Creating a Demo Account with the FXTM Broker on Metatrader4

Creating a demo account is quite simple and straight forward. We just need to follow the steps below.

Step one:

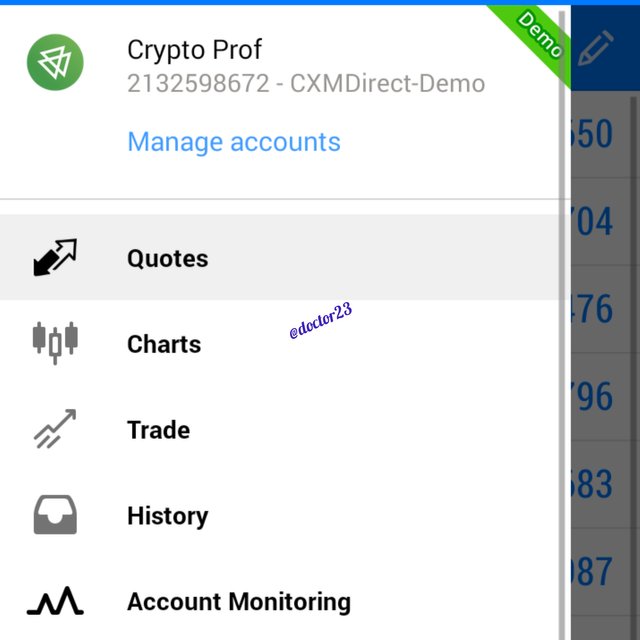

We download and install the metatrader 4 application which I have it all installed already. Click on manage account and take search broker

Step two:

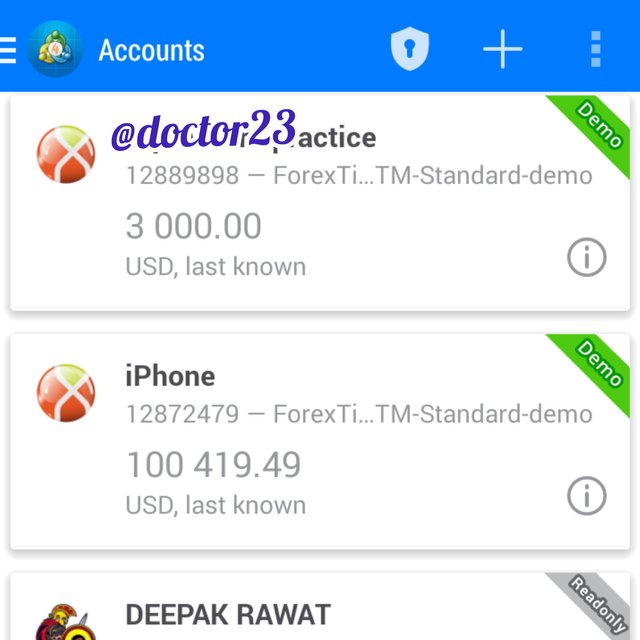

We click on plus + sign

Step three:

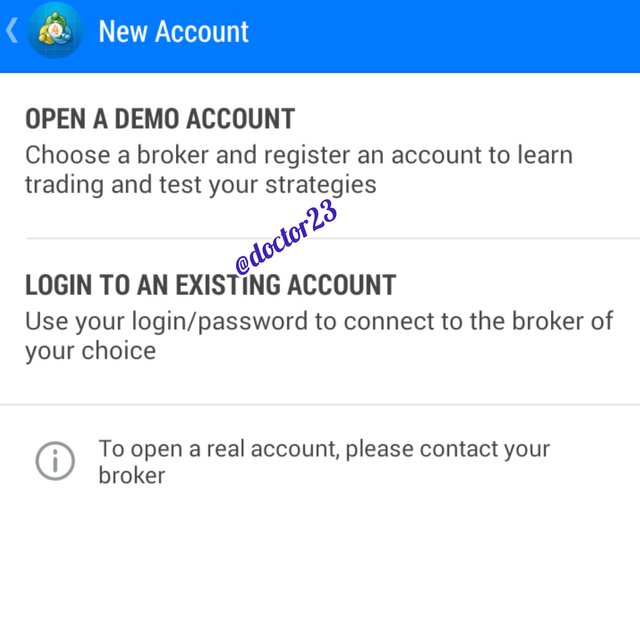

Click on create demo account

Step four:

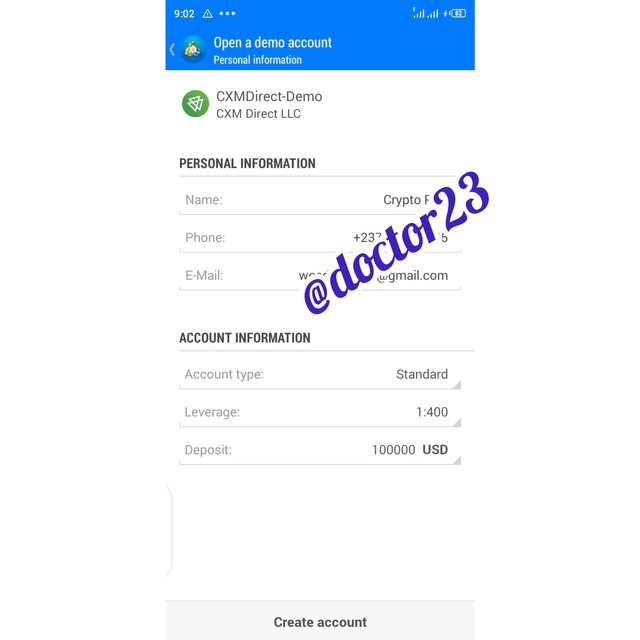

We search for FXTM and fill in the necessary information and account is all ready to go.

Trading with the CCI Indicator

Trading with the CCI is quite simple and straight forward. All we need to do is add them to the trading chart and find our support and resistance levels.

I will be using the following crypto currency pairs to demonstrate trade entry and exit, and trade managements

- ltc/usd

- btc/usd

- eth/usd

- xrp/usd

- usd/eth

A) The CCI indicator with LTC/USD

Trade Entry

Trade entry here means we begin by adding our indicator to the ltc/usd chart. We then find potential overbought or oversold regions regions. The flexibility of this regions will be dependent opon if that region once held. As seen with the ltc/usd it shows we have had an overbought on that same region a couple of times.

Trade Exit and Management

Trade exiting is about setting a stop a stop loss and take profit regions. If in case the trade goes as planned, the trade will hit the take profit level and book the profits if not then it will stop further loss by hitting and closing on the stop loss level.

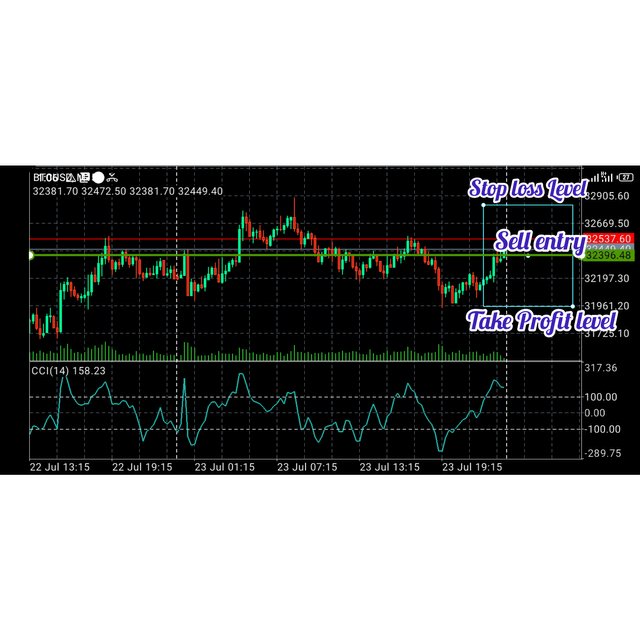

B) The CCI indicator with BTC/USD

Trade Entry

Trade entry here means we begin by adding our indicator to the ltc/usd chart. We then find potential overbought or oversold regions regions. The flexibility of this regions will be dependent opon if that region once held. As seen with the ltc/usd it shows we have had an overbought on that same region a couple of times.

Trade Exit and Management

Trade exiting is about setting a stop a stop loss and take profit regions. If in case the trade goes as planned, the trade will hit the take profit level and book the profits if not then it will stop further loss by hitting and closing on the stop loss level.

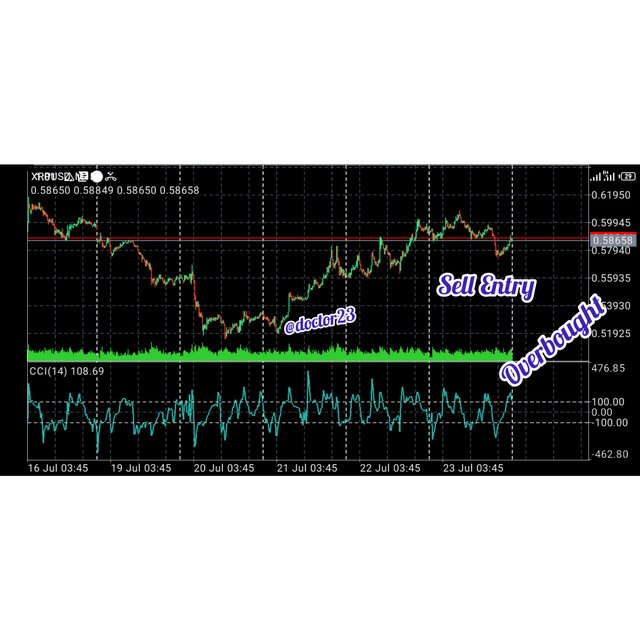

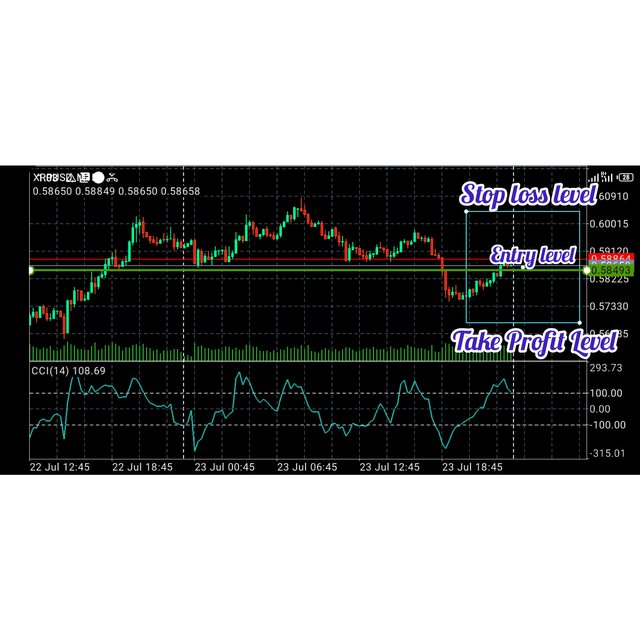

C) The CCI indicator with XRP/USD

Trade Entry

Trade entry here means we begin by adding our indicator to the ltc/usd chart. We then find potential overbought or oversold regions regions. The flexibility of this regions will be dependent opon if that region once held. As seen with the ltc/usd it shows we have had an overbought on that same region a couple of times.

Trade Exit and Management

Trade exiting is about setting a stop a stop loss and take profit regions. If in case the trade goes as planned, the trade will hit the take profit level and book the profits if not then it will stop further loss by hitting and closing on the stop loss level.

D) The CCI indicator with ETH/USD

Trade Entry

Trade entry here means we begin by adding our indicator to the ltc/usd chart. We then find potential overbought or oversold regions regions. The flexibility of this regions will be dependent opon if that region once held. As seen with the ltc/usd it shows we have had an overbought on that same region a couple of times.

Trade Exit and Management

Trade exiting is about setting a stop a stop loss and take profit regions. If in case the trade goes as planned, the trade will hit the take profit level and book the profits if not then it will stop further loss by hitting and closing on the stop loss level.

E) The CCI indicator with BTC/ETH

Trade Entry

Trade entry here means we begin by adding our indicator to the ltc/usd chart. We then find potential overbought or oversold regions regions. The flexibility of this regions will be dependent opon if that region once held. As seen with the ltc/usd it shows we have had an overbought on that same region a couple of times.

Trade Exit and Management

Trade exiting is about setting a stop a stop loss and take profit regions. If in case the trade goes as planned, the trade will hit the take profit level and book the profits if not then it will stop further loss by hitting and closing on the stop loss level.

CC: @asaj

Hi @doctor23, thanks for performing the above task in the fourth week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 3.5 out of 10. Here are the details:

Remarks:

Commendable effort but fair performance. You did well selecting the coins for this exercise. Unfortunately, you did not complete the task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit