Properly explain the Bid-Ask Spread

Ans . : I will be explaining the Bid-ask spread using a currency pair(cryptocurrency)

NOTE : These Bid-Ask spread concept is normally used in the crypto or forex trades and the Market executors who tells the price they wants to buy or sell a commodity in forex markets initiates market Orders which can be: instant market execution

limit orders and

stop orders

and they also gives bid price and Ask price of a trade or commodity,this difference or gap between the Bid and Ask price(spread) determines the liquidity of the market

I'll start by explaining what a Bid price and Ask price is;

BID PRICE is the price that the buyers are willing to buy a currency or commodity and this is usually high,it is represented with a green colour While

ASK PRICE is the price that the sellers are willing to sell a currency or a commodity and it is usually low,this is represented with a red colour ;

Let's take for example using my location Nigeria and America whose currency pair should be USD/NGN;A friend who stays in U.S and uses dollars sent me 100dollar and I went to the bank to withdraw it,know that I'm in Nigeria and what I should be getting is naira as the exchange from dollar that means I am selling the dollar to get naira from the bank and with the $100 I bought 40,000naira with the exchange rate of 40naira and then the next day I decided to send back the money to my friend who stays in U.S and I have to meet the bank for another transaction, this time the bank is buying from me and because I might be in a hurry to sell to them they will charge me higher than I bought the commodity which might be 38,000naira (38naira per one), remember I was selling dollar to the bank and now the bank is buying naira from me.

The difference between this two prices which are the BID PRICE and ASK PRICE is known as SPREAD which can also be called the Bid-Ask spread (in a more simple understanding, the Bid-Ask spread is the subtraction of Ask from Bid price)

Equation : Bid-Ask spread =Ask price -Bid price

Therefore ; Ask price - Bid price =spread

40- 38= 2

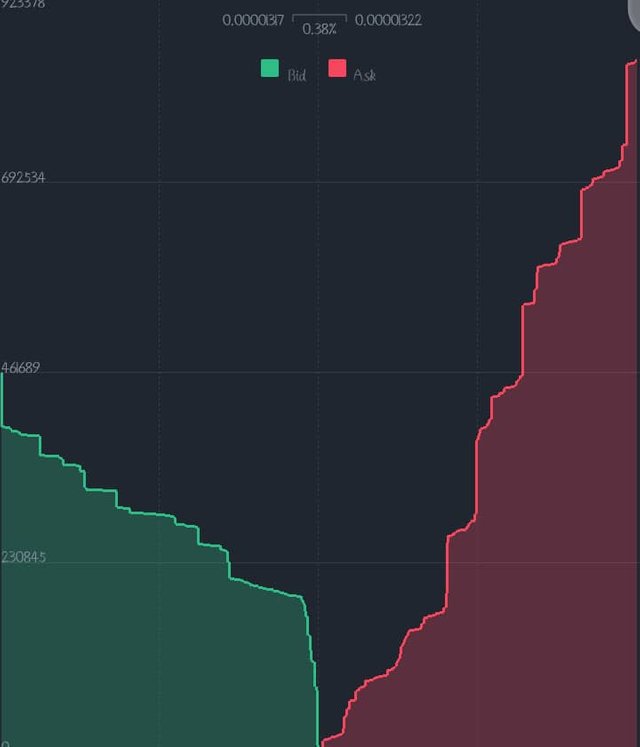

From the image, the bid is the green side, and the ask is the red. That very bid-ask spread is for Steem/BTC and looking at the spread, it is showing that the ask for steem is high which will deflate the price of steem/ BTC down

From the image, the bid is the green side, and the ask is the red. That very bid-ask spread is for Steem/BTC and looking at the spread, it is showing that the ask for steem is high which will deflate the price of steem/ BTC down

This is another spread showing that the bid is in possession, which is why the steem coin increased by 5.18%

This is another spread showing that the bid is in possession, which is why the steem coin increased by 5.18%

Why is the Bid-Ask Spread important in a market?

Ans. : It was adviced by a coach to use a low spread when trading as it increases the movement of the market or the liquidity ;therefore the Bid-Ask spread is important in a market because it helps traders make a good market executions by the use of limit orders to attain a good liquidity.

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread .

b.) Calculate the Bid-Ask spread in percentage .

Ans :

A. Bid-ask Spread = Ask price - Bid price

Therefore; $5.20 - $5

Spread = 0.2

B. Bid-Ask price in percentage

%Spread = (Spread/Ask Price) x 100

%spread = (0.2/5.20)×100

0.0384615385 ×100

= 3.8461538462%

Apprx. 3.85%

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Ans:

A. Bid-ask Spread = Ask price - Bid price

Therefore; $8.80 - $8.40 = 0.4

Spread = 0.4

B. Bid-Ask price in percentage

%Spread = (Spread/Ask Price) x 100

%spread = (0.4/8.80)×100

= 0.0454545455 ×100

Therefore; %spread = 4.54545%

In one statement, which of the assets above has the higher liquidity and why?

Ans.: crypto x has the higher liquidity than y because of its low spread as low or small spread favours liquidity

Explain Slippage .

The term slippage is used in illustrating the deviation of price of an asset from the traders fixed price or intended price because Crypto prices has the tendency to change fast or fluctuate and this slippage is mostly experienced in a gaped or high bid-ask spread which in turn causes low liquidity,

Explain Positive Slippage and Negative slippage with price illustrations for each .

Positive slippage

N.B : Slippage=expected price of a trade-price it is executed.

Positive slippage favours buyer/seller as they makes profits from the slight fluctuation of a trade .In this slippage, the market order to get a coin is done at a lower price instead of the intended price.

E.g;, An order was placed to buy a coin at $12 and because of the change in price of the coin it becomes $11.6

Therefore; the positive slippage would be

$12- $11.6

=$0.4

OR

An order was placed to sell a coin at $10.5 and because of the change in price of the coin it becomes $11

Therefore; the positive slippage would be

$11 - $10.5

=$0.5

Negative slippage

Just as the positive slippage favours buyer/sellers as they gain, in negative slippage buyer/seller losses from these change or fluctuation in intended price so they are just the opposite of each other that is to say that in negative slippage the intended order given to buying a coin is executed at a higher price than the given price.

E.g; An order was placed to buy a coin at $15. However, due to the sudden fluctuation, this buying occurred at$16.

In this case, the negative slippage would be $16 - $15

=$1

OR

An order to sell a coin was placed at $13. And due to the sudden change fluctuation, this selling occurred at $ 12

In this case, the negative slippage would be $13-$12

=$1

Cc @awesononso