Earlier in the crypto space, there was nothing like stability as the coins where known to be very volatile and this is caused by the fact that crypto was traded by humans with emotions, the greed and the fear been the number one factor. This volatility has caused a lot of investors keeping away from the crypto space and also made nations put a ban to digital currency as it has been viewed as something that will be detrimental to their citizens.

Another issue was the fact that the digital currency has been proven not to be able to hold a particular value in that it changes price anytime the price can rise very fast which can be an advantage to the traders and also which can decline in price very fast which can be a loss for the trader as well. So for it to be considered a store of value the price has to be a bit stable.

What exactly does stability means, this simply means the tendency to resist change thus cryptocurrencies should be able to resist change for it to be considered as a store of value this is the reason why Stable coin were created.

Stablecoins are digital currency which price has been pegged to real.wolrd assets or are been pegged to other cryptocurrency which serve as a reserve for them. This has thus made the crypto space exaond as the stable coin has become very popular and this is another avenue that people can use in saving their money in a digital currency.

There are various types of stable coin which are explained below.

1. FIAT PEGED STABLECOINS:

these are stable coins that are been pegged to the value of our traditional currencies most especially the US dollar. The US dollar serve as a reserve for them and are collateralized by it. Emaoles of this coin are the USDT, TUSD, USDC, BUSD etc.

2. Assets Pegged stablecoins:

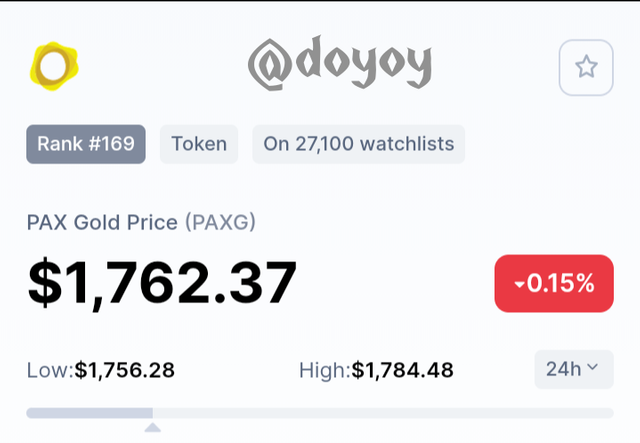

these are stable coins that are been pegged to the value of a commodity or asset like Gold, silver, real estates etc. These assets acts as their reserve and it is been used to collaterize it. Examples.of these stable coin are Paxos gold, digix, tether gold and meld gold.

Pax gold symbol and details in screenshot above.

3. Crypto -

pegged stablecoina: these stable coin are special as they use other crypto as their collateral to attain stability. Some uses smart contracts to over collayerize the currency, this way the volatility of the crypto pegged to doesn't affect the price of the asset. Example is DAI.

4. Central Bank Digital currency:

this Theo of currency is a digital version of a country's currency. It has the same value of the countrys national currency but it is built on a blockchain to make it digital.

BENEFITS OF STABILITY OR STABLECOIN

- It minimize volatility unlike the price of other crypto like Bitcoin and ether that fluctuates alot this gives investors who wants to invest in digital currency that their money won't fluctuate so much.

- It can be used to save assets as no bank account is needed to hold the coin and they are very easy to transfer with very minimal fees and it is fast to send to any globe around the world. There is no need to start looking for bureau de change to change the coin to a country particular currency as it is universal.

- Stablecoin can be used to earn interest for depositing them which gives very high interest unlike the banks.

- It brings more.investor into the crypto space as there is more trust and assurance that the investor won't end up losing his money.

CENTRAL BANK DIGITAL CURRENCY

Just like I explained earlier above, a central bank digital currency is the virtual version of a country or region traditional currency. It is an official digital token of that nation and it is issued and regulated by the monetary authority of the nation or region.

according to me I think this is a good improvement for the nation banking system as it allows for digitalization of the nation's currency which will ease the use of the traditional banking system and allow more convenience using the system.

There are two major types of CBDCs which are the wholesale and the retail.

1. Wholesale CBDCs:

this tyeos settle Trànsactions between financial transactions, that is it is the transaction that involves sending of asset or money from one bank to another prior to certain conditions.

2. Retail CBDCs:

this is the trànsaction done between the central government backed digital currency directly with the citizens or consumers. This eliminate the intermediary risk or the risk that banking institution might not have liquidity and sink depositor fund.

The retail CBDCs provides two variant which are:

- Cash based access system: the digital currency is passed into the receiver through a digital wallet which is not fully autonomous but pseudonymous. The wallet will be identifiable in the oubkuvj blockchain but it will be difficult to identify the people.imvokbed in such transactions.

- Account based access: this type.of access is similar to the service provided by a bank account. This needs the use of a third party who will be responsible for the verification of the identity if the recipient and monitoring every activity and payments between accounts. It provides more privacy as personal data is shielded from the public.

ADVANTAGES OF CENTRAL BANK DIGITAL CURRENCY

This allows those who haven't started banking to be included in the banking system

It is legally backed as it is issued by the government of the nation.

It gives room for digitalization and moving with the trend of civilization.

DISADVANTAGES OF CBDCs

It is centralized and there might be trust issues within the users as they won't have full control over their asset.

The regulations might not sit well with the users of the currency

There is lack.of privacy as every transaction can be monitored and the person behind each trànsaction can be traced.

REBASE TOKEN

A rebase token is a unique token which is sometimes pegged to a another cryptocurrency and has a special way of achieving it's stability. It uses the REBASE mechanism which adjust the supply of the asset when it's price changes than it should. They are called elastic token as the supply changes when the price change

How Rebase Tokens work

REBASE tokens works in a different way in that whenever the price increases due to high demand the circulating supply will also increase as wellz the increase in the supply ensure the price of the coin return to the intended value or a very close range to the value which it ought to be.

We know that the more the supply the lower the price of an asset. Same thing happens as well when the price if the asset fall below standard the supply is also reduced so as to bring the price back to the standard set. The holders of rebase tokens will.often notice the change in the quantity of their asset from time to time.

Rebases of a token can be calculated with the formula

Rebase % = [(Oracle rate - price target)/price target]×100)÷10

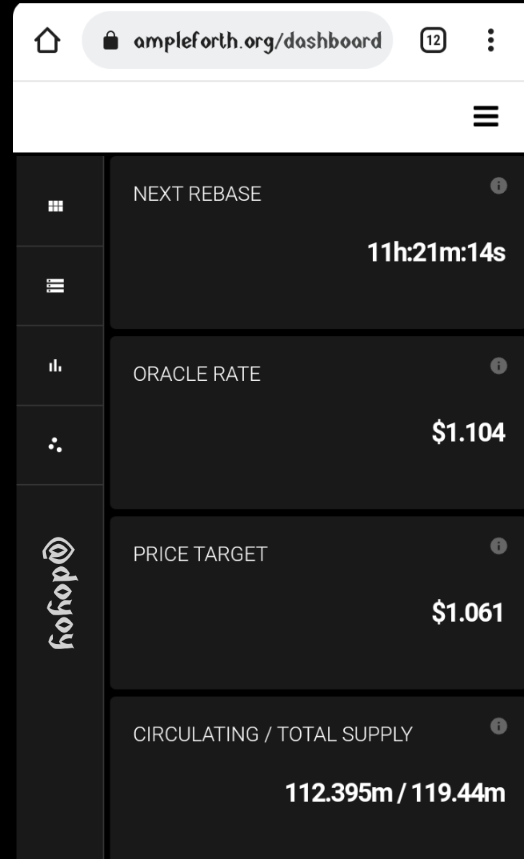

For example we will be using the Ample token which neccessary value needed can be gotten from the website https://www.ampleforth.org/dashboard/

Oracle rate = $1.104

Price target = $1.061 using the formula

Rebase % = [(Oracle rate - price target)/price target]×100)÷10

REBASE =$( 1.104 - 1.061) ÷ 1.061 × 100) ÷ 10

($0.043 ÷ 1.061) ×100) ÷ 10

0.0405 × 100 ÷10

= 0.4%

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps

First of all you need a Verifed exchange to do trading which in this case is Binance, you login to your Binance account.

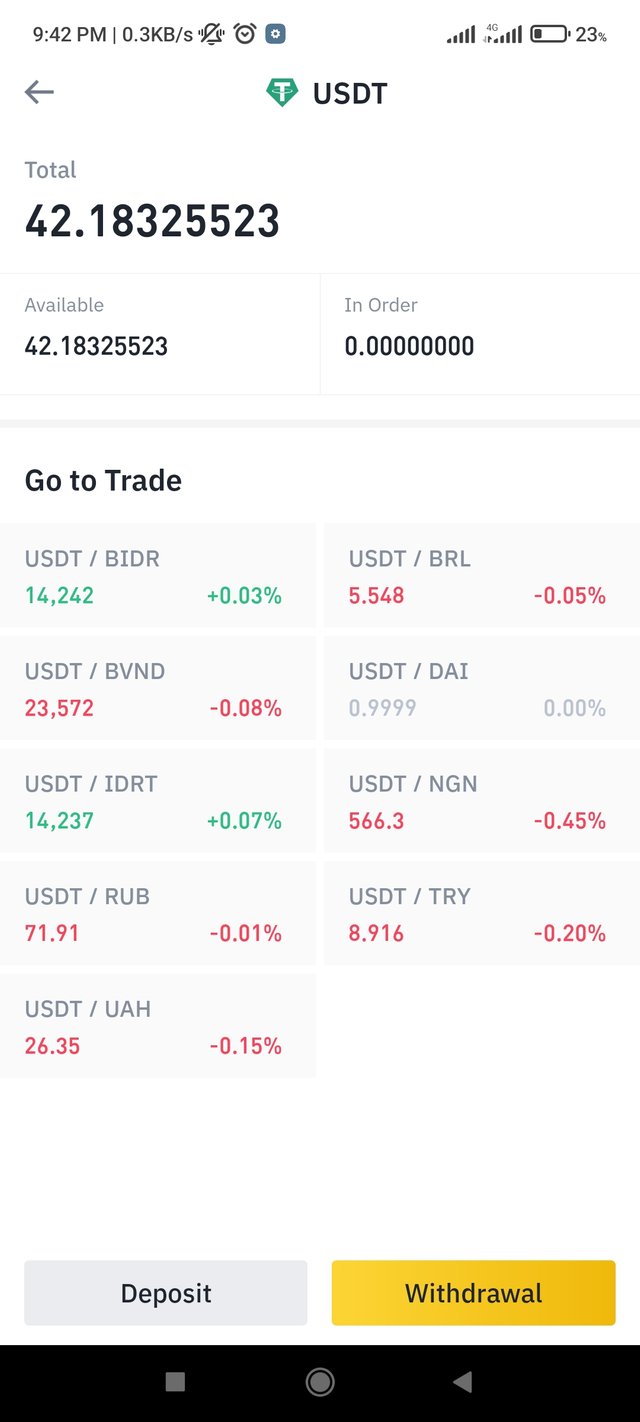

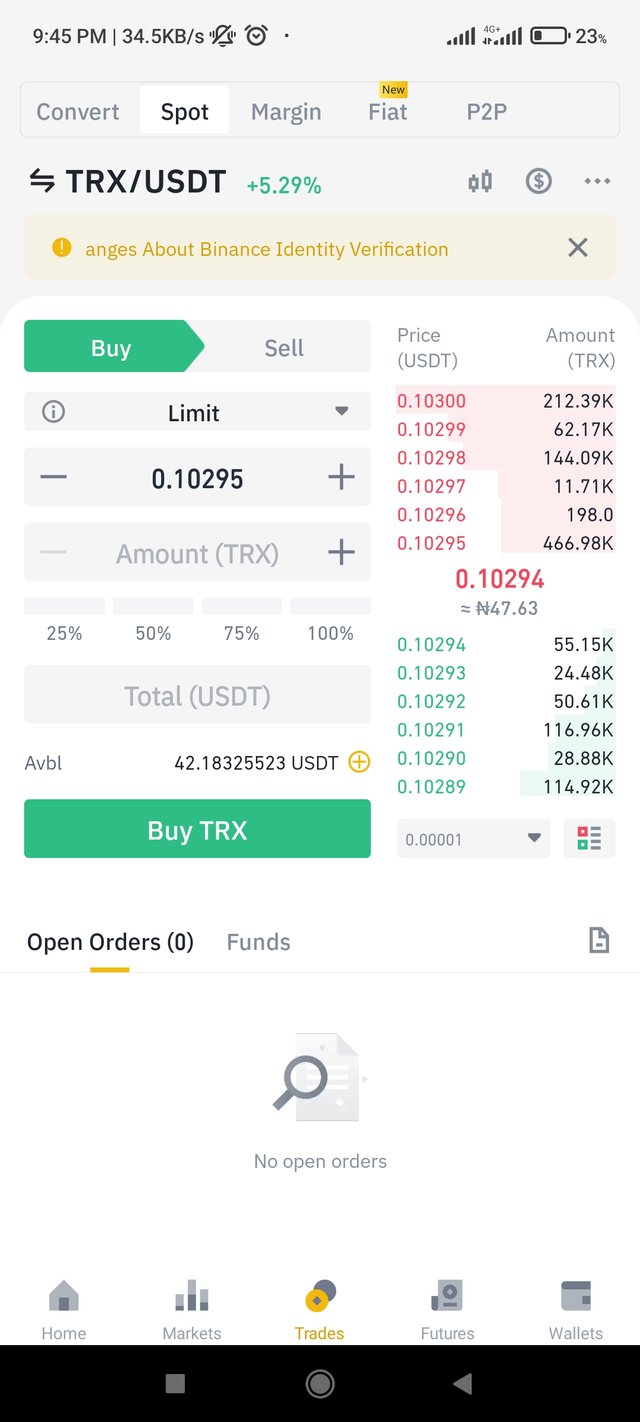

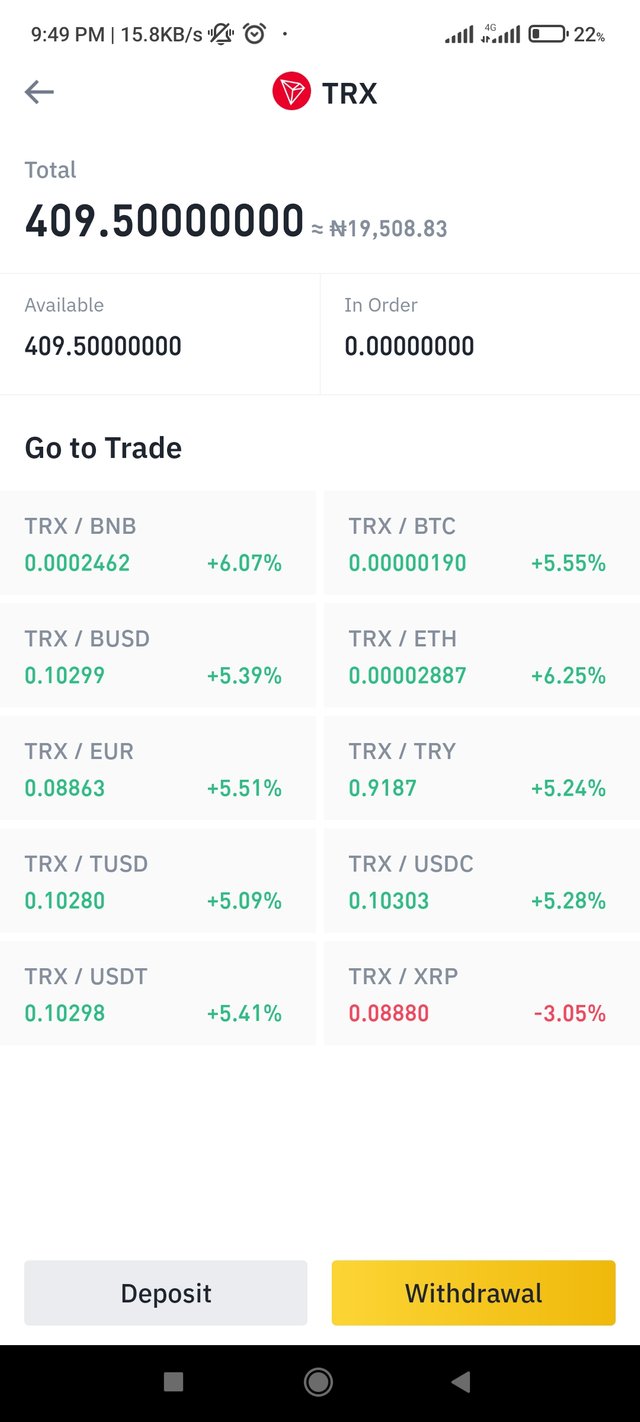

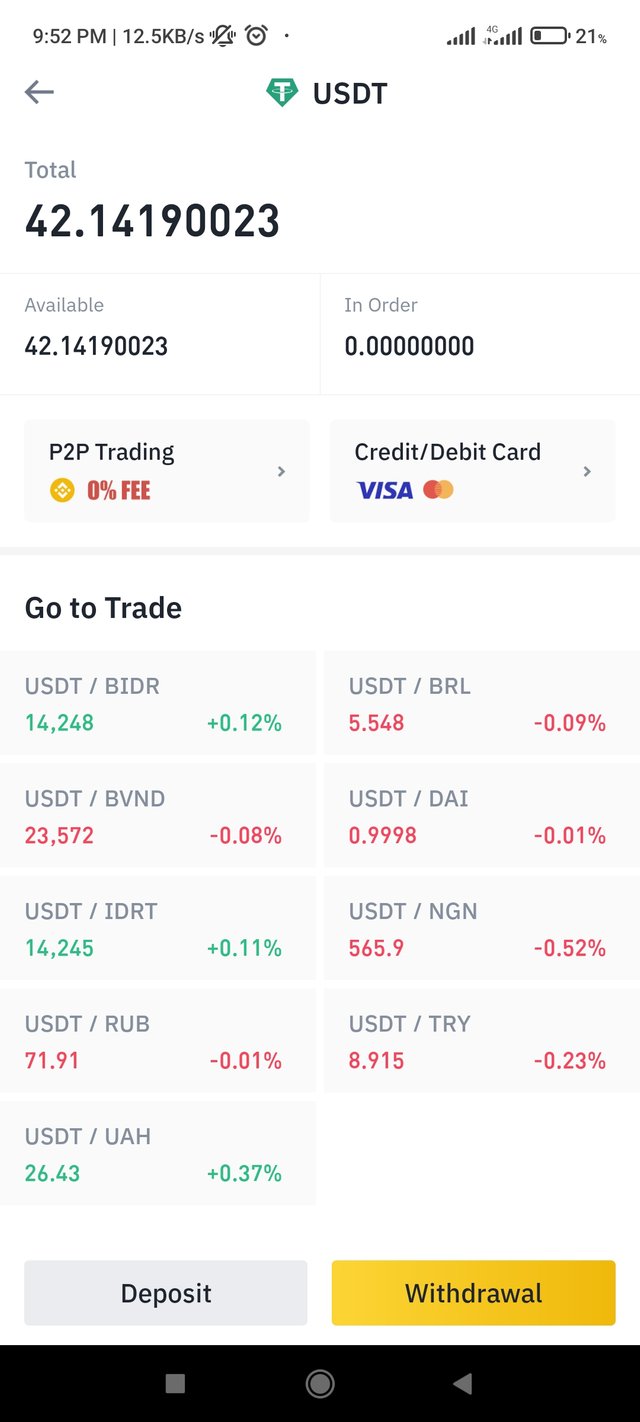

Yes in this aspect I will be using the Binance exchange to do the trading with a Usdt worth $42 as you can see in the screenshots below

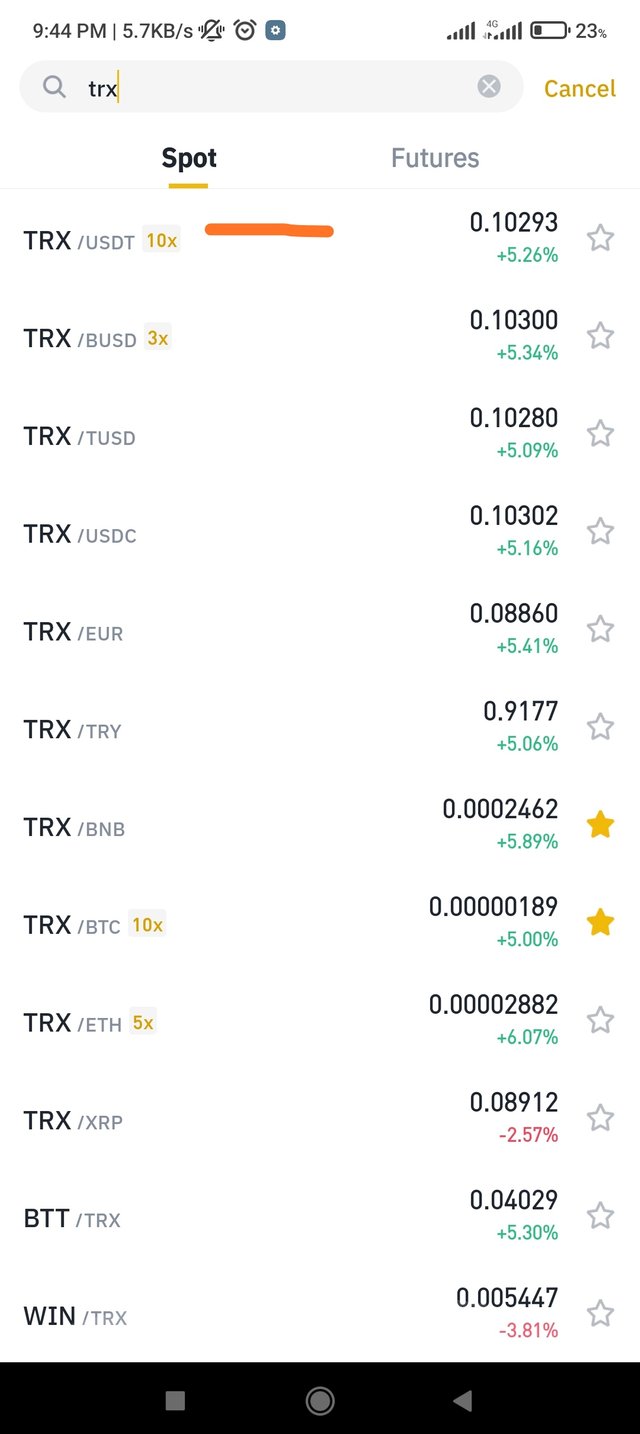

So first of all, I will be trading the token called Trons or Trx in short. So first step is to head to the Trons/Usdt pair which will enable us to start the Trading

Clicking it will take us to the first page which will show the chart graph of the token which is Trons and how it is behaving in the market and then we click either the buy or sell option according to the screenshots

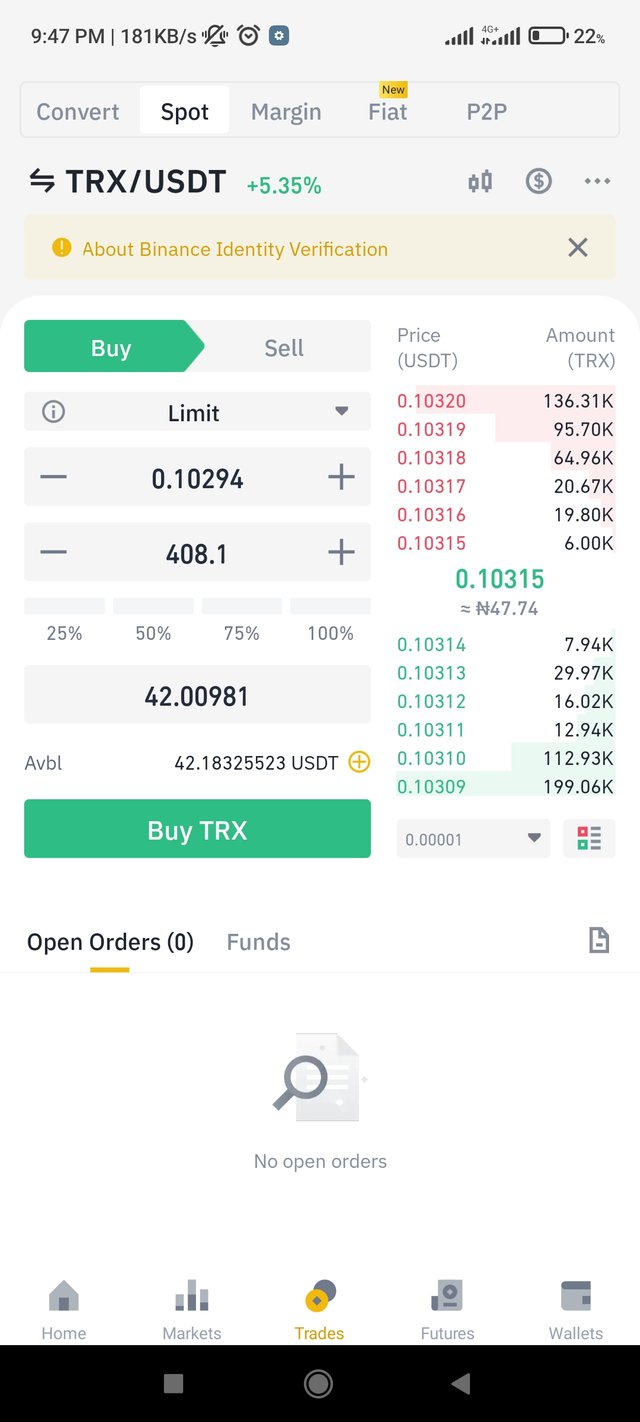

Just like I said earlier, I have $42 Usdt which I want to trade, now trying to buy Trons with the whole of the $42 Usdt will give me a return of 408 Trons which I will buy as you can see in the screenshots below

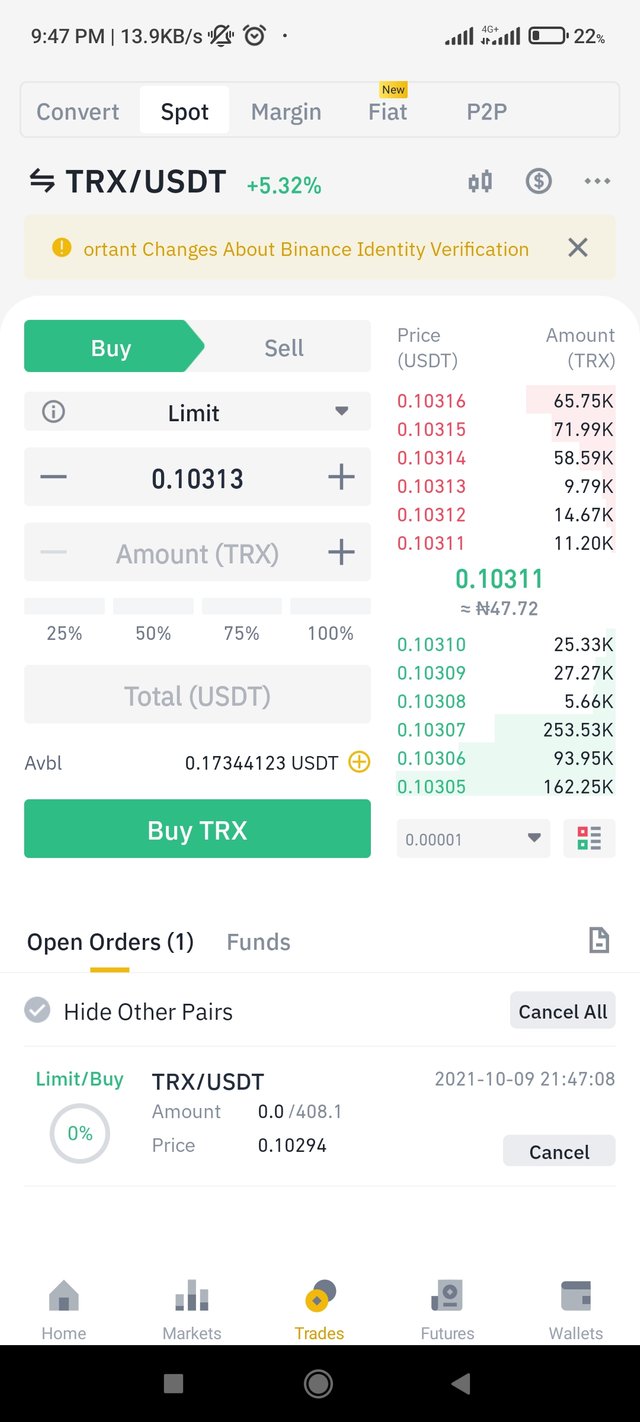

Clicking buy and then the order been filled made me now to have 409 new Trons I just bought with the $42 Usdt according to the screenshots below

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of stable coins over fiat money transactions?

Now I will be transferring the Usdt to another wallet with the Tron network using the same exchange called Binance.

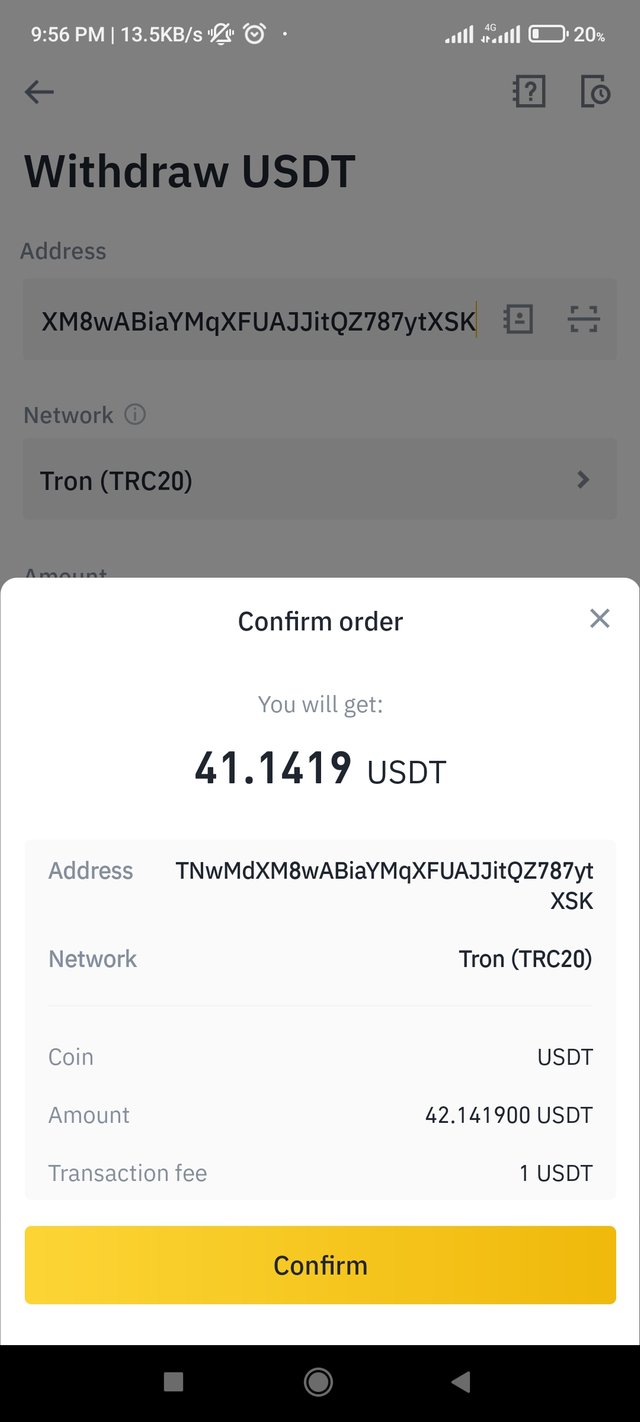

We first go to the deposit and withdrawal page of Usdt on my Binance account which is this below

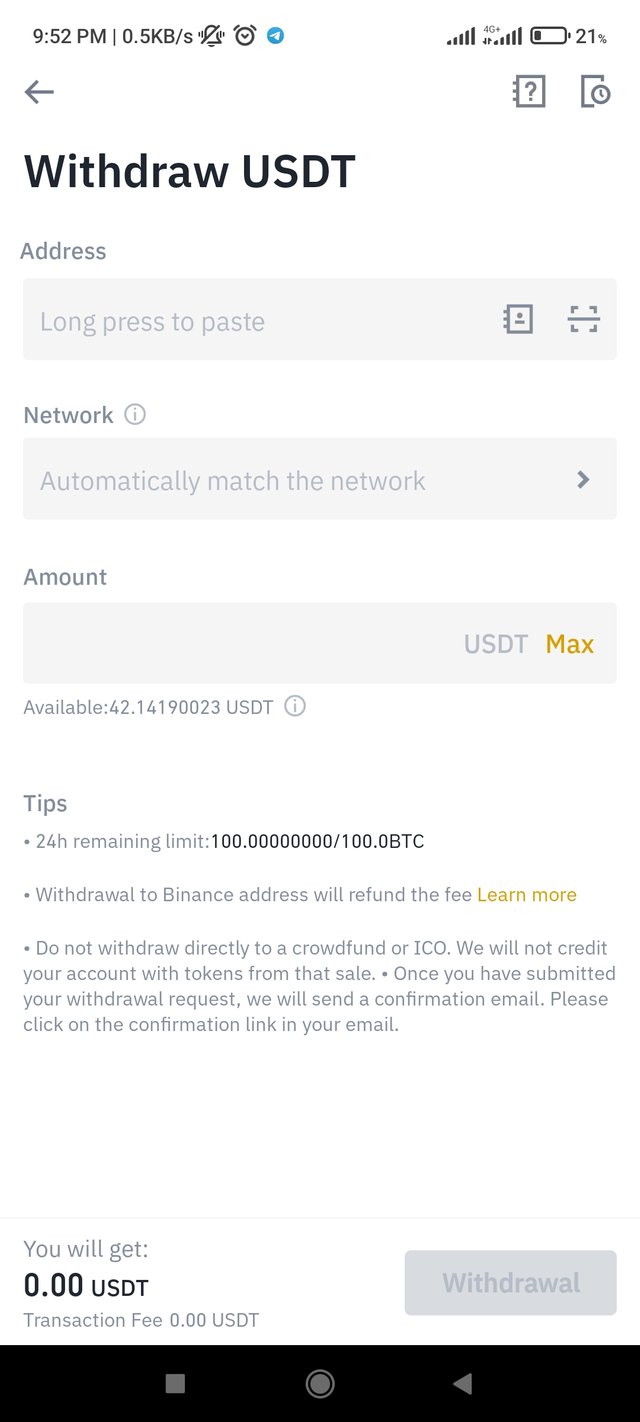

Now after getting to the withdrawal page, we can see several options like the address, the network, the amount of Usdt one want to transfer and also the withdrawal option also

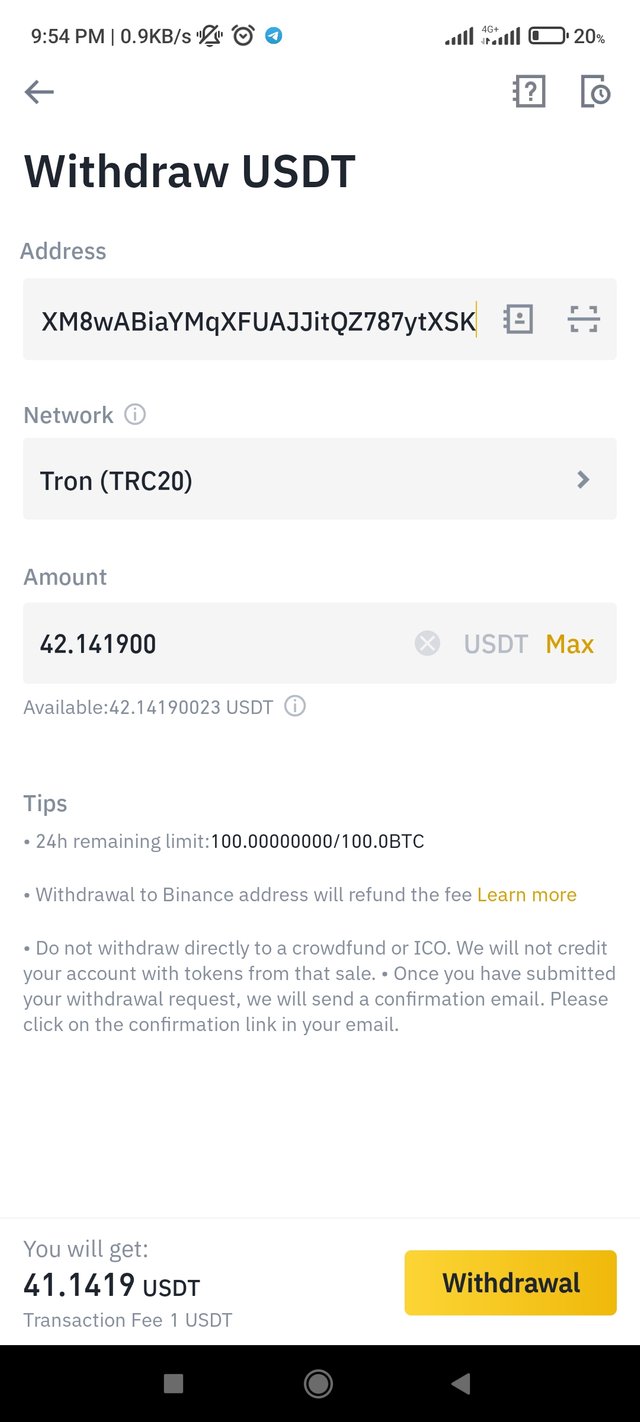

So according to the screenshots above, I have inputted the address, I have also changed the network to the Tron network and also inputted the amount of Usdt I want to sell which in this case is all which is $42, then I will now click the withdrawal option

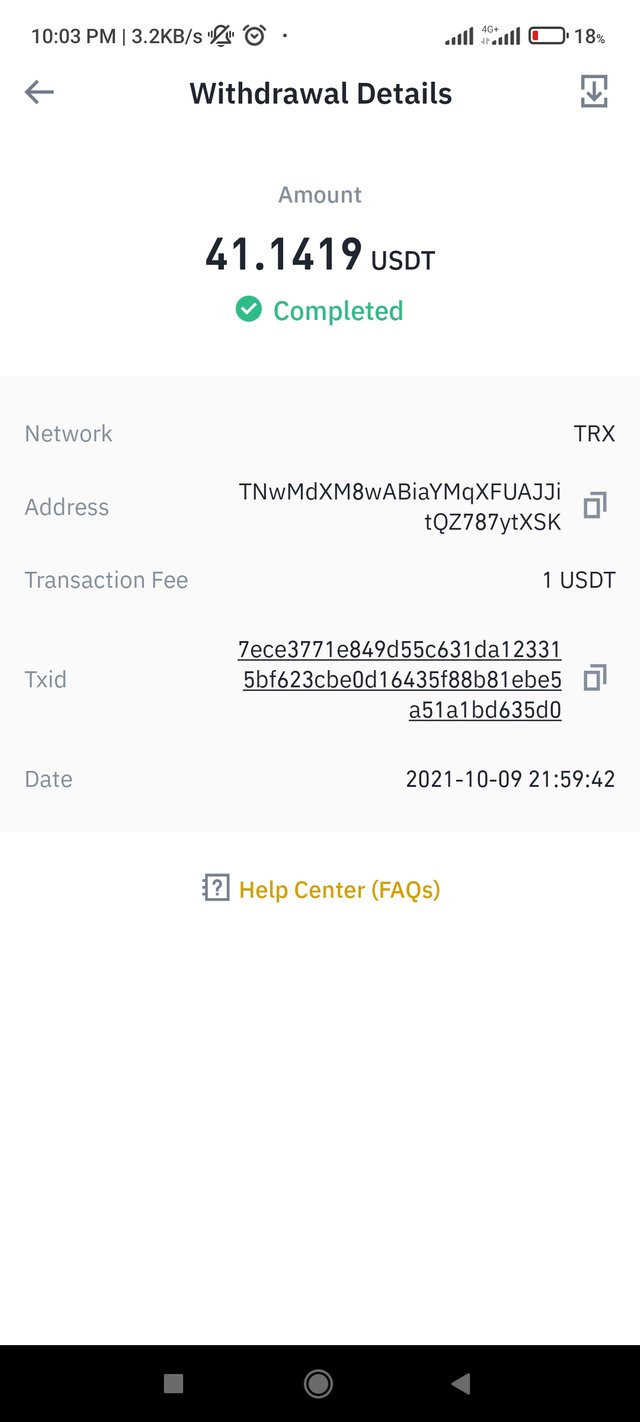

It will bring another option for us to confirm the withdrawal option which I do then I complete the verification section last then finally the withdrawal is completed as you can see in the screenshots below

what are the pros of stable coins over fiat money transactions?

One thing that I noticed is that both the transaction fee and also the minutes to arrive or send is stable and uniform in other network and also the transaction fee was $1 Usdt also.

One thing I also noticed is that stable coins transaction seems to be more faster than fiat money transactions

Hello @doyoy,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Your work is really difficult to navigate. You need to improve on your arrangement a lot.

You should always be original and stop trying to paraphrase other sources. Take Note!

The work is incomplete.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit