The DeFi market has set off a new wave, this time the focus is on stablecoins . The development of stablecoins in the past two years can be said to have advanced by leaps and bounds, with outstanding performance. Among them, the algorithmic stable currency took off due to its skyrocketing and controversy, which once again heated up DeFi.

What is an algorithmic stable coin?

Algorithmic stablecoin, as its name implies, is a kind of algorithmic adjustment of the total market currency, increasing market supply when the stablecoin price is higher than the anchor price, and recovering the supply when the stablecoin price is lower than the anchor price, or to provide arbitrage space for balance and stability Currency price. The establishment of this model does not anchor the real legal currency and does not need to mortgage the stable currency. It is controlled by market will and algorithms. The market is also called flexible currency.

With the rapid rise of decentralized finance in 2020, people have continued interest in algorithmic stablecoins. Among the more famous ones are Ampleforth (AMPL), Based, Empty Set Dollar (ESD) and Dynamic Set Dollar (DSD).

Although these tokens are generally considered to be algorithmic stablecoins, the relevant teams have different definitions. For MakerDAO, an algorithmic stablecoin is a stablecoin that maintains a fixed exchange rate by manipulating the total supply. The founders of the stablecoin projects Empty Set Dollar and Neutrino believe that Dai is also an algorithmic stablecoin because it has a programmatic coinage mechanism.

It is more obvious that the assets defined by MakerDAO show almost no stability. According to CoinGecko's data, the historical high and historical low price of ESD is 23.88 US dollars and 0.174 US dollars respectively. In contrast, Dai's trading price is between US$0.90 and US$1.22.

The rebasing system used by tokens such as Ampleforth and Based is based on the cyclical expansion and contraction of the entire supply. If the trading price of the token is higher than a certain range, the supply will expand by one-tenth of the price deviation. This means that if the transaction price of the token is $1.50, then the total daily supply will increase by 5%.

As a result, the supply of tokens may grow and shrink at an alarming rate, putting tremendous pressure on prices. This supply change is evenly distributed among all wallets holding tokens, which means that if the price changes exactly as a percentage of the newly minted tokens, the value of the user's total portfolio will not change.

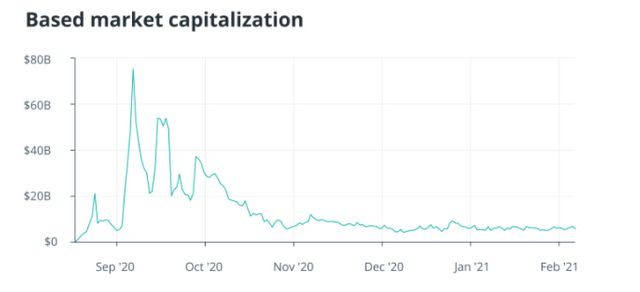

To measure whether the token is really "stable", you also need to take into account changes in supply, because every wallet will be affected by these changes. When analyzing the total market value while considering both supply and price, it is clear that AMPL is extremely volatile.

What are the benefits of algorithmic stablecoins?

Given that algorithmic stablecoins have obvious difficulties in maintaining value stability, are there other possible benefits of these tokens?

The ESD team stated that the goal of the project is to "have a decentralized, combinable account unit that can be used in the DeFi protocol." They classify the token in the same category as Dai or USD Coin (USDC).

According to Rincon-Cruz, Ampleforth is just a speculative asset with one major advantage: the ability to value contracts with stable value. Traditionally, money is considered to have three different uses: as a unit of account, a medium of exchange, and a store of value.

The unit of account refers to how the price is measured. For example, many exchanges and cryptocurrency companies price certain services in Bitcoin, which means that when the price of Bitcoin is higher, they will get more value in USD.

The medium of exchange is the asset that is actually used to deliver and express value. Another common practice in the cryptocurrency industry is to negotiate contracts in U.S. dollars, but pay in Bitcoin or Ethereum based on the exchange rate at the time of delivery, making the cryptocurrency a medium of exchange rather than a unit of account.

Finally, store of value refers to assets that are expected to neither lose nor gain for a long period of time, although in reality, this rarely happens. Over time, the U.S. dollar will depreciate, but it is fairly stable in the short term, while assets such as bonds and gold may fluctuate sharply, but will still bring long-term growth.

In order for a stablecoin to be usable in all three definitions of currency, its value must remain stable at least to a certain degree. Major cryptocurrencies such as Bitcoin and Ethereum have historically been used for these three functions, and the rise of stablecoins has reduced their use in commercial transactions.

A currency like Ampleforth may be useful as a unit of account, but so far it has shown excessive volatility in the other two uses.

In practice, algorithmic stablecoins that use supply manipulation have hardly been adopted in any environment where the US dollar may be used, even as a unit of account. The Ampleforth team is currently working to integrate its tokens into the Aave loan agreement.

Can better algorithms make value stability a reality?

The ESD team believes that the ideal mechanism has not yet been found, because it is a difficult problem to make algorithmic stablecoins work, and achieving value stability is a problem of incentives and adoption.

They believe that reflexivity will eventually make the tokens effective and stable. The only way for a purely algorithmic stablecoin to grow to a large enough network is through speculation and reflexivity.

On the other hand, Rincon-Cruz believes that there is no "perfect mechanism" and added that "the trinity of adaptive supply, lasting value and stable exchange rate is impossible."

Neutrino USD (USDN) is a potential counter-example. It is a hybrid stablecoin that uses both a mortgage pool to support its value and a coupon algorithm. When the system is insufficiently mortgaged, the latter can be used, and the price algorithm can provide a considerable return for making up for the loss.

The volatility of the token is much smaller than that of ESD and DSD, from a low of $0.79 on March 13, 2020 to a high of $1.06 on January 29, and the usual price is $1. Its supply is elastic and depends on the market's demand for stablecoins, because it can be freely minted and redeemed with WAVE tokens.

Sasha Ivanov, founder of Waves, said: "The Neutrino design is inspired by combining pure market mechanisms with the value of local blockchain tokens and transforming the basic blockchain economy into a stable asset economy."

Perhaps newer mechanisms and market dynamics may allow algorithmic stablecoins to effectively maintain their value.

Image source: CoinGecko, Neutrino, Pixabay

Author @defigeek

good post my friend. I have shared your post 👍👍👍😁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you for reading, have a nice day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit