Question 1

Define in your own words what a contractile diagonal is and why it is important to study it. Explain what happens in the market for this chart pattern to occur. (screenshot required / Bitcoin not allowed)

Contractile diagonal is the movement in price which shows the diagonal line convergence. This pattern is a great tool for traders as it has been of great help to them when it analyzing reversals in trends.

The convergence are identified as wave patterns having a format of 1-2-3-4-5.

It is ideal to know that price can never always remain in one trend. It will always go up and come down. Therefore, as a result of lesser liquidity providers in the market, and the price begins to consolidate, contractile diagonal aids a trader in predicting the next possible trend after the price compression.

Some traders know the contractile diagonal as Wedges. These wedges are of two types namely;

- The rising wedges which indicates that a bearish trend might possibly occur.

- Falling wedges which indicates that a bullish trend might possibly occur.

Question 2

Example Of A Contractile Diagonal That Meets The Criteria Of Operability And An Example Of A Contractile Diagonal That Does Not Meet The Criteria.

In order to achieve a considerably correct contractile diagonal operability, certain criterias has to be observed and these criterias are;

The wave labeled as number 1 has to be higher than the wave labeled as number 3.

Wave number 3 should be seen greater than wave number 5.

Wave number 2 must be of greater length than wave number 4.

When a diagonal is drawn, point 1, 3 and 5 has to align with each other except in some occasions which wave number 5 may have some deviations.

Point 2 and 4 must align to each other when the diagonal is plotted.

There should be some convergence on the points to be plotted.

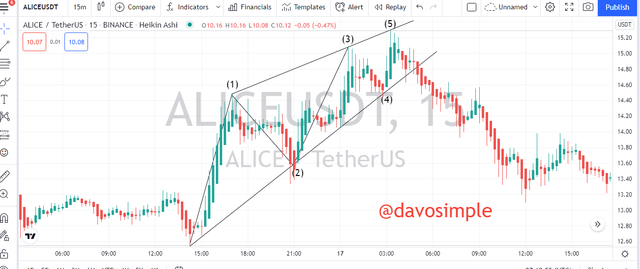

The image below justifies the above mentioned criteria. As the criteria were met, there was a counter trend which led to the change of trend.

This type contractile diagonal is referred as rising wedge.

The screenshot below shows how price successfully prevailed in making a counter movement even when it did not fulfill the contractile diagonal criteria. As can seen below, wave 3 is so apart than wave 1. This therefore means that the contractile diagonal criteria was not met.

Question 3

Through your Verified exchange account, perform one REAL buy operation (15 USD minimum) through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Your purchase data must match your analysis data: such as cryptocurrency and entry price.

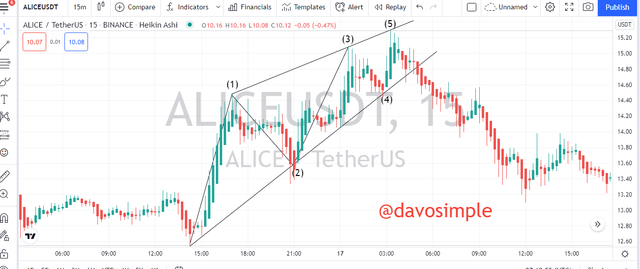

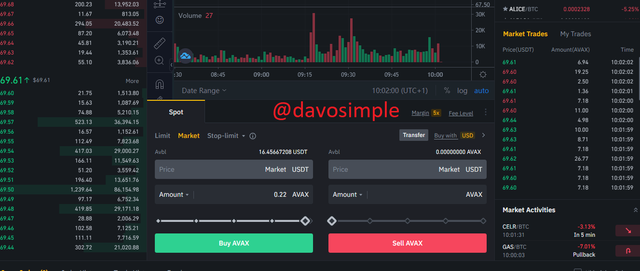

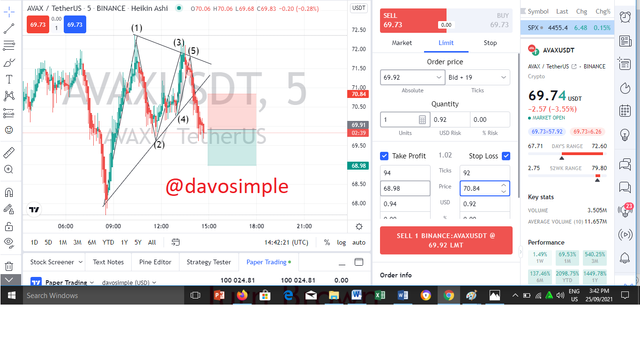

In the AVAXUSDT chart shown below, I noticed that there was a contractile diagonal signal. I then drew my diagonals and plotted the convergence lines.

Then I notice that price had made a counter move I then waited for confirmation and then opened a buy entry with 15 USDT.

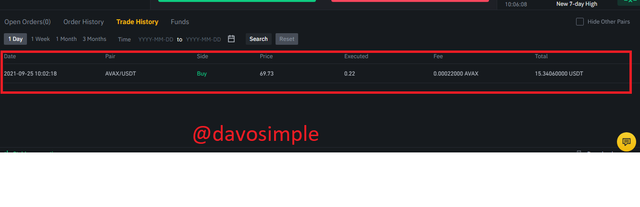

Here is the history of my trade which was filled.

Question 4

Through a DEMO account, perform one sell operation through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Bitcoin is not allowed.

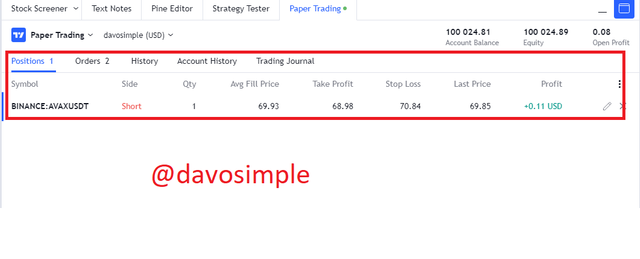

I identified the contractile diagonal on the chart of AVAXUSDT. I identified the points of convergence and then plotted the lines.

I then opened a sell position when I got the confirmation. My stop loss and take profit were placed in the ratio of RR 1:1.

This is my order history as I was still in profit.

Question 5

Explain and develop why not all contractile diagonals are operative from a practical point of view. (screenshot required / Bitcoin not allowed)

When trading with the contractile diagonal, it is always ideal to have a good idea of how and to correctly plot the converging points. The reason for the non-operative functionality of contractile diagonal even when the trading criterias are met is majorly because of its disadvantageous nature of R:R (Risk:Reward ratio) of contractile diagonal. This is because stop loss and take profit has to be carefully placed in order to make profits that is higher than the loss.

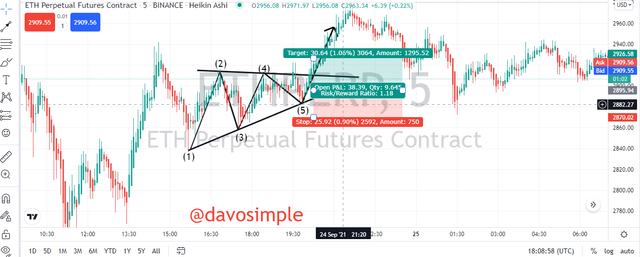

Below is a screenshot of ETHPERP where the trading criteria of the contractile diagonal was satisfied but the profit is lower than the loss.

Below is another screenshot where the take profit is just a little higher than the stop loss which in my opinion, it should be more.

Conclusion

The contractile diagonal is a great way of analyzing the price chart in order to be able to predict counter trends. This strategy really need a trader to understand it very well because it has a way of being disadvantageous to a trader when it has to do with risk reward ratio.

This is to say that it sometimes gives lesser profit that loss even when the criterion are justified.

Thank you