Introduction

In an era of financial innovation and technological advancement, investors find themselves at a crossroads between traditional stocks and the rapidly expanding world of cryptocurrencies. Both asset classes have their merits and drawbacks, making it crucial for investors to delve deeper into their characteristics and performance. This comprehensive blog post aims to explore the key aspects of stocks and cryptocurrencies, including historical performance, volatility, market accessibility, dividends, regulation, and investment strategies.

Stocks

Aspect Stocks

Historical Performance Historically, stocks have shown steady growth over the long term, with an average annual return of around 7-10%. However, returns can vary significantly based on the market conditions and the performance of individual companies.

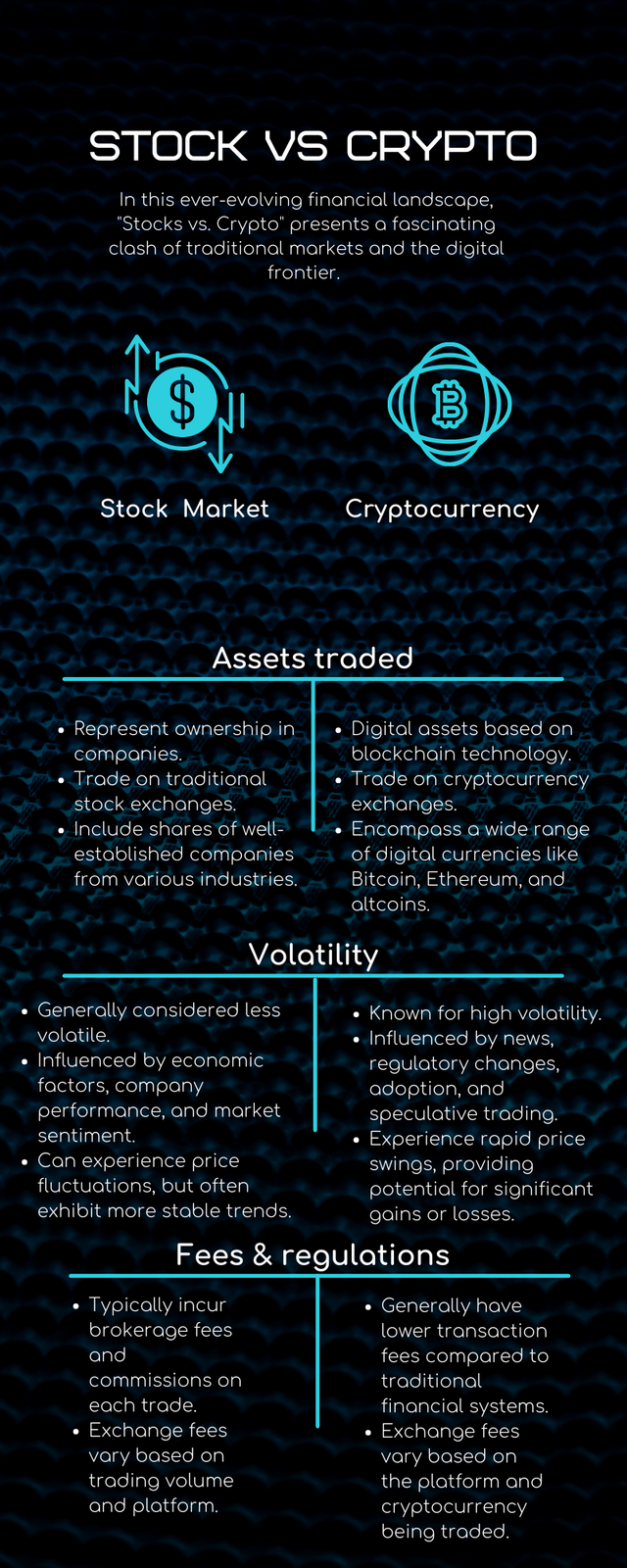

Volatility Stocks are generally considered less volatile than cryptocurrencies, but fluctuations can still occur due to economic conditions, geopolitical events, or company-specific factors. Investors often evaluate stock volatility through beta measurements.

Market Accessibility Stocks are widely accessible through traditional stock exchanges and brokerage accounts, making them relatively easy to buy and sell. Companies must meet regulatory requirements to be listed on exchanges.

Dividends Some stocks pay dividends, providing investors with regular income based on the company's profits. Dividend yields can be an attractive feature for income-focused investors.

Regulation The stock market is heavily regulated by government agencies and exchanges to ensure transparency, fair trading, and investor protection. Compliance with securities laws is mandatory for listed companies.

Investment Strategies Investors can employ various strategies when trading stocks, including value investing, growth investing, or dividend investing. Diversifying across industries and market caps is common to manage risk.

Cryptocurrencies

Aspect Cryptocurrencies

Historical Performance Cryptocurrencies have exhibited high volatility, with both rapid growth and significant pullbacks. Historical returns have seen both extraordinary gains and periods of steep declines.

Volatility Cryptocurrencies are known for their extreme volatility, with price fluctuations influenced by factors like news, market sentiment, and technological developments.

Market Accessibility Cryptocurrencies are accessible through online cryptocurrency exchanges. Many digital assets are open-source and can be bought, sold, and held in digital wallets.

Dividends Unlike stocks, most cryptocurrencies do not pay dividends, as they are primarily designed as digital currencies or utility tokens. Investors look for capital appreciation rather than dividends.

Regulation The regulatory landscape for cryptocurrencies is evolving, with varying degrees of government oversight in different regions. Regulatory uncertainty can impact market sentiment and adoption.

Investment Strategies Cryptocurrency investment strategies include long-term HODLing (holding), trading based on technical analysis, participating in initial coin offerings (ICOs), or investing in DeFi protocols. Risk management is essential due to high volatility.

Comparing Liquidity and Market Hours:

Stocks:

Stock markets operate during specific trading hours, typically from 9:30 AM to 4:00 PM (Eastern Time) on weekdays. Some exchanges have extended trading hours for after-market and pre-market sessions, but liquidity during these periods may be lower.

Stocks are generally considered highly liquid, especially for large-cap companies, where millions of shares can be traded daily.

Cryptocurrencies:

Cryptocurrency markets operate 24/7, allowing investors to trade at any time, including weekends and holidays. This continuous trading is a unique feature of the crypto market.

Liquidity in the cryptocurrency market can vary significantly between different digital assets. Popular cryptocurrencies like Bitcoin and Ethereum tend to have higher liquidity, while less-known altcoins may have lower liquidity.

Market Regulation and Investor Protection:

Stocks:

The stock market is heavily regulated by government agencies, such as the SEC in the United States, to protect investors and maintain market integrity.

Listed companies must comply with strict reporting requirements, providing transparency to investors and analysts.

Cryptocurrencies:

The regulatory landscape for cryptocurrencies is still evolving, with varying levels of oversight in different countries.

Regulatory uncertainty can lead to market volatility and impact investor confidence.

Market Access and Account Security:

Stocks:

Investors access the stock market through brokerage accounts, which often require identity verification and adherence to know-your-customer (KYC) procedures.

Brokerage accounts offer various security features, such as two-factor authentication, to protect investor funds and data.

Cryptocurrencies:

Investors access cryptocurrency markets through digital wallets, which can be either custodial (managed by third-party providers) or non-custodial (controlled by the investor).

Securing private keys and using hardware wallets are essential practices to protect cryptocurrency assets from theft and hacking attempts.

Taxation and Reporting Requirements:

Stocks:

Profits from stock trading are generally subject to capital gains tax, with different rates depending on the holding period.

Brokers and financial institutions provide tax reporting documents, simplifying the process for investors.

Cryptocurrencies:

Cryptocurrency taxation varies by country and can be complex, especially for frequent traders and participants in initial coin offerings (ICOs).

Investors are responsible for accurately reporting their crypto gains and losses for tax purposes.

Institutional Adoption and Mainstream Recognition:

Stocks:

Stocks have a long history of institutional adoption, with large companies, mutual funds, pension funds, and other institutions actively participating in the stock market.

Mainstream financial media extensively covers stock market developments and company performances.

Cryptocurrencies:

Cryptocurrencies are gradually gaining institutional interest, with some hedge funds, investment firms, and corporate entities investing in digital assets.

Mainstream recognition is increasing as prominent companies and financial institutions embrace blockchain technology and explore cryptocurrency adoption.

Conclusion

In conclusion, the decision between stocks and cryptocurrencies rests on the individual investor's risk appetite, investment horizon, and financial goals. Stocks offer a history of steady growth, dividends, and a well-established regulatory framework, making them suitable for long-term investors seeking stability. On the other hand, cryptocurrencies offer a high-risk, high-reward proposition, attracting investors seeking rapid gains in a fast-paced, decentralized market.