An exchange is likened to a market where we go to exchange or buy an item with fiat or traditional money so as to acquire the item needed. Let's take for example Jake is in need of a book but all he has is just is country's currency, Jake will then go to a bookshop or store that has the kind of book he needs, the bookshop has the book and Jake has just fiat money so there will be an agreement between Jake and the store keeper on how much fiat Jake has to give him before he gets the book, after the agreement is done Jake recieves the book.

Back in 2009 when the first successful crypto was launched, someone suggested that there should be a creation of a website or platform that would make it easier for people to buy Bitcoin with fiat money which was the first crypto, in 2010 bitcoinmarket was then proposed and that was what brought about exchanges in crypto to limelight.

According to the above explanations an exchange can be said to be an online platform or application which allows users to buy or sell their crypto assets with the use of Fiat money and also the use of other digital assets to buy and asset and to receive payment.

As this exchanges are likened to the tradotional market they are special in that since crypto are digital assets that can't be held physically they have to be created online and also have to be built on a blockchain.

Most of the exchanges has a simple interface with other functions such as the inclusion of Orders, take profit and stop loss function and so on, there are also commissions taken from users depending on the trànsaction carried out.

There are two major types of exchanges which are the

- DECENTRALIZED EXCHANGE: These are exchanges that doesn't have any third party to be involved in the trading of crypto assets, the exchange are done directly between users which is known as P2P and as though there might be little charges or no charges attached to such Trading. They also provide higher privacy as there is no need to put up personal informations about themselves.

This exchanges are built on a blockchain and they make use of smart contracts. Examples of this exchanges are uniswap, pancakeswap, zoomswap etc.

- CENTRALIZED ECHANGE: this platform is usually coordinated by third parties which are always trusted and these third parties are the one who see to every operations done on the okay from and it is usually made important for users to provide their personal informations which is usually known as KYC and it is also controlled by anti money laundering.

The informations gotten from users are also shared with tax authoritiesz and there are fees paid by users for every trànsaction done. Some of the known centralized exchanges are Binance, huobi, okex, kucoin etc.

ANALYSIS OF ZOOMSWAP

Zoomswap is a cross chain platform that creates liquidity for layer one blockchains, AMMs and other projects, it is built on IoTex blocjvjian because of its cheap and fast transaction capabilities. It has an exchange of it's own which is built on the most popular DEX on IoTex network which is called MIMO EXCHANGE and the Liquidity pool tokens belongs to mimo exchange.

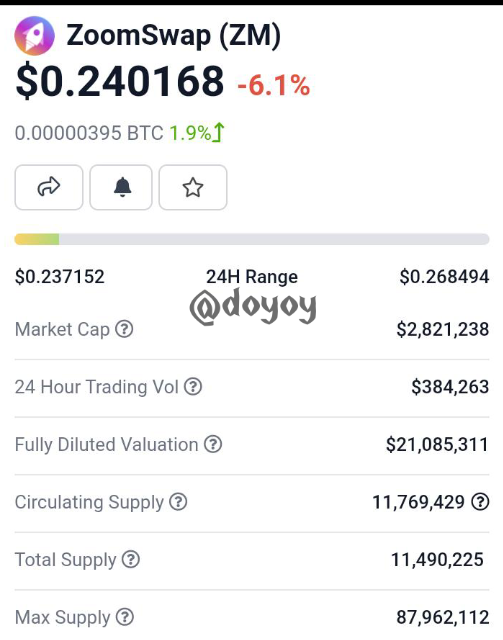

The exchange offer various services which ranges from farming, staking etc. The zoomswap has its own token which is known as ZOOM. Zoom has a total Max supply of 87,692,112 $ZM unlike other farming tokens which has unlimited supplies.

$ZOOM has N initial supply of 870,912 tokens which 1% of it is minted for marketing while the remaining 99% are mined which is controlled by the smart contracts. The farming rate is reduced over time just like bitcoin. Here is the details below;

The token also has a buy back mechanism which is bought using the deposit fees for farming and it has been stated that the $zm token will be used to create limited NFTs in the future.

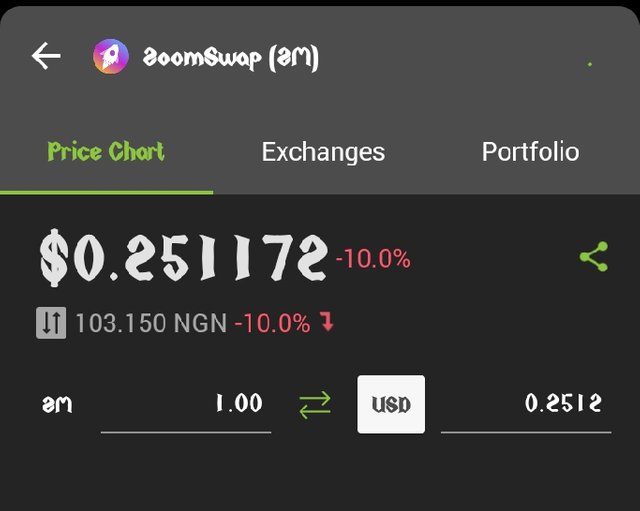

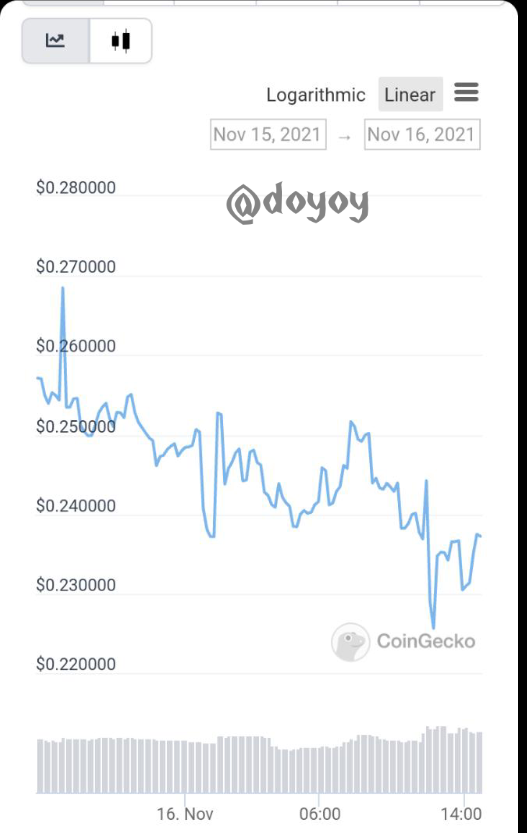

As at the time of writing the price of ZoomSwap was at $0.25, with a 24 hour trading volume of $384,263 and a market cap of $2821,238 with a curvukating supply of 11,769,429.

HOW TO PURCHASE ZOOMSWAP

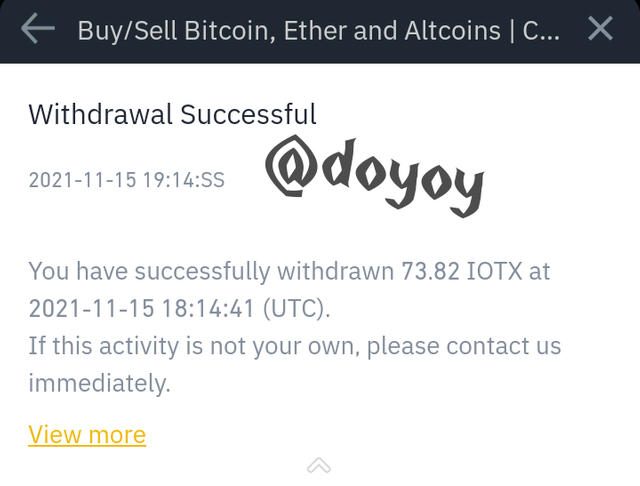

To purchase the Zoomswap token one need to first buy the IoTex token as it is required to be used as a gas fee for exchanging the token on ZoomSwap exchange, so we will first need to purchase the IoTex token on Binance. We navigate to the trade section of binance after we must have deposited usdt on binance, then we select the IOTX/USDT pair then we input the amount of IOTX we want to buy, then we click sell.

After buying the token, we will then transfer it to the wallet we wish to swap the token with, I will be using the iopay wallet, after copying our wallet address from the wallet we paste it ok the required space on the binance app then we transfer the asset.

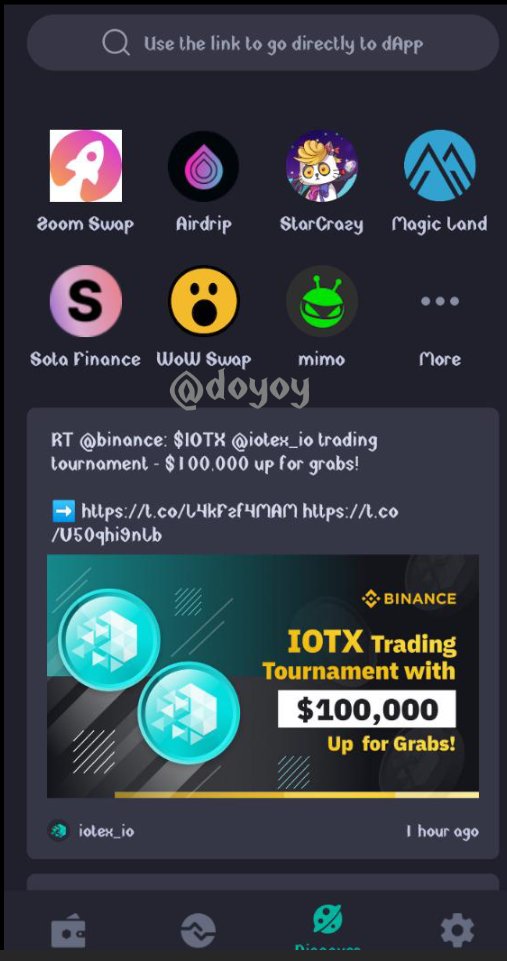

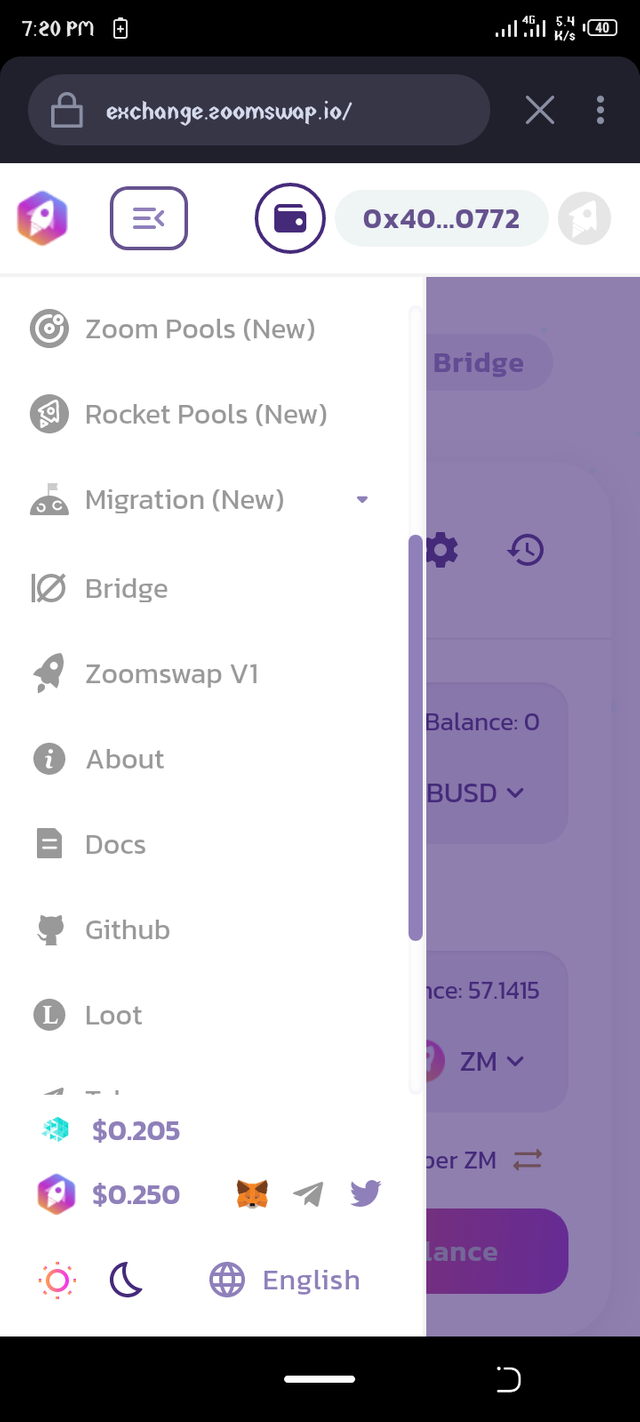

Now that the asset has been successfully withdrawn, we will then proceed to the browser section on the iopay wallet and then we will click on the zoomswap icon which will take us to the zoomswap interface.

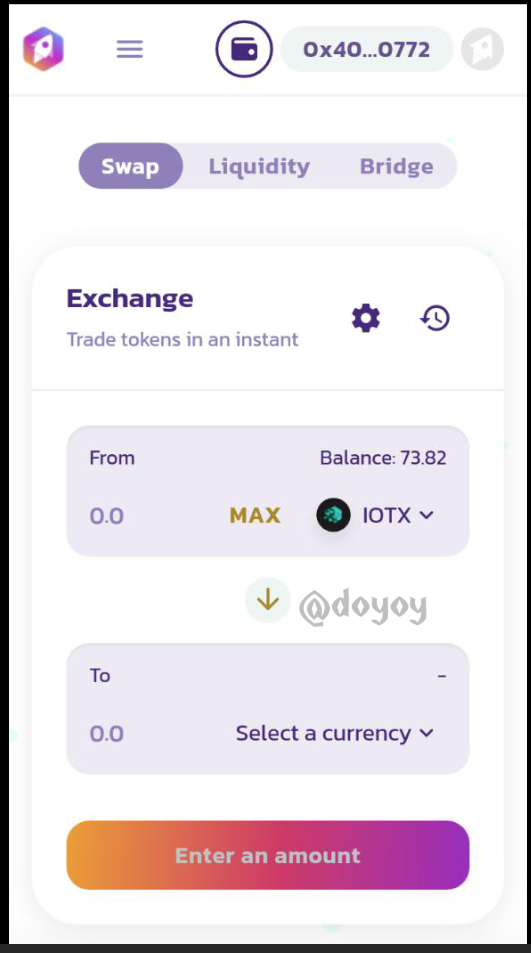

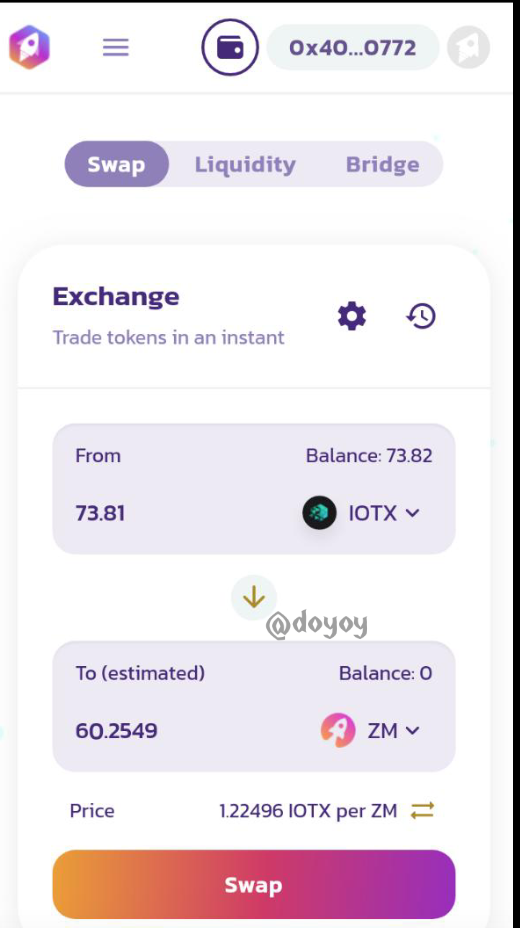

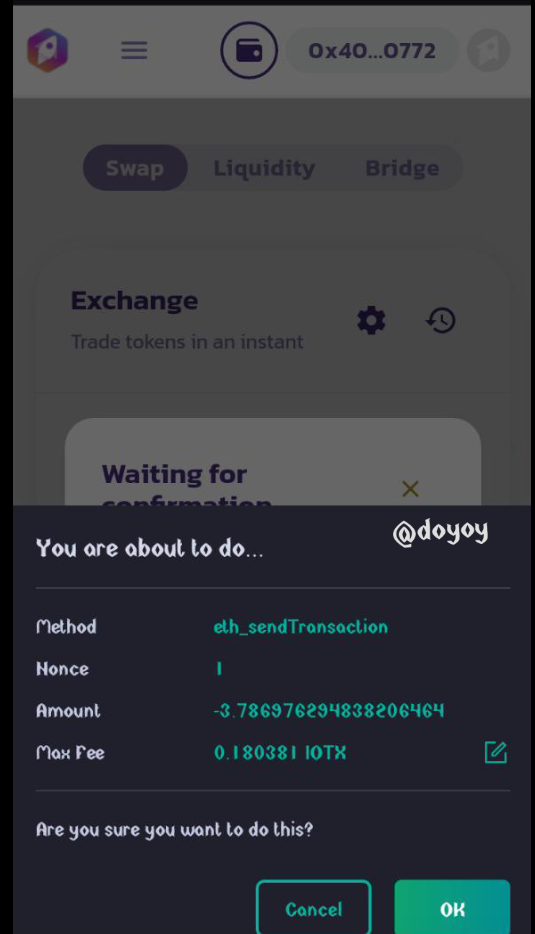

Then we navigate to the swap interface then we select the IOTX at the top and select ZOOM below since we are swapping IOTX to ZOOM. We will then input the number of IOTX we want to swap to Zoom then we click on swap.

After clicking swap, we will be asked to approve the trànsaction, we then click okay, the trànsaction will be submitted and will show a success proof. After we have successfully bought the token we will be staking it in a pool.

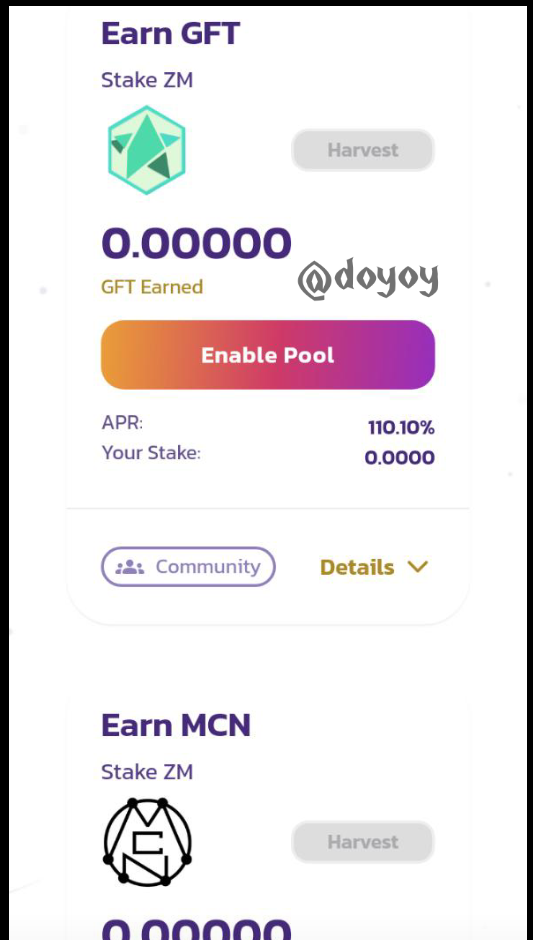

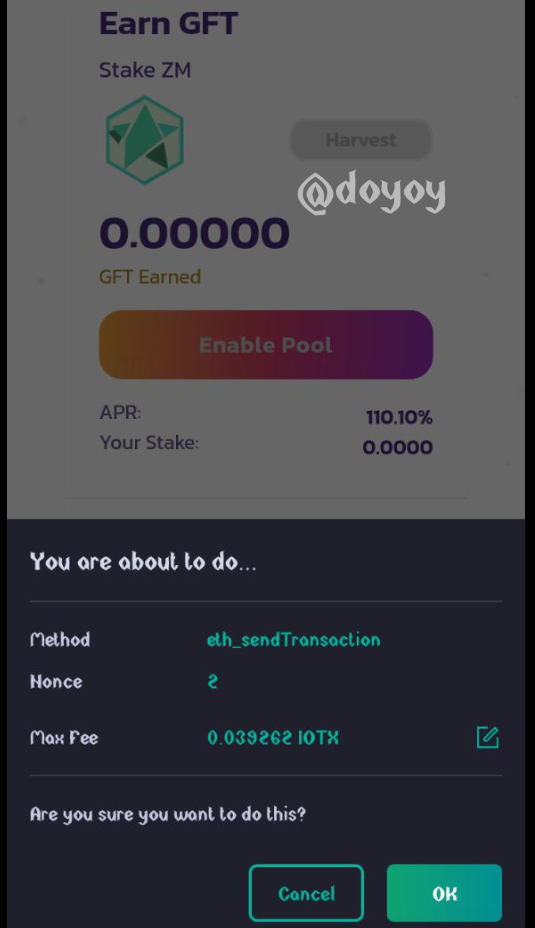

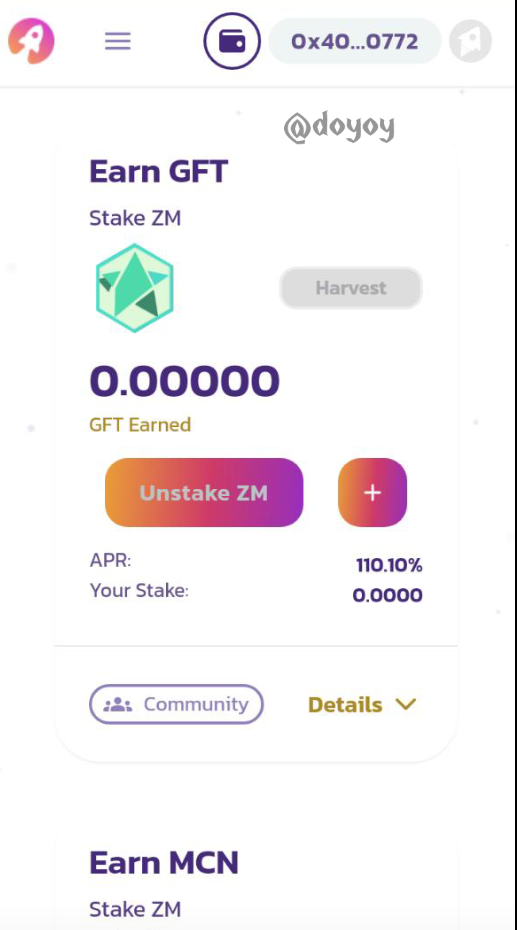

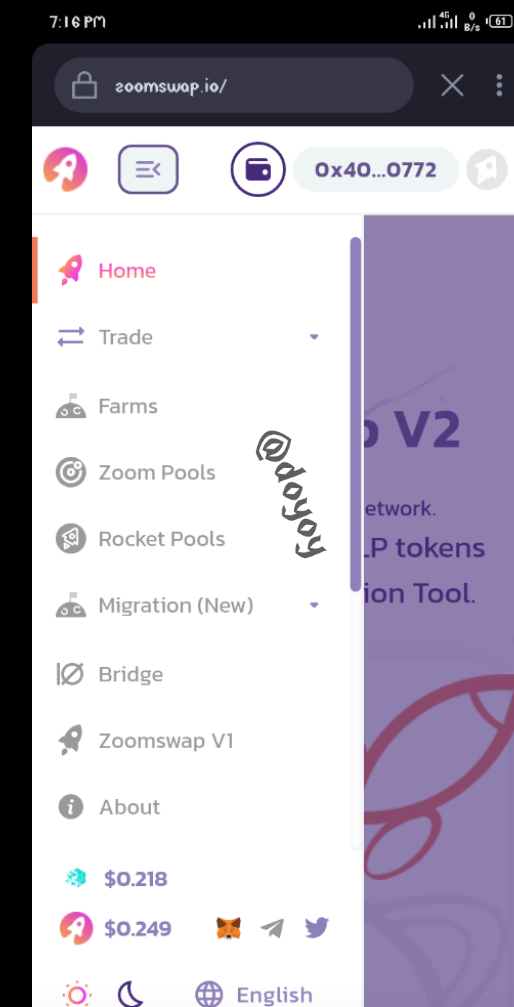

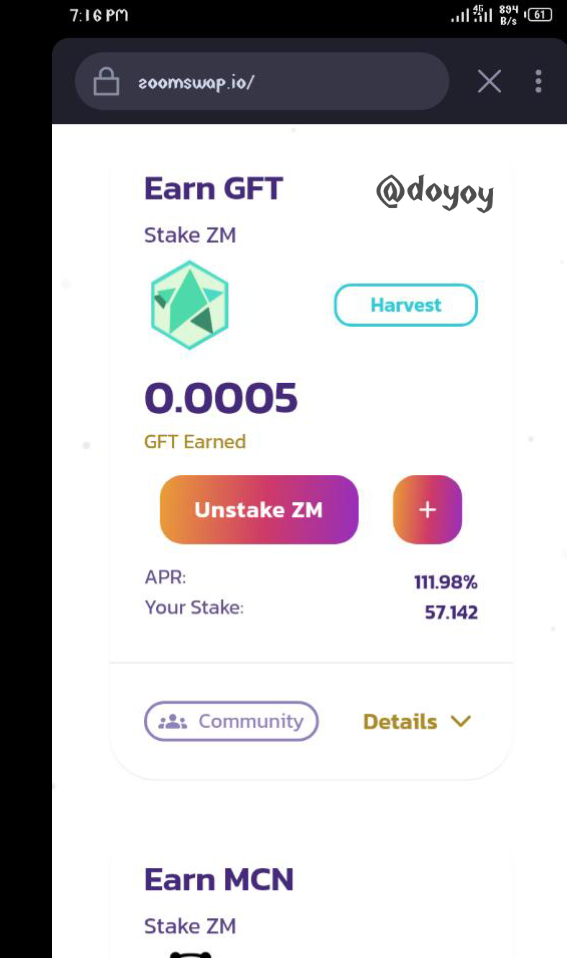

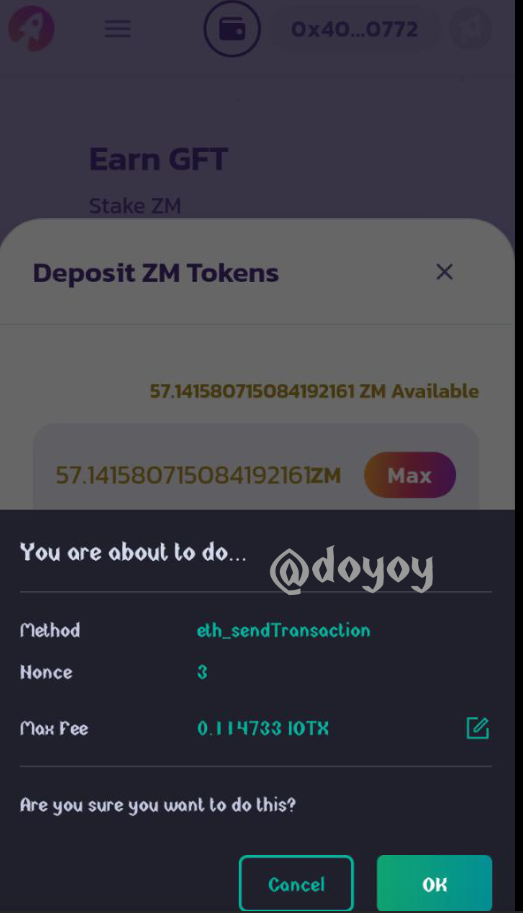

The first screenshot shows the features that the platform offers, we will be navigating to the rocket pool section where we can stake Zoom to earn other tokens. After clicking the button, there are 2 pools available staking zoom for GFT and staking Zoom for MCN. We will be staking for GFT. The first thing is to enable the pool and approve the transaction.

After enabling the pool we then click on the + button and input the amount of zoom we wish to stake, then we also approve the transaction and that's the end.

The reason I chose to stake is because with the staking feature we can earn other token instead of keeping the token without use for a long time waiting for it to pump.

RETURN OF INVESTMENT

As at time of buying the asset by 7.20pm on 15th of November the asset was at the price $0.25 which is indicated below.

As seen in the second screenshot above the price of the asset has dipped a little bit and there is no profitable gain at the moment after 24 hours. The only gain is the coin we are earning while staking our asset.

As shown in the screenshot below, after 48 hours of the investment we can see a dip in the price and this has resulted in a loss in the investment but this isn't a bad sign as there is a general dip in the crypto market as BTC has fallen greatly in price. On the other hand we were able to get a free coin during our investment which current price for a unit is $25 dollars if the coin is left for more days we might be lucky to earn up to a unit of the coin.

According to the chart above we can see that the token price movement doesn't strictly follow the price pattern of Bitcoin but follows the general trend of the market in that Bitcoin dominance is greater in the market. When Bitcoin entered a Dip all token was also in a dip, but the price movement of zoom wasn't strictly correlating with that of Bitcoin but there was also a dip in the coin.

FUTURES TRADING

Futures simply means an event that hasn't occured but will take place later on which can be in 2 days, 6 months or a year. So when we talk about futures trading, let's take a more real life example, this is more like going to the market to purchase a good but it is pre order whereby we order the goods and a particular price especially when we believe the good in particular might increase in price before it's needed. This is also how the futures trading in financial markets works.

Futures trading is a legal agreement between a buyer and seller of an asset to buy or sell an asset in the future with an agreement on the price at which the seller and buyer wants to do so. This assets varies most especially in the financial market, Futures trading is most especially done on centralized exchanges.

This is also not done without prior knowledge as there are analysis that needs to be done to be sure to what direction the price of an asset which one wants to buy or sell will go.

For example if BTC is at $56k and we have this speculation that BTC will hit $70k later on, then it is the futures market one can do so by placing the trade to sell their BTC they bought at $56k at $70k using leverage to make higher profit.

The futures market is very risky as there is use of leverage which makes you make higher profits but at the same time if the trade goes against one the loss will also be much.

MARGIN TRADING

In our regular world we all know that whenever one is to venture into a business and doesn't have enough capital such person takes up a loan either in a bank or somewhere so as to start their business and they pay back when they are already in profit. So this is what is also offered in the crypto market and it's called Margin trading.

Margin trading is making use of assets or funds that is given to a user by a third party to carry out trànsactions. This gives them more capital to carry out trànsactions and be able to make more profit as well. The assets is borrowed to the user who uses it to trade and then pay them back once profit is made.

SIDE EFFECTS OF HACK ON EXCHANGES CRYPTOCURRENCIES

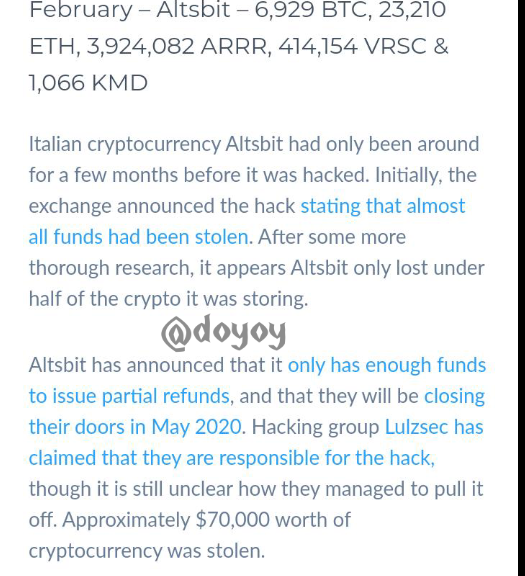

When an exchange suffers an attack, the major thing that happens is that the exchange might experience a little set back if the money stolen isn't much if not there is always possibility of the pack up of such exchanges below are exchanges that have experienced attacks and the outcome of the attacks.

The first instance is the attack on Altsbit exchange which resulted to the closure of the exchange afterwards as they were not able to pay everyone that was affected as alot of coin was stolen as shown in the screenshot above.

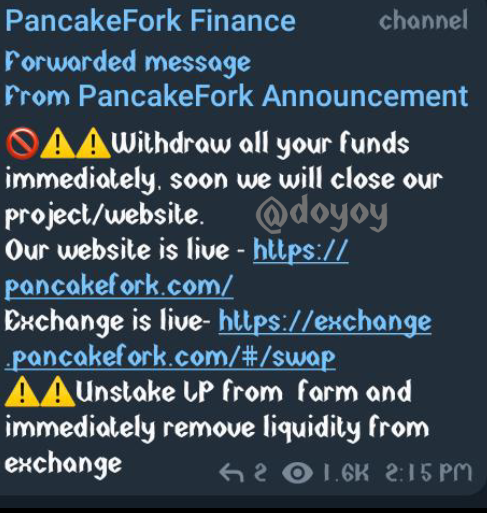

Another example is a Decentralized exchange whose pool was exploited and it tried to bounce back but at the long run they couldn't continue, so they asked everyone to take there funds as they will be closing up the project.

Ever since the token of the project has dipped greatly.

These are some of the side effects of hacks on an exchange.