These patterns are grouped into two forms based on their functionalities, they are known as the Price reversal pattern and the continuous pattern. The continuous pattern deals with tools or indicators that shows that there will be a continuation in the already faced direction of the price of an asset which means when this pattern occurs when there is a bullish movement it continues.

The other pattern which we are more concerned about today is the reversal pattern which shows that there is an imminent reversal possible in the market soon. It shows that the end of a trend has come and it will be changing directions.

This reversal patterns can also be further broken down into two which is known as the HEAD AND SHOULDER PATTERN and the INVERSE HEAD AND SHOULDER PATTERN.

Follow me as we go deeper and explain how

both indicator works

HEAD AND SHOULDER PATTERN

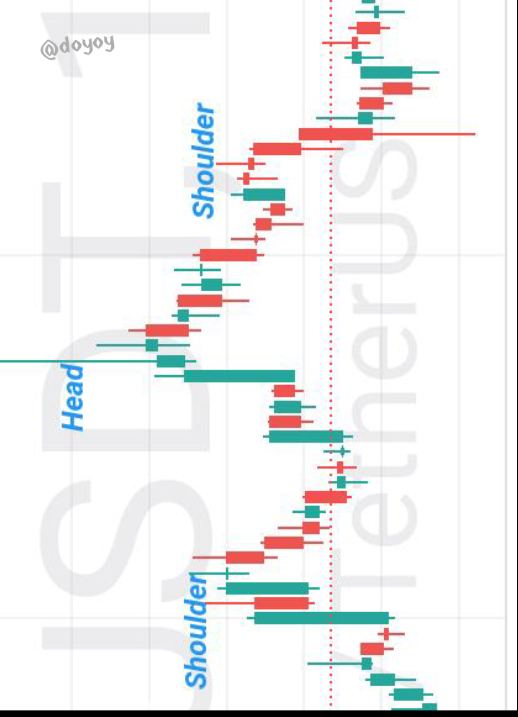

Head and shoulders pattern is a technical indicator that is considered to be one of the most dependable trend reversal signifier, it predicts a bullish to bearish trend reversal when formed in a chart. It has three peaks where the one in the left and right have the same or almost the same height and the one in the middle has the highest height.

This pattern shows clearly the end of a bullish run and it leads to a reversal to the downward direction, when seen by traders they know the bull is about to come to an end and wait for a confirmation of the reversal before trading the opposite. The pattern is said to have a good accuracy as it doesn't just play out Everytime.

As said earlier, there are three peaks or let's say components that is attached to the head and shoulder pattern, which are;

1. LEFT SHOULDER:

The left shoulder is the first step to formation of the head and shoulder pattern it is the formed when the price of the assets gets to a peak towards the upward direction and there is a reversal immediately.

2. HEAD:

This is the second step, which us formed after the left shoulder it is usually higher than the left shoulder and also declines after the peak has been reached.

3. Right shoulder:

this is the last component whichbsi formed after the head, the price rises as well but doesn't get to the level of the head, it is usually the same level with the left shoulder or almost at the same level.

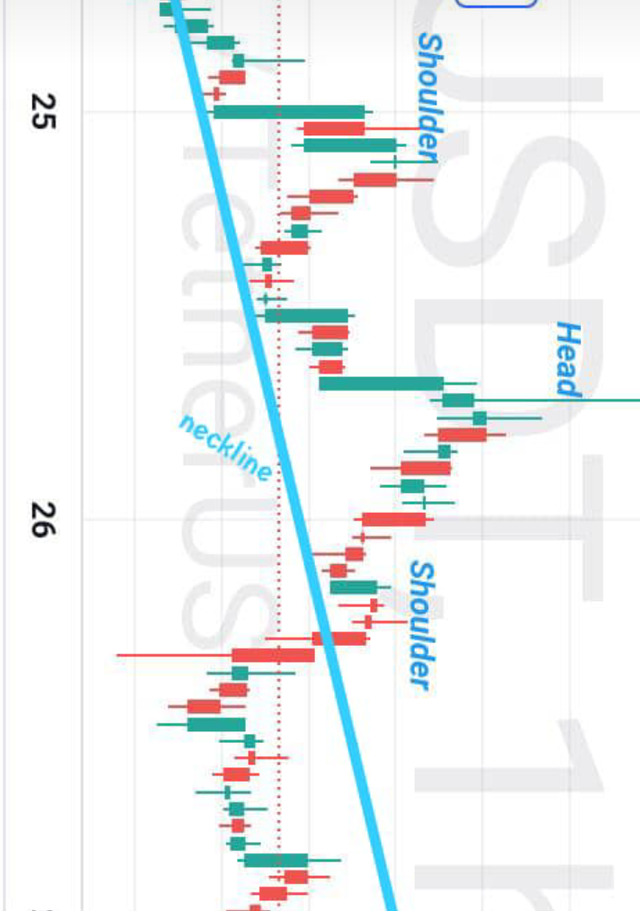

INVERSE HEAD AND SHOULDER PATTERN

This pattern is the opposite of the head and shoulder pattern as it shows the end of a downtrend and a possible reversal of an uptrend. This pattern is always formed when the bearish movement wants to come to an end, after the bearish movement has ended then we see a reversal that brings a bullish movement and this is why it is called the Bearish - bullish trend reversal.

The pattern is also made up of three components as well just like the head and shoulder but this one is known as the inverse left shoulder, inverse head and the inverse right shoulder.

Looking at the image above, that is the correct form of an inverse head and shoulder pattern, the first shoulder was formed due to a fall in price towards the downward direction and it immediately picked up again going upward a bit, then there was another fall again which goes lower than the shoulder level and this is known as the head then the price reverses again and then comes the last fall.in price which doesn't get to the level of the head but stays at a level almost the same as the first shoulder level.

IMPORTANCE OF VOLUME IN THE PATTERN

Volume is what indicates or represents how much pressure is exerted in buying or selling of an asset at a particular time in the market. The volume is very important in the head and shoulder pattern as it is what makes the formation of the head and the shoulders. If the buying pressure is at the same level there won't be any formation of the head and shoulder.

So let's take at the screenshot above the first shoulder was formed when there was selling in the market which didn't have much pressure, after the little buying pressure then came the selling pressure which was higher than the previous one which formed the shoulder and that was how the head was formed. Also, the second dhoufker was formed because the selling pressure was normalized and it wasn't as much as the previous selling pressure.

A trader can use the volume to determine and maximize his or her profit with the use of the head and shoulder pattern if such trader knows how to read volume perfectly well.

PSYCHOLOGY BEHIND HEAD AND SHOULDER PATTERN

The psychology of traders is what determines the formation of the head and shoulder pattern, this psychology is known as the emotions of humans which is greed and fear. This emotions affects the movement if the price in the market.

The first shoulder is formed in the head and shoulder pattern as a result of greed, this is because there is initially an increase in the price of the asset which will then attracts former investors to want to buy more so they can maximize their profit this then brings the price up and early investors begins to take their profits, this causes aa reduction in price, for the investors who couldn't get in earlier and enter the market thinking it's a retest and then the price begins to move up again and this time it surpasses the shoulder peak and forms the head.

The investors also after making little profits begins to sell off again because of fear of other investors not dumping on them. Then FOMO sets in as other investors also don't want to miss out so they quickly enter the market not knowing they are buying the top, the pressure for buying isn't much so they sell off their little profit and other investors also starts taking profit which brings the price below the neck line and the price keeps falling which turns to a bearish trend.

PSYCHOLOGY BEHIND INVERSE HEAD AND SHOULDER

.

The psychology behind the inverse head and shoulder pattern is the opposite of that of the head and shoulder pattern. The first formation which is the left shoulder is due to fear which brings about the selling of the assets and it reduces the price, buyers then see this as an opportunity and buy into the project and this makes the price increase a bit, then there is fear of loosing the already gained profits and this leads to taking of profits which further reduces the price than the previous level and this firms the head then buyers sees another opportunity and buy again which then increases the price once more and then sellers sell again which drops the price sharply. This then forms the second shoulder. Buyers then increase the pressure and buy into the project coupled with greed and thus makes the price pass the neckline and leads to a bullish trend.

DEMO TRADING FOR HEAD AND SHOULDER PATTERN

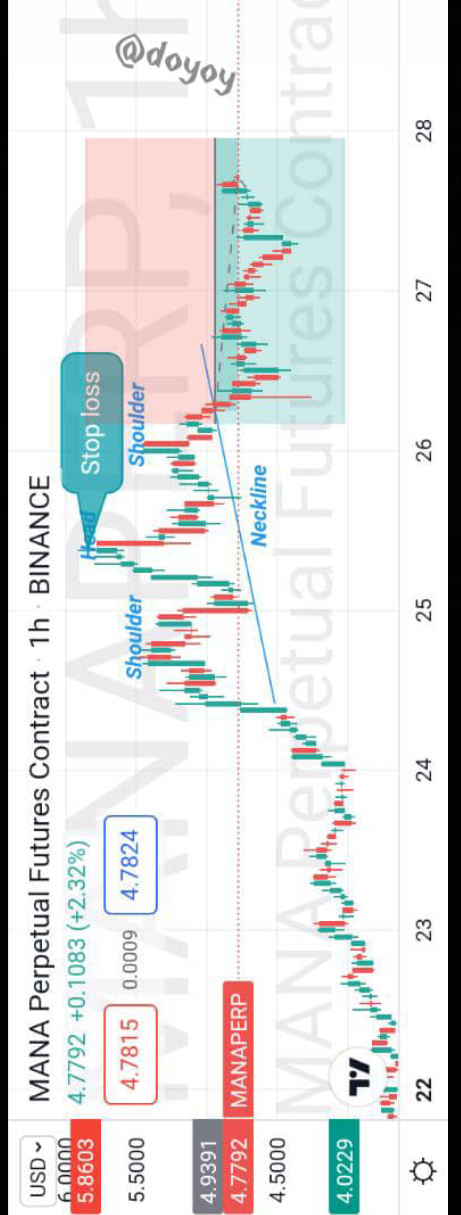

Using the chart above to analyze a demo trade if MANA/USDT on trading view platform using a 1 hour timeframe. From the screenshot above we can notice the formation of the left shoulder, head and the right should which gives a complete formation of the bullish-bearish trend reversal.

Now that we have gotten a complete setup, what we need to do is to get how to setup our trade, when to enter, the stop loss and how to take profit from the trade.

After the formation of the right shoulder we will wait for an entry point which is going to be signified at the breaking of the neckline drawn on the chart. We wait for the formation of a red candlestick falling below the neckline and wait for the complete formation before going into the trade.

Once the candlestick forms after the neckline that is a good entry level, we mark that particular place. Then we look out to where we can set our stop loss. To set the stop loss we will place the stop loss a little above the right shoulder but to be on a safer side because the market is quite funny at times one can set at the top of the head, this gives better security to the trade. For the target take profit, we can use two method, first is to set the take profit at the previous low in that region or better still do a little calculations by subtracting the high value of the head from the high value of the left shoulder then we subtract the result from the neckline level to set the take profit.

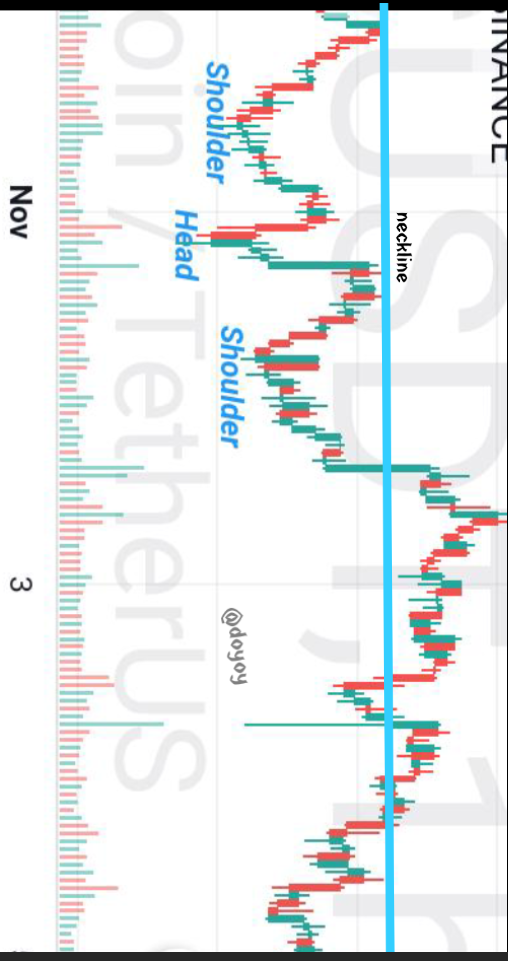

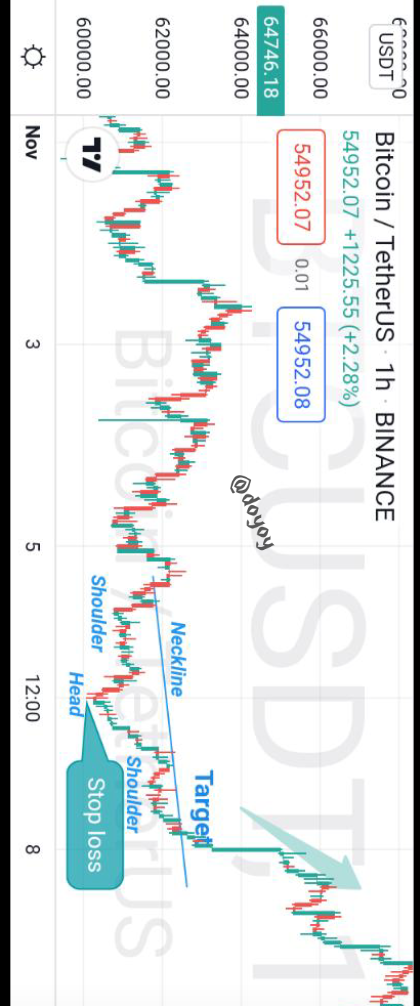

DEMO FOR INVERSE HEAD AND SHOULDER

This is a chart of BTC/USDT on a 1 hour Timeframe using the trading view app. According to the chart, we find out that the formation of the inverse head and shoulder has played out as there are two shoulders and head that met the requirements of the pattern. Then we look out for the entry zone which is waiting for the formation of a candle above the neckline drawn. When the candlestick has formed then we enter at that point, to set the stop loss we set a price a little below the head then our Target can be taken depending on the trader, but a Calculation can be done by subtracting the head from the left shoulder and then adding it to the neckline.

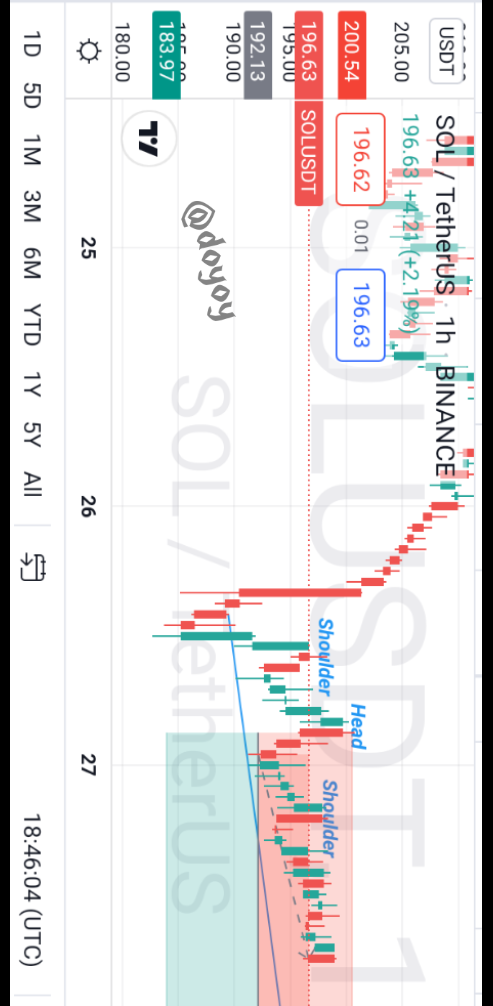

REAL TRADE USING HEAD AND SHOULDER INDICATOR

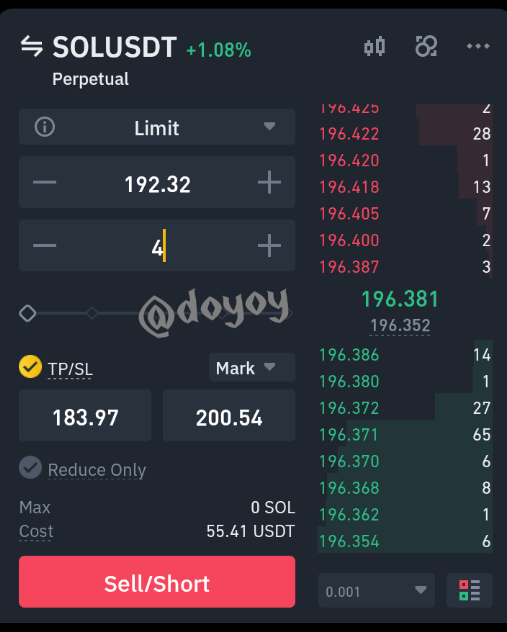

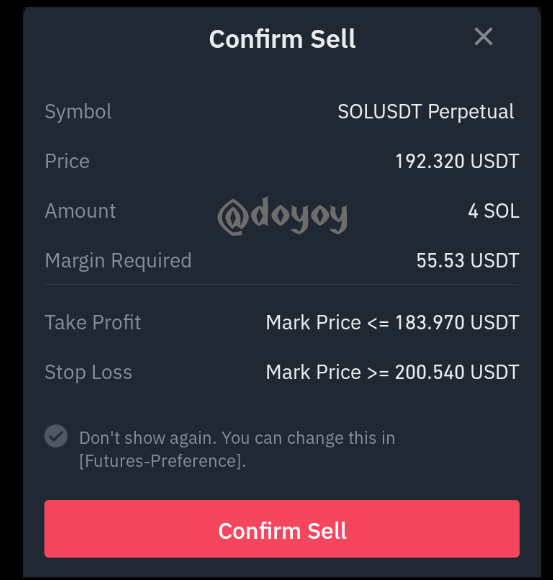

Now we will be placing a real trade using the SOL/USDT pair on the 1 hour time frame, we will be using the trading view app for the analysis. First we try to detect where the pattern has been formed and we locate one just at the nick of time. After locating we draw our neckline and wait for a candlestick to form below the neckline which will indicate that the trend will be reversing. Due to our time I made an analysis on how the trade will go if it crosses the neckline, then we place an order of the trade. According to my estimate once the candlestick touches $192.13 it's a good entry then we set our stop loss above the head which is at $200.54. then our Target is set at $183.97. we will then go to our traidng app to place the trade. I will be using binance futures.

The trade will be placed in the manner as shown above, then we hope for the best and wait for the order to be trigger and take our profit.