ENTIRE QUESTION

1. Discuss your understanding of the ATR indicator and how it is calculated? Give a clear example of calculation

2. What do you think is the best setting of the ATR indicator period?

3. How to read the ATR indicator? And is it better to read it alone or with other tools? If so, show the importance. (Screenshot required)

4. How to know the price volatility and how one can determine the dominant price force using the ATR indicator? (Screenshot required)

5. How to use the ATR indicator to manage trading risk ?(screenshot required)

6. How does this indicator allow us to highlight the strength of a trend and identify any signs of change in the trend itself? (Screenshot required)

7. List the advantages and disadvantages of this indicator:

8. Conclusion:

1. Discuss your understanding of the ATR indicator and how it is calculated? Give a clear example of calculation

It is a tool used for the analysis of the measurement of volatility created by J. Welles Wilder and published for the first time in his book New Concepts in Technical Trading Systems in 1978 along with other indicators well known today. It is an oscillator-type stock market indicator that is used for the future prediction of the evolution of a financial asset by measuring the volatility of prices in the market. Therefore, this indicator offers buy and sell signals based on today's volatility, taking into account the separation of prices in a normal trading session with respect to the average price.

It is represented by a line below the chart of a cryptocurrency market. Like other indicators, when this line goes up it means that the market is being more volatile, in the opposite case, when the line goes down, it means that the market is losing volatility. Therefore, it is a good tool to decide when to enter or exit a trade or place a stop or limit order, this thanks to the fact that the indicator examines the market volatility during a certain period of time, the ATR indicator can indicate when the price movement moves more or less sporadically, depending on whether volatility increases or decreases. That is, the indicator does not measure the direction of the price, what it intends to do is measure the distance between two points, to know if it increases, decreases or stays the same.

The ATR indicator as we can see is the red line that we can see below the price chart, we can see how I show in a square that the indicator moved up which indicates that the SHIB / USDT market is volatile and as we can see in the graph, the price is decreasing. However, there is a problem and that is that the volatility measurement is done based on normal days where the price movement is not excessive, which results in a failure since it does not measure the full probability distribution where There are many days when the price moves excessively and not only that, volatility can change several times due to the elasticity in the movement that cryptocurrency prices can have in a difficult to predict situation.

Calculation of ATR

To calculate the ATR, the largest value is taken into account, that is, that of the bull market or the smaller one which would be in the bear market, so, to calculate the true average range, we must first calculate the true range and For this we must choose the largest of the following three values:

-Current high minus today's low.

-Today's high minus yesterday's close.

-Yesterday's close minus today's low.

This operation is repeated during a certain interval of time to achieve the moving average, it is recommended or at least, it is the most common, to use a moving average of 14 periods to calculate the true average range during a period of 14 or 14 days, for a short period of time, shorter periods such as between 2 and 10 periods are used, while for longer periods of time, it is used between 20 to 50 periods. In this case we will use a period of 14 sessions and the formula to be used will be the following:

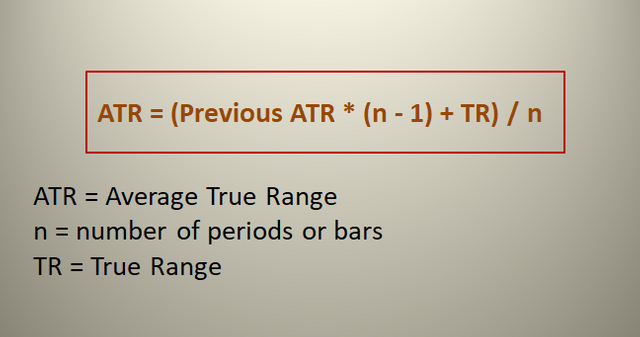

Image created by me in MS powerpoint

But first, an average must be made between the true ranges of the periods already analyzed (14 periods).Which would be something like this:

1.) From the maximum price of the current period, the minimum price of the current period is subtracted.

2.) From the absolute value of the current maximum price, the closing price of the previous period is subtracted.

3.) From the absolute value of the current minimum price, the closing rate of the last period is subtracted.

Of these three values we take the largest which is:

- Current high price: 0.00005775

- Closing price of the previous period: 0.00005086

Let us imagine the previous ATR is 0.45 for 14 periods and maximum is 0.25. Then the current ATR is calculated as below.

Current ATR = [(Previous ATR × (n-1) + Current TR] / n

n = number of periods

= [(0.45 x (14-1)) + 0.25] / 14

=6.1/14

= 0.435

2. What do you think is the best setting of the ATR indicator period?

As we have said in previous classes, there is no magic configuration that solves everything even close, so, which is the best configuration depends on the user and is that each one has their way of working, this is the good thing about the indicators and is that it is adjusted to each trader, taking into account that a larger period is for a long-term trader and has fewer errors, while a short period is for a short-term trader, but it would cause many failures that would make it difficult for us to analyze and we can make a mistake.

Therefore, if you are new, it would be best to start looking for a period that is more comfortable depending on whether you are a long or short-term trader. When entering the indicator we have a predetermined number of periods which is 14 that we can obviously change, 14 is an ideal period because it is not such a low number to cause failures, but it is not that high either, therefore, the indicator will not react slower.

I also mentioned earlier that the most used periods are between 14 and 20, so we can test each one so I would advise starting there and if you don't like it, you can try other periods, therefore, the ideal configuration would be between on the 14th and the 20th to better identify volatility, but this can still change depending on the trader.

So, first let's practice a little with the indicator, establish a strategy and then, we look for the period that best suits our strategy.

3. How to read the ATR indicator? And is it better to read it alone or with other tools? If so, show the importance. (Screenshot required)

Unlike other indicators, the ATR does not indicate the exact moment when a trend change occurs, but it can warn of the momentum of a trend either bearish or bullish. As we can see, the indicator is a line where the high ATR values indicate a high activity in the market, these values indicate that there is a big rise or fall in the market, when the ATR indicator indicates this it can mean that this value is hold for a while.

When the values indicated by the ATR may also be low, this indicates that there is little activity in the market, so it remains calm. While prolonged low ATR values indicate a consolidation of the price and can be considered as the starting point or continuation of a trend. As we can see, the ATR indicator does not show in which direction the price is moving, it will rise when there is a price change, but it can be for better or for worse. For example using the SHIB / USDT pair.

In this example we can see how first the ATR values are high, which indicates a presence of volatility in the market and in both cases there was a price drop, then we can see how the ATR indicator goes down and remains at that level for a period of time. time, this indicates that there is not great volatility in the market, which represents the lack of interest on the part of investors, but this may indicate that there will be a change in trend and we can see that after that period of low volatility, the price rises a little .

We can say that this indicator shows the interest or disinterest of investors, because an increase in the value of ATR indicates a strong interest in cryptocurrencies either to buy or sell them and would reinforce the hypothetical case that there will be a change of direction in the price, on the other hand, when the ATR line becomes quiet, we must proceed with caution.

We will need an indicator that shows us the entry and exit points or the trend direction in an effective way. In addition, indicators usually show false signals and the best way to avoid this is by using another indicator, so it is advisable to use at least one or two more indicators, this to confirm ATR signals, for example using the SHIB / BTC pair. using the RSI indicator:

Using two indicators we can better analyze the market, the RSI indicator was also created by J. Welles Wilder that measures the speed and change of the market price movement, indicating an overbought condition when the RSI line is above 70 and an oversold condition when the RSI line is below 30. As we can see, the graph shows how the price increases to an uptrend, the ATR indicator indicates a large increase which means that there is a great volatility in the market and the RSI indicator shows that the line is moving above 70, which signifies an overbought condition.

As you can see, the two indicators show us the same and with this it gives me more security when it comes to trading, therefore, both indicators work very well, there are also other indicators that can be much better, but again it depends on preferences of the trader.

4. How to know the price volatility and how one can determine the dominant price force using the ATR indicator? (Screenshot required)

The abrupt movements of the indicated shows us the volatility of the market price and as we could see, when the price fell or increased quite quickly, it was shown in the indicator with the formation of peaks, but this happens when there is a great force or interest in the market, so if there is little or no interest at the moment, there will be no spikes.

We must also remember that this indicator does not show us the trend, when volatility rises it does not mean that we are in an uptrend and when it goes down it does not mean that we are in a downtrend. Once we understand this we can see it better in the following example with the SHIB / USDT pair.

We can see in the first circle there is an increase in volatility, not so great, but it is present and at that moment, but this is not all, after a downtrend it is followed by a uptrend, so, at any time the price will increase, but after an uptrend a downtrend arrives and the price falls again, we can see this in the second point of the ATR indicator as volatility increases.

We will see volatility in both the bear market and the bull market and as we could see, a change in the ATR indicator means a reversal of the price and possibly a trend because, as I already mentioned, after a downtrend it is continued by an upward trend and so on.

5. How to use the ATR indicator to manage trading risk ?(screenshot required)

Money management is one of the fundamental pieces when it comes to trading, that is why the ATR indicator is one of the most important pieces when measuring market volatility and thus maximizing profits, but as you already know, the market is very volatile and there are many risks even having a lot of experience in trading, that is why risk management is required to first exit the market when there are losses (this would be the Stoploss) and in the opposite case, when the market is going to our favor (Take Profit).

Remember that there are two paths which a trader can choose when using the Stoploss, these are the narrow and the wide paths, they generally use the narrow paths to avoid risking money, but I recommend using the wide paths together with Trailing Stoploss strategies. In order not to fall into the traps of the market, for this we use the Supertrend indicator, since it shows us the possible entries and exits, since the green and red lines move away from the candles, it depends on whether the price rises or falls and when the price Touching the Supertrend line indicates that there will soon be a change in trend which indicates a good exit, this is better for exits because in the case of entries, it can cause errors. With all this we can create a wide entrance.

For this we place the Stoploss right on the green line in the case of buying and in the case of selling right on the red line, the good thing is that as the price increases, the Stoploss also and the risk will be lower.

6. How does this indicator allow us to highlight the strength of a trend and identify any signs of change in the trend itself? (Screenshot required)

We saw earlier how we can determine the strength of the market with the ATR indicator and the price chart and thanks to volatility, we can know if the trend is strong or weak, but to know the strength of the trend we will need the so-called supports and resistances the which have all the assets and in previous classes we were able to talk about them. These supports and resistances will indicate if the asset will continue in its movement and these points are formed by the supply and demand of the market. If the support line is broken, it means that the price is very low and a prolonged downtrend can continue and if the resistance line is broken it means that there may be a prolonged uptrend with a large price increase.

The price breaks the resistance line and we can see an increase in the volatility of the market going up, indicating a prolonged uptrend, in addition, we can see that the price goes down a bit again, there may be a change in trend, but this We must wait to know if this is the case and as we can see later, the price breaks the resistance line again, which indicates that the price fell a little, but again rose again and volatility also began to rise little by little. which indicates that we continue in an upward trend with the presence of buyers in the market.

A change in trend can occur at any time, it must be borne in mind that for this it does not need to give signals, so we must be alert and for this we must observe the entire structure of the market. A trend reversal occurs when the price rises from below the support or resistance line and passes the support or resistance line with high volatility. In the previous example with the same pair we can see how the price was below the support line and then rose until it exceeded the resistance line, this can be seen with the green arrow that indicates an uptrend that confirms the ATR indicator with the volatility.

Then the price goes back down above the support line, which indicates a downtrend represented by the red arrow and the ATR indicator shows little volatility and then the price goes back up from the bottom to the top, breaking the resistance line showing a trend bullish represented by the green arrow and the ATR indicator shows an increase in volatility.

7. List the advantages and disadvantages of this indicator

| Advantages | Diadvatages |

|---|---|

| Easy to use and helps you observe one of the most important elements of cryptocurrencies, volatility. | It does not report on the reversal or continuation of the trend, therefore, only with this indicator we will not be able to identify the strength or weakness of it. |

| It is an almost indispensable tool for risk management, in addition, together with other indicators, it forms a very important tool. | It does not provide buy and sell signals for buyers |

| It can be used in any time frame and does not take up much space on the stock chart. | To explore its full potential, we must use it together with other indicators, this is not necessarily a disadvantage, but for some traders it can be considered one. |

8. Conclusion

This indicator is an indispensable element when it comes to trading, it is quite easy to use even for a beginner, avoiding many failures and making our operations much easier. But together with other indicators, we can have a great advantage compared to other traders, so we should use this indicator in our future operations.

Hello @dilchamo Can you check my achievement 2 assignment it's been 27 days since I finished my achievement 2 assignment no one has checked it yet.

Task2

Sorry if I intterupt your time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @dilchamo i have a big problem please verify my achievement 5 task 2 post.

https://steemit.com/hive-172186/@alihasnain8/5trtu3-achievement-5-task-2-by-alihasnain8-or-or-review-steemscan-com

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit