Explain Wedge Pattern in your own word.

Explain both types of Wedges and How to identify them in detail. (Screenshots required)

Do the breakout of these Wedge Patterns produce False Signals sometimes? If yes, then Explain how to filter out these False signals.

Show full trade setup using this pattern for both types of Wedges.( Entry Point, Take Profit, Stop Loss, Breakout)

Conclusion

Explain Wedge Pattern in your own word

Wedge Pattern is a kind of exchanging pattern that utilize two trendlines combining toward the finish of their movement. This implies that the lines being referred to meets toward the end of their development which suggests that the current thing will end and a new trend should start. The trendline is normally drawn on the value graph one over the price and the other beneath the price. This lines viewed as above and below the value goes about as protections level and supporting level separately.

It is important to know that the two pattern lines in questions have a huge opening at their start and as the continue the agreement i.e the come closer to each other. It proceeds with that way until it at long last meet one another. This is for the most part following the value breakout and afterward turns around to the other way. At the point when this break out or inversion is will want to occur, the volume of the resource will diminish.

We see this wedges in a pattern market not in a reach market. So we can detect wedges in bullish pattern or negative pattern movement and hence, we have two sorts of wedges the rising and the falling wedges. Can we see the pictures of both rising and falling wedge below.

Explain both types of Wedges and How to identify them in detail. (Screenshots required)

As I have early said we have two sorts of wadge which are the Rising wedge and the Falling wedge. We should check out them in subtleties in a steady progression.

Rising Wedge

A rising wedge is a technical marker, proposing an reversal pattern often found in bear markets. This example appears in outlines when the chart moves up with turn highs and lows merging toward a single point known as the apex. Utilizing two pattern lines—one for drawing across at least two turn highs and one interfacing at least two turn lows—assembly is evident toward the upper right piece of the diagram below

The screenshot above shows the rising wedge in a price chart on an outline, while a rising diagram pattern is obvious in the day by day chart

As you can see in the screenshot This means the lines must touch highs and lows for it to be a reliable wedge. Noticing a breakout in a rising wedge, we are to place a sell entry immediately to maximize every opportunity.

How to identify rising wadge pattern

The rising wedge framed when two pattern lines are combining. The rising wedge design cuts a progression of new records all around.

The obstruction pattern line needs to cover the super high marks, two better upsides is required for the opposition line.

draw a help pattern line covering the more promising low points. You'll require something like two swing depressed spots to draw the help pattern line.

Drawing the opposition backing pattern lines, you should see a three-sided shape that additionally resembles a wedge. A useful detail of the rising wedge design is that the apex of the triangle should be faced vertical. Along these lines, the obstruction pattern line should slant up to approve this as a rising wedge pattern.

At the point when this is found in a descending pattern, it is viewed as an reversal pattern, as the compression of the reach shows the downtrend is losing steam. At the point when this is found in an upswing, it is viewed as a bullish example, as the market range becomes smaller into the amendment, demonstrating that the descending pattern is losing strength and the resumption of the upturn is really taking shape.

In a descending corner, the two boundary lines slope downward from left to right. The upper descend at a more extreme point than the lower line. Volume continues to decrease and exchanging movement slow down because of limiting price. There comes the limit, and exchanging action later the breakout contrasts. When the price goes outside the particular limit lines of a descending wedge, they are usually moving sideways and saucer-out before they continue the essential pattern. Here is an example of falling wedge screenshot can be seen below.

From the screenshot above shows the falling wedge in a price chart. All factor are being considered I.e the both trendline, the breakout point, the decrement in the asset volume. As we can see in the screenshot above the trendline touches points on the top and bottom of the price respectively. It means the lines should touch highs and lows for it to be a trusted wedge.

How to identify falling wadge pattern

One of the common way to recognized falling wedge start happens in a clean uptrend. The price activity move higher, but the purchasers lose the force at one point and the bears assume temporary responsibility for the price activity.

The second stage is the point at which the consolidation stage begins, which makes the price move lower. It's necessary to pay close attention of the difference between a descending channel and falling wedge. In a channel, the price action makes a progression of the worse high points and worse low points while in the descending wedge we have the worse high points however the lows are printed at greater price.We have two pattern lines that are not running in equal.

It is the Same as other exchange pattern, the wedge pattern for the most part produce bogus signs. To channel these off track signals, specialized examiners utilized specialized markers to decide if the sign is valid or false.

Do the breakout of these Wedge Patterns produce False Signals sometimes? If yes, then Explain how to filter out these False signals.

During the development of a wedge pattern, there are a couple of indictators brokers can use to decide if the sign is valid or false.

The first is to utilize the volume indicator. To set the cases of a wedge pattern, volume will diminish as the start of a wedge advances. This is on the grounds that a uniqueness between price action and volume is showing a continuation or break out is going to occur.

The next is to search for how far the remember a progressed from the start of the pattern. In the event that it has gone above half where backing and obstruction are probably going to happen, then, at that point, it's a false sign. On the off chance that it is under the half line, then, at that point, the sign is a legitimate sign.

Show full trade setup using this pattern for both types of Wedges.( Entry Point, Take Profit, Stop Loss, Breakout)

Trading the rising wedge:

Anytime you have distinguished the rising wedge, regardless of whether in an uptrend or downtrend, one strategy you can use to enter the market with is to put in a sell request (short passage) on the break of the down side of the wedge. To stay away from false breakouts, you should wait for a candle to close underneath the trend pattern line prior to entering.

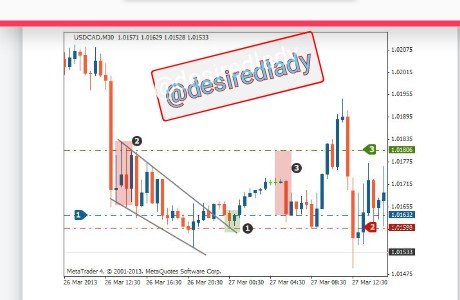

The chart underneath shows the region where value breaks the lower support pattern line and where you should put in the sell request:

Buying section entry is normally the problem in the falling wedge. This is on the grounds that the movement before breakout is usually a descending way and the breakout makes space for up movement or bullish pattern. Buying section is generally set when the pattern is moving a vertical way. So how about we see the buying section arrangement outline below.

The chart above has everything needed to set up a trend, the falling wedge. As you can see from the chart, we have our both pattern lines, we have mark our breakout position and our entrance position too. The stoploss just as think about profit level is additionally taken.

Conclusion

There are many pattern of exchanging and the wedge pattern is only one out of many. This pattern as I have disclosed before has to do with two pattern lines which combines toward the finish of their movement. There are essentially two diverse sort of wedge pattern, which are, the rising wedge pattern and the falling wedge pattern.

We come to understand the place where the consolidation stage starts, which makes the price move lower. It's important to observe a distinction between a descending channel and falling wedge. In a channel, the price action make a movement high focuses and more terrible depressed spots while in the descending wedge we have the more regrettable high focuses anyway the lows are printed at more noteworthy price.We have two pattern lines that are not running in equivalent

I really want to thank professor @sachin08, The undertaking was troublesome anyway I am happy I did this is in light of the fact that I took in an incredible arrangement about the wadge pattern.

Thanks in anticipation of your remarks

Cc: professor @sachin08

Warm Regards

@desiredlady

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit