ENTIRE QUESTION

1- Define TD Sequential Indicator in your own words.

2- Explain the Psychology behind TD Sequential. (Screenshots required)

3- Explain the TD Setup during a bullish and a bearish market. (Screenshots required)

4- Graphically explain how to identify a trend reversal using TD Sequential Indicator in a chart. (Screenshots required)

5- Using the knowledge gained from previous lessons, do a better Technical Analysis combining TD Sequential Indicator and make a real purchase of a coin at a point in which TD 9 or 8 count occurs. Then sell it before the next resistance line. (You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines or any other trading pattern such as Double bottom, Falling wedge and Inverse Head and Shoulders patterns.)

1- Define TD Sequential Indicator in your own words.

What is TD sequential indicator?

This indicator is used to identify a price point where an uptrend or a downtrend. It gives a recommendation of buy and sell. The TD sequential is an indicator that defines a turning point in the price trend of an asset. On any time frame, if the chart of an asset shows nine consecutive candles above or below the closure of four candles prior to them, then it prints a TD9.

Tom DeMark has developed TD Sequential to provide quantitative measure of a reversal in a price trend. It is based on three main concepts:

- Buy/Sell Setup, which signals partial trend exhaustion,

- Buy/Sell Countdown, which indicates that the initial trend’s momentum is drained.

What should we look at?

- A series of nine candles where each close higher/lower than its 4th predecessor candle’s close value.

Buy recommendation? - When you see 9 consecutive closes “lower” than the close 4 bars prior.

- An ideal buy is when the low of bars 6 and 7 in the count are exceeded by the low of bars 8 or 9.

Sell recommendation? - When you see 9 consecutive closes “higher” than the close 4 candles prior.

- An ideal sell is when the high of bars 6 and 7 in the count are exceeded by the high of bars 8 or 9.

Features of TD Sequential

(1) This can be used in any timeframe and in any financial-traded asset

(2) It includes two phases named Setup phase (9-count) and the Countdown phase (13-count)

(3) The TD Sequential work only in a Japanese Candlesticks or a Bar chart

(4) The TD Sequential is ideal for the early-recognition of key market reversals

(5) It generates support and resistance levels (TDST lines)

(6) The rules of TD Sequential can be modified when needed

2- Explain the Psychology behind TD Sequential

As I have mentioned above there are two processes that we should consider when talking about TD sequential. They are,

- The TD Setup

The TD Setup phase takes place after a Price Flip and includes a count of 9-candles. When the 9-candle count is completed, the TD Sequential identifies a point of a likely top or bottom. (it is theTrading Signal-1)

- The TD Countdown

If the TD Setup is already established the second phase is valid. It includes a count of 13-candles. If the 13-candles count is completed, the TD Sequential identifies a point of a top or bottom. (It is the Trading Signal-2)

TD Countdown commences after the TD Setup phase is completed. TD Countdown phase includes 13 candles. Each candle’s close is compared to a close of two candles prior.

- The Calculation

The TD Countdown phase starts as the TD Setup phase is already confirmed. The final ‘9’ candles of the setup become the candles number ‘1’ of the countdown. The number ‘1’ candle can be postponed until the conditions are fulfilled. The number ‘1’ candle can be postponed, cannot be canceled. In order for the TD Countdown phase to complete, the number ‘13’ candle must close on a bullish countdown or on a bearish countdown the close of Countdown candle number ‘8’.

Then, the 13th candle must be below/above the 8th candle. In addition, like every other Countdown candle, it must be higher/lower than the close of the candle's previous candles. If both these conditions are not satisfied, traders should expect new candles, until these requirements are completed. If the 13th candle doesn’t meet the needed conditions, it is plotted with a «+» above, and the TD Countdown continues to search for a 13th candle at the next ones until the conditions are completed. When the Countdown completes, a new Price Flip and a new trend are likely to happen.

3- Explain the TD Setup during a bullish and a bearish market

Bullish Trend TD Setup

A starting number ‘1’ is plotted if a candle manages to close higher than the close of a candle four periods ago. This four-period rule is key for the calculations of the TD Sequential as it keeps on repeating. Consequently, the second number ‘2’ is plotted only if the second candle manages to close higher than the close of the candle four periods ago. The point of reversal comes when the TD Sequential plots the number ‘9’ on top of a candle. If a candle closes lower than the candle four periods earlier at any point the TD setup will immediately be canceled.

- For the perfect setup, the highs of the 8th and 9th candle must be higher than the highs of the 6th and 7th candle

Bearish Trend TD Setup

In a bearish trend, the initial starting number ‘1’ is plotted if a candle closes lower than the close of a candle four periods ago. And this rule is applied to all the other candles. The reversal point comes when the TD Sequential plots the number ‘9’ on the bottom of a candle.

- If at any point, a candle closes higher than the candle four periods earlier then the TD setup is immediately canceled

- For the perfect setup, the lows of the 8th and 9th candles must be lower than the lows of the 6th and 7th candles.

Trading Signals in the Setup Phase

If one of the above patterns is completed there is a high probability that the market will reverse in the opposite direction. The number ‘9’ is good for entering a trade opposite to the established trend. The stop-loss should be above or below the highs/lows of the 9th candle. If the pattern goes out, the pullback will significantly be strong during the first 3-4 candles after completion of number ‘9’.

When the 9th candle is confirmed there is a high probability for a trend reversal. Ideally, the 9th candle should close near its TDST line. If the Setup is perfect, anticipate 3-4 strong candles in the opposite direction.

4- Graphically explain how to identify a trend reversal using TD Sequential Indicator in a chart

The screenshot above is a 1 hour Time frame chart of SHIB/USD. TD sequential indicator is added to this chart as seen in the above screenshot. Thus asset is seen to be trading on a downtrend as the price keeps forming lower highs and lower lows as indicated by the blue lines in screenshot. This then form market cycle and structure.

The TD 9 count is indicated by a long red arrow in the screenshot above. And immediately it was plotted, a reversal to the uptrend occurred and the previous high was broken as indicated by a black horizontal line and arrow in the screenshot.

As we have bullish reversal as in the case of the picture uploaded above, TD sequential indicator can also be used to identify bearish reversal. The bearish reversal identified by the help TD sequential indicator is uploaded below.

5- Using the knowledge gained from previous lessons, do a better Technical Analysis combining TD Sequential Indicator and make a real purchase of a coin at a point in which TD 9 or 8 count occurs. Then sell it before the next resistance line. (You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines, or any other trading pattern such as Double bottom, Falling wedge, and Inverse Head and Shoulders patterns.)

The screenshot above is a chart of SHIB/USD taken from a trading view. I have identified the trade entry and exit points. For that I added trend lines which act as a support and resistance line. TD 8 is the trade entry point for me. I have identified my trade exit point before the major resistance level. At TD 5 I exit the trade. You can clearly see that I sell it before the next resistance line.

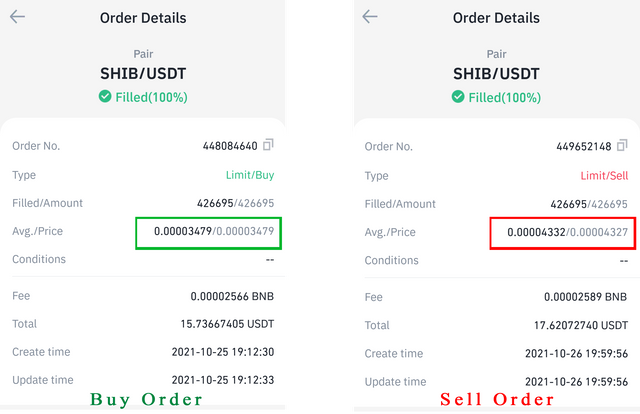

Here I have used the screenshots of my trade details. The average price is 0.00003479 in my buy order. The total amount was 15.7 USDT from the buy order. Then in the sell order the average price is 0.00004332. the total amount is 17.6 USDT. The buy order was created on 25 th October and the sell order was created on 26 th October.

The order decisions are taken from the signals given by the TD sequential indicator. This proves that if we study how to use the indicator and take trading decisions accordingly we can gain profits from the trades.

CONCLUSION

TD sequential is hard to identify indicator which is used by many experienced traders but here there is a probability of having accurate signals. But we cannot rely on one single indicator to make trading decisions. The TD sequential is a wonderful lecture done by professor @reddileep and thank you for the amazing lecture.

Note : All screenshots are taken from Tradingview

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit