PART A (case study)

QUESTION 1

The case study given is an example of what type of psychology? Explain the reason for your answer.

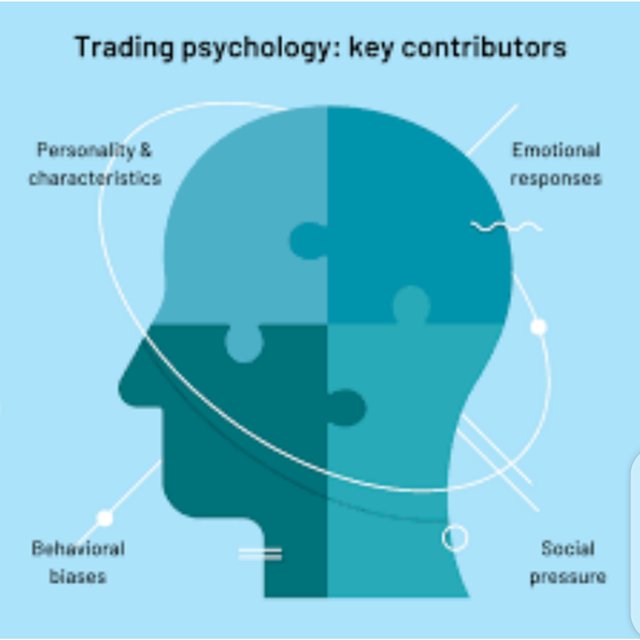

The case study is an example of trading psychology.

We actually have two types of psychologies, which are the trading and the market psychology. I choose trading psychology because here the psychology is directed to a single trader, being Jane. We saw that Jane made a lot of bad trading investments which was totally based on her emotions, her fears, and hopes as well.

QUESTION 2

Using the case study above, list and explain at least 5 biases that influenced Jane’s trading behaviour with examples of how it affected her

Trading Biases and how it affected Jane

Listing out the various trading biases in regards to the $15 investments Jane made in trading; there are as follows, emotion bias, disposition bias, confirmation bias,

1) Emotional Bias

It is evident enough that Jane was trading based on her emotion. Jane actually bought the crypto asset not because she performed some technical analysis on it, but because she saw some crypto listed in a telegram group had the fear of missing out if others are actually making profits from it.

Now that she purchased, and yes made a profit of $5 adding to her initial $20, she did not exit the trade but kept on holding because of the Greed aspect in the Emotional Bias. This was just due to over confidence. Which finally made her loose the $5 profit and $10 of her investment.

2) Disposition Bias

Now going to the disposition aspect, Jane actually refused to accept the fact that she made an error in not exiting the trade or not doing analysis before entering the trade. She actually noticed that this crypto asset has lost value and entered her investment, yet she did not accept the fact.

Refusing to accept that she made an error even caused more error, leading to more emotional distress.

3) Confirmation Bias

The next here is the confirmation bias. The confirmation Bias explains the relief one feels with a piece of you were hoping for. We notice that after Jane’s stop loss was triggered, she actually felt bad. But when she saw the prices kept going bearish, she became relieved, knowing that without a stop loss, she should have lost everything.

This actually affected Jane in that, the confirmation Bias finally gave her a little joy, and freed her mindset from the prison she put into feeling about the lost. But now it is too bad to notice that there was a trend reversal.

4) Anchoring Bias

The anchoring bias talks about the interpretation of the first information accessed. I actually noticed the anchoring bias in two scenario in Jane’s case study. Firstly, after getting the piece of information from telegram, she did not mind doing research or getting another confirmation but relied solely on the first information. Secondly after finding a bearish trend, she did not still do analysis to find a possible reversal.

This actually affected jane in a great way, as she lost about $10 of her investment due to the fact that she relied on the every first information she got.

5) Herd Mentality Bias

Following the whales cycle as many investors do is an example of herd mentality. Here, investors and traders turn to follow what other investors are doing. In jane’s case, she saw a trade knowing many traders will be doing that as well, and truely it shows that so many people demanded for that asset at that time, but investors selling off soon after without her knowledge because of inadequate findings.

Due to the fact that, Jane could not do enough findings the Herd Mentallity affected her in great way making her hold her position when others are selling, and selling when others are buying.

QUESTION 3

List and explain how each bias you have mentioned can be avoided?

How Bias can be avoided.

Herd Mentality Bias

The herd Mentality can be avoided by carrying out research yourself before taking actions.

Confirmation Bias

The confirmation bias actually causes relief for a short period of time, but one should always be sceptical to why this things are happen, and it can be avoided

Anchoring Bias

The Anchoring Bias can be avoided by interpreting several informations on not relying only on the first.

Deposition Bias

For the dispostion bias, it is simple, to avoid it, just accept faults and mistakes and exit the trade.

Emotional Bias

When you rely on emotions for on trading, you will always fall into this, this can be avoided by going into action to carry out your research before trading.

PART B (Research and Analysis)

QUESTION 1

What type of analysis can be used to monitor market psychology and trading psychology, and why? Identify the difference between trading psychology and market Psychology.

Analysis with Market and Trading Psychology

Market Psychology is the collection of the different trading psycholgy. The market psychology collects the different psychology of each investor and trader which determines the price movement of that particular asset.

Analysis can be done to monitor the market psychology using principally the Fundamemtal and Technical analysis such as:

- Confluence of fundamental and technical analysis

- Price action indicators

- market structure.

I will be explaining some this below principally the Technical analysis.

Trading psychology actually points out to the psychology or behaviour of a single trader or investor, which is an example of jane above.

With this type of psychology each investor or trader has the power to control your behaviour based on the total market sentiment.

- The market psychology collects the sentiment and psychology of different traders and investors while the trading psychology is a single trader or investor.

- The trading psychology can be viewed on a personal aspect where as the market psychology is done within various analysis such as technical and fundamental.

QUESTION 2

How can you measure market psychology using a crypto chart? Select 5 trading biases and explain with screenshots of any cryptocurrency chart how the biases can cause a coin to be oversold and overbought.

Measurement of market psychology using a crypto chart

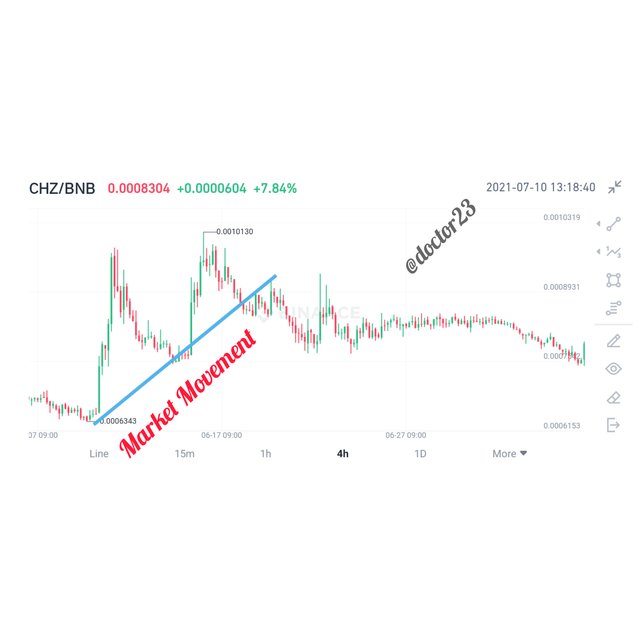

1) Market Structure.

The marker structure can either either be bullish which is an uptrend, bearish, a downtrend, or sideway. The bullish trend indicates market psychology as so many traders are purchasing that asset, the bearish shows investors selling off the asset, and the sideway shows indecision sentiment.

2) Price action Indicators

We can use indicators such as the relative strength index, stochastics to find potential overbought and oversold regions which shows when other investors are selling off their holdings.

QUESTION 3

In your own words, define the term efficient market hypothesis. List and explain the advantages and disadvantages of efficient market hypothesis.

The Efficient Market Hypothesis

The balanced nature of traded market is always described using the efficient market structure. Traders actually use this to find a way to earn profit above the market price.

The efficient market hypothesis indicates if the market reflects prices in all its informations. This information involves fundamental news events and movements of whales in the crypto market.

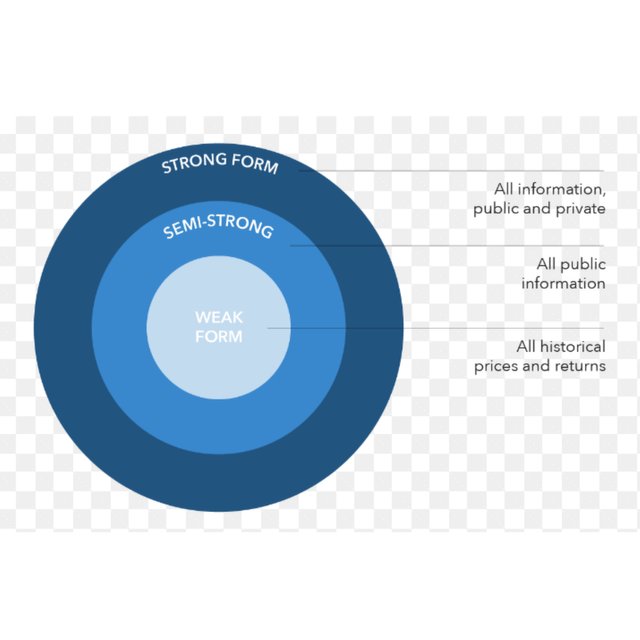

They consist 3 Efficient market Hypothesis;

strong EMH

Which shows that no investor can earn above the average return of each asset.

semi-strong EMH

Shows that new informations are absorbed by the market instantly hence no gain above average margin

weak EMH

Which shows that the previous market does influence current price.

- The knowledge of the efficient market hypothesis yields more profit to investors.

- the efficient market hypothesis reflects the actual value of an asset.

- Without the move being started started, investors cannot determine the direction of the prices.

- it is generally on an average base difficult to predict actual price

- it has higher risk effect.

CONCLUSION

The Market and trading Psychology should what be what traders should try to work against a for. As a trader, it is proper to decipline your self from falling into such traps by carrying out research. And as a trader again, you can analyse the market psychology in your favour using technical analysis.

Hi @doctor23, thanks for performing the above task in the second week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 5 out of 10. Here are the details:

Remarks:

Commendable effort but fair performance. While you did considerably well in the Part A, your answers to Part B questions lacked some depth to it. Also, you did not explain how biases can lead to overbought and oversold conditions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit