The emergence of defi of in the cryptoverse has brought some great revolution to the traditional financial system by removing the middle man and replacing him with smart contract. This is to ensure that everyone transacts with lesser hassles without having to trust the the other transacting party because every transaction is completely decentralized.

After the emergence of defi in 2013 with Ethereum being, so many other Defi platform has emerged and has allowed people to both lend, borrow and stake crypto while anticipating promisingly great returns of investment.

Amongst the numerous defi platform available in the cryptoverse is the Zethyr Finance.

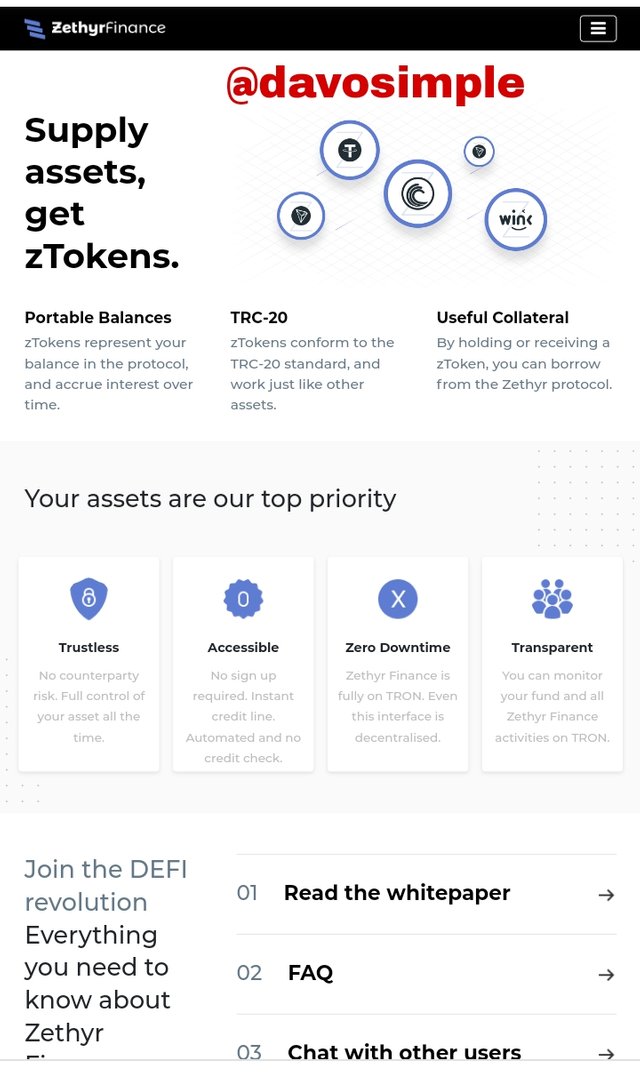

Zethyr finance is one of fastest growing decentralized finance protocol incorporated in the Tron blockchain that allows users to borrow and lend their TRC-20 tokens while aggregating great yields.

The Zethyr finance protocol has a set of tokens known as zTokens which when a user deposit some TRC-20 tokens in the dApp, the zTokens will be freely given to the user. This zTokens are minted upon deposits and then directly transfered to the user's wallet.

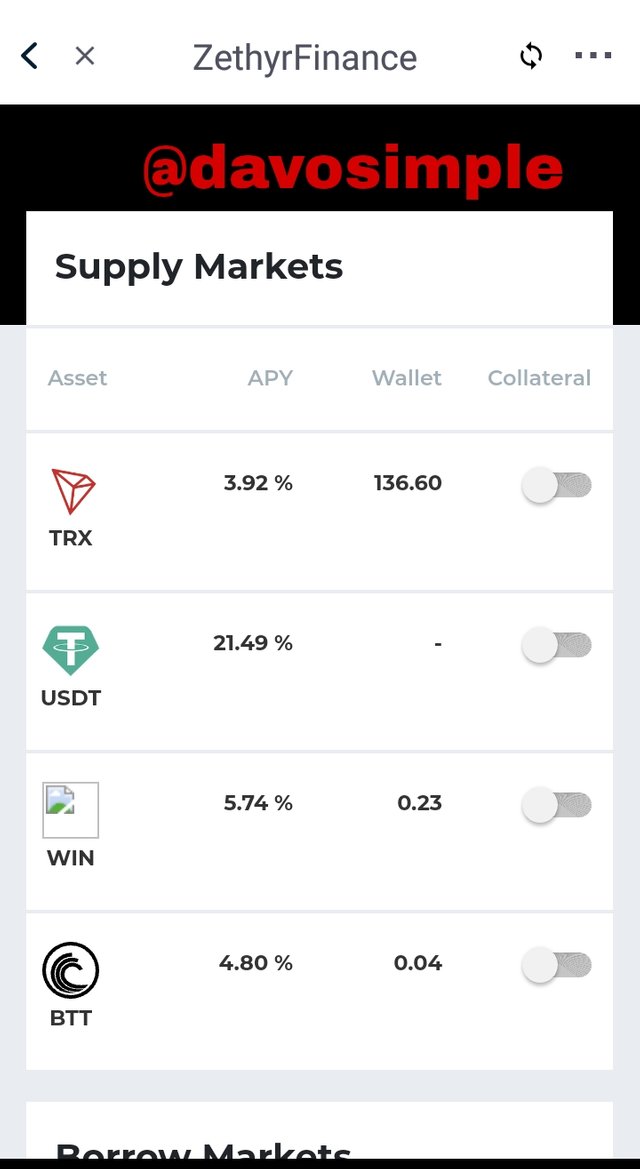

The tokens currently accepted for lending and borrowing in the Zethyr finance are TRX, USDT, WIN and BTT. Upon every successful deposit in the Zethyr protocol, the minted zTokens for the underlying deposits will be zTRX, zUSDT, zWIN and zBTT.

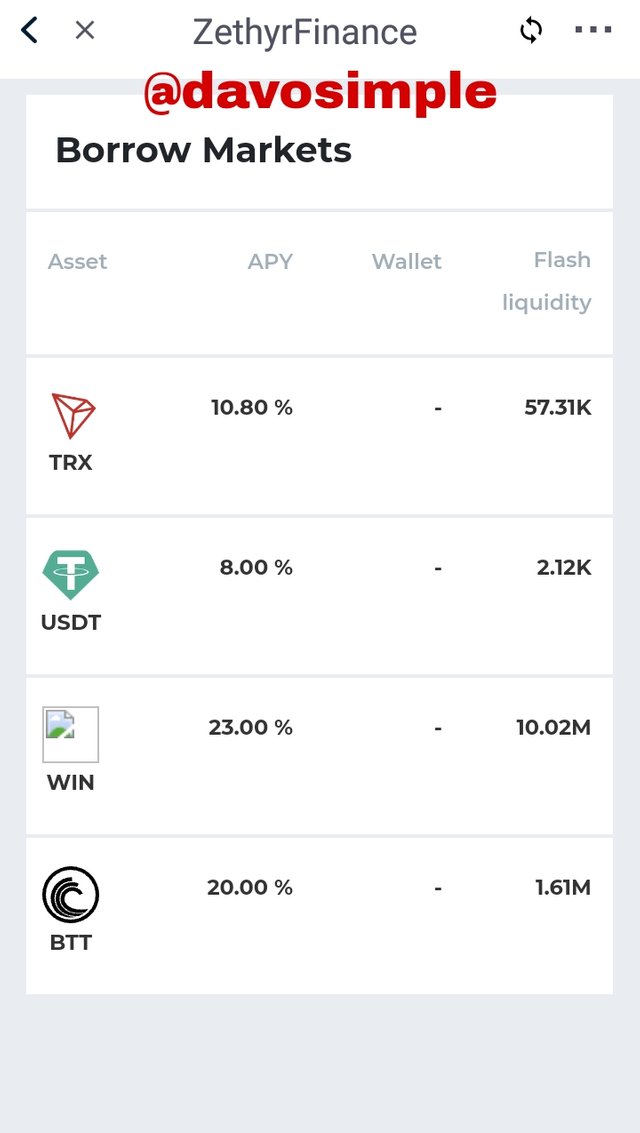

The available tokens listed for borrowing in the Zethyr finance protocol have their own interest rate for both borrowing and lending.

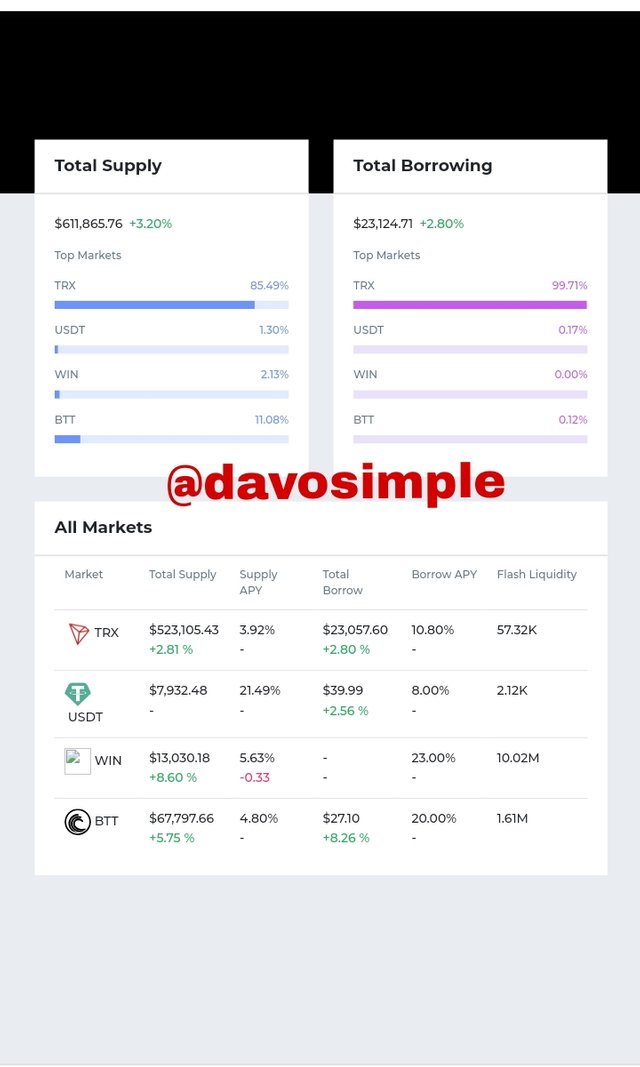

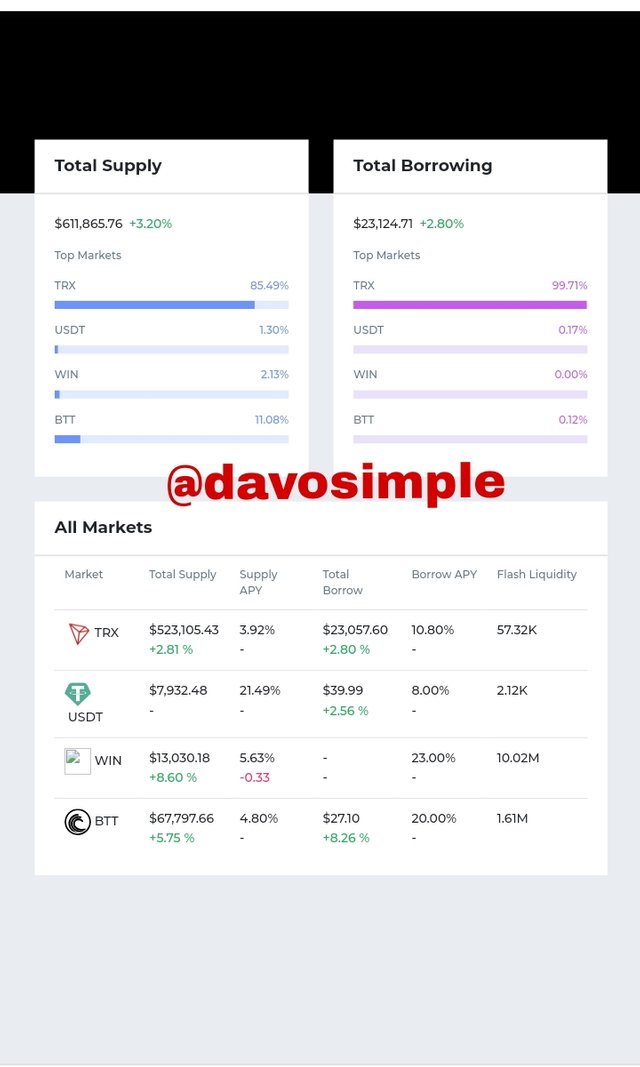

While making this report, the total amount in the supply pool of the Zethyr finance was $ while the total amount in the borrowing pool was $. The table below shows the interest rate of each of token.

2. What are the features of Zethyr Finance? Discuss them. What's your understanding of DEX Aggregator?

The Zethyr finance has several great features which are;

Lending and Borrowing

Lending and borrowing is one of the basic feature the Zethyr finance is characterized with. This feature let's users to be serve as liquidity providers by lending their asset to the pool through a process called staking, and then earn great interest depending on the amount of the staked asset.

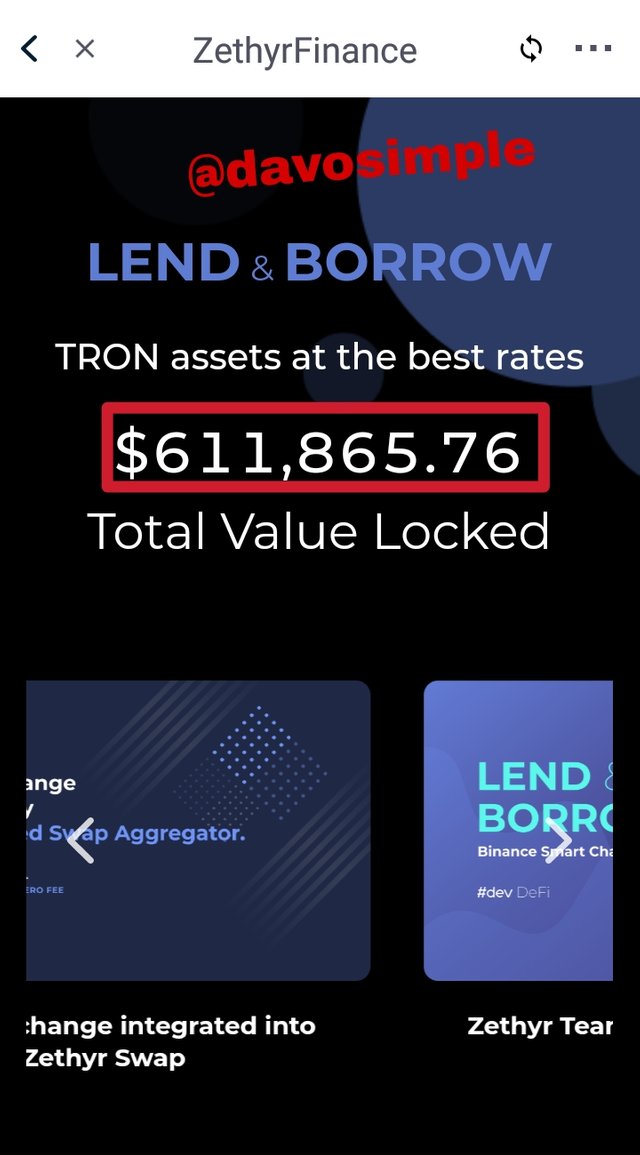

As seen above, a total of $ was the value of the locked asset while I made this post.

Swap feature

This is another great feature in the Zethyr protocol that lets users to swap their tokens from centralized exchange like Binance an decentralized exchange like Justswap swiftly at zero fee rate.

zTokens

These are tokens which are rewarded to users when they deposit their asset to the Zethyr protocol. They are directly sent to the wallet of users upon every successful deposit. It also helps allows anyone who wants to borrow from the Zethyr protocol to do so with ease just because the person holds the zTokens.

Stable Feature

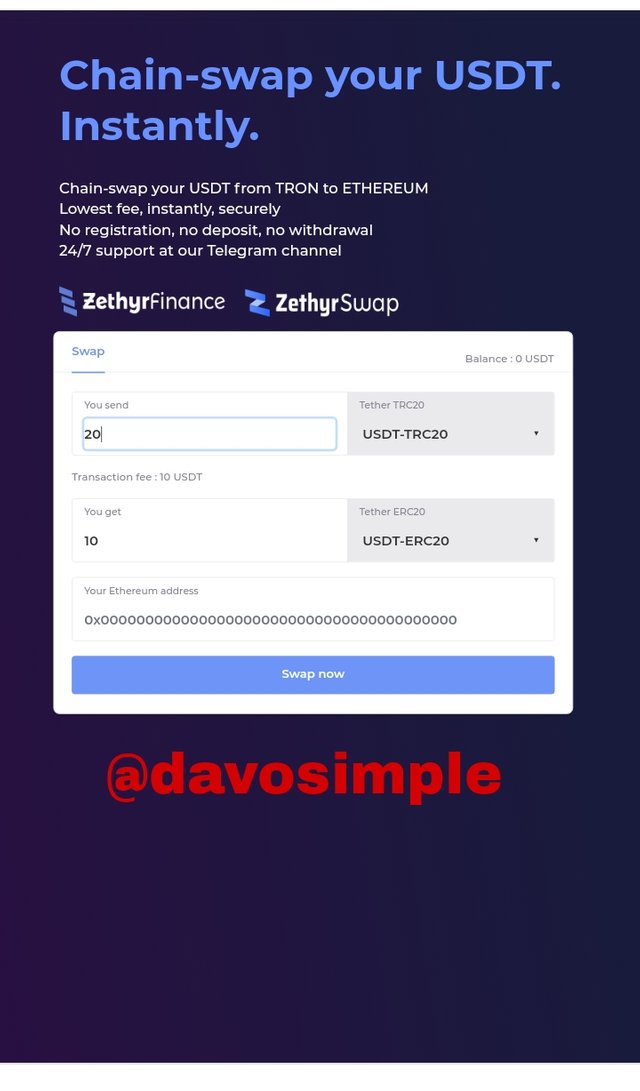

This is another great feature of the Zethyr finance. It allows users to, in just few clicks swap stable coins from TRC-20 to ERC-20 .

For example, if I want to swap a stable coin as USDT from TRC-20 to ERC-20, an exchange fee charge of $10 which is 10 USDT will be charged.

Market

This feature displays all the readily available tokens in the Zethyr finance protocol for lending and borrowing.

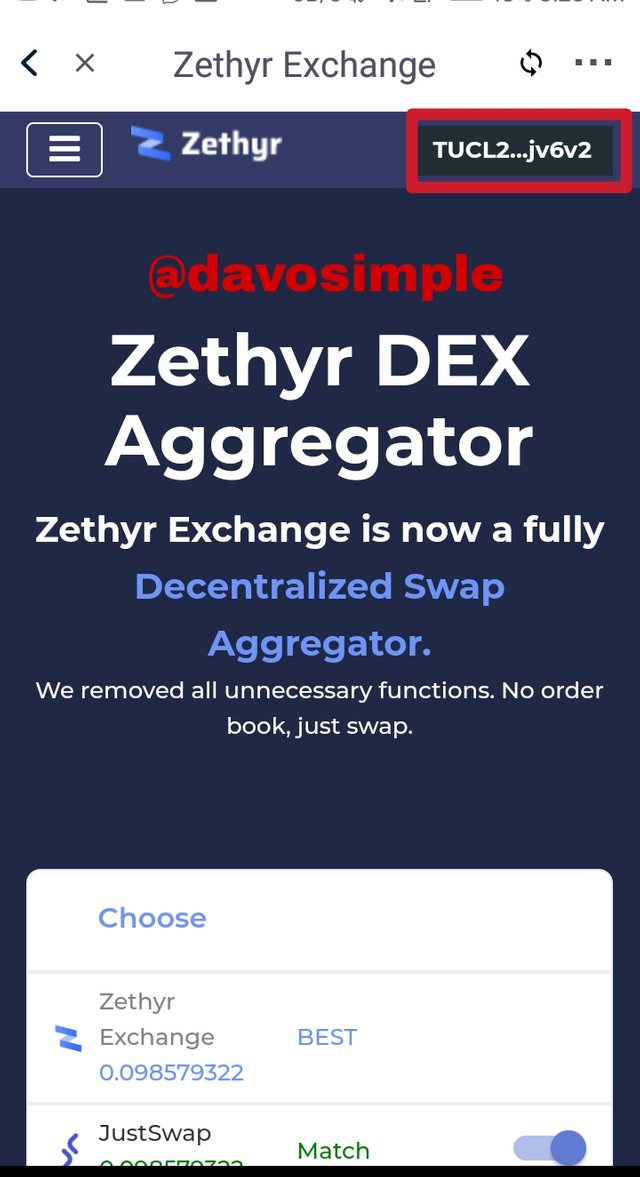

The Zethyr DEX Aggregator

The The Zethyr DEX Aggregator is simply a merge of the Zethyr Exchange with the Zethyr Swap protocol which rendered the Zethyr Exchange to be fully decentralized. This means that with just a click, swapping can be executed, no such thing as order book.

The Zethyr DEX Aggregator was introduced after an upgrade to version 2.2.8 was done in Zethyr protocol. This therefore means that before the upgrade, there was an extensive use of order book model for data recording in the Zethyr Exchange. For users to successfully exchange one token for another, they had to first place their order and wait for the order to filled. But all the waiting was eliminated after the upgrade. Users are now able to instantly swap one token to another in a complete decentralized manner, thanks to the The Zethyr DEX Aggregator.

3. Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

The Zethyr finance market can be explored either with Tron Link wallet or visiting Zethyr Finance

On the home page, click on Market to be able to access all the available assets for lending and borrowing.

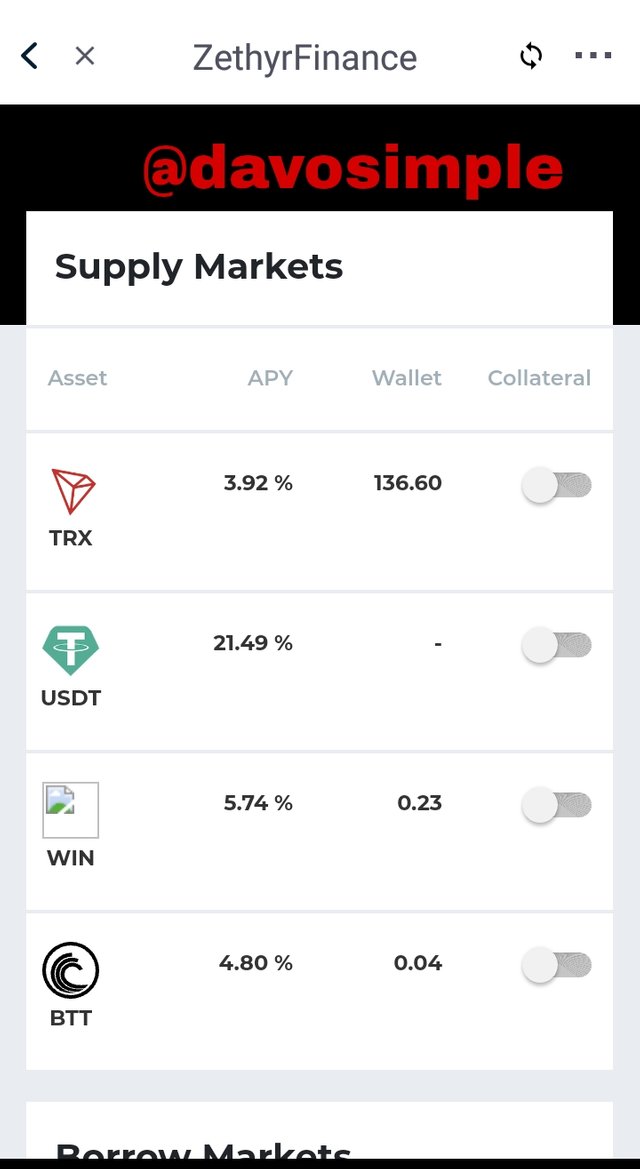

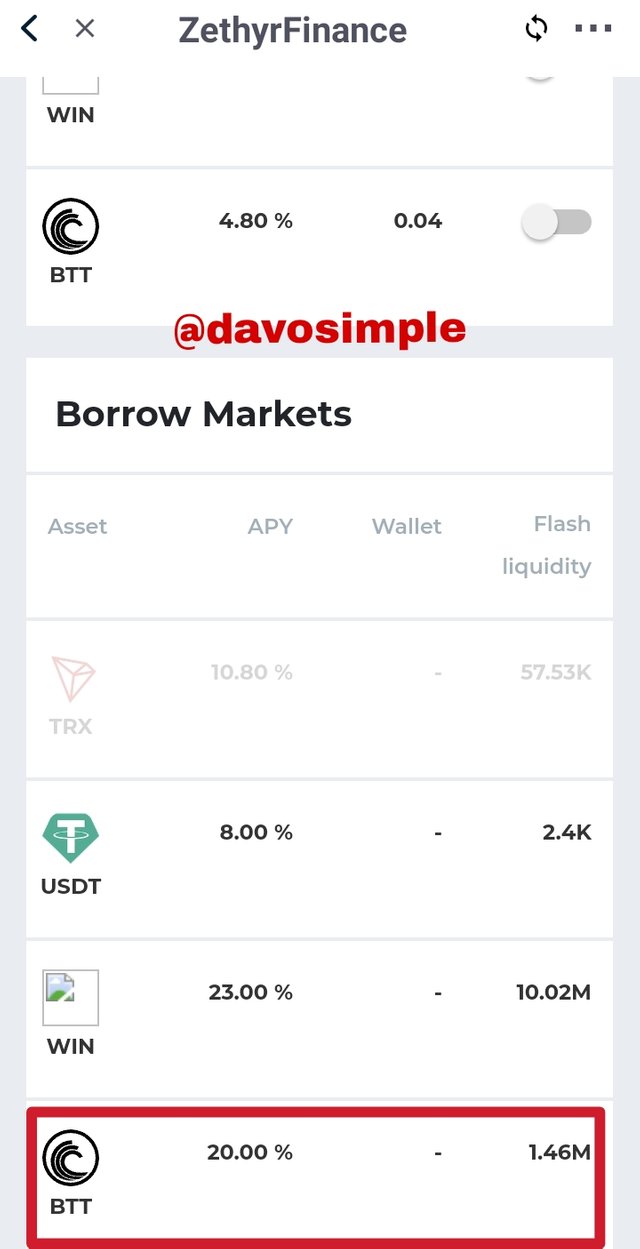

The available assets available for lending and borrowing are TRX, USDT, WIN and BTT. The total Supply was $611,865.76 and the total Borrow was $23,124.71.

The table below gives a breakdown of the profitability in terms of Supply and Borrow as at the time I created this post.

| TRC-20 Tokens | Total Supply | Total Borrow | Supply % Value | Borrow % Value |

|---|---|---|---|---|

| TRX | $523,105.43 | $23,057.60 | 85.49% | 99.71% |

| USDT | $7,932.48 | $39.99 | 1.30% | 0.17% |

| WIN | $13,030.18 | -- | 2.13% | 0.00% |

| BTT | $67,797.66 | $27.10 | 11.08% | 0.12% |

TRX has the highest percentage of Supply and Borrow capitalization.

The table below further shows a breakdown of the tokens and their supply and borrow APY.

| Tokens | Supply APY (%) | Borrow APY (%) |

|---|---|---|

| TRX | 3.92 | 10.80 |

| USDT | 21.49 | 8.00 |

| WIN | 5.63 | 23.00 |

| BTT | 4.80 | 20.00 |

From the table above, USDT has the best and profitable APY in both supply and borrowing which are 21.49% and 8.00% respectively.

4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

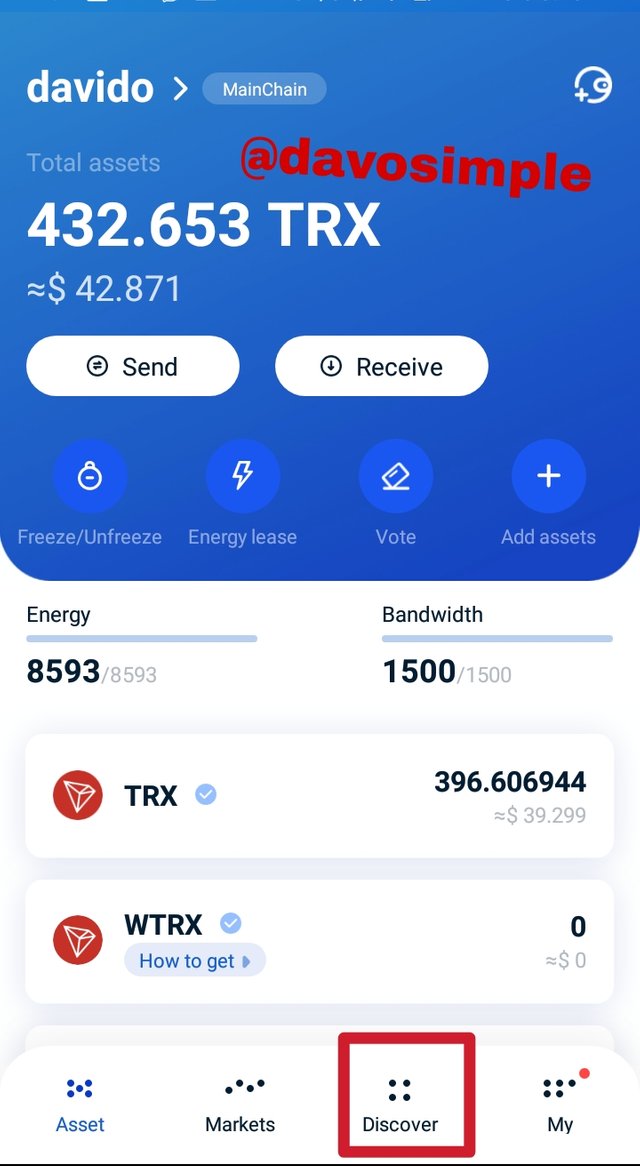

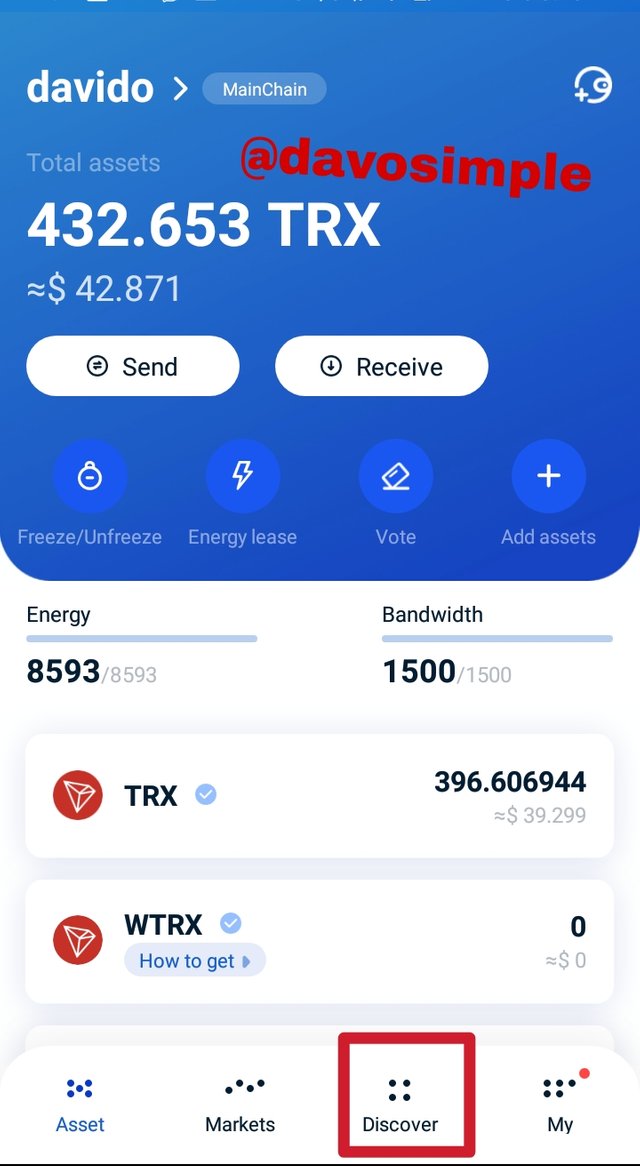

For this very question, I will be using my Tron Link wallet mobile app downloaded from Google Playstore to show the steps on how to connect to Zethyr Finance.

First, I launched my Tron Link wallet and then hit the Discover botton.

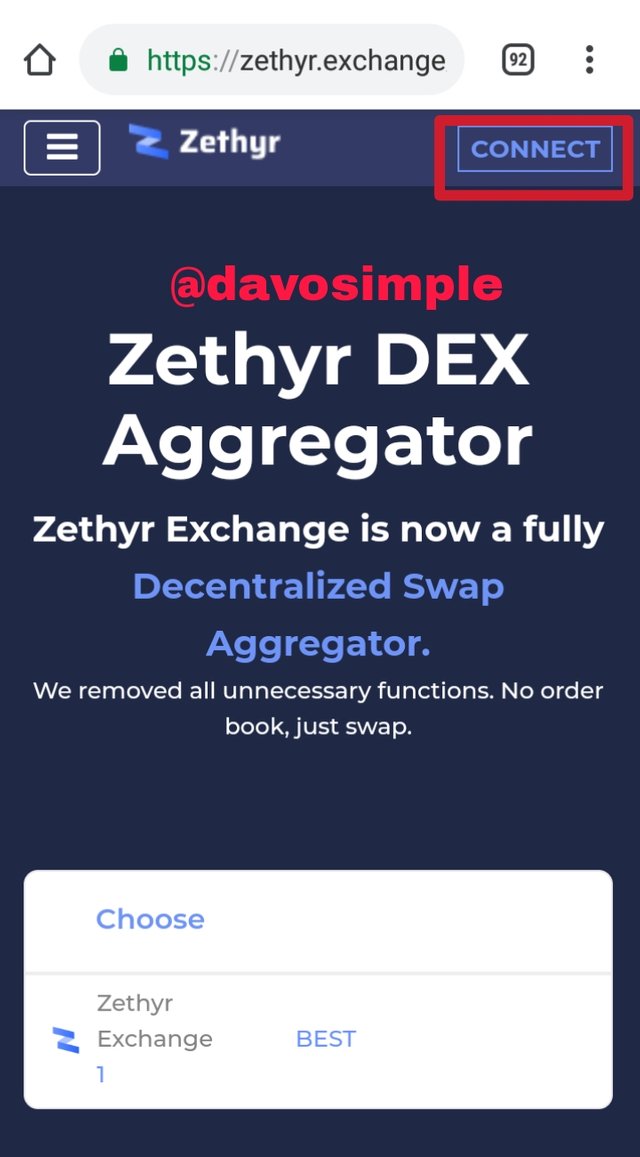

Then I used the search bar to search for Zethyr Exchange which popped up and I clicked on it.

Then I clicked on Connect

Here my wallet is successfully connected and I can swap any of the readily available tokens in a decentralized manner.

5. Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

zTokens are those tokens which are minted after a user has successfully made a deposit of any of the listed TRC-20 tokens in the Zethyr. They are pegged in the ratio of 1:1 with respect to the underlying interest accrued upon a upon successful deposits.

These tokens are readily minted when deposits are made in Zethyr and they are burned on redemption and then sent to the user's wallet instantly.

The tokens currently accepted for lending and borrowing in the Zethyr finance are TRX, USDT, WIN and BTT. Upon every successful deposit in the Zethyr protocol, the minted zTokens for the underlying deposits will be zTRX, zUSDT, zWIN and zBTT.

Another project with similarities to zTokens is jTokens which is available in the JustLend protocol.

JustLend is another project that has jTokens as the underlying tokens which are minted and distributed to users when they deposit their TRC-20 tokens.

Just like zTokens, jTokens are also deposited directly in wallet of the user after the user has made a deposit. The amount of jTokens a user receives depends on how much TRC-20 tokens the user deposits.

6. Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred

For this task, I first launched my Tron Link wallet and then clicked on Discover.

Then I searched for Zethyr finance and clicked on it.

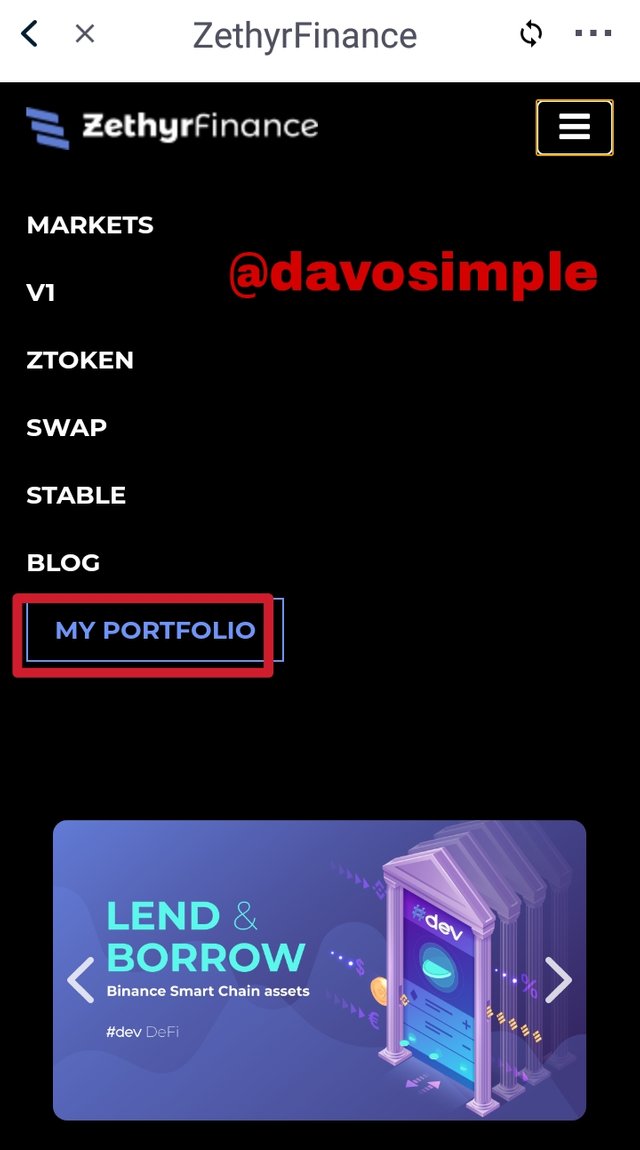

Then I clicked on the three parallel lines at the top right corner.

Then I select My Portfolio

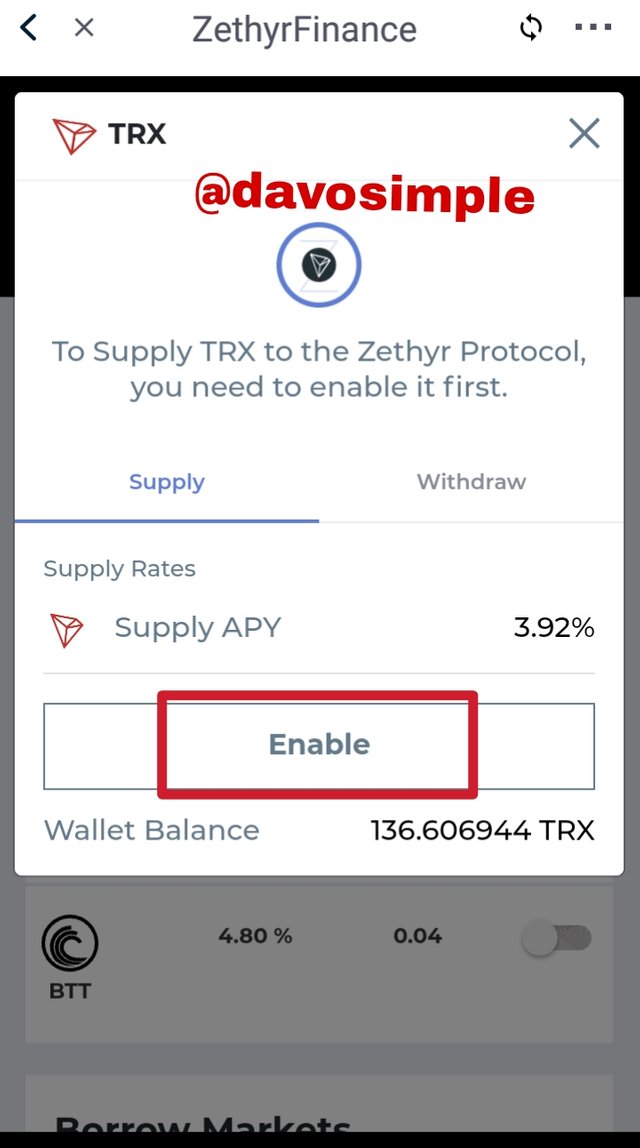

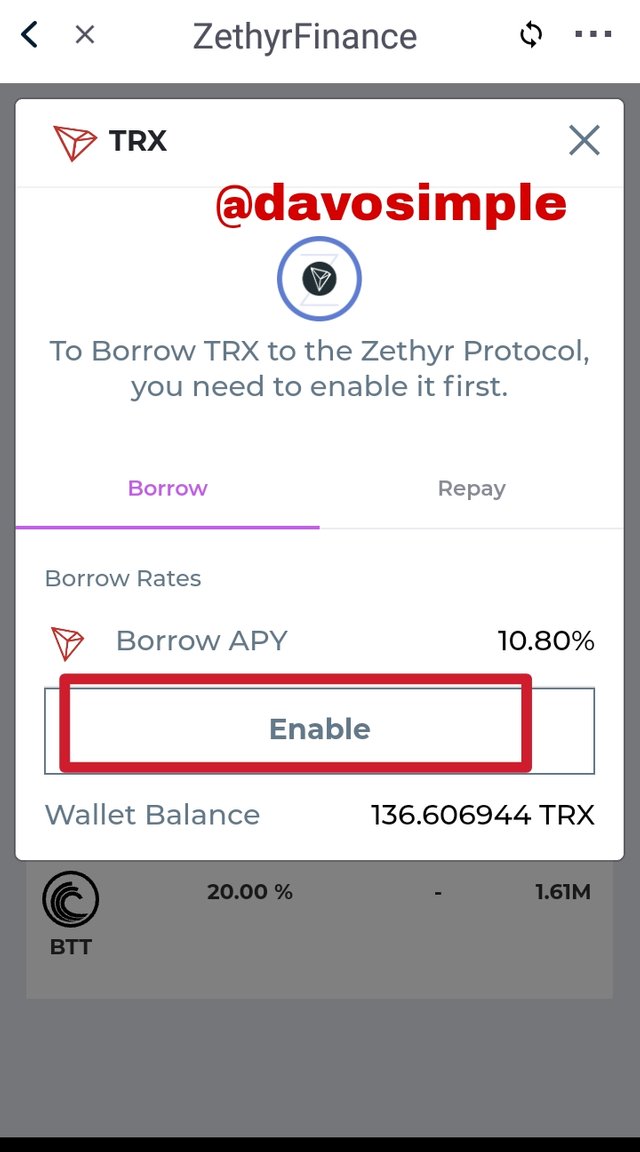

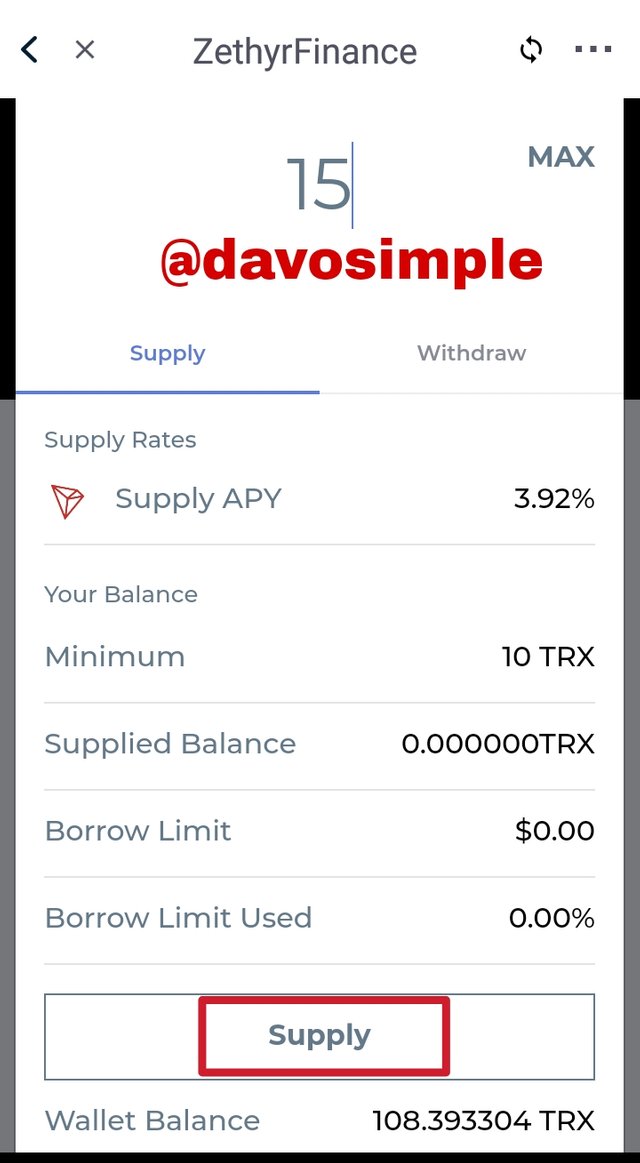

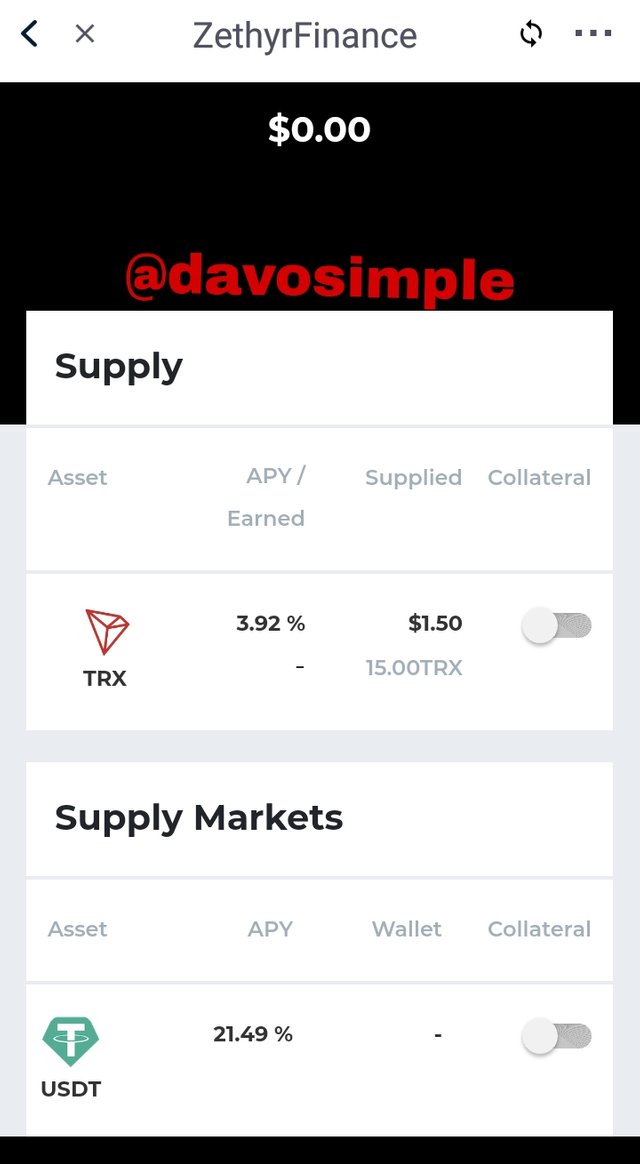

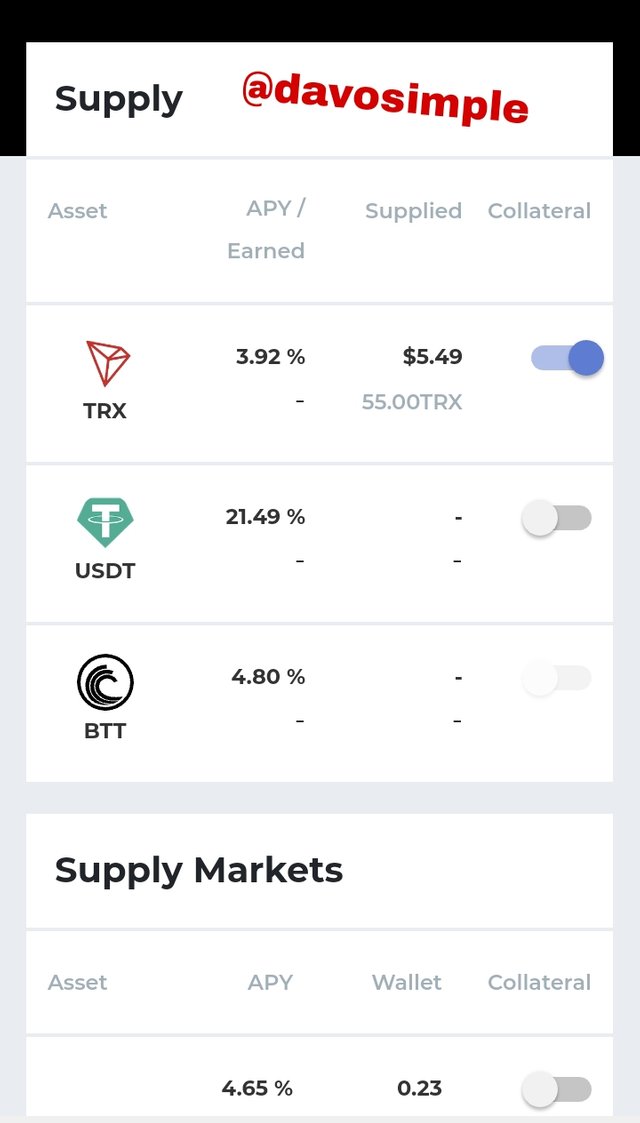

On the supply market, I clicked on TRX because it is the asset I wish to use.

Next, I clicked on enable

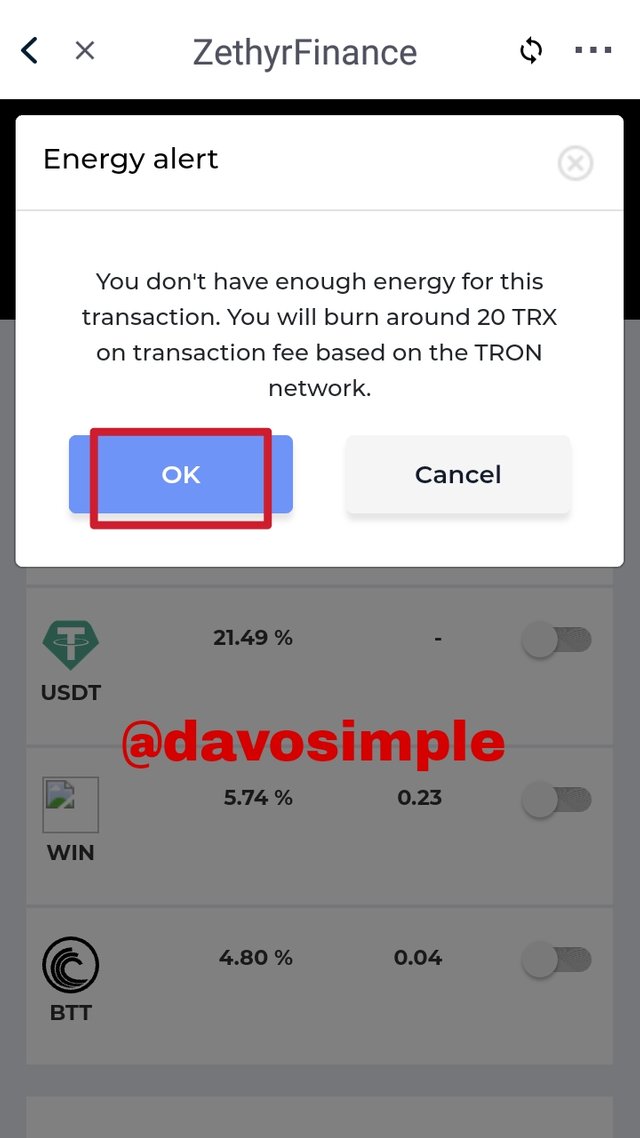

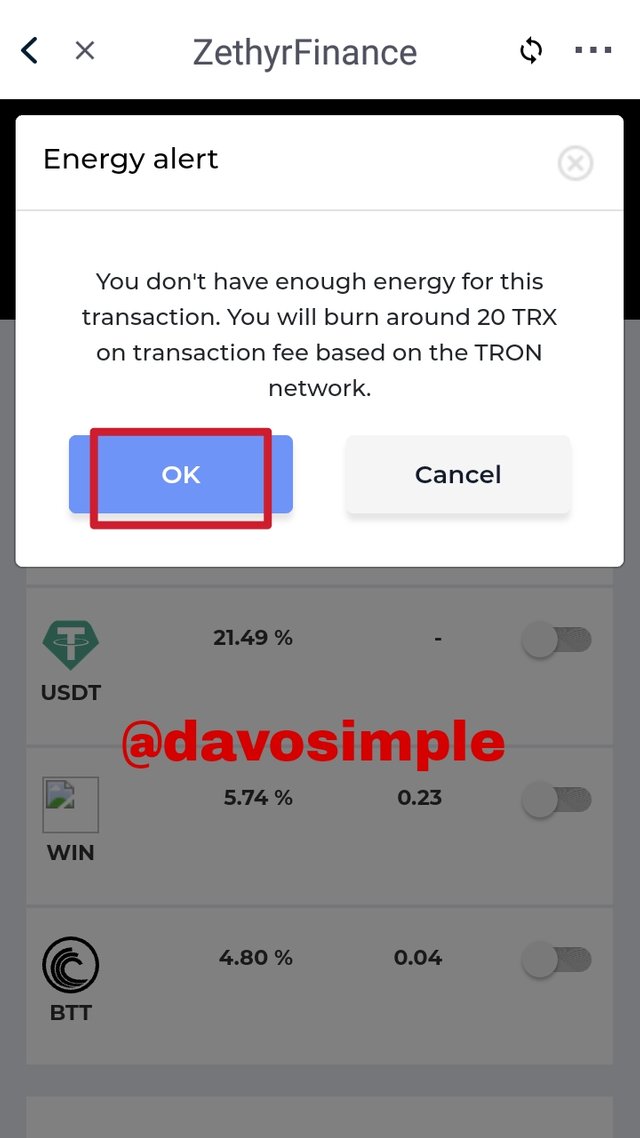

A pop up message appeared, letting me know that the transaction will burn 20 TRX as fee. I clicked Ok

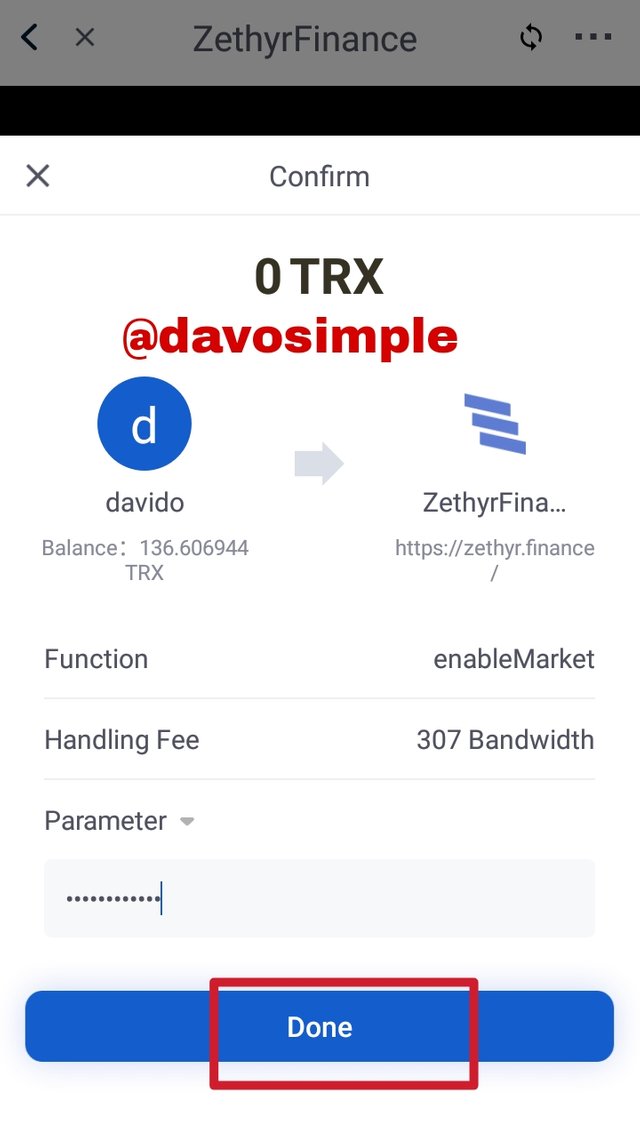

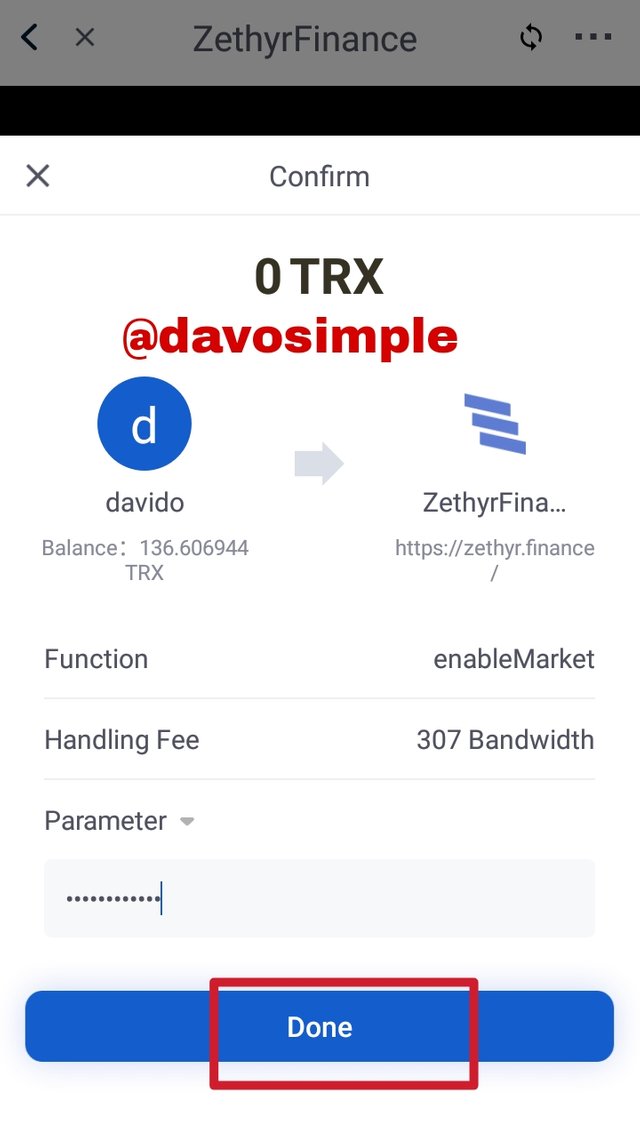

Next I supplied my password having understood that a Handling fee of 307 bandwidth will as well be consumed and the clicked Done

I will have to also repeat the same procedure for the Borrow market. So I clicked on TRX

Clicked enable

Energy alert popped up and I clicked Ok

Then I supplied my password and clicked Done

How to Supply Asset.

To supply my asset, I clicked on the asset I earlier wanted to to supply which is TRX.

Then I entered the amount of TRX I wish to supply which is 15 after which, I clicked on Supply.

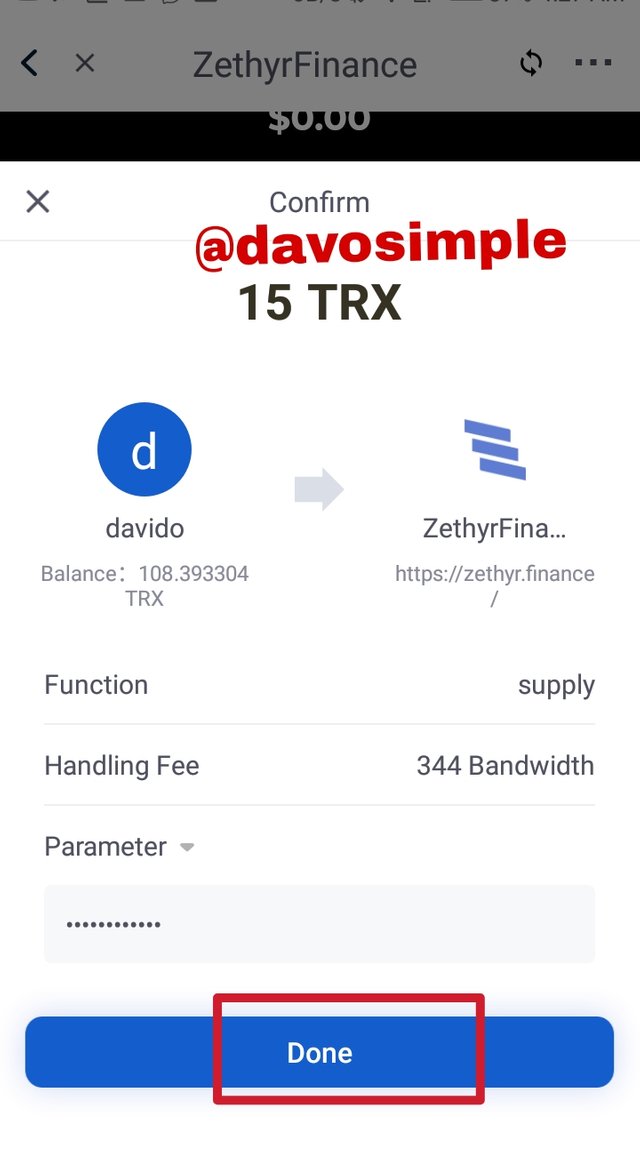

Then I supplied my password and clicked Done

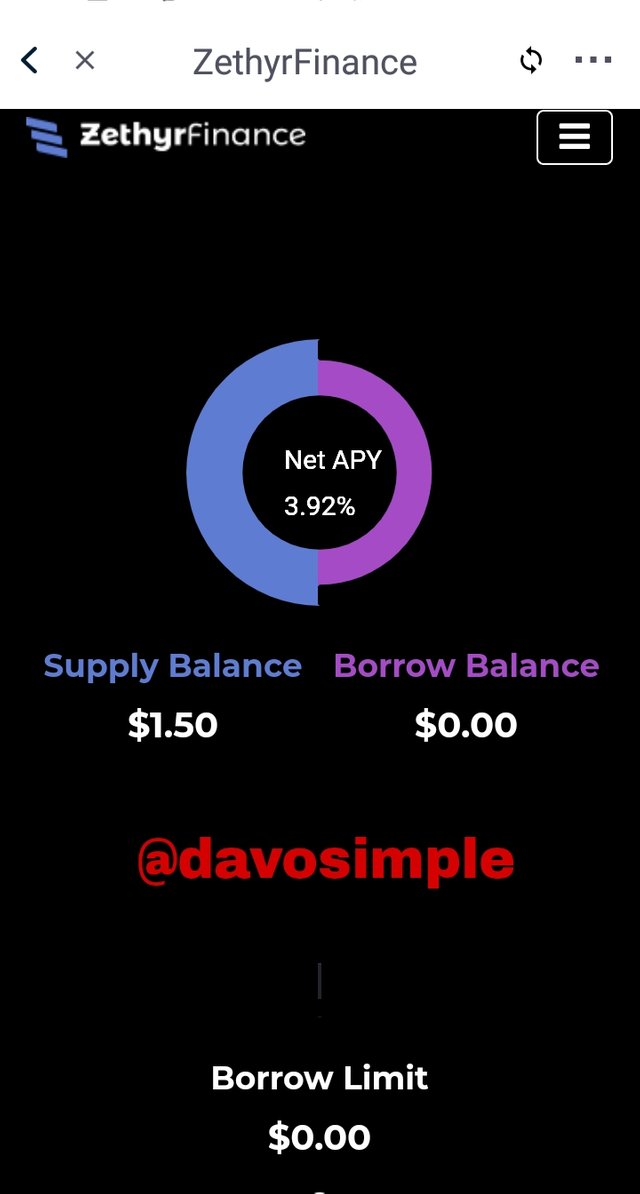

Here, I have successfully supplied my asset.

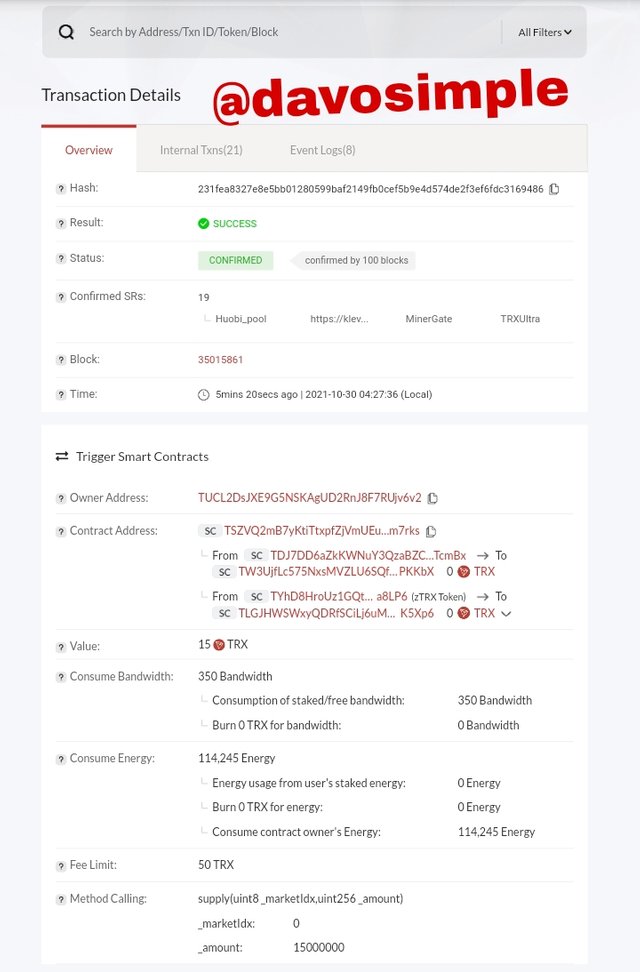

Here is the transaction details on tronscan with the transaction hash of 231fea8327e8e5bb01280599baf2149fb0cef5b9e4d574de2f3ef6fdc3169486.

7. Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

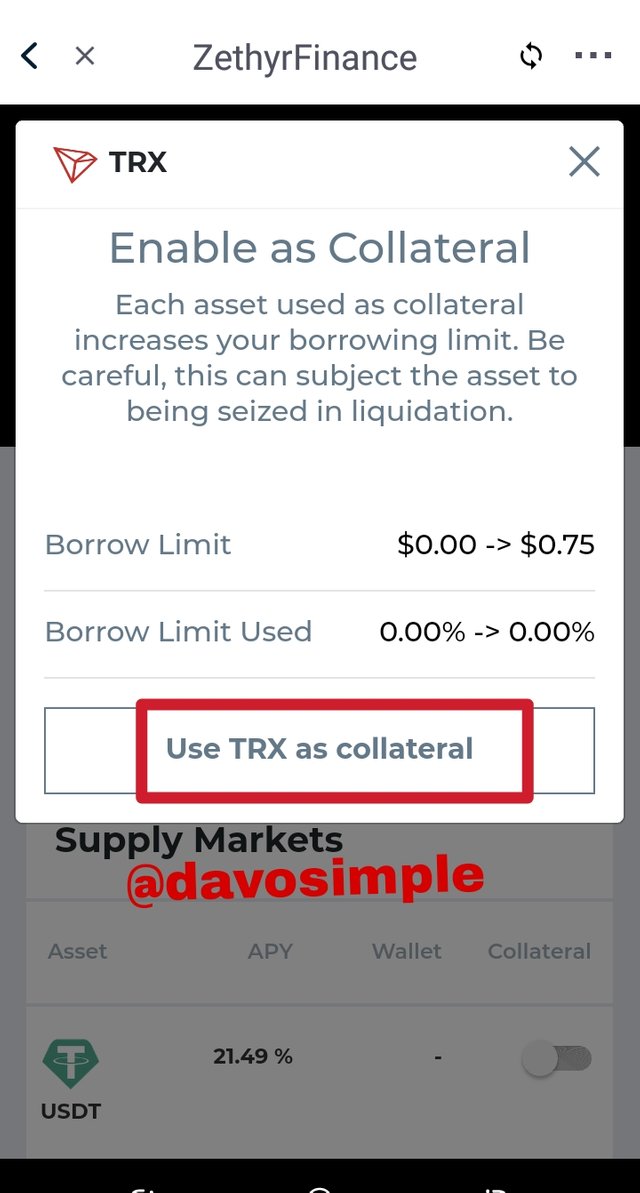

To collateralize my asset, I will toggle on the asset I already supplied which is TRX.

Then I clicked on Use TRX as collateral

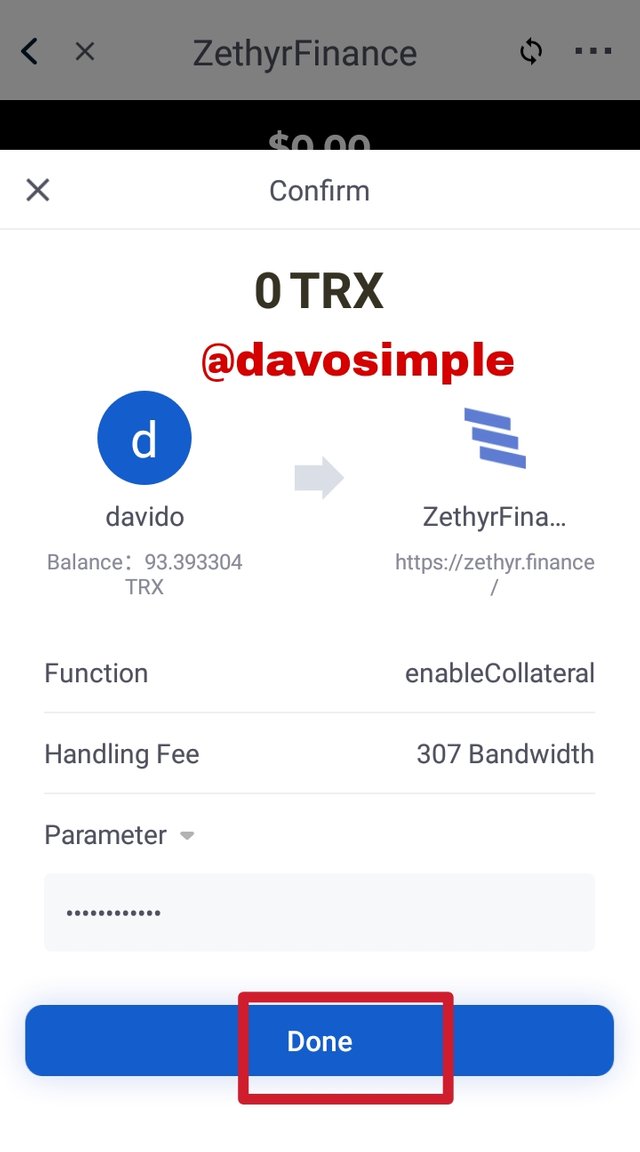

I supplied my password and clicked Done

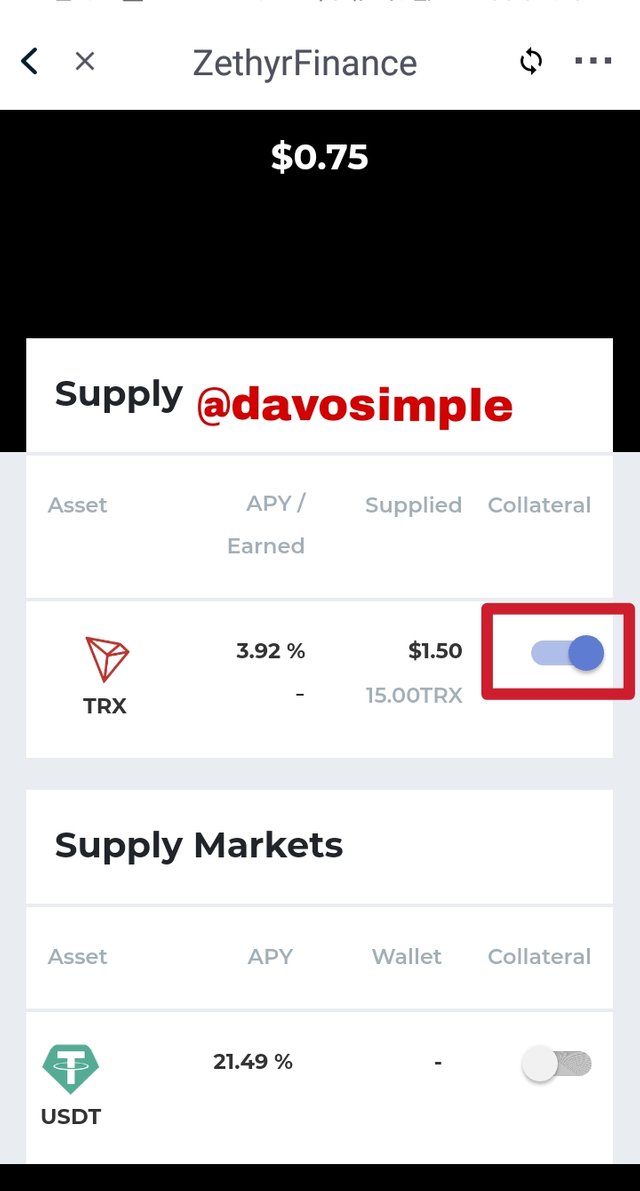

The asset has been toggled on, meaning that it has been collateralized.

Borrowing on Zethyr finance

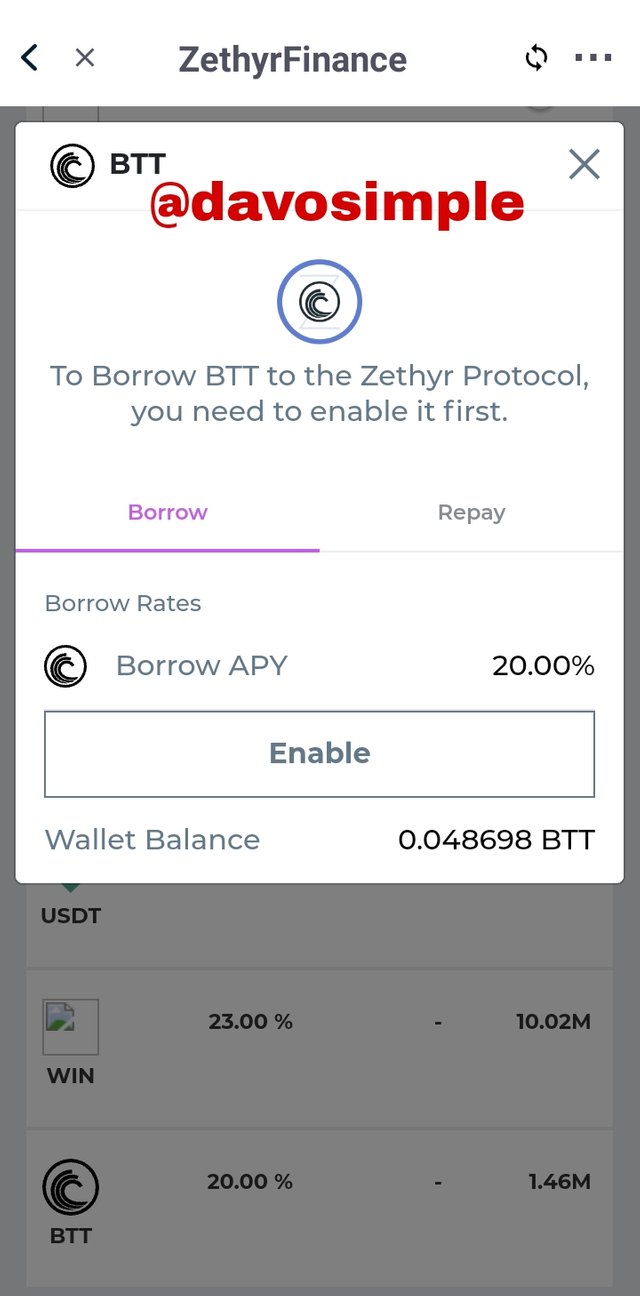

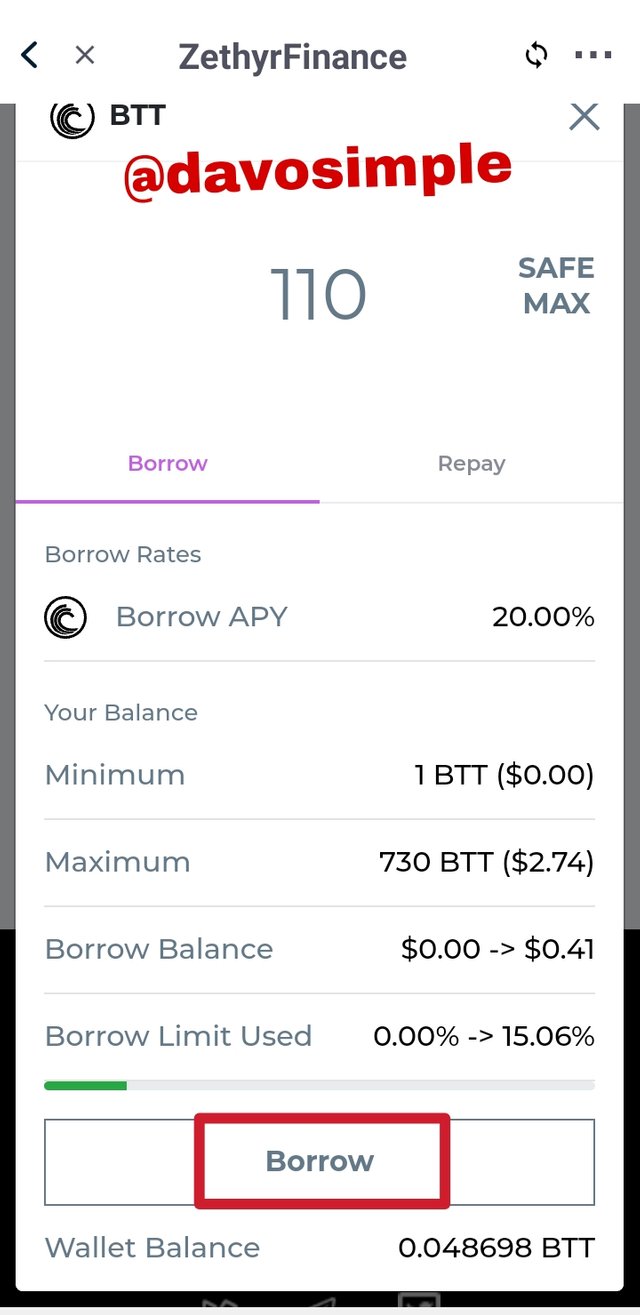

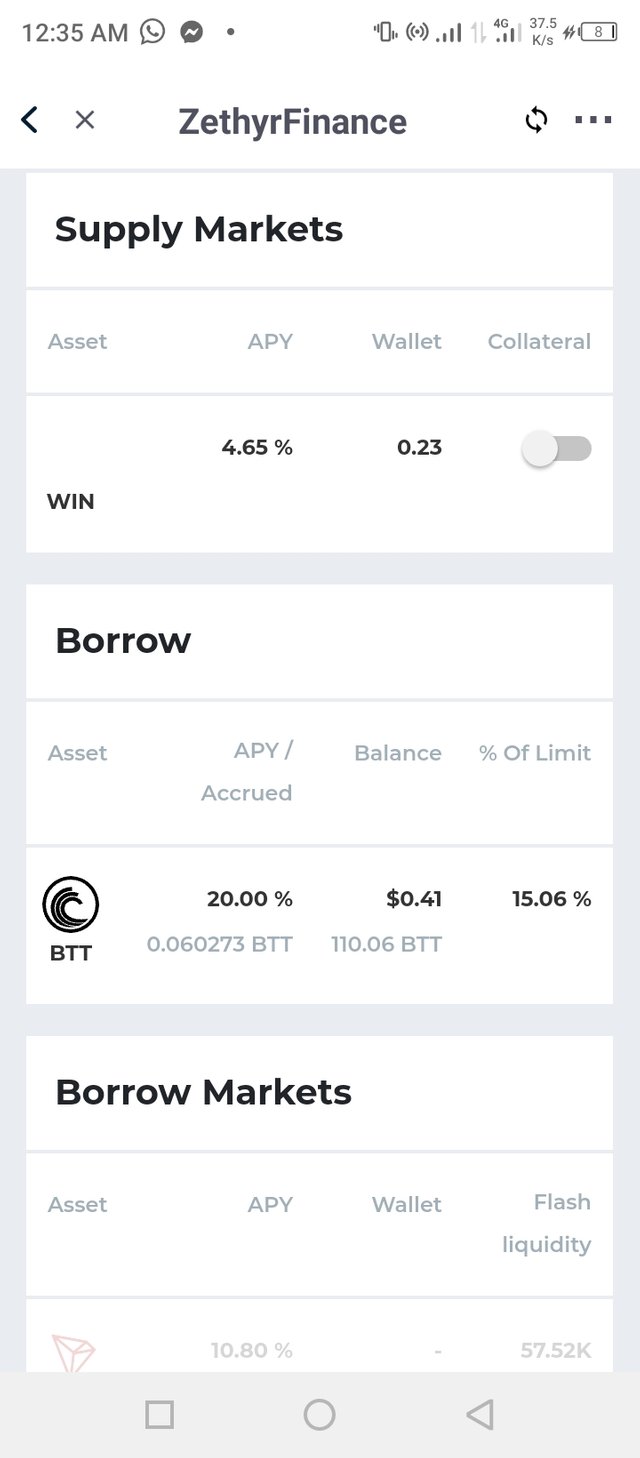

On the Borrow market, I clicked on BTT which is the asset I wish to borrow.

Then clicked the enable botton

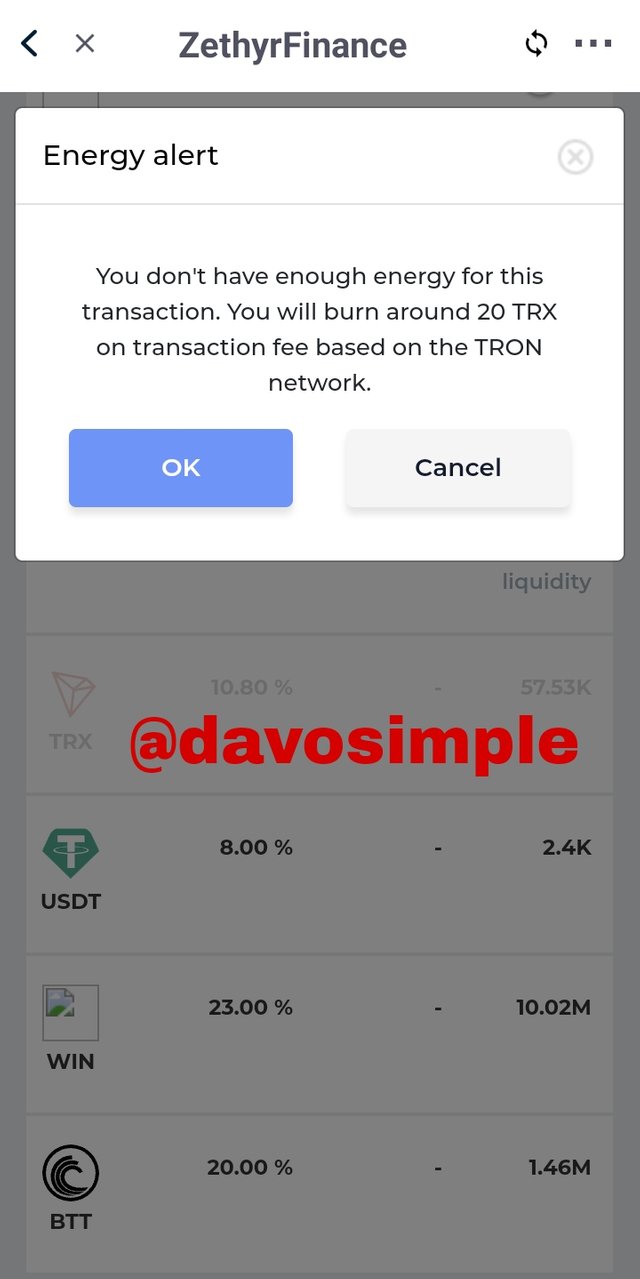

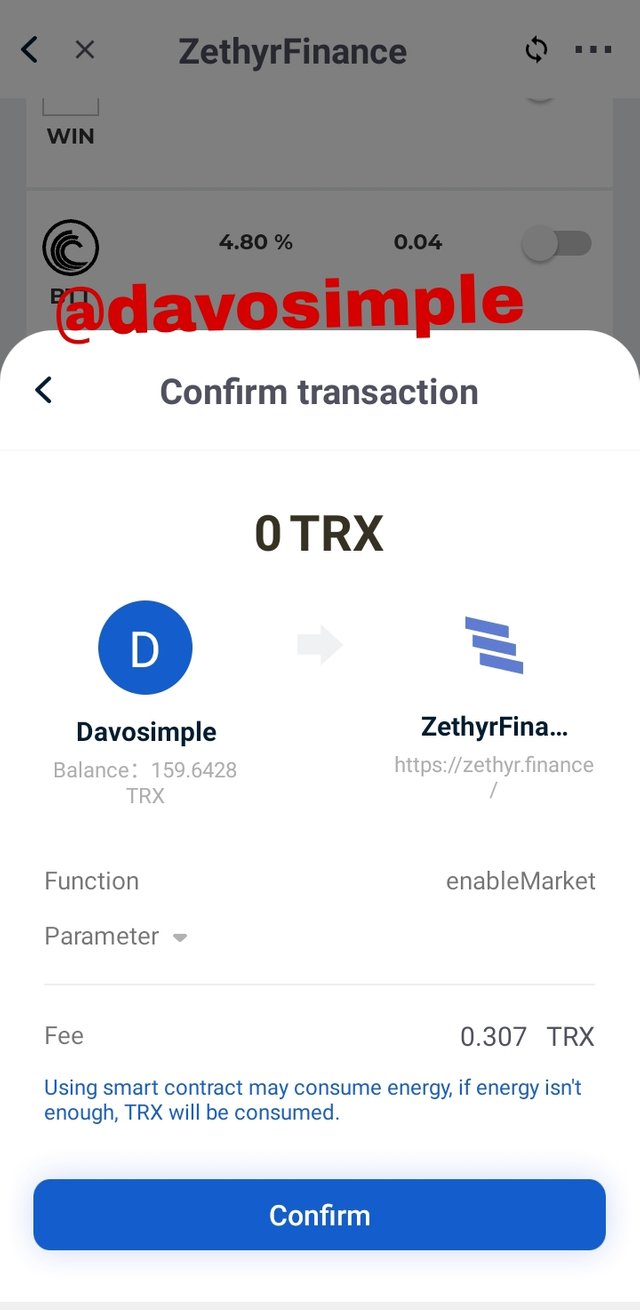

I then clicked on Ok for the energy consumption pop up message.

Typed in my password and clicked Done

Since the initial TRX I supplied wasn't enough, I had to supply more so that I will be able to augment my borrow limit.

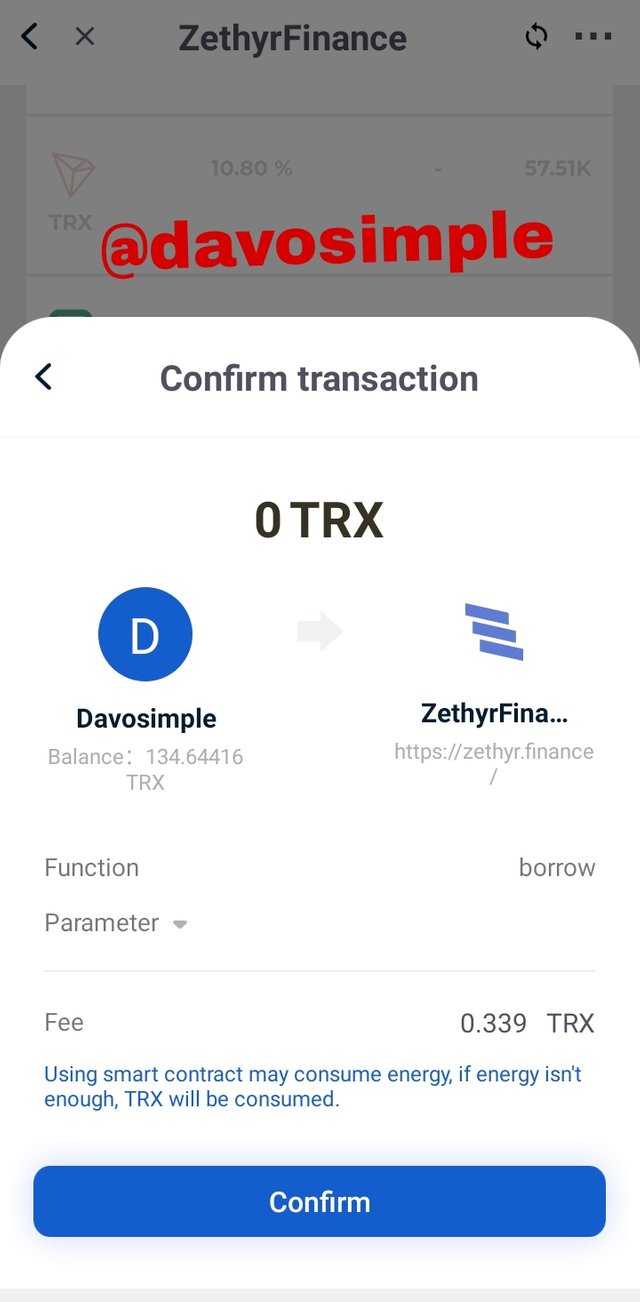

I then select the asset i wish to borrow and then typed in the amount of BTT I want to borrow which is 110 and then I clicked Borrow

Supplied my password and clicked Done.

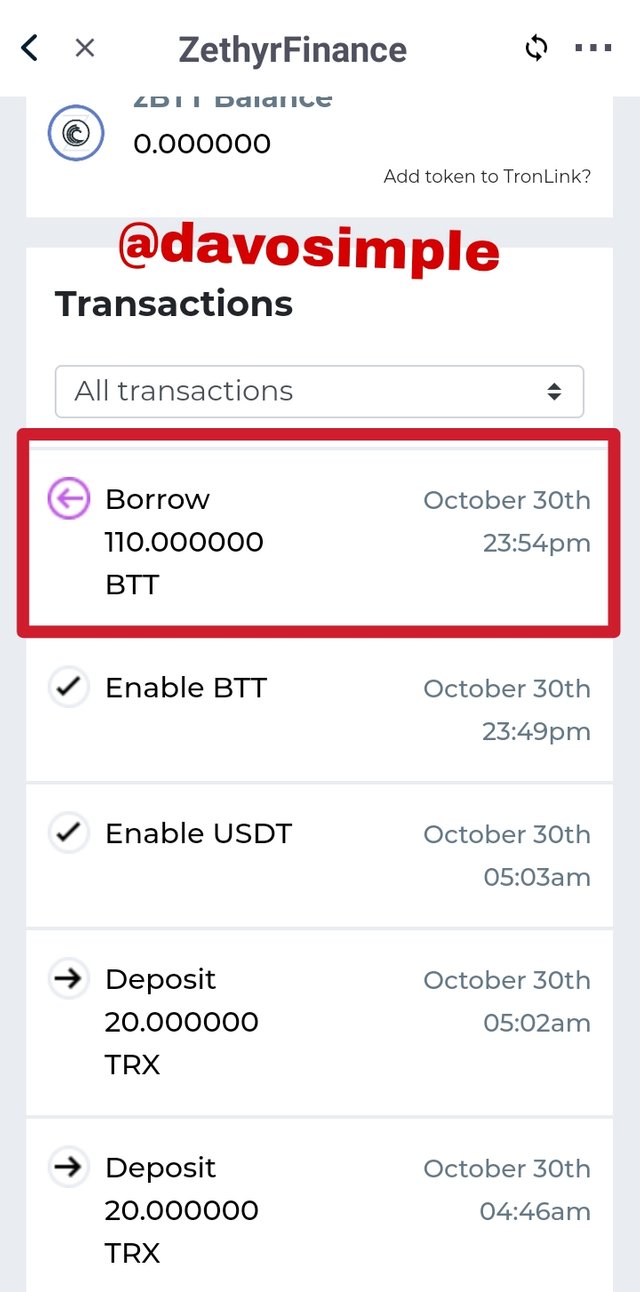

The borrowing was successful.

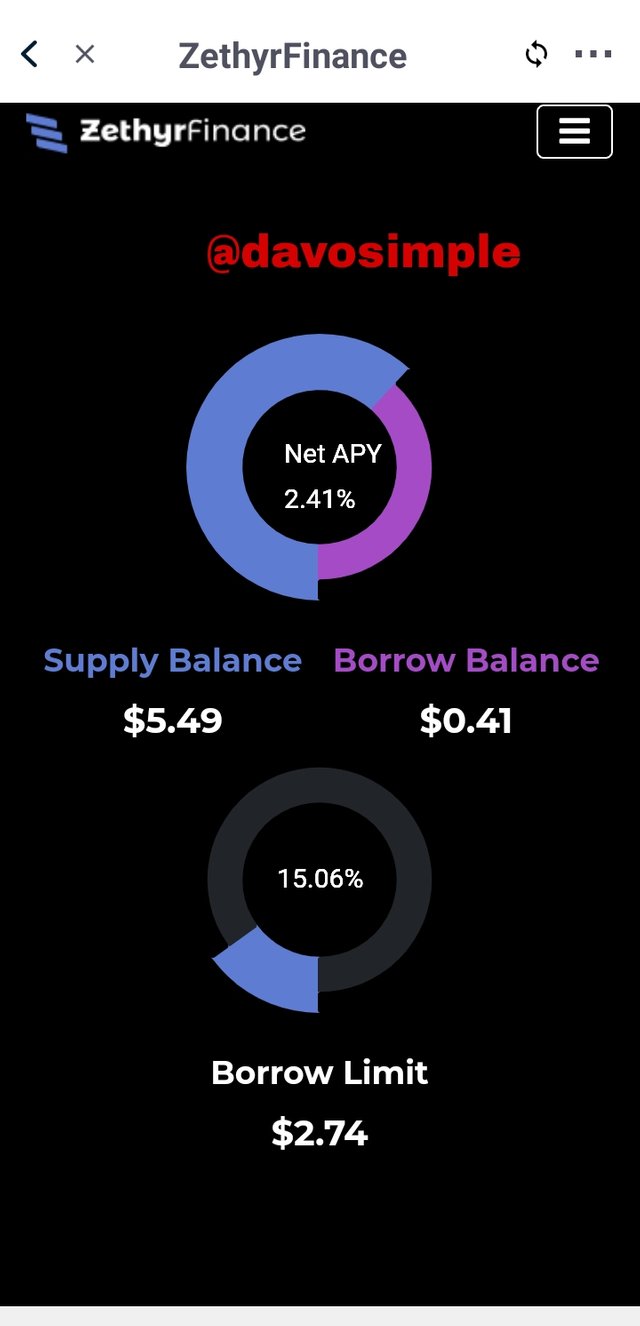

As seen from the screenshot above, I have used on 25.06% of my borrow limit which allowed me to borrow 110 BTT.

My NET APY is now 2.41%.

Here is the transaction hash of the successful borrow.

Repaying for Borrowed Asset

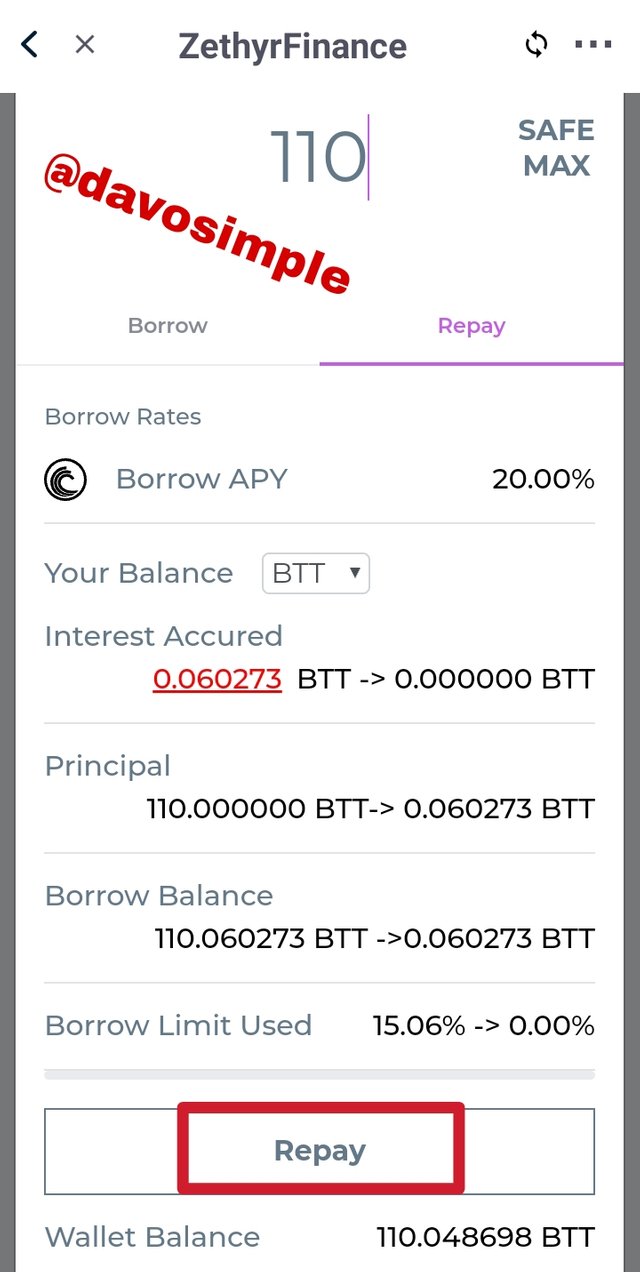

I will first click on the borrowed asset

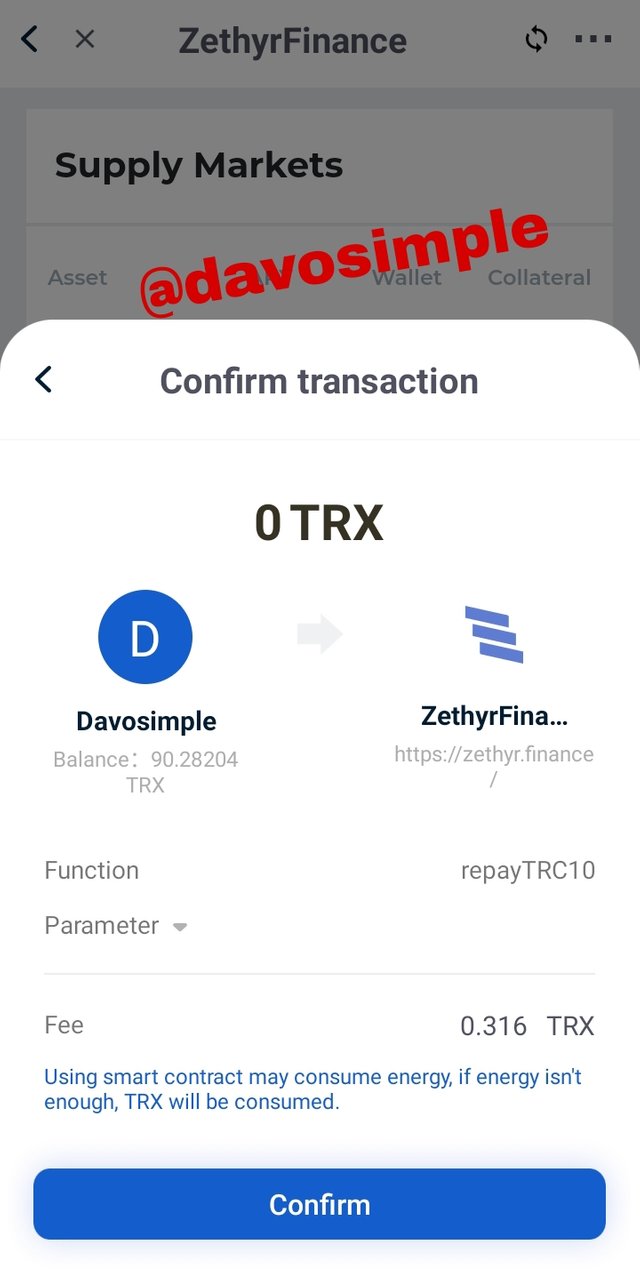

Then I switch to Repay. Then I entered the amount I want to repair which is 110 BTT. The Borrowing accrued an interest of 0.060273 BTT. I then clicked on Repay.

Then I supplied my password to authorize the transaction.

Withdrawing My Asset from the Supply Pool

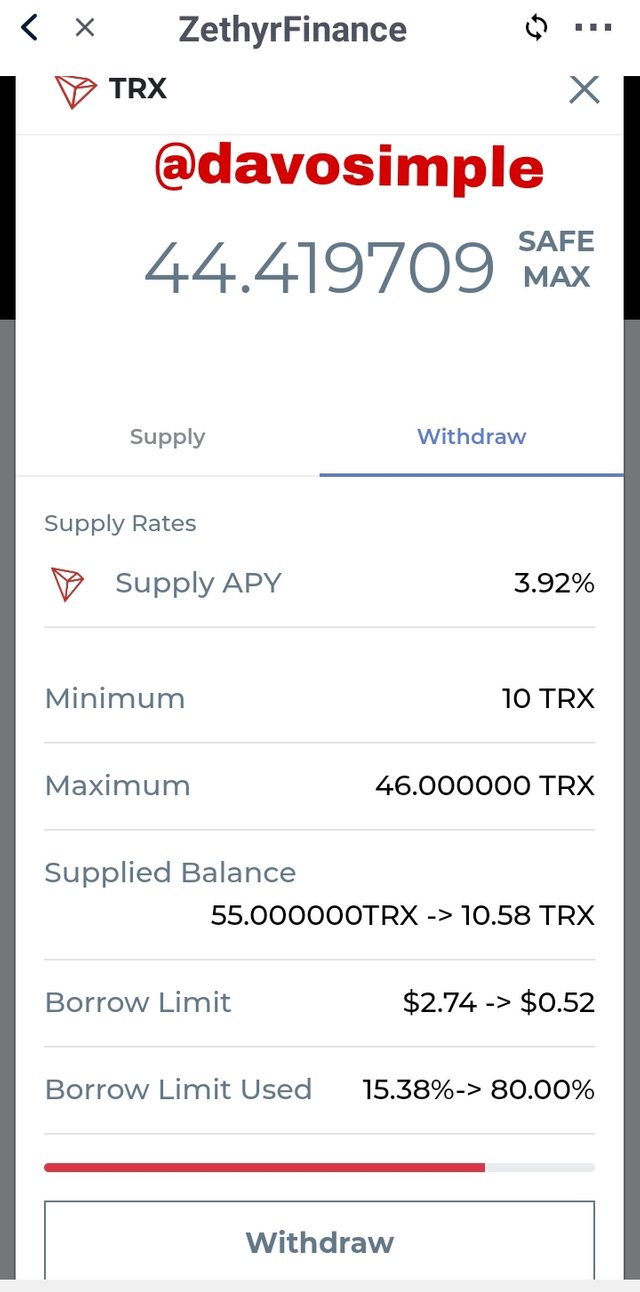

I first clicked on the supplied asset which is TRX

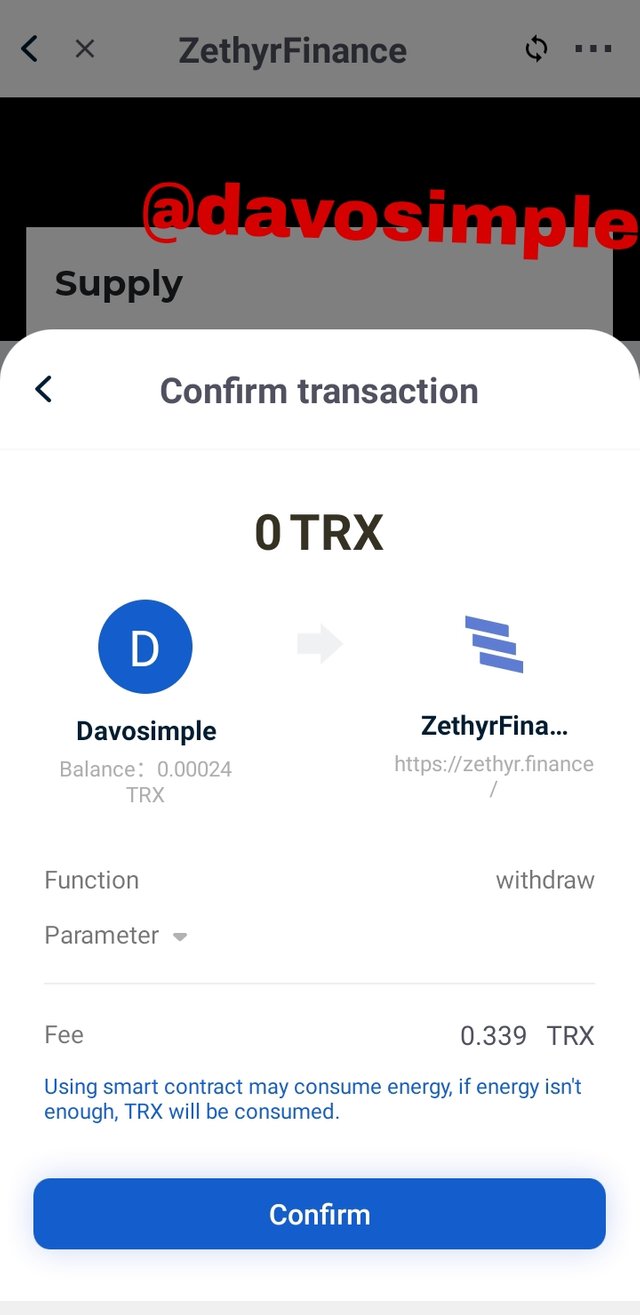

Then I switched to withdraw and then select SAFE MAX and clicked in withdraw.

Then I supplied my password to authorize the transaction.

8. What do you think of Zethyr Finance? Is it great or not? State your reasons

Zethyr finance is undeniably a great dApp and I will love to justify my opinion using the following reasons;

One of the greatest selling point of the Zethyr finance is the Zethyr DEX Aggregator which allows for swift swap of TRC-20 tokens in a complete decentralized manner. This feature was developed after an upgrade was done in the Zethyr protocol

Another great characteristic of the Zethyr finance is the security it offers to the capital of lenders.

Zethyr finance is also great because it allows it's holders to propose and vote for who they want as their delegate in the Zethyr governance.

It provides it's users with some underlying passive rewards known as zTokens for staking in the Zethyr pool. This means for every deposit, there is an underlying reward.

It allows users to borrow and lend their TRC-20 tokens. For lenders who could also be called liquidity providers, the daily accrued interest paid by the borrowers is also shared to amongst the Liquidity providers.

It has a relatively low fee charge 0.1%.

With just a click, swapping of Stable coins can be done with less fee charges and without much delay. Swapping of TRC-20 tokens swiftly to ERC-20 tokens can be done in Zethyr.

The SAFE MAX feature which ensures that future liquidation is curbed by always providing liquidity to the trade, therefore keeping the funds of users safe.

Zethyr finance also let's user to borrow and look end Binance Smart Chain assets.

Conclusion

Zethyr finance is one of the rewarding dApp built on the tron network. It allows users to lend and borrow assets without the presence of any intermediary. This dApp is indeed a great dApp.

Thank you.

cc: Prof. @fredquantum

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

God bless you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit