Hello great minds, it is my pleasure to take part in this weeks lectures about Arbitrage trading my Prof @reddileep. It has been a great lecture.

Source

Question 1

Define Arbitrage Trading in your own words.

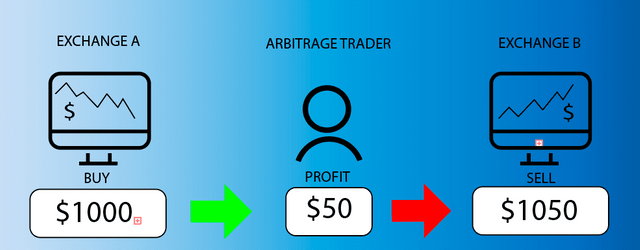

Arbitrage trading is simply the process of buying an asset low in a particular market and selling the asset at a higher price or selling the asset at a price slightly higher than the amount that asset was bought in another market.

This trading strategy perfectly works when it is done very quickly and it must be done strategically. This trading strategy is possible because there are some liquidity variance or liquidity difference in every exchange. This is means that each exchange has a number of persons buying and selling a particular crypto asset and this process of buying and selling determines the current price of that crypto asset in that exchange. That is why in most cases, the price of an asset in particular exchange is a bit higher than the price of that same crypto in another exchange.

This is a low risk trading strategy of taking advantage of market variance of the price of an asset. It is less riskier than day trading or swing trading because day trading and swing trading makes use potential price action to determine the profit of traders but Arbitrage trading makes use of current price valuations.

A simple example is buying BTC from Coinbase at $100 and selling the BTC on Binance for $103. It means I have now made $3 profit just for being a middle man or an Arbiter .

Criteria For Executing Arbitrage Trading

- For a profitable trade execution, assets must be bought and sold immediately.

- The same asset bought in a particular market must be the same asset sold in another market.

- Delays in trade execution will always lead to potential exposure to risk.

Question 2

Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

In my research, I found out that there are about 40 types of Arbitrage. Below I have listed few of them and the source from which I found them.

• Cryptocurrency Arbitrage

• Triangular Arbitrage

• Covered Interest Arbitrage

• Uncovered Interest Arbitrage

• Merger Arbitrage Or Risk Arbitrage

• Statistical Arbitrage

• Index Arbitrage

• Betting Arbitrage Or Sports Arbitrage

• Currency Arbitrage

• Convertible Arbitrage

• Futures Arbitrage etc. Source

Cryptocurrency Arbitrage

Cryptocurrency arbitrage has to with the ability of a trader to take advantage of price variance between two different cryptocurrency exchanges. Take for example, Binance is selling Steem lower than Bittrex, a trader can take full advantage of that price variance and quickly buy from Binance an sell in Bittrex and make profit.

Triangular Arbitrage

This trading strategy, also known as three point arbitrage or cross currency arbitrage is the type of trading strategy where a trader makes profit from the variance between three assets. This is done by trading a particular asset lets say asset X for asset Y, then trading asset Y for asset Z and finally trading asset Z back to asset X.

Covered Interest Arbitrage

This trading opportunity takes advantage of the variance between the interest rates of two countries. This is possibly achieved by using forward contract to minimize the risk associated with exchange rates.

Question 3

Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

This trading strategy, also known as three point arbitrage or cross currency arbitrage is the type of trading strategy where a trader makes profit from the variance between three assets. This is done by trading a particular asset lets say asset X for asset Y, then trading asset Y for asset Z and finally trading asset Z back to asset X. This cross currency trading has to be done very quick when the market price of a particular asset is undervalued and the other is overvalued.

Below is a practical example of how triangular arbitrage looks like.

The three assets i will be using to illustrate this example are STEEM, BTC and ETH.

![PicsArt_09-30-07.47.32[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmenT7tDbaDWwNNDd6ZbKC5Rgkrw4vbnZdNtAt6twwEizD/PicsArt_09-30-07.47.32[1].jpg)

screenshot from Binance

I began the trade with STEEMBTC pair in the Binance exchange. I sold 182 Steem for 0.00188006 BTC at the current bid price of $0.00001033.

![PicsArt_09-30-07.52.21[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmYopKKYuBdoR8biQ7BP5iyZtLyVNgfEWesMqf94ozUvVo/PicsArt_09-30-07.52.21[1].jpg)

screenshot from Binance

I then used the 0.00188006 BTC to purchase 0.001876 ETH at the current ask price which is $0.06949.

![PicsArt_09-30-07.54.26[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmcVHjXgTV5EkE47z3AJVLCHJR3F3TFouWY3co2vW4mR6C/PicsArt_09-30-07.54.26[1].jpg)

screenshot from Binance

Then finally, i then used the purchased 0.001876 ETH to further purchase 183 steem at a current ask price of 0.0001483.

![PicsArt_09-30-07.29.35[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmad9kjrhMH8HaNyauyrZKoTBHM56icJWB1aquso6fhFJv/PicsArt_09-30-07.29.35[1].jpg)

Designed with PicsArt

This illustration further explains how i have just completed a triangular arbitrage and made a profit of 1 steem in a very few minutes.

Question 4.

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

For this task, i compared the price movement of Tron in both the Poloniex exchange and the Binance exchange. I noticed the price update on Poloniex was a bit behind that of Binance.

![PicsArt_09-30-07.33.24[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmXJPvNMsqMXcn3DmGUqowgJc4BqCrt45rdUdMx5J1Sr6R/PicsArt_09-30-07.33.24[1].jpg)

screenshot from Poloniex

![PicsArt_09-30-07.34.44[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmeKqMGv8RirdpLMPPf1d1vh5ZiSgt88atFQRorVeuZrmA/PicsArt_09-30-07.34.44[1].jpg)

screenshot from Poloniex

Then I placed a purchase order of 15 Trx with 1.310 USDT on Poloniex exchange.

![PicsArt_09-30-07.35.59[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmTsbbTXCX7vv9SCgE3ee2dux8BZ9Wa8Egp4bhRQtrdkGz/PicsArt_09-30-07.35.59[1].jpg)

screenshot from Poloniex

Here my purchase order got filled.

![PicsArt_09-30-07.30.59[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmUCzDuR9MvrU4VEx3mQTuBrcmdx3UFQY2XBA5ZPWmMt5K/PicsArt_09-30-07.30.59[1].jpg)

screenshot from Poloniex

![PicsArt_09-30-07.58.31[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmbYB3F59K2LWcfRHSnocZfrZrpQ8GUjABuJNmoyyaBLZj/PicsArt_09-30-07.58.31[1].jpg)

screenshot from Binance

I then moved the Trx to Binance exchange.

![PicsArt_09-30-07.43.19[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmTXvvZr87ZweawxdyzTDPkMw1jD5Szv2dKcSozWXv8bge/PicsArt_09-30-07.43.19[1].jpg)

screenshot from Binance

I then sold the Trx for USDT at the current bid price of $0.08755. You can see that on Poloniex I had 1.310 USDT but on Binance, i have now had 1.313 USDT meaning that i have made a little profit.

Question 5.

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

To answer this question, i used STEEM, BTC and ETH to execute my arbitrage trading.

![PicsArt_09-30-08.07.56[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmdeAXSuq5gxzFqsrEYsrfXQvdtNTuYxyVHaWKYzreDPpi/PicsArt_09-30-08.07.56[1].jpg)

screenshot from Binance

Above is a screenshot that shows my verification status on Bianance.

![PicsArt_09-30-07.47.32[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmenT7tDbaDWwNNDd6ZbKC5Rgkrw4vbnZdNtAt6twwEizD/PicsArt_09-30-07.47.32[1].jpg)

screenshot from Binance

I began the trade with STEEMBTC pair. I sold 182 Steem for 0.00188006 BTC at the current bid price of $0.00001033.

![PicsArt_09-30-07.52.21[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmYopKKYuBdoR8biQ7BP5iyZtLyVNgfEWesMqf94ozUvVo/PicsArt_09-30-07.52.21[1].jpg)

screenshot from Binance

I then used the 0.00188006 BTC to purchase 0.001876 ETH at the current ask price which is $0.06949.

![PicsArt_09-30-07.54.26[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmcVHjXgTV5EkE47z3AJVLCHJR3F3TFouWY3co2vW4mR6C/PicsArt_09-30-07.54.26[1].jpg)

screenshot from Binance

![PicsArt_09-30-08.37.05[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmUS9nSq1Hirqm9ocHn9jvsYJxNBYxvjKPAc5bVPxgZzar/PicsArt_09-30-08.37.05[1].jpg)

screenshot from Binance

Then finally, i then used the purchased 0.001876 ETH to further purchase 183 steem at a current ask price of 0.0001483.

This quick triangular arbitrage trade earned me an extra 1 steem. This means that if i strategically perform this trade for 10 times in a day, i would make 10 steem with less risk involved.

Question 6.

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

| Advantages of Arbitrage Trade | Disadvantages of Arbitrage Trade |

|---|---|

| The risk involved in the trade is very minimal | It requires good strategy before a trader can take advantage of the market and make profit. |

| Profit making in this trade is very quick | A trader could spend all day focusing on the market in order to execute a quick trade. |

| This trade is made much easier with bots | The profits with small capital is very low |

Conclusion

Arbitrage trading is one of the risk-effective trading strategy that is very useful for traders especially cryptocurrency traders because of the high market volatility in the crypto space. This strategy has helped many traders make profit without having to be in too much risk. Even though the Arbitrage trading strategy requires some level of efficiency and speed from the trader, it has still proved to be one of most quick-profit-making trading strategy one could ever think of.

Thank you.

cc

@reddileep

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit