Hello everyone, it is my pleasure participating in this week's course by Prof. @fredquantum. The lecture really is a great one.

1. OBV Indicator

Indicators are technical tools that are of great significance when analyzing the financial market and most indicators have proven to use real time price movement to increase the win rate of most traders. That is why good understanding of some great indicators and how they work should be given some attention.

OBV Indicator is a momentum indicator that makes use of pressures associated with volume to give a clue of the future movement of price.

Simply put, OBV Indicator simply helps a trader to analyze the possible volume flow in the market.

This indicator has been in existence since 1963 and was introduced by Joseph Granville in his book which he titled; "Granville's New Key to Stock Market Profits". The book has got so many good reviews and ratings, meaning that the OBV Indicator has been of great use to traders in the technical community.

Joseph Granville was of the believe that every movement of price action was propelled by the increase or decrease in volume, therefore he designed the OBV Indicator to give an early clue of when major price movement would happen.

2. How to Add OBV Indicator on the Chart

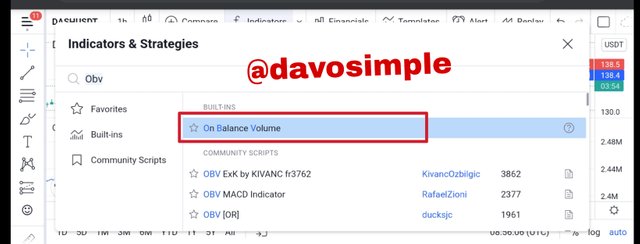

I will be using the Tradingview platform to show how to add OBV Indicator on the chart.

First, I visited the official website of Tradingview and then I clicked on Indicators

Then I search for OBV and the Indicator surfaced and I clicked on it.

Here, the Indicator is successfully added to the chart.

3. Formulas and Rules for calculating

In order to have a good understanding of how indicators correlates with price price action, it is pertinent to understand how they are calculated and the rules behind the calculations.

OBV = OBVprev ± Current Volume

Where;

OBV = On-Balance volume of present level

OBVprev = OBV of previous level

Now let's have a look at some considerations.

If the current market closes higher than the previous day's close, then the formula to be used is;

OBV = OBVprev + Current VolumeIf the current market closes lower than the previous day's close, then the formula to be used is;

OBV = OBVprev - Current VolumeIf the current market close equals the previous day's close, then formula will be;

OBV = OBVprev + 0

Below are some examples.

Lets assume that in the last 4days, closing price of STEEM had the following datas

1st Day : Closing price = $10, Volume = 20,000

2nd Day : Closing price = $12, Volume = 25,000

3rd Day: Closing price = $11, Volume = 23,000

4th Day: Closing price = $13, Volume = 25,000

OBV for 1st Day = 0

OBV for 2nd Day = 0 + 25,000 = 25,000 (I summed it up because the presents day close is higher than that of the previous day)

OBV for 3rd Day = 25,000 - 23,000 = 2,000 (I subtracted it because the presents day close is lesser than that of the previous day)

OBV for 4th Day = 2,000 + 25,000 = 27,000 (I summed it up because the presents day close is higher than that of the previous day).

4. Trend Confirmation using On-Balance Volume Indicator

One of the major use case of OBV Indicator is to identify trends and as such, traders will know what trend is about to occur in order to prepare for a trade entry, identify when there will be a possible divergence, and also know the strength of the trend.

Identifying Bullish Trend

Since OBV helps to project when there will be major market moves, a bullish trend can be identified if the OBV line is seen making some progressive higher highs and higher lows. A trader can take advantage of this signal by riding the trend and take some profits as the bull market might continue as the indicator line is making some swing highs .

Identifying Bearish Trend

Bearish trend can be identified if the indicator line is seen towing the downward direction, therefore making some swing lows. Traders can take advantage of the move and take some profits by opening a sell position and hold on as long as the downward movement of the OBV line continues but with strict care.

5. Breakout Confirmation with On-Balance Volume Indicator

When the market is in a range, that is, consolidating, OBV Indicator can play a great role in identifying when the market is about to pop out of the support or resistance. This is so because the OBV Indicator is purely a momentum indicator, therefore it helps a trader to have a clue of some breakouts of either resistance or support areas.

It is important to understand that breakouts occur after traders had closed there positions and the market consolidates, and traders gets back in to open new positions. Ofcourse traders getting back to open new positions simply means an increase in volume. OBV aids to know when this volume is about to increase.

From the screenshot above, we can see how price was consolidating and the OBV Indicator gave a good picture of the ranging market. As traders got back in the market and the volume increased, OBV line projected to the upward direction, indicating a major breakout.

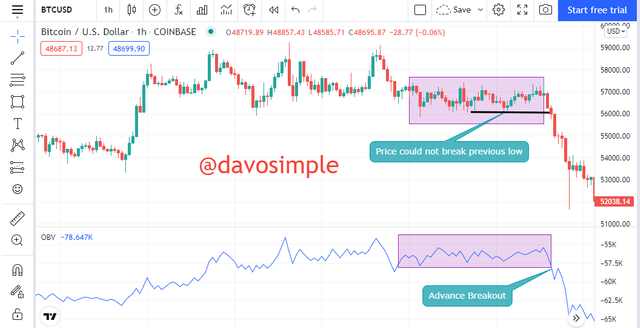

Above is another screenshot of the OBV line projecting a major breakout but this time, in the downward direction after the market had been in consolidation.

6. Advanced Breakout with On-Balance Volume Indicator.

Having learned about breakout in the previous question, let's now talk about advance breakout.

Advance breakout exists in the market if price kept respecting the previous high or previous low but OBV line made breakout above the previous high or low because it has been sensitive to an increase in volume, thereby telling a trader to get ready for a major breakout.

The screenshot above shows a view of the advanced breakout.

Price was still yet to break the previous high but OBV had already been sensitive to the increase in volume and then broke above it's previous high, thereby giving a trader a signal of major breakout soon to happen. This could be called a bullish advanced breakout

Above is another screenshot showing price respecting the previous low but the OBV line already broke out below it's previous low as a result of increased volume flow in the market. This is a good signal for a major breakout and this breakout is known as bullish advanced breakout.

7. Bullish and Bearish Divergence Using On-Balance Indicator

The OBV Indicator being a momentum indicator plays a great role in giving traders an early signal of trend reversal.

Let's consider a market which is in an uptrend making some swing highs. If the price makes an higher high but OBV line begin to make lower high, it is giving a trader an early signal that an uptrend will soon finish, therefore traders who were riding the uptrend can start preparing to exit the market and prepare to open a sell position. This type of divergence could be referred to as bearish or downtrend divergence. A better understanding of this can be seen the screenshot above

If the market was in a downtrend, and the price was making some swing lows. At a point price makes a lower low and the OBV Indicator makes a higher low, the indicator is telling the trader to get ready to close the sell position as the downtrend will soon come to a close and prepare to open a buy position. This type of divergence is known as bullish or uptrend divergence. A better understanding of this can be seen the screenshot above.

8. Placing a Demo Trade Using OBV indicator and Moving Average

Buy Trade

For this very question, I will be making my analysis with Tradingview and then place my trade with MT4.

On the chart of DASHUSD above, I added two moving averages

of 34 period and 12 period. The idea is to watch out for when the 12 MA crosses above the 35 MA so I can place a buy trade. I got a signal as the slow MA crossed above the fast MA. I then placed my trade on MT4 set my stop loss at 138.56 and my take profit at 140.14.

The trade then hit my take profit and left me with some profit.

Sell Trade

Again I had a sell signal on the same DASHUSD as I saw the fast EMA above the slow EMA. I then placed my trade on MT4.

I set my stop loss and take profit at 138.35 and 137.65 respectively.

The trade this time was against me as it hit my SL, giving me a loss of $56.74.

I feel this loss occurred because I used a very low time frame to enter the trade and as such, there were some deceptive signals. Therefore, the OBV Indicator should better be used with a higher time frame for it's effectiveness to come to play.

9. Advantages and Disadvantages of OBV Indicator

Advantages of OBV

The indicator and it's calculation is easy to comprehend.

The OBV Indicator can give so many early trend continuation and trend reversal signals.

It gives so many early buy and sell signals when used on a medium or higher time frame

The OBV Indicator tries to maintain information about the previous datas and doesn't repaint.

Disadvantages of OBV

The OBV Indicator doesn't work perfectly on lower time frames as it will give avalanche of false signals.

Using the indicator with low volatility instruments won't let the Indicator work well

The indicator even with it's good reviews about how best it works, it still can't work perfectly on its own unless combined with other good indicators.

Conclusion

OBV Indicator is one of the best Indicators when it has to do with measuring momentum in the market. It gives early signals of when to and when not to enter a trade. It also gives an early signal of price breakouts, thereby preparing a trader to ride the trend.

The OBV Indicator suits almost every trading strategy and as such, people tend to embrace it even more. Even though it has some few limitations, it could help a trader in understanding when large volume has been injected into the market and when the volume has been retrieved.

Thanks so much Prof. @fredquantum for delivering this amazing lecture.

Please Note: All screenshots used in this post are screenshots taken from Tradingview and Mt4 app

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit