs 10% fee levy. This fee is used to incentivize the token holders.

For example if $100 of safemoon is sold, a $10 financial fees is enacted and the $10 fee is split into two such that the $5 fee is redistributed to the loyal and existing holders and this is known as static reward. The remaining $5 is split into half, $2.50 is sold by the contract into binance and the other $2.50 is added as a pair of liquidity on pancakeswap.

Functions/Aim Of Safemoon

It is envisioned to curb the risk of impermanent losses faced by so many investors in yield farming. This means it is poised to give static rewards to its investors

It has a burn strategy which is believed will be of great benefit to the community of traders in the long term.

It has an automatic liquidity pool which drives at alleviating the troubles associated with current Defi reflection tokens.

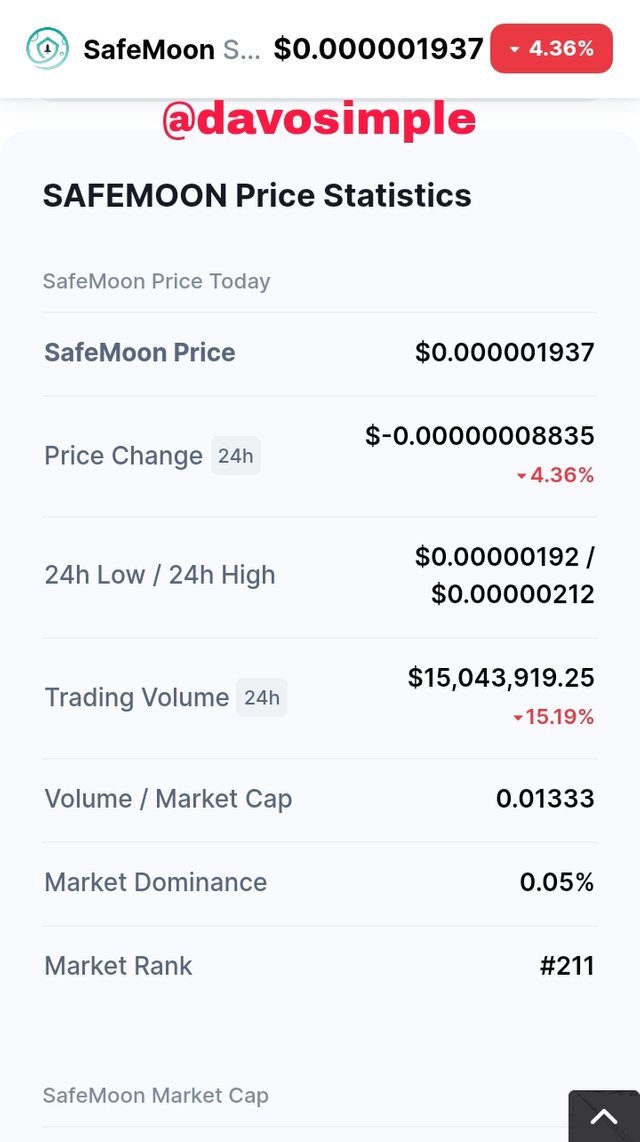

coinmarket

As at the time of writing this post, safemoon was worth $0.000001937.

24h trading volume of $15,043,919.25.

24h low of $0.00000192

24h high of $0.00000212

Volume/Market cap of $0.01333

Market Dominance of 0.05%

And it is ranked #211 in the market.

Cc

Prof. @reminiscence01

Hello @davosimple, I’m glad you participated in the 8th week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

You meant Initial Coin Offering (ICO)

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit