QUESTION 1

What is liquidity in pancakeSwap explain with examples? And add liquidity in pancakeSwap and explain all the steps with screenshot. (Explain in your own words)

Liquidity in PancakeSwap

In bis to define Liquidity in Pancakeswap, I will begin by talking what the so called PancakeSwap and Liquidity are all about.

Beginning with the PancakeSwap, it is actually a decentralized exchange that is used to swap BEP-20 tokens. The pancakeswap is built on the Binance smart chain, and thus manages liquidity and provides protocol on the platform and market respectively.

Normally, in the decentralized systemsm the users of the platform perform all necessary activities without the concern of any third party and has a very high level of security, with the pancakeswap not excluded in that. In this regards, the users of the platform can partake in the liquidity process as well as directly transact in the liquidity pool.

Now liquidity pool is the collection of the invested coins by different investors and provides a platform for the exchange of tokens.

Liquidity now on the pancakeswap is the shares of coins that has been deposited by investors to the liquidity pool, and it actually enables users of the platform to carryout transaction,

Examples of tokens earned is usdt-busd lp if you deposited busd and usdt

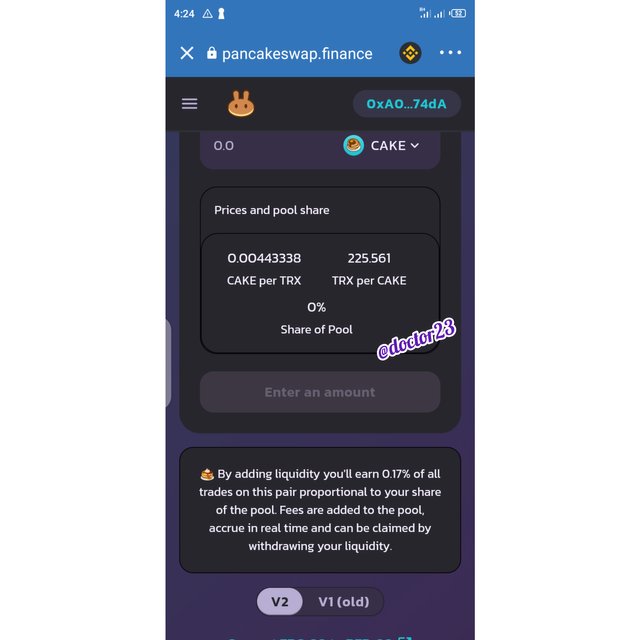

I will give out the steps in point form.

Step 1

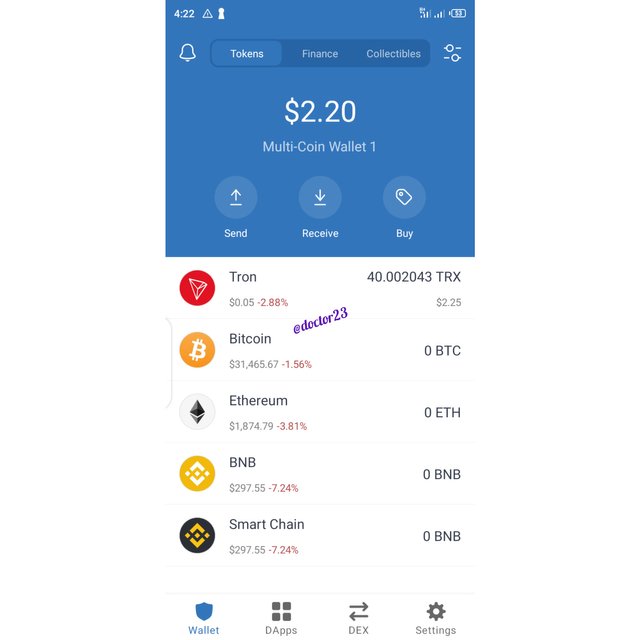

We log into the trust wallet application, which I have already downloaded

Step 2

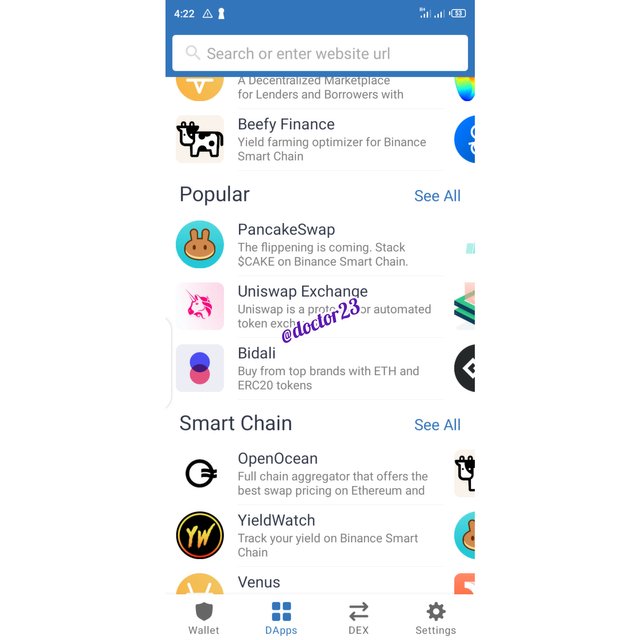

Click on Dapps and take pancakeswap

Step 3

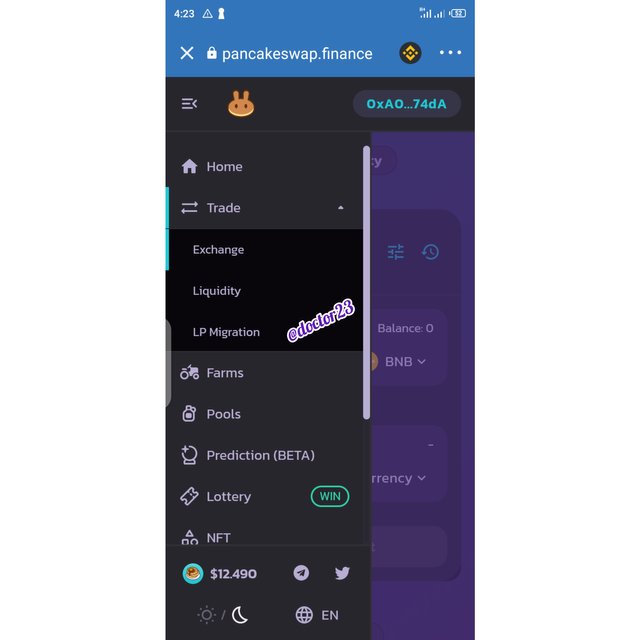

Click on the 3 menu button and take trade, then liquidity.

Step 4

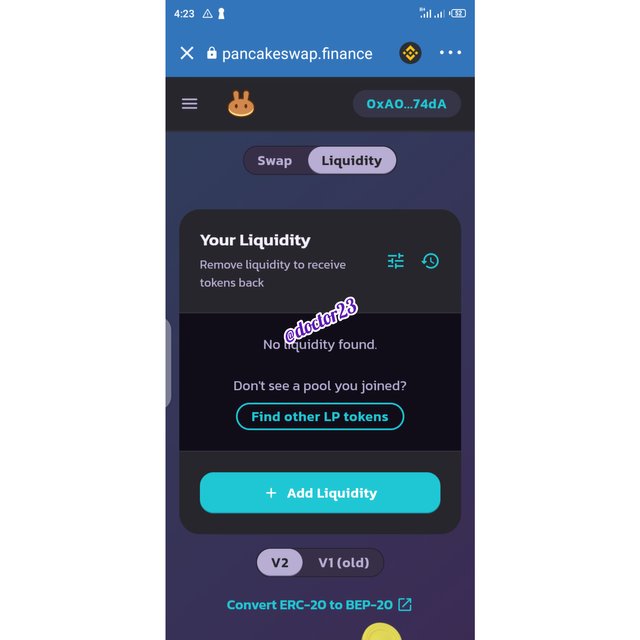

Click on add liquidity, and choose the asset.

QUESTION 2

How to connect binance exchange account with binance smart chain or trust wallet. Explain all the steps through screenshot. And transfer any coin from binance smart chain.

Connecting Binance Exchange with Binance Smart Chain.

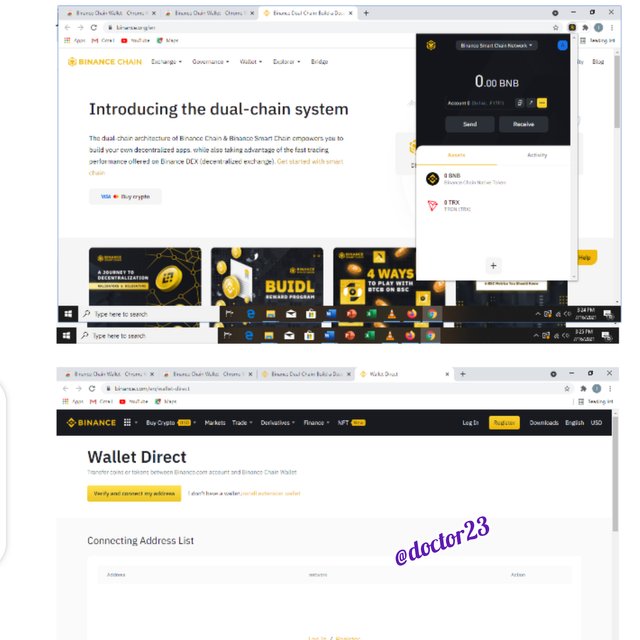

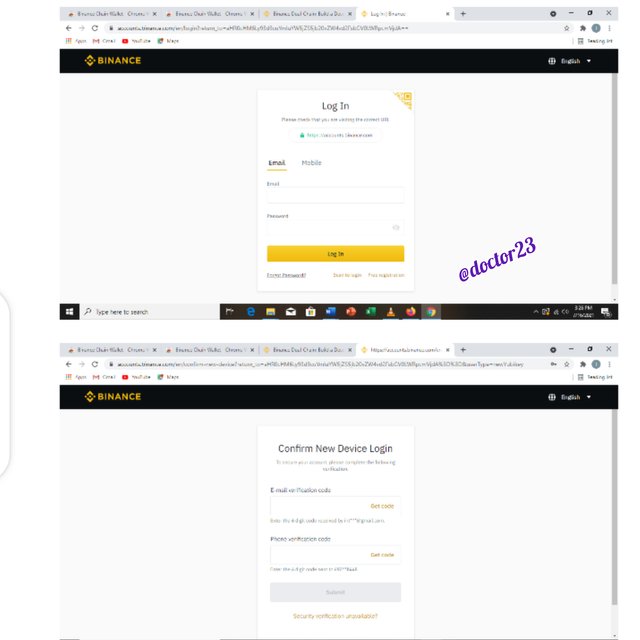

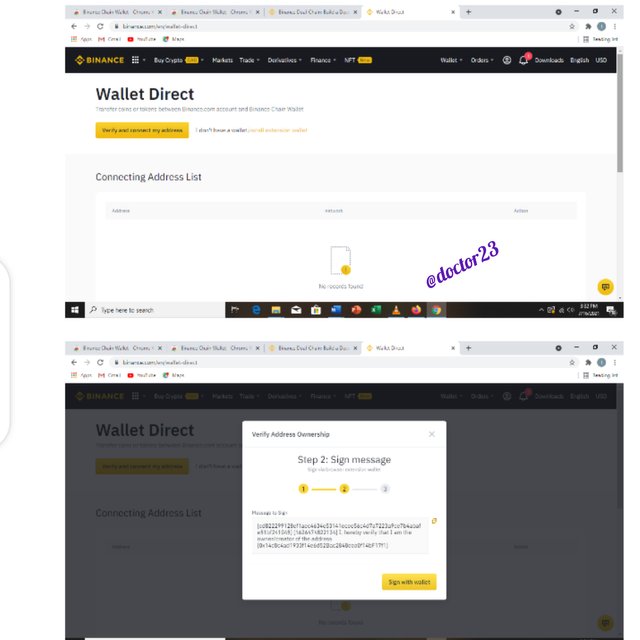

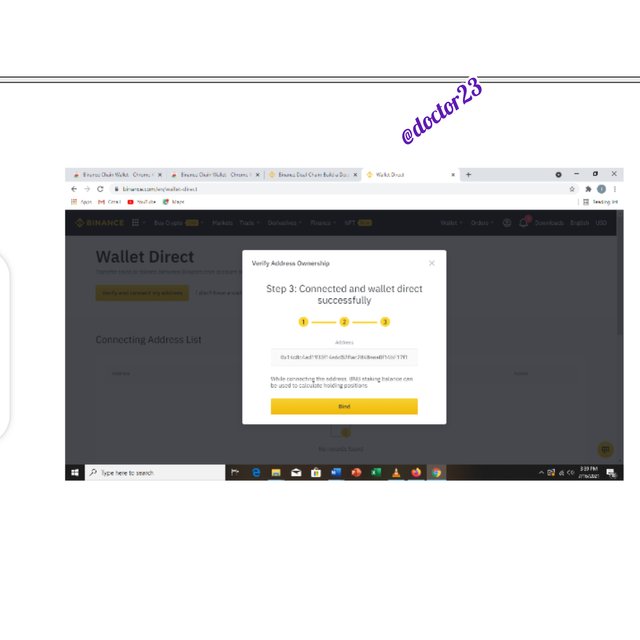

Step 1

Step 2

Step 3

Step 4

QUESTION 3

What is the difference between trust wallet and metamask and which of them better and why? Explain in your own words.

Differentiating Trust wallet and metamask

Though both of them happen to be decentralized wallets, the metamask is developed on the Ethereum Blockchain which accepts ERC-20 tokens, while the trust wallet is developed on the Binance Blockchain that accepts tokens such as ERC-20, ERC721, BEP-20 and others.

The trust wallet has a limited accessibility when compared with the metamask. The metamask can be access via mobile application web wallet and also linked to an exchange account. Whereas the trust wallet can be access via a mobile application and connected to binance exchange account.

Which is Better and Why

I prefer the trust wallet personallym because I have been using it and it has a good user interface.

The trust wallet accepts a variety of tokens than the metamask such as the BEP-20, ERC-20 among others which makes it easier.

QUESTION 4

What is meant by pancakeswap and uniswap

- And what is the main difference between them

- Explain the different futures of both

- Which of these exchanges is better and why? Explain in your own words.

The PancakeSwap and the Uniswap

Both the Pancakeswap and the Uniswap are decentralized exchanges which is based on the automated market maker model in providing liquidity.

One of the unique features of the pancakeswap and the uniswap being decentralized exchanges is that no verification is required for carryout various activities. We can easily stake tokens on the platforms and it is done by linking wallets such as the trust wallets and the metamask wallets mentioned above.

main difference between the Pancakeswap and Uniswap

- In the Pancakeswap exchange it is based on the Binance Blockchain while the Uniswap is based on the Ethereum network

- The uniswap is popular than the pancakeswap has more listed crypto assets.

- The transaction fee of the uniswap is higher than that of pancakeswap.

Which is Better and why.

For me I will prefer the Uniswap, though it has a relative higher transaction and gas fee, but at least it has more assets listed which is why prefer it.

Features of Pancakeswap and Uniswap

Liquidity pool

The liquidity pool which is created by investors as mentioned above is a core feature on the two exchanges. As it allows exchange access to other users.

Staking

We can stake in the two platforms. As participants can stake tokens earn income based on the APR

Reward Token

Using liquidity provider tokens, those who partake in the liquidity pool can earn such tokens as well as from transaction fees

Swap

We can various crypto assets in both platforms.

QUESTION 5

How to connect PancakeSwap with Metamask. Explain this with a screenshot.

Conclusion

The decentralized exchanges such as the pancake and metamask Can be use for staking tokens which you get rewarded for participating in the liquidity pool. The decentralized exchanges are more better when compared with the central exchanges as you have full access over your account and it has been proven to be more secure/

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 3

you did not explain good in screenshot ,, i could not understand your presentation of screenshot,,

try to read course , and make your own research

always try to explain according to your experience, what do you have your own words about any project than you very much for taking interest in this class

question first to last you did not provide complete screenshot

thank you very much for taking interest in this class

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit