.png)

1.What do you understand by trading? Explain your understanding in your own words.

Trading, by its name means buying and selling of stocks. The traders focus on trading by analyzing the value of the assets. Each asset has its own real value and a market value. In a particular market we can see there is a demand and supply for each asset which may vary with time. Excess demand or supply of assets can create a market lag. The prevalence of the asset in the market depends on its supply according to the demand. The price of assets may fluctuate due to the market maker behavior.

The ultimate aim of engaging in trading is to make a profit. The profit is generated when assets are bought for a low price they are resold at a high price. The lower a buyer can buy the assets and sell for a high price makes a profitable trade.

In order to gain profits we need to identify the asset properly by analyzing it. Traders can go for in detail documentation analysis which is known as a fundamental analysis or they can go for a technical analysis which is done by using indicators. The fundamental analysis gives details about the asset, who work in the team, demand and supply, goals and objectives of the management etc.. The technical analysis gives details about the future price movements. We as traders can apply the indicators to an asset price chart and predict what happens in the future. Technical indicators give a signal only but it also can breakout any time.

In cryptocurrency trading buying and selling of assets is done by predicting the price movement of assets. Any cryptocurrency has a unique real value. The market makers are a great influence to change the price action. Crypto currency trades are done on an exchange platform.

2.What are the strong and weak hands in the market

Strong hands are known as the investors with a great capital to invest in an asset. They have a huge amount of cash in hand. These are also known as market makers as they are the once who create the market. The actions of buy and sell taken by the strong hands can change a whole price trend of an asset. The strong hands always buy assets for low price and sell for a high price having a smart profit.

First the investors/traders start buying the assets once the price is lower. They tend to buy as many assets as they can until the price rises according to the capital that they have in hand. They are also a pressure group for the market.

In the next level once the traders have completed buying all the assets the price raises and the traders start selling their assets to a high price by gaining profits in high amounts. Here the traders sell all their assets to gain the full profit.

Weak hands by the name itself are the weak investors in the market. Weak hands do not have a huge capital to invest in assets. They are with lack of resources or capital to buy assets. So more often they buy assets for a high price and sell for a lower price. This creates a loss for them instead of profits.

The weak hands cannot influence the market a lot as they are lacking in conviction. Weak hands are created when the traders try to exit the trade quicker than waiting for a profit. It can be due to their fear of losing their money. It is better to patiently wait till you get the desired profit. The weak hands are just like speculators.

3.Which do you think is the better idea: think like the pack or like a pro?

The pack thinks only about the tasks that they are trained to do. They identify the position that they have and reach goals only as they are used to or trained to.

But the way of pro is way better because it tells about the personality. No one can influence the emotions and feelings of a pro. They are more advanced in thinking unlike packs. The pack thinks only about the tasks that they are trained to do. They identify the position that they have and reach goals only as they are used to or trained to.

But the way of pro is way better because it tells about the personality. No one can influence the emotions and feelings of a pro. They are more advanced in thinking unlike packs. The pro always learn through the behaviors of others and react accordingly. In trading we should be like pro as we can independently take decisions and get right decisions at the right time. we should learn through losses and failures it is worth to win through number of failures rather than winning at the first time being a pack.

4.Demonstrate your understanding of trend trading

Trend trading can be identified as a method of trading done when the price of an asset goes up. Traders take advantage of the upward or downward price trends. Here the traders predict that the price will move in the same trend direction as current trend and place trades. Traders use technical analysis methods and price actions to determine a future price movement and place trades.

Traders use RSI , MA s and other good indicators to predict the price of assets. In an upward trend the traders observe whether the upward trend continues if so they place trades in upward trend. In the same way in downward trend the traders observe if the trend continues downwards for a certain period of time and place their trades. Here they believe that the trend will remain in the same direction without breakout.

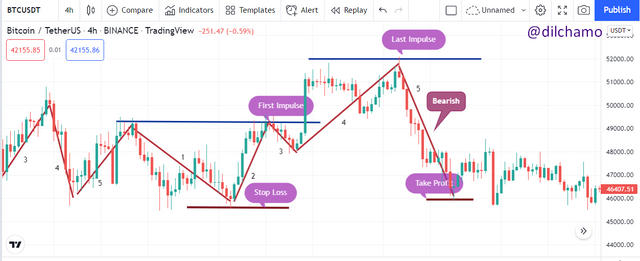

I have used the BTC/USDT cryptocurrency pair chart to demonstrate the trend trading method using impulse wave pattern. Here using the impulse wave pattern I have identified 5 waves and three corrective waves which is really good signal for a trade.

5.Show how to identify the first and last impulse waves in a trend, plus explain the importance of this

When talking about the impulse waves, the Impulse wave pattern is essential to speak about. In this method the impulse wave pattern demonstrates a strong breakout in the price of the asset. Impulse wave patterns can be occurred in both upward and downward trends.

Unlike other indicators and strategies, impulse waves do not have a specific time period. It also takes the same direction of the trend. There are 5 waves in an impulse wave pattern. In this set of 5 waves there are three motive waves and two corrective waves. These waves should undergo three rules in order to make the wave pattern.

- Second wave cannot retrace more than 100% of first wave

- Third wave can never be the shortest of first, third and fifth waves

- Fourth wave cannot overlap first wave

If the requirements are satisfied then there is a probability of creating an impulse wave pattern.

In the screenshot below you can see the first and last impulses are generated according to the Elliot wave pattern. The first impulse is noticed with higher lows which signal of a bearish trend in future. The last impulse is checked when the limit of the first impulse is gone out passing the first impulse position. So in my screenshot you can see that my last impulse accurately signals of the trend which passes lower than the first impulse point.

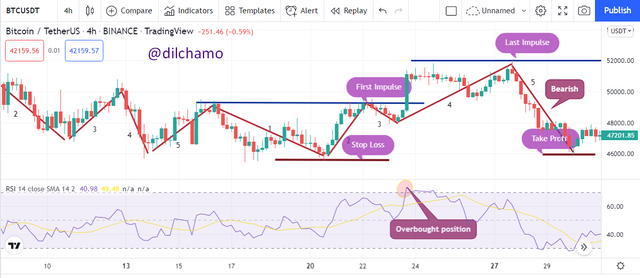

6.Show how to identify a good point to set a buy and sell order

As seen in the screenshot above I have taken the BTC/USDT cryptocurrency pair to determine the trading capacities. A good buy and sell order can be placed if we accurately identify the price trend using the impulse wave pattern. I wanted to place a sell short order. So without depending only on the impulse wave pattern I applied the RSI indicator to predict the price trend. I noticed an overbought position in the RSI indicator and also the first impulse of the wave pattern gives a signal of the sell short order. So definitely I can get profit from the sell order this time according to the Impulse wave pattern signal and the RSI indicator.

7.Explain the relationship of Elliott Wave Theory with the explained method

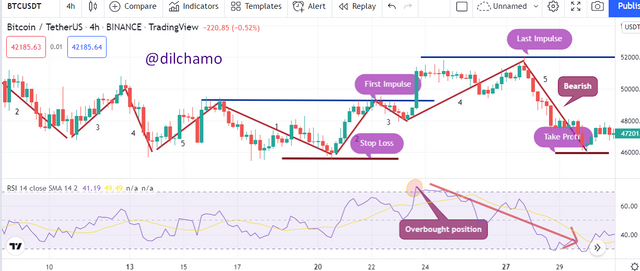

The Elliot theory explains about a series of waves which gives the signal about price trends. In my point of view I used the Elliot wave pattern with the RSI indicator to place a profitable sell order.

The overbought position depicts a signal that there will be a price downtrend which is profitable for sellers. The same signal was given by the Elliot wave pattern after the first impulse. The first impulse of the wave pattern gives a similar signal as the RSI indicator gives the traders.

The fourth wave of the impulse wave pattern gives a good signal of the exactly similar to the overbought position of the RSI indicator. The overbought position signals about a price down trend. Also the fourth wave in the wave pattern also goes beyond the previous waves and signals a huge down trend of price. So the study of waves and the indicator reading gives an accurate signal of price movement.

8.Conclusion

In conclusion, I should say the importance of Elliot wave theory for traders. The most important thing is that we should study the way of identifying the waves accurately in the price chart. It is better to use wave theory with another technical indicator to get an accurate price determination. Beginner traders must be very careful when using the wave theory as most of the experienced traders fail due to misidentification of waves. Thank you professor @nane15 for this nice lesson and I'm happy to take part in it.

https://steemit.com/hive-165917/@azeemtariq/about-stable-coin-paxos-standard-pax-explained-by-azeemtariq

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit