Cryptocurrency trading is without a doubt a very important concept for one to be proficient in as this market is by and large an unstable one . for a long time traders have attempted to spot examples and trends or models that can be utilized to basically foresee the market trends and make benefit .

indicators

Indicators are automated tools that assist a merchant with future decisions in regards to things like the coin price , highs price and low price ,and so on dependent on the previous performance of a particular coin.

There are a great deal of technical indicators accessible and they have been made considerably more open following the Coming of the web and our cell phones .

A few kinds of technical indicators

Technical indicators can be isolated into leading and lagging indicator . this grouping is dependent on the time of the indicator signal and price action on the candle charts .

leading indicators : These are indicators that gives its sign preceding the price action or the real trend. Isn't this wonderful ? A broker becomes more informed whether there will be a bearish or bullish trend prior before the trend really happens and this assists the trader with making an educated decision concerning when to enter and sell positions on the market to make great benefit . A few instances of leading indicators are Fibonacci indicator , On-balance volume (OBV) indicator,and so forth

lagging indicators : These are indicators that gives an indication about a trend when the trend has happened .

The name lagging indicator came as a result of the fact that its indication comes after the trend has already started . although the signal occurs late , it is still very important in swing trading .One must be extremely cautious however as a trend inversion may be within reach and the trader falls into a trap.

It is generally expected counsel to use a lagging and leading indicator concurrently to give a more balanced investigation . A few instances of the lagging indicator incorporates Moving average (MA) , Exponential moving average (EMA) , and so on .

Illustration of a leading indicator and market reaction

Utilizing On-balance volume (OBV) : The OBV is a viable indicator that tells when whales are trading . Whales by and large affect the price of a token and will in general influence the price of a token .

From the chart above , it well may be seen that upon an ascent shown by the indicator , the price action rose consequently . This is especially useful for scalpers or day traders, since they can leverage on these little and fast trends .

Instance of lagging indicator and market reaction

Utilizing the Exponential Moving Average (EMA) : This indicator gives more significance to recent exchange information thus lets the merchant know how the market is getting along as of now contrasted with past periods .

This assists the dealer with knowing when best to enter and leave the market ; it is best utilized in combination with another technical investigation vice.

Components to be considered in utilizing an indicator

trading isn't something one should approach however one sees fit, so is the decision or utilization of technical indicators . Utilizing a specific indicator or a couple of indicators is reliant upon a wide scope of Variables or rules which is talked about bellow

trading Technique : Prior to picking an indicator to utilize, it is significant that you have a trading methodology . A trading technique is the what decides your reaction to price fluctuations and situations that makes the dealer purchase or sell their position.

Confluence or convergence of a combination of indicators: Very much like mentioned above , consolidate more than one indicator and a point where the indicators concur or converge ought to be our place of action or inaction .

indicator type : Indicators are of different varieties . so Envision starting a trade utilizing a lagging indicator like the moving average? While you might be lucky to stay away from misfortunes , it isn't great , you ought to likewise consult other criterion like the price action to be very certain or combime your indicator with another one to ascertain how strong the trend is.

Confluence

Confluence is the place of alignment between a technical indicator and another technical tool. This assists with making better trading decisions.

Combining double top or bottom Model and the MACD indicator.

The MACD indicator is a generally excellent and simple to interprete indicator . This indicator indicates a bearish trend when the MACD line croses over the signal line upward and a bullish trend when the MACD line falls beneath the signal line. Another exceptional component is the representation of the strenght of the trends utilizing a histogram.

The double top and bottom wave model is especially utilized to foresee a market trend inversion . At the point when the candle chart has a low high followed by a correction and a higher high, then, at that point, a bearish trend is anticipated to follow also when there is a low followed by a short correction and a lower low, then, at that point, a bullish trend is in theory expected to follow.

From the TESLA chart displayed above , it may be seen that the double top and bottom model in the candle chart was in phase with the trend inversion of the MACD signal . This is a decent point of entry and the lowest low of the wave model could be set as support and the past high a resistance .

A false MACD signal and how to avoid it.

One sure method of detecting a false indicator indication is by contrasting the prediction with the price action . So the questions a broker ought to ask is " is this indicator signal proportional to the price action? " . in a case whereby the MACD indicator crosses over the signal line and candle chart is likewise to expect a trend inversion presumably after a long bearish run , then, at that point, that bullish trend is valid and not fake , assuming something else , then, at that point, the sign is false . One more method of really looking at feigned signs is by concurrently using the MACD indicator with an indicator like the relative strength index (RSI) .

Divergence

Divergence is the point at which the readings of the technical indicator and that of the price action are not in sync; that is, the point at which the indicator is giving a false sign . The false signal being given out could end up being surprisingly good developments since it can likewise be utilized to detect a trend inversion .

Divergences can assist a merchant with recognizing a trend inversion in it's beginning phase . Divergences are of two sorts and they are :

Bullish divergence : Bullish divergence is a situation where by the indicator is flagging a bullish trend though the price action or candle chart is downtrending .

Bearish divergence : A bearish divergence is the point at which the indicator is flagging a bearish trend yet the price action is saying there is a bullish trend .

Bullish divergence ( TESLA/USDT PAIR)

Bullish divergence is a sort of divergence whereby a bogus sign of a separated to give a prescient sign of a bullush trend . This means the technical indicator is flagging a bullish trend while the price action is downtrending , yet in the event that we see from the chart above , we can see that soon after the downtrend , an uptrend follows .

Summarily in the event of a bullish divergence , a bullish trend is probably going to happen soonest.

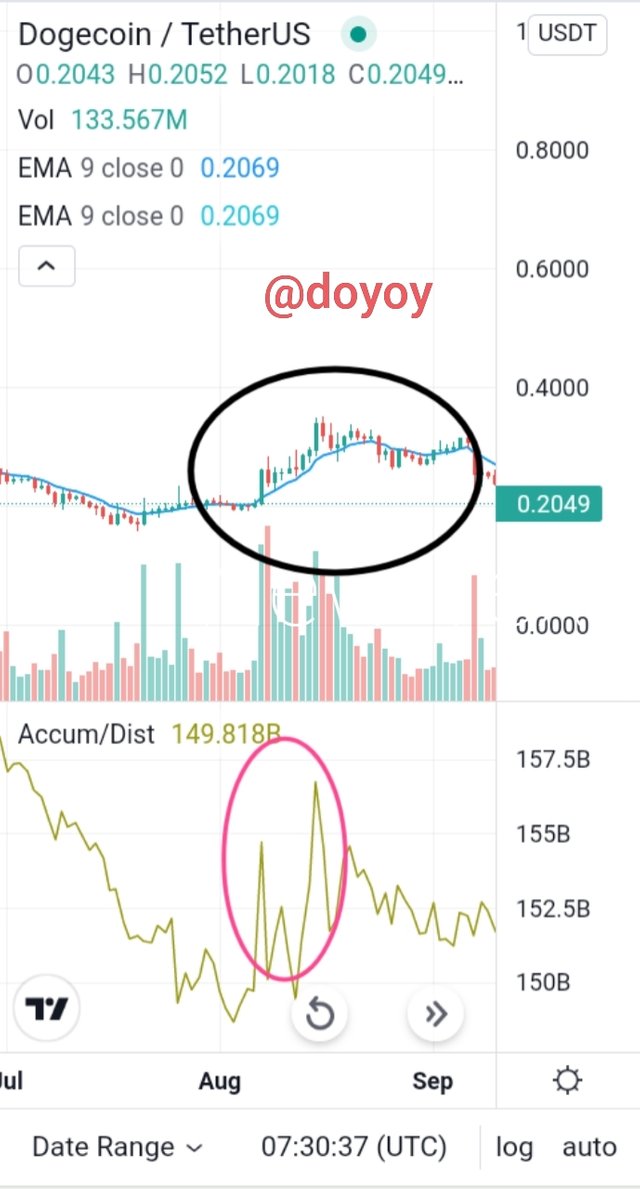

Bearish divergence ( Doge/USDT)

A bearish divergence is something contrary to the bullish divergence and it is displayed in the chart above. From the chart we can see that the Indicator shows a bearish trend while the price is uptrending , however, soon after the uptrend , a bearish run started . A bearish divergence is a decent sign to sell ones position or leave the market .

Conclusion

Technical examination brings a feeling of consistency into the exceptionally inconsistent and unstable space of Cryptocurrency , many indicators have really been in presence for quite a while and other came up as of late .

To capitalize on this indicators , the right pair of indicators ought to be used together and the mind has to be set right as nothing is 100% ensured in this space . One ought not to trade with money that the person can't stand to path way with .

Hello @doyoy , I’m glad you participated in the 4th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

I suggest you spend time to understand the lesson before performing this homework task.

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit