Spot trading is the direct buying or selling if an asset ranging from crypto, forez, stocks etc with the delivery of the asset at an almost immediate time. This trading is the simplest way to invest and trade in crypto using your own capital and without borrowing any asset from the exchange platform. The spot trading requires holding the asset after purchase for a while and sell.it off whenever the trader trageted profit has been made l, all this are been done in the spot market.

A spot market is a market where spot trading are been carried out, it is a marketplace of asset which is made public where assets are traded immediately with the use of Fiat or other asset to exchange from a seller. Spot market is also known as cash market as traders pay their money before they can buy an asset.

ADVANTAGES OF SPOT MARKETS

- The prices of the spot market are very transparent and they only depends on the supply and demand in the market unlike other market like futures that has multiple reference prices.

- It is easier to calculate risk, reward and the rules are always simple on the spot market.

- There is nothing ekije liquidation on the spot market as one can buy and asset and not monitor it from time to time.

DISADVANTAGES OF SPOT TRADING

- Spot trading leaves a trader hanging with an asset and he or she has to be careful not to loose information of the exchange or wallet that the holding is so as not to loose the asset completely.

- The profit or gain realized in a spot trading is a bit low except in an instance when the price of the asset moves up to a percentage of 1000% upward.

2. FUTURES TRADING

Futures trading is a complex trading system that is used by only experienced and professional traders, it has a high level of risk which is why it is important for only proffessionals to trade it.

The future market gives room for traders to take advantage of both the rising in the price of an asset and both the falling in the price of the asset. Traders can do analysis and predict the future price of an asset which will then make them either go long or short depending on their analysis and prediction.

In future trading the asset isn't belonging to the trader rather they only own a contract which is pegged with the real asset price. Another important aspect of the futures trading is that leverages are given to traders to enable them buy higher than their capacity for example a trader with $10 can be given leverage to buy and asset worth $100.

Leveraging helps to get more profit if the market goes in the trader desired trànsaction also when the trade goes in the wrong direction it makes one loose hugely as well and this can lead to liquidation of ones account. So, it is dangerous to use high leverages and of at all.ome will.use a leverage it shouldn't exceed ×10 depending on the asset.

ADVANTAGES OF FUTURE TRADING

- Trader is able to trade and make profit irrespective of the trend the market is either the bearish season or bullish season.

- A trader can make alot of profit in a single trade making use of the leverage as along as the prediction is right.

- Futures gives a trader advantage of hedging ( this is the ability to open another position in opposite direction of a already opened position)

DISADVANTAGES OF FUTURE TRADING

The major disadvantage of future trading is the risk of using leverage which means if the prediction goes wrong the trader will loose his capital and also it can lead to liquidation.

MARGIN TRADING

Margin trading is almost similar to the future trading but this is slight different, in margin trading it uses a method whereby a trader is borrowed assets by a third party to use in trading. Margin trading allows traders to have access to greater capital which allows them to leverage their position and gives them larger profits whenever they trade successfully.

ADVANTAGES OF MARGIN TRADING

Margin trading gives traders access to capital to trade if they have low capital and this gives them access to higher profits and also ability to take multiple trade due to funds they have borrowed.

DISADVANTAGES OF MARGIN TRADING

Margin trading allows traders to incur much loss when the trade goes against them, also if a trader doesn't have enough money to pay back his loan he or she will be liquidated.

TRADING ORDERS

In trading there are some orders which are given to traders which enables them to be able to set the price at which they wish to buy an asset and also enables them to reduce lose in trading as well. Below are the types of orders available.

1. MARKET ORDER

Market order is an instantaneous buying of an asset, the trade is executed at the current price of the asset . It is the fastest and easiest way to execute an order by a trader.

As seen in the screenshot above the highlighted part is the current price of the asset, the place which the number 10 is refers to the amount of usdt I want to use in purchasing the asset. If comfortable with the price we then press the buy button.

2. LIMIT ORDER

This order is a kind of order that is very different from the market order as this order allows you to place a trade at a price that is convenient for a trader either buying or selling.

According to the screenshot above we can see the actual price of the asset at the right side highlited which is $2.05 then I want to place a buy order but I want to only buy when the price is $1.9, so I will be buying 100 unit of the token whenever the price is at $1.9 the exchange will help me execute my order whenever the price gets to the point I have indicated.

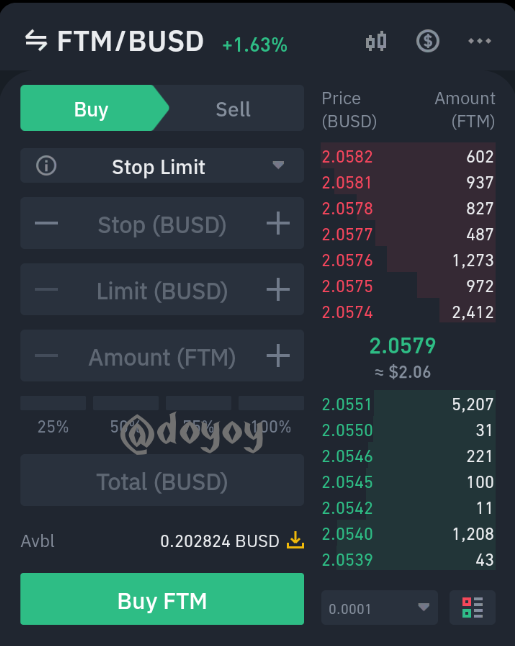

3. STOP - LIMIT ORDER

The stop limit order is another unique order type that which is the conjunction of a limit order and a stop price feature. This allows a trader to place a limit order on an asset but the transaction is only executed when the price hits the stop price which means the asset will be bought at a lower price set at the stop price or at that particular price.

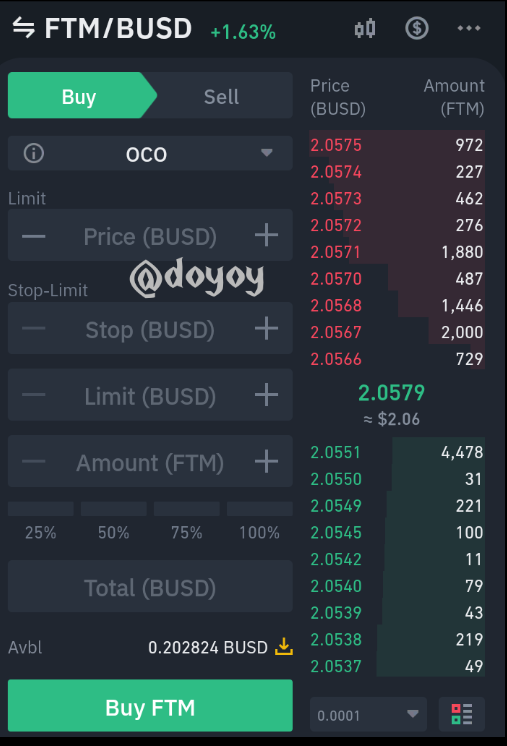

4. O-C-O

One cancel one is the full meaning to OCO. This is an order type that reduces the risk of a trader in a market. This order works in a way that a trader can place two orders at the same time after which one is executed the other one is cancelled.

Let's take an example of this token FTM, we see it's approaching a price of $2.1 but we aren't sure if it will get to that price because there might be a reversal. We can place an OCO order for a sell by setting the limit at $2.1 and we then set the stop limit order at a price of $2 in case the price comes down so as not to make much loss.

BUYING ASSET WITH A LIMIT ORDER

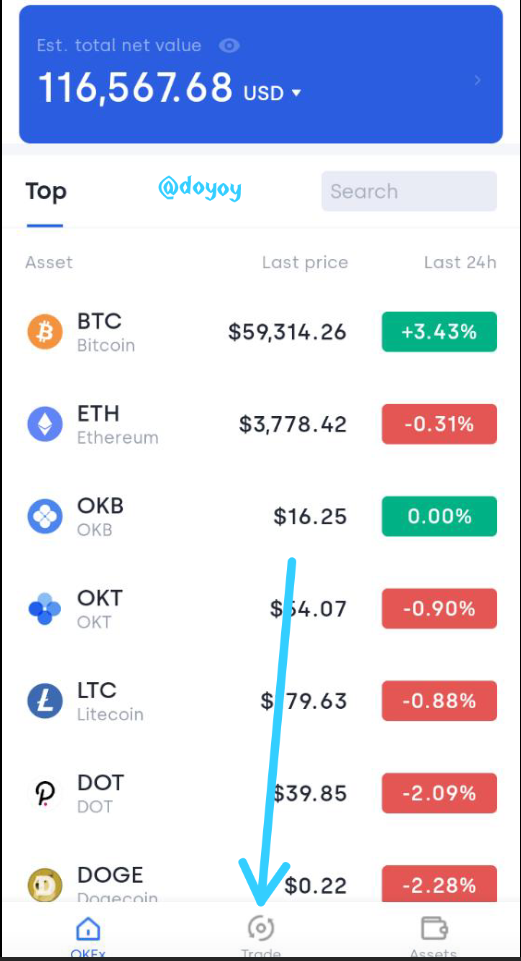

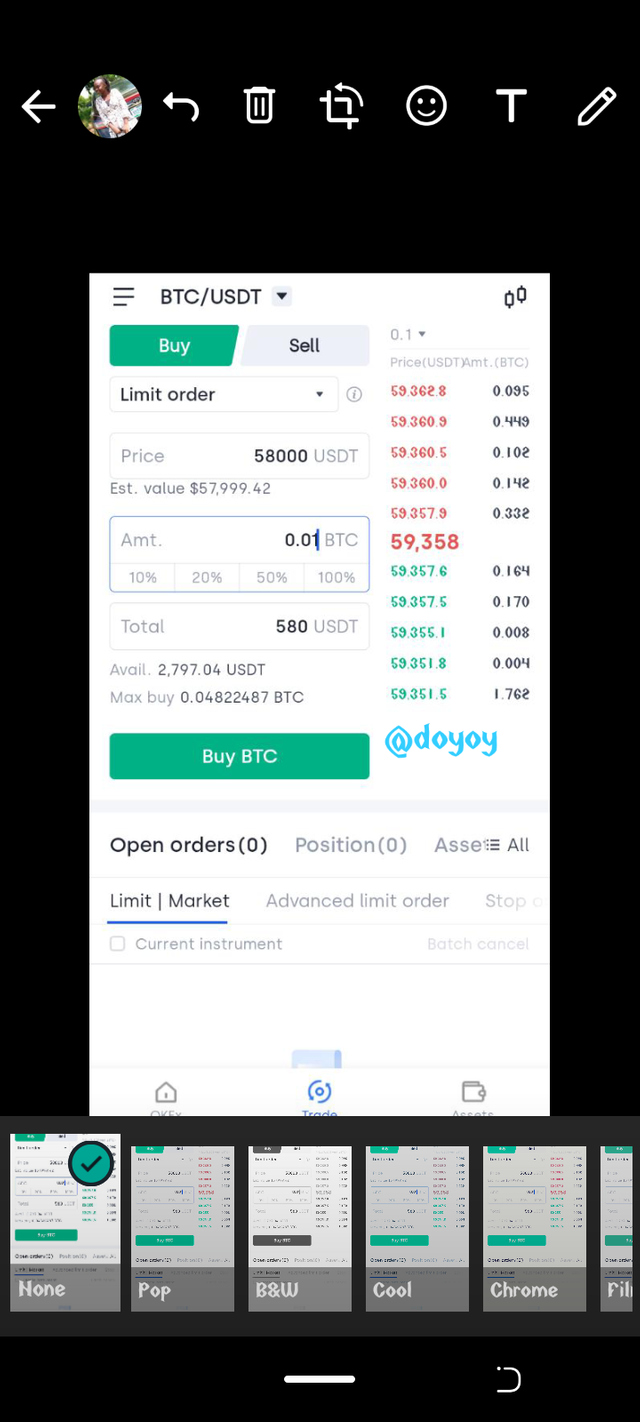

We will be using the okex app to buy an asset using the limit order, the first thing is to launch the app after which we then navigate to the trade section, then we select the coin we wish to trade and I will be trading the BTCUSDT pair.

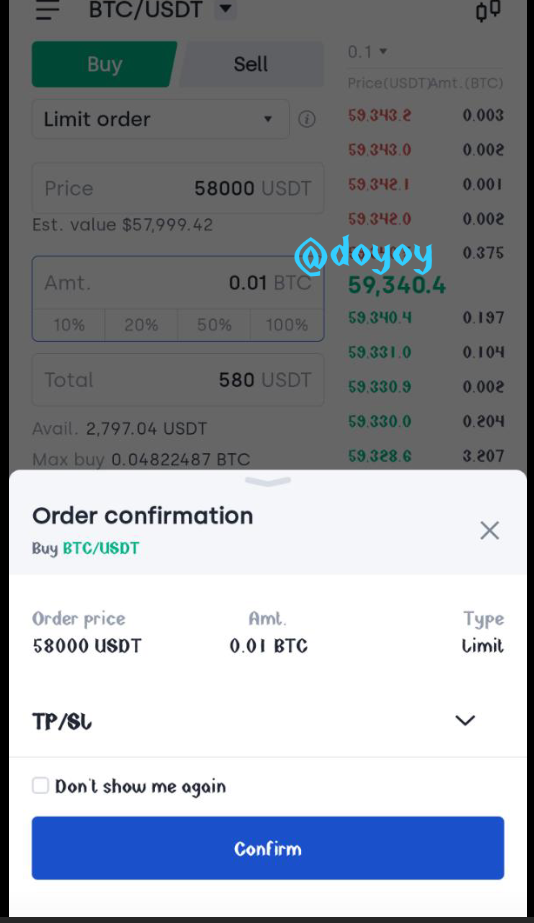

According to the screenshot above we can see the current price of $59,358 but I don't want to but at this particular price so I set the price to $58000 and the unit of BTC I want to buy then I click on the buy button, after which there is another pop up then I click confirm.

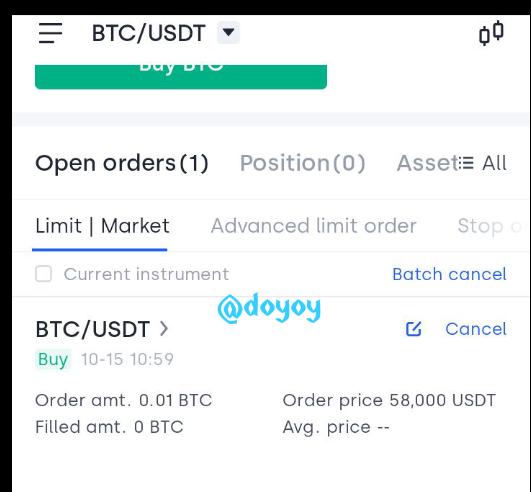

The order has then been opened but it hasn't been executed until the price gets to my desired price before it is executed.

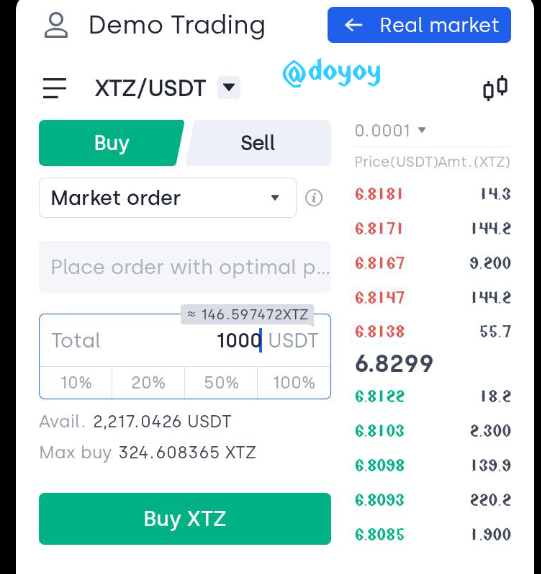

OPENING A BUY POSITION WITH A DEMO ACCOUNT

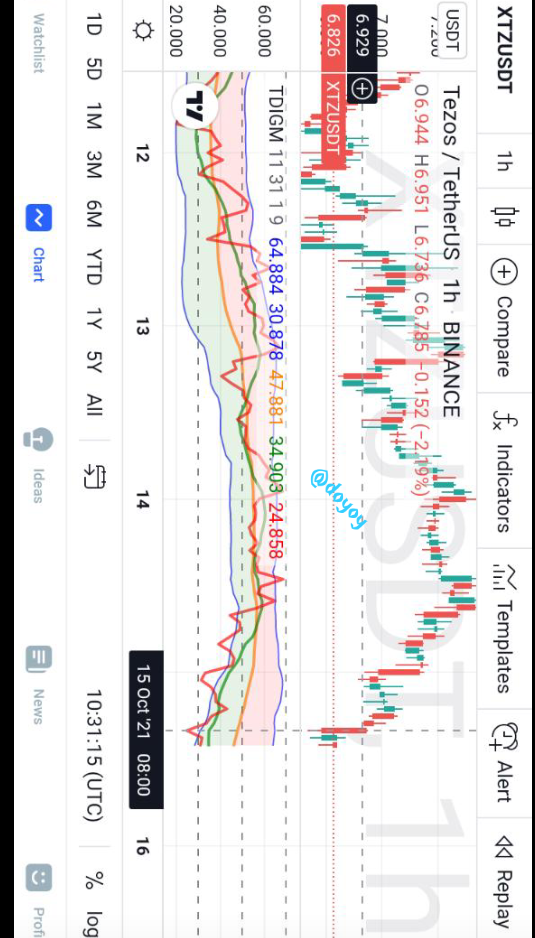

It is important to know that to trade it is advisable to have a technical analysis done and also make a research about the coin you want to trade. I will be trading the tezos XTZ token. Tezos token is a native token to the tezos blockchain which so far has been a very good blockchain.

It has a lower gas fee compared to etheruem with a better scalability, due to this reason NFT enthusiast has been moving to this blockchain and this gives assurance that the project will do well.

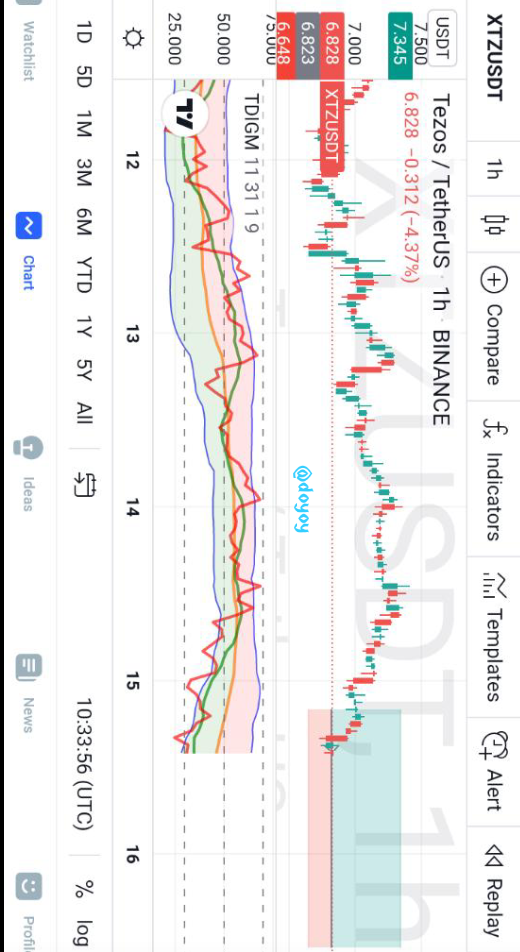

According to the screenshot a technical analysis has been done by me with the use of the TDI indicator which is an indicator that has 3 indicators joined together.

According to the TDI there was an oversold of the asset and we can see an imminent reversal as the green and red line are moving to cross over the yellow line. Based on this a entry position and take profit position has been set has seen in the screenshot above. Our exit strategy is the use of the stop loss and take profit method which will be down below.

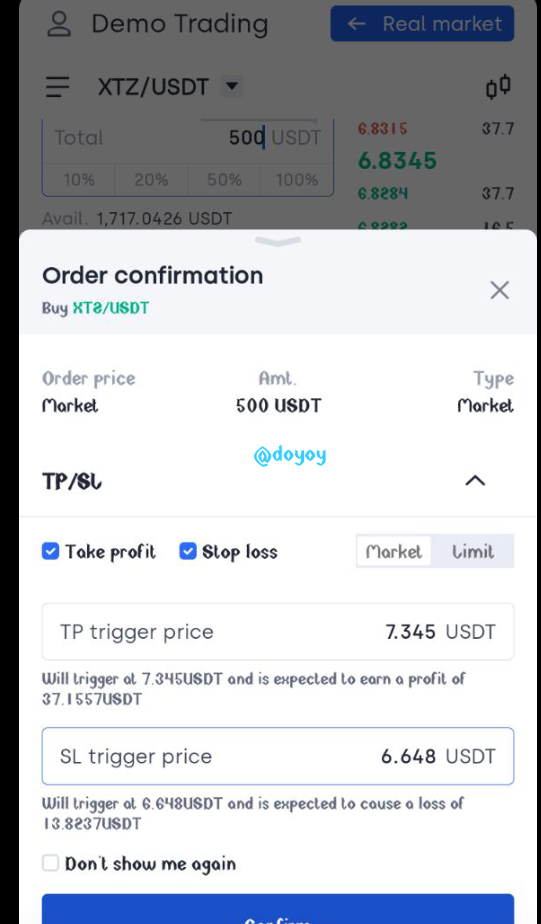

As seen above we are entering the market with the market price, and buying the asset with $500. Then I click on the buy button which shows me a pop up where I tick the take profit and stop loss box so as to active the exit strategy.

Then I set my take profit and stop loss as set in the chart. My risk to reward ratio is set at 2.5:1 then I confirm the trade and wait for the results.

Hello @doyoy, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit