We must always have heard people talk about venturing into a business but before they do so they have to come up with a plan on how to run the business, the proposed people they are selling to and how their profits will be made which makes them know how to excel in the business and make profit, this is usually know as a business plan in the business world. This is also same for trading either other stocks, cryptocurrency or the financial market at large.

A trading plan is simply a strategic method, rules or let's say a roadmap that an investor or a trader sets for his or herself to enable them trade perfectly.

This plan includes things like time to trade, risk management, traders objective or investors objectives, it also shows how a trader will execute trades, when they will buy or when you sell, the amount to use in purchasing and asset and at what time will profit be taken. This is a very important aspect to be considered by a trader or investor as the trader or investor only take a trade only when the criteria set are been met.

This plans after been come up with aren't to be altered unless it is not working well for the trader or investor, also it is important to know that no capital should be risked until there is a trading plan or strategy which entails a detailed and research write up.

To understand better what a trading plan is, it can be built in various ways which means trading plans are designed according to who is involved and according to their personal goals and objectives.

Traodng plans should be well detailed especially for everyday traders or swing traders and this can make the plan very lengthy as they are ever active in the market, but simpler ones can be done for just investors who enter the market once in a while.

Whenever the traders outline plan isn't fulfilled he or she would not enter the trade and let it pass since it can cause a loss of capital, which will not be a good thing for a trader, although it should be noted that losses are bond to happen also in the market.

IMPORTANCE OF TRADING PLAN

Just as I stated earlier that there is no business without it's plan so also is the importance of trading plan for a trader as this helps the trader achieve greater success.

It also helps a trader to take quick decisions and able to take advantage of opportunities that might arise in the market especially when to trade wasn't planned earlier. It also helps a trader to trade without emotions and greater confidence after one must have experienced a loss in the market earlier while trading.

In addition the trading onan helps to know when to take position and in what direction to go it also helps one to know when to exit a position as well.

FUNDAMENTAL ELEMENTS OF A TRADING PLAN

In every standard trading plan that is to be built there are some fundamental elements which the trader must consider, these traidng plans will be discussed below.

1. CAPITAL MANAGEMENT:

This is a strategy mapped out to control or regulate how the money meant for investment will be properly used when entering the market.

This helps us to determine what percentage of money we will be investing in a single trade and how much we are willing to loose and make depending on the trader.

A typical example is let's say as a trader I have $100 as my capital depending on the trader, it is advisable to use 1% or 2% of their total capital while some suggest the use of 5%, but for me I will suggest not more than 2% so in my case I am just willing to use $2 per the trade I take.

Also, another thing to be considered is how much profit do we intend to make with the amount of money we are using to invest, this also boils down to the trader the most common one is the 1:2 which means if I use $2 to place a trade I am set out to make $4 out of it. Some other traders suggest 1:3 or 1:4 depending on the trader.

2. RISK MANAGEMENT:

This is a criteria which is very neccessary that views the profit and losses of a trader. Every trader should be cautious not to have more loss than wins, this element is very key as this is what determines whether a trader is successful or not, although it is inevitable to avoid losses but the wins should always be greater.

An example is setting how many trades to take per day and how many wins Target or loss Target so if a trader decides to take 3 trades in a day when he makes 3 wins he exit the market irrespective of how the market seem favourable also when the trader has a loss he or she can stop trading and decide to wait till the next day.

3. OPERATION DAYS:

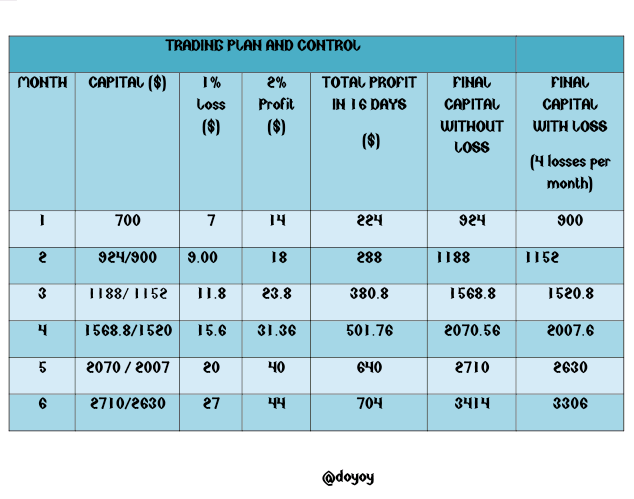

this is another vital element that a trader should have in mind, this is based on their aim and the time they are ready to dedicate to trading. If the trader works somewhere else he o she can dedicate just their free days to trading like the weekend, if it's a full proffesion a trader can decide to trade for 4, 5 or 6 working days but I will be choosing 4 working days to trade per week. Which is Tuesdays - Friday which will amount to 16 days in a month.

4. TRADING PSYCHOLOGY:

This is another important element a trader should look into, it is the way a trader controls his or her emotions while trading or precautions to take when his or her emotions is over ruling. There is this tension which arise when s trader places a trade without proper plan which can cause the trader to make mistakes, also when a trader looses money and is clouded by emotions to revenge on the market it normally leads to loss.

Here are some of the precautions a trader can set

The trader should never ever a trade whenever he or she is troubled at heart or having a huge financial need this will bring greed which might make the trader loose money.

If a trader won't be there to monitor the trade it is essential not to enter the trade or multi tasking that I'd trading and doing another work at the same time will cause distraction.

- Another one is that the trader shouldn't go against the capital risk shd risk management set in the trading plan.

TRADING PLAN EXAMPLE

I will be creating my own trading plan according to the elements I discussed with us earlier in this lesson, the trading plan will cover risk management, capital management, trading days, psychology trading etc.

How do I manage my risk as a trader ?

I will not take more than 3 successful trades per day no matter how the market is favourable and moving in the direction of where I would love to trade.

The maximum amount of trade I am permitted to loose in a day is 1 trade which means after I loose one trade I am done trading for that day.

Whenever i am skeptical about a trade after having 2 successful trades I should ensure to leave the trade till the next day and be satisfied with the profits made already.

Whenever I make concurrent losses in a week like I loose repeatedly in a week i should ensure to stop trading for that week and find out why I am making looses if it's the market or I am not doing something right, then I make use to demo account for the rest of the week to know better.

How will I manage my capital?

To manage my capital, first I will be starting up the trading with $700 with this been said here is how I will manage my capital.

No matter how certain I am that the market will move in the direction I have predicted I am not allowed to use more than 2% of my portfolio to trade

Depending on how confident I am or skeptical about a particular trade I should ensure to use 1% - 1.5% of my portfolio.

For my risk to reward ratio, I am permitted to use the 1:2 which means for every one dollar I risk I should make back $2. In rare occasions I am allowed to do a 1:3 depending on the volatility of the market at that time.

Also, I am allowed to make use of 1:1.5 as well but the standard set for me is 1:2.

My operation days

I will only operate four times in a week which is starting from Tuesday to friday, this is to have time for the family on weekend and to have time to rest on Monday as well.

Except in rare occasions where just a trade is permitted for me on Mondays.

PSYCHOLOGY TO BE USED

The reason for stopping trade when I loose once is to control my emotions and not allow revenge crop up in my mind, this is a way to control my emotions.

Under no circumstance should I have an urgent need and place a trade to make the money needed immediately

I should never place a trade whenever I am emotionally drained or inbalance.

Hello professor @lenonmc21

My post is still yet to be verified

@lenonmc21

@lenonmc21

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit