.jpeg)

As a Bitcoin investor, you need to make many decisions before and after investing:

How much do you plan to invest?

how to buy?

How long do you intend to hold it?

What is your goal?

Do you plan to trade actively or keep the funds in a cold wallet?

The list goes on...

In this article, we want to talk specifically about this issue, whether it is better to diversify the investment portfolio or to centralize the allocation of funds and invest all of them in Bitcoin.

Please note that this article is for educational discussion and reference only, and does not constitute financial advice.

Trading vs. Long Hold

For some traders, the attractiveness of Bitcoin mainly comes from its volatility. Such traders do not even hold Bitcoin, but seek risk exposure through derivatives such as options or perpetual contracts . More sophisticated traders may take advantage of the inefficiency of the market to take certain risks and carry out arbitrage .

However, it is important to understand that trading in the market is a conscious choice that brings additional risks. On-chain analyst Willy Woo explained this well in a recent podcast, he said, "HODLing" is basically a zero-to-one game. If you believe in long-term growth, then logically, you also want the value of your investment to appreciate. However, trading is a zero-sum game, which means that the money gained in the market is always the same as the money lost. Winners always make as much money as losers lose. If you are not a top trader, you may win by luck, but you are also likely to lose money.

So in our discussion in this article, we will assume a safer choice and think about diversified investment from the perspective of long-term holdings.

From "Paper Hand" to "Diamond Hand"

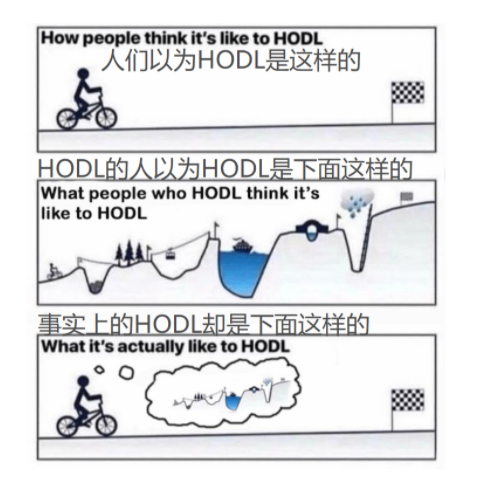

Long-term holding sounds very simple: buy, hold, and resolutely not sell. However, the psychology is not simple. This complex model from Twitter is one of the best ways to illustrate the complexity of HODLing.

If you want to stay calm HODL when the price fluctuates and the indicator turns bearish, you need to know why you want to invest in Bitcoin. This is a screening process, we usually see the distinction between the so-called "paper hand" and "diamond hand".

Those who invest in Bitcoin in order to make quick money will actively seek to sell at the top and are more likely to exit the market during periods of increased volatility.

In the current bull market, many such traders would expect some major trend reversal at the end of 2021. Some people may even start to take risks early. This strategy does not necessarily mean that these investors are not HODLers. On the contrary, it should be seen as a rebalancing behavior. It is possible that when the market turns into a bull market, capital will be re-allocated to Bitcoin.

We should note that this is not a foolproof strategy. Compared with the bull market in 2017, the current macro conditions are quite different. The entire crypto community (including institutional investors) has some expectations that this wave of bull market may continue until 2022, and perhaps we will never see it again. 90% drop.

Strong HODLers look at a longer period of time. Although the degree of risk is lower, these HODLers are generally not sold. Whenever the price plummets, they will rush into the market to buy the limit, and they are not interested in selling a partial top.

Long-term HODLER will not look at prices like ordinary speculators. Instead, they look at adoption rates, larger narratives, and technical analysis. They are more interested in deeper fundamentals that can be tracked on the chain.

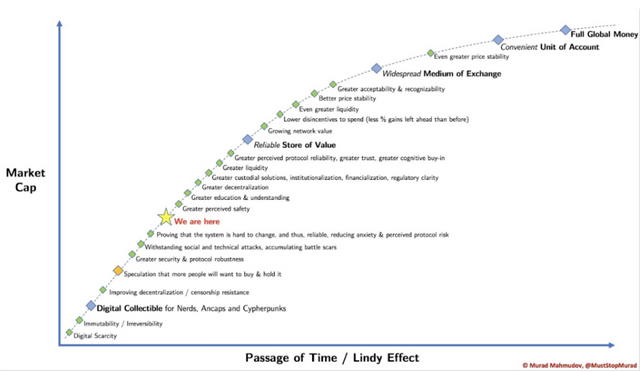

This is a chart drawn by Murad Mahmudov , which clearly shows how to look at prices from the perspective of adoption rates.

To become a strong HODLer, you need to have a vision-driven belief.

To get inspiration, you might as well listen to Murad Mahmudov’s podcast . He strongly praised Bitcoin in the podcast. He pointed out that even in the Western world, to preserve wealth, investors need to invest in stocks, bonds, small-cap stocks, commodities, and foreign exchange. , It is absurd to diversify investment in derivatives, and it is very accidental that artworks and real estate serve as stores of value. He predicts that trillions of dollars will eventually flow to Bitcoin, just because it is the best store of value in the history of the world.

As we learned from Mahmudov, a network must be a good store of value

It requires a high degree of safety, preferably without a single point of failure.

There needs to be a credible or fixed monetary policy.

The network/asset needs to have strong liquidity and proper infrastructure.

The network needs to be highly adaptable, thanks to the support and advocacy of the community, and to play a simple game theory role.

All long-term investors, if they want to hold Bitcoin for more than 10 years, will track the progress of Bitcoin through the above factors.

Tips: In this context, you might as well learn more about the Lindy effect.

What is the Lindy effect?

The Lindy effect means that the older a thing is, the longer it may exist in the future.

Reference: " Anti-fragility: Benefit from Uncertainty " (Nasim Nicholas Taleb).

Asset allocation

Whether to invest 1% or 99% of your capital in Bitcoin is entirely up to you. Ultimately it depends on how strong your beliefs are.

If you believe that Bitcoin will continue to absorb global wealth and eventually play a role as a universal store of value, then based on your certainty, diversified investment may not make sense. Modern portfolio theory is not the case, but some investors believe that current macro conditions are clearly in favor of Bitcoin, and holding gold, bonds and even stocks is simply inefficient.

Of course, investing all in Bitcoin does not mean that you have to sell all your belongings and live on the streets until Bitcoin "makes you rich". On the contrary, full investment means long-term investment in Bitcoin. It is important to understand that Bitcoin is more like a savings account, rather than "selling for profit." In the future, the only reason you sell Bitcoin is when you need it to pay for some Something, or something you want to buy, such as a house (or a Lamborghini).