Thank you very much professor @sapwood for this wonderful teaching on On-chain Metrics. In this post, I will answer the homework questions you asked us after your class

Question 1: How do you calculate Relative Unrealized Profit/Loss & SOPR? Examples? How are they different from MVRV Ratio(For MVRV, please refer to this POST)?

How do you calculate Relative Unrealized Profit/Loss

Relative unrealized profit/ loss (RUPL) is an indicator that is derived from market capitalization and realized capitalization. This capitalization also refers to as value.

Relative Unrealized Profit or Loss = ( Market Cap - Realized Cap ) / Market Cap

Where

Market cap: this is calculated by multiplying the number of coins currently in circulation with the current price of the coin.

Example one

Let assume that we have 2000 coins of Ethereum in circulation and the current price is $3,585. Calculate the Market Cap

Solution

the market cap = $3,585 × 2000 = $7,170,000

Realized cap: this is calculated by valuing each unspent transaction output (UTXO) based on the price when it was last transacted or moved.

Note that Unspent transaction output (UTXO) talk about the currency left after executing a transaction.

Realized cap = Value × Price created (USD) of all UTXOs

Example Two

Let say that Ethereum has 2000 UTXO and a circulation supply of 2000 ETH. Since 2017, 300 UTXO had not be moved and the price was $407 when it was moved last. Since 2018, 500 UTXO had not be moved and the price was $1000 when it was moved last. Since 2020, 1000 UTXO have not be moved and the price was $1800 when it was moved last. And since 2020, 200 UTXO have not be moved and the price was 2200$ when it was moved last. Calculate the realized capitalization.

Solution

Realized cap = (300 × 407) + (500 × 1000) + (1000 × 1800) + (200 × 2200)

=122,100 + 500,000 + 1,800,000 + 440,000

= 2,862,100 USD

To calculate

Unrealized Profit/loss which is the total profits or losses of a coin or asset

Unrealized Profit or loss = Market Cap - Realized Cap

And to calculate relative unrealized profit/ loss will divide the unrealized profit/loss with a market cap

Relative Unrealized Profit or Loss = ( Market Cap - Realized Cap ) / Market Cap

Example three

Let assume that our market cap is $7,170,000 and realized value is $2,862,100. Calculate the Unrealized Profit/ loss and the Relative Unrealized Profit or Loss.

Solution

(1). Unrealized Profit or loss = Market Cap - Realized Cap

Unrealized Profit/loss = $7,170,000 - $2,862,100 = $4,307,900

Unrealized Profit/loss = $4,307,900

(2). Relative Unrealized Profit or Loss = ( Market Cap - Realized Cap ) / Market Cap

Relative unrealized profit/ loss = ($7,170,000 - $2,862,100) / $7,170,000

Relative Unrealized Profit or Loss = $4,307,900/$7,170,000

Relative Unrealized Profit or Loss = 0.6008

0.6008 show that it is a relative unrealized profit and the price trend is green and currently in the belief-denial zone.

How do you calculate SOPR

When coins are moved on-chain, Spent Output Profit Ratio (SOPR) can be used to reflects the degree of the realised profit and loss.

Spent Output Profit Ratio (SOPR) is calculated when we divide the realized value of the spent output ( in USD or base currency )by the realized value at the creation of the UTXO ( in USD or base currency)

SOPR = value × Price spent [USD] of all spent outputs/value × Price created [USD] of all spent outputs

Example Four

let say that we have a Y and Z spent outputs and UTXO Y has 1000 ETH while that of Z has 2000 ETH. If the created value of UTXO Y was 1300 USD and UTXO Z was 1600 USD and let assume that as of today the sold price for Y and Z is 2500USD

Solution

SOPR = value × Price spent [USD] of all spent outputs / value × Price created [USD] of all spent outputs

SOPR = [(1000 × 2500USD) + (2000 × 2500USD)] / [(1000 × 1300USD) + (2000 × 1600)]

SOPR = (2,500,000 + 5,000,000) / (1,300,000 + 3,200,000)

SOPR = 7,500,000 / 4,500,000

SOPR = 1.67

With SOPR being 1.67 show that if the market traders sell their coins they will make profits.

What MVRV is all about

MVRV on the other hand deal with the ratio of market value to that of realized value.

Market Value to Realized Value Ratio (MVRV) is defined as the ratio of market capitalization ( also called market value) to realized capitalization (also called realized value) of any given asset

Market Value to Realized Value (MVRV) is calculated when we divide market cap with total realized cap

MVRV = market cap / realized cap

Using example three above

Let assume that our market cap is $7,170,000 and realized value is $2,862,100. Calculate the MVRV

Solution

Market cap = $7,170,000

Realized cap = $2,862,100

MVRV = 7,170,000 / 2,862,100

MVRV = 2.51

So

RUPL help to determine whether a coin or network at large is in an unrealized profit state or not.

SOPR compare outputs value as at when it was spent to the created time so that the whole profits ratio of the market traders can be evaluated.

While MVRV focus on the fairness of a coin. Its use to determine whether a coin price is overvalued or undervalued.

Question 2: Consider the on-chain metrics-- Relative Unrealized Profit/Loss & SOPR, from any reliable source(Santiment, Glassnode, LookintoBitcoin, Coinmetrics, etc), and create a fundamental analysis model for any UTXO based crypto, e.g. BTC, LTC [create a model to identify the cycle top & bottom and/or local top & bottom] and determine the price trend/predict the market (or correlate the data with the price trend)w.r.t. the on-chain metrics? Examples/Analysis/Screenshot?

Analysis of Ethereum using RUPL indicator for Five Years on Glassnode

Net Unrealized profit and loss (NUPL) metric can be calculated when we substrate realized capitalization from market capitalization and divide it by market capitalization. In other words NUPL can also be referred to as Relative unrealized profit/ loss (RUPL).

RUPL can also be calculated by substrating Relative Unrealized loss from Relative Unrealized profit.

Anything less than zero is capitulation and between 0 to 0.25 that is 0 to 25% is the hope - fear stage while 0.26 to 0.50 is the optimism- anxiety stage and 0.51 to 0.75 is the belief-denial stage. When the RUPL exceed 0.75 equivalent to 75% then it is at the Euphoria-Greed stage which means that many traders sold their coins and make profits.

At the top- take profit

16th June 2016, RUPL was 0.872759 at $20.93 price, 05th June 2017 the price was at $248.40 and RUPL was 0.91680966 while on January 08 2018, the price was $1,134.85 at RUPL of 0.888865

These are some of the tops where the traders take profits by selling their assets.

At the bottom- Traders lose their money when selling of coin take place

Anything less than 0% fall in capitulation zone. Ethereum price trend was at the bottom on October 22, 2015, with a RUPL of -3.1124 and the price was $0.568. On December 15, 2018, RUPL was -2.04977 at the price of $84.45. Likewise 17th of march 2020 the RUPL was -0.82514 at $114.15

Any sales of coins at this bottom level will lead to losses

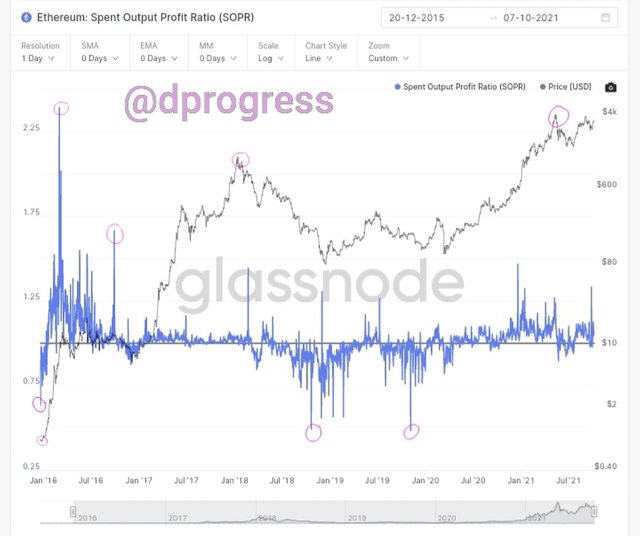

Analysis of Ethereum using SOPR indicator for Seven Years on Glassnode

At the top

On March 02, 2016, Ethereum hit its top at $8.39 with a SOPR of 2.3915, and on 27th September 2016 SOPR was 1.02504065 at $13.03, 0n January 13th 2018, SOPR was 1.04388525 at $1,382.28. At the top majority of the trade sold their coin at this top.

At the bottom

On August 10th, 2015 Spent output profit ratio (SOPR) was 0.36058702, which implies that a lot of traders lose money and at the same time prompt many to buy Ethereum, the price was $0.70070518. Friday, November 27th 2015, the SOPR was 0.80984853 and the price was $0.87294662. October 20th, 2018 Ethereum hit another bottom with a SOPR of 0.94470708 at $205.46. November 06, 2019, the SOPR was 1.000 and the price was $191.60.

If the SOPR is great than 1 it shows that the market traders are making a profit when they sell and if it is less than 1 then it means that the market traders are selling at loss.

Both Relative Unrealized Profit/Loss and SOPR are good and better as a metric that help traders to have a good price correlation. they both show the top and bottom wave of the price trend, when the price trend is at the top many trades sold their coin making it take a reverse order and when the price trend is at the bottom many traders buy making the trend moving upward.

Question 3: Write down the specific use of Relative Unrealized Profit/Loss(RUPL), SOPR, and MVRV in the context of identifying top & bottom?

Use of Relative Unrealized Profit/Loss(RUPL)

In Relative Unrealized Profit/Loss(RUPL) metric any price value that is great than zero show that the state is moving towards profit and the higher the price trend move to the top the better the opportunities for the investors to take profit. Likewise, if the price value moves below or less than zero it indicates loss and at this point, the investors are lost if they sell their assets. So in summary RUPL help investors to know when to take profit and the time to re-enter and buy more coins.

Use of Spent Output Profit Ratio (SOPR)

Spent Output Profit Ratio (SOPR) is very useful when it comes to measuring profit and loss for transactions, when the price trend is at the top, it is profitable for a lot of trade because the sold price is high than the price they buy the coins or created price. SOPR measure the variation between purchase and sale price.

The Oscillator is used as a marker to identify local tops and bottoms

Use of Market Value and Realized Value Metrics (MVRV)

The comparison of market value and realized value metrics make MVRV useful in sensing fair value, that is when the price is above or below which help to spot the market tops and bottoms.

The comparison enables us to estimate the overvalued or undervalued of the coin. If MVRV is between 0 and 1 then many traders will lose if they sell their assets which mean that the market is undervalued but if MVRV is more than 1 then the market is overvalued and the traders will make a profit if they sell their coins. So if the MVRV ratio keeps increasing to the top, more profits will be taken because more people will be willing to sell likewise if the ratio keeps decreasing to the bottom, it will result in a loss if the traders sell their assets.

Conclusion

An on-chain metric like RUPL, SOPR, MVRV and others has been very useful in blockchain analysis which has help cryptocurrencies participants to make wise and good trading or investment decisions.

Thanks for reading