Price action refers to the price movement in the market, and there are three forms of price movement in the market: sideways, uptrend, and downturn.

That common trader's knowledge by quoting trading in the market, which means that if we have to do any sort of trading, we must first look at the market and gain an understanding of what the market is doing. Depending on whether the market is in an uptrend, downtrend, or sideways trend, we will open our trade. We use candles to figure out the price action on the chart.

Indicates that the marketcandles are green. If the red and green candles are equal, the market is in an uptrend. If the red and green candles are equal, the market is in a sideways trend. Similarly, we can gain a sense of the price motion by looking at these candles and determining which direction the price is moving in.

Price Changes This period is referred to as what do you believe about your transaction based on the price action. Should you start your business now or wait? By quoting your transaction, price action leads you. What the market is doing and what you should do if you find yourself in this situation.

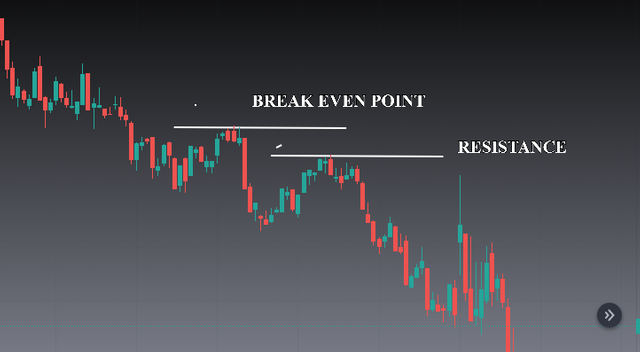

##£ THE BALANCE POINT

The balance point is the point at which the market's last candles indicate that the market trend on those candles is ending, and in general, if the market turns downtrend or back upwards at that time.

Your market trend changes at the balance point; initially, it is uptrending, but after the balance point, it is downtrending; therefore, you cannot begin trading after the balance point. It's a train that's always changing.

STEP BY STEP ON HOW TO RUN A PRICE ACTION WITH THE BREAKEVEN

When trading price action, you must not only monitor the price action but also have a comprehensive understanding of the market. You must choose a break even strategy based on the market's current situation.

If you want to do day trading, you should monitor the half-hour, one-hour, or two-hour chart and keep an eye on it throughout the day to see when your trade entry point is. If you are a long-term investor, you should use a week, a day, or a month to plan your trades.

Aside from that, you must be familiar with the candle chart from which you will be entering time. You will enter the market in accordance with the candles, regardless of when you wish to enter the upward market. If you want to go into a downtrend, you'll need to pay attention to the candles and act accordingly.

You should always remember to trade according to your chart's balancing point, which implies that if the market is in a decline, you should support your trading entry point if it is too much for you. In an uptrend, you'll want to keep an eye on the market to see if it's heading in the direction you want it to go, and then place your trade accordingly.

THE ENTRY AND EXIT CRITERIA USING BREAKEVEN

If you notice the end of the last candles in an uptrend or the bottom straight of a downtrend, you should join your trade at that time. If you see the end of the last candles in an uptrend or the bottom straight of a downtrend, you should enter your trade at that time.

You can take entry at the bottom and exit at the top whenever the second comes in the last of any bad candle, but after the high break or the last correction of the candle at the conclusion of the downtrend.

Set your stoploss above breakeven to allow you to profit above breakeven, and your trade will be automatically withdrawn if he touches your stop loss. In the same way, your work risk will be lower, and your pick will yield a higher reward.

PRICE ACTION VS TECHNICAL INDICATORS, WHICH IS MORE EFFECTIVE?

Price action is useful because when a new investor enters the crypto market, he is unfamiliar with many other indications and can earn a good profit by monitoring price action and employing break even points. I made a lot of money since I used to trade daily and would exit my trade entrance point by doing more follow and focusing too much on break even and price action.

I understand how to use market indicators, but the more I learn about them and how to apply them, the more difficult it becomes for me to add about market trading. It's happening in the same manner that we may make a lot of money by following two basic market guidelines.

Both of these procedures are simple and effective. Price action and even a break strategy are two strategies that might be used. In my opinion, we can trade well by following both of these tactics, and we can learn about the market's trend and downtrend, as well as when we should enter the market. We can achieve all of these things by following these two steps, including determining when we should exit.

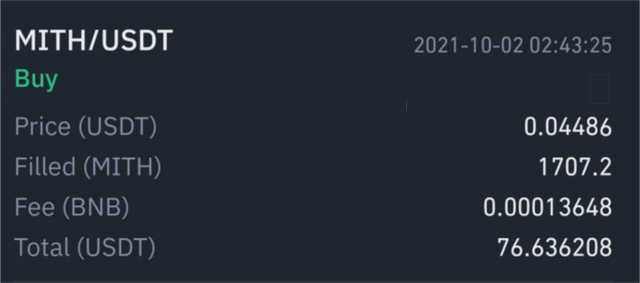

MY TRADE

Just as was required , I carried out a transaction in the Mithril(MITH) market and I used the breakeven analysis just as we were taught and the analysis and details of thwe transaction are as shown.

CONCLUSION

We must first examine candle behavior, support and resistance, as well as supply and demand, if we want to employ price action in technical analysis.

These three things are the foundation of price action technical analysis. When trading, it's also a good idea to research break-even to reduce losses as much as possible, because while nothing guarantees a profit in trading, we can at least reduce losses.