Terra is a blockchain network that allows users to develop fiat-pegged stablecoins. The platform's seigniorage process is largely used by these coins. Do Kwon and Daniel Shim of Terraform Labs established the platform in 2018, and it deploys Tendermint Delegated-Proof-of-Stake (DPoS) as its consensus algorithm. Terra allows you to create a variety of different stablecoin types using smart contracts.

The project has gained traction in Asian e-commerce marketplaces and has a sizable market presence in South Korea, where it is headquartered. Taxi passengers in Mongolia, for instance, can pay selected drivers with Terra MNT, a stablecoin tied to the Mongolian tugrik. Terra currencies are tokens created on the network that exist alongside LUNA, the platform's primary currency for governance and utility. The relationship between Terra and LUNA is mutually beneficial.

Terra already offers stablecoins tied to the US dollar, euro, among other currencies. With the stablecoins created on the network, the project has gained a lot of traction in a short period of time. TerraUSD is now the fifth-largest stablecoin in terms of market capitalization.

As I previously stated, LUNA is the Terra network's native cryptocurrency, and it is used for a variety of purposes on the platform, including paying transaction fees in its gas system, similar to how eth is used to pay for gas fees on the Ethereum network, participating in the platform's governance system, but you must stake your LUNA tokens in order to create and vote on proposals regarding the Terra protocol, and serving as a volatility absorber for the Terra protocol.

The max target supply of LUNA tokens a billion. Terra will burn LUNA until its supply reaches the equilibrium rate if the network surpasses 1 billion LUNA. Luna can be bought on cryptocurrency exchanges such as Binancr, okex, hibtc, bitfinex, and others.

With this understand of Terra, I will like to answer the questions given by our professor.

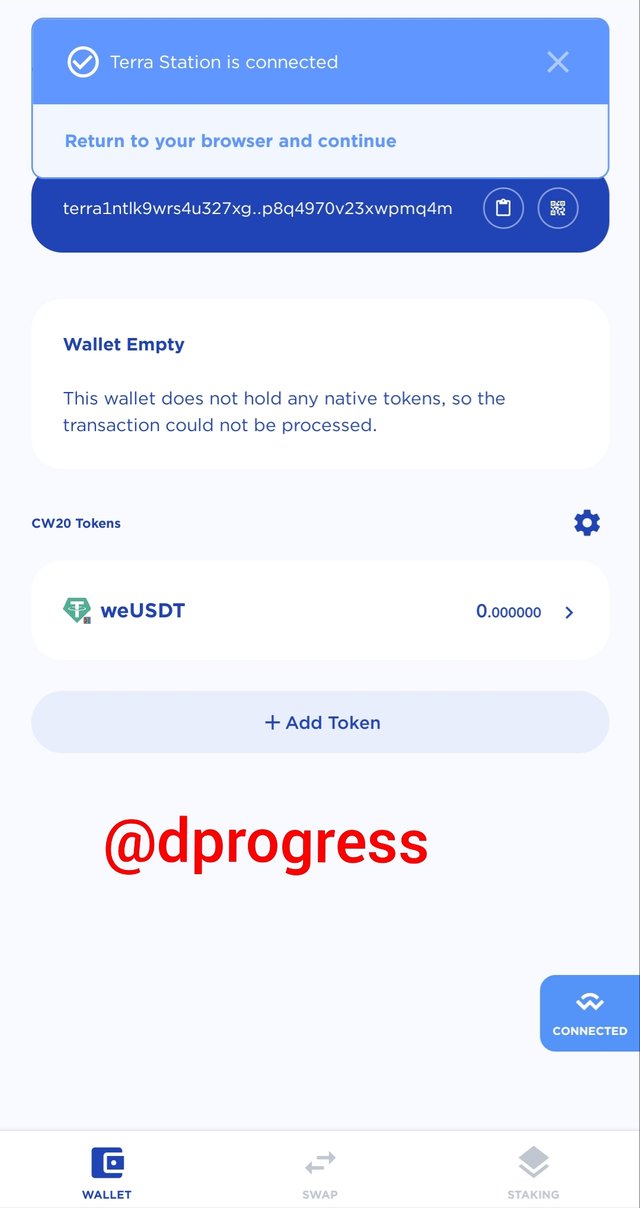

Question 1: What is Terra Station? Explore Terra Station on the web, Download the wallet and connect the wallet to Terra Station. Screenshots required.

Terra Station is the official Terra cryptocurrency digital wallet and dashboard, which enables Terra users to manage their accounts, funds, decentralized applications on the Blockchain, stake assets, and engage in the network's governance structure.

Let's have a look at the Blockchain together and figure out how to connect the wallet; the official site is https://www.terra.money/(web browsing). The app is on the Google Play Store (for Android) and the Apple Store (for iOS).

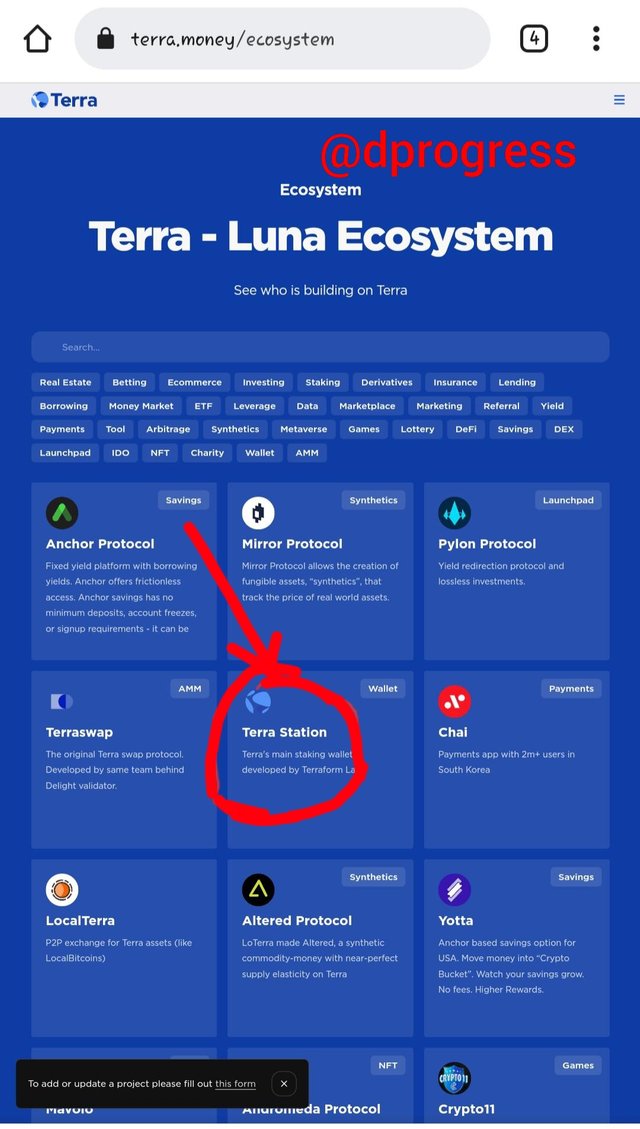

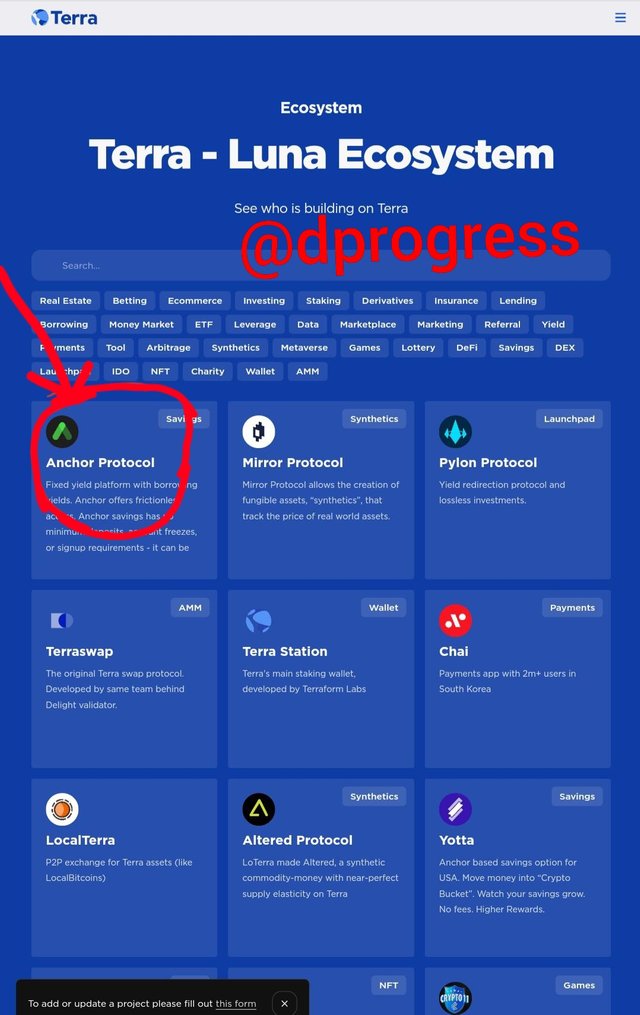

After clicking the link, go to discover the ecosystem (the circled part) to see the protocols and dapps available on the network, then go to terra station (circled).

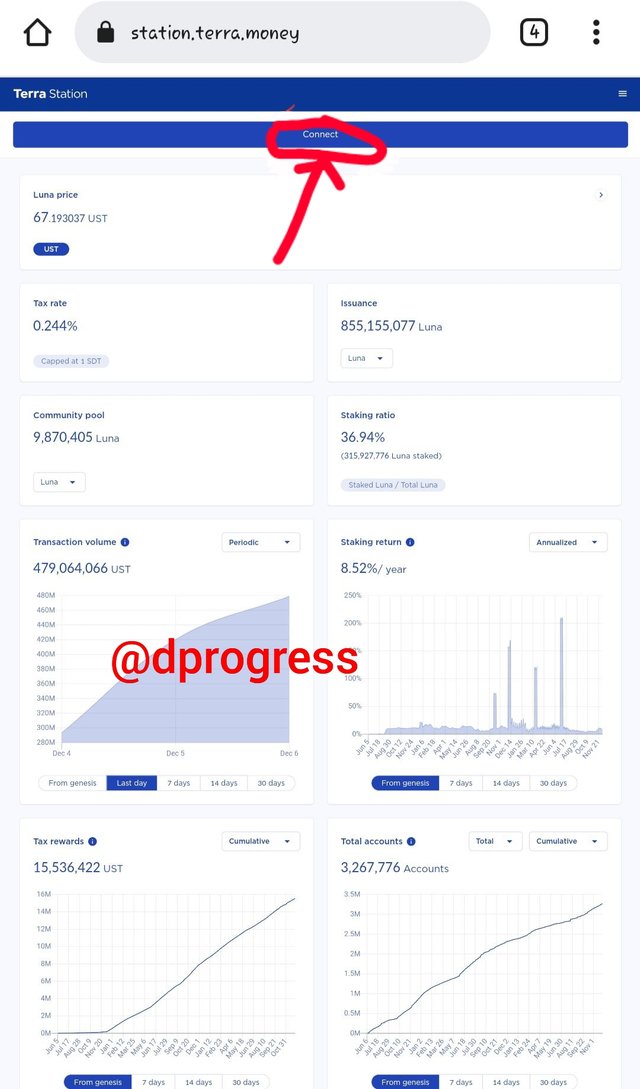

The station's homepage will appear; click the connect button at the top of the page (circled).

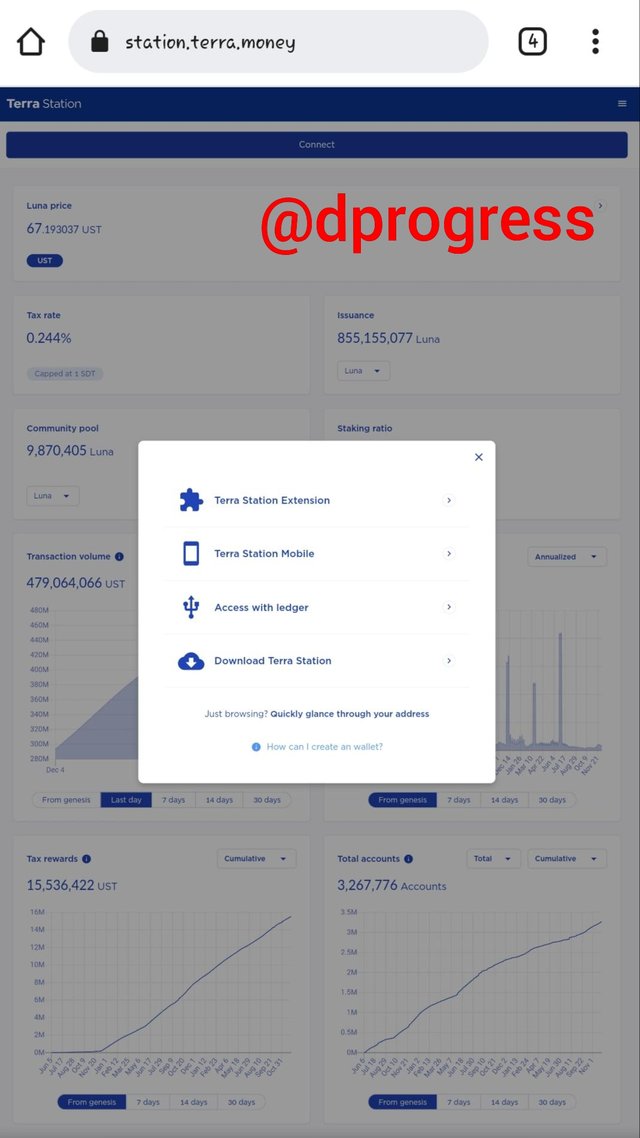

You can connect in four different ways; I'll use terra station mobile because I'm on a mobile device and already have the terra station app on my phone.

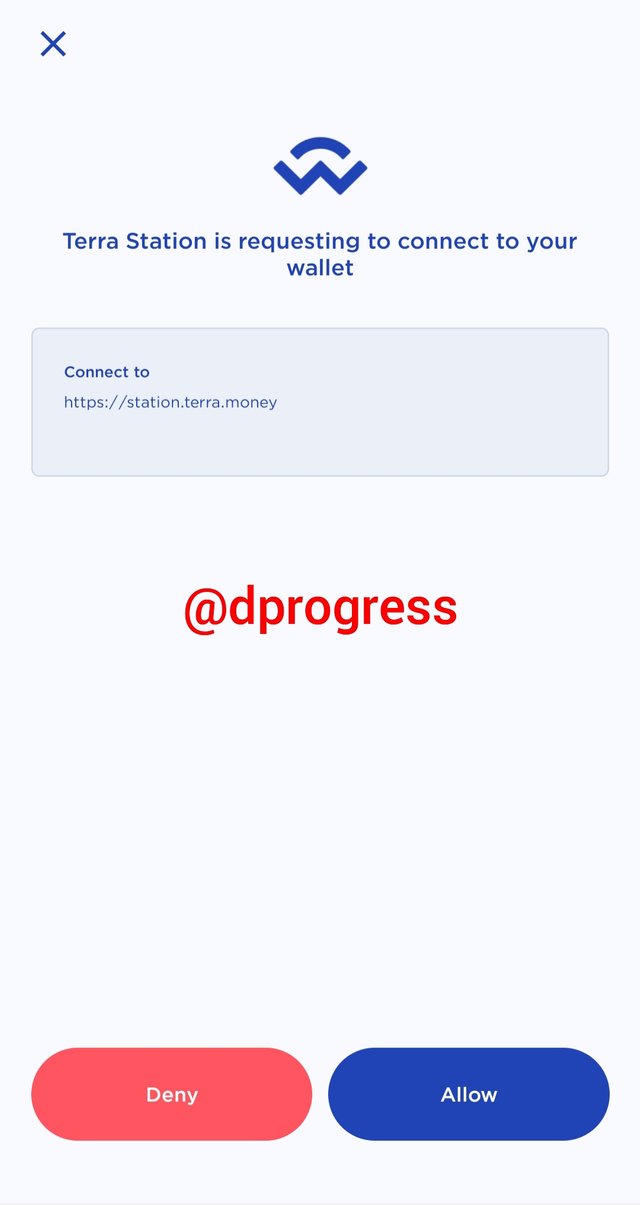

Wait patiently for the site to switch to the mobile app, then click Allow when it asks for your permission to connect. The connection between your terra station and the terra Blockchain would be completed successfully.

The following are some of the network's major functions:

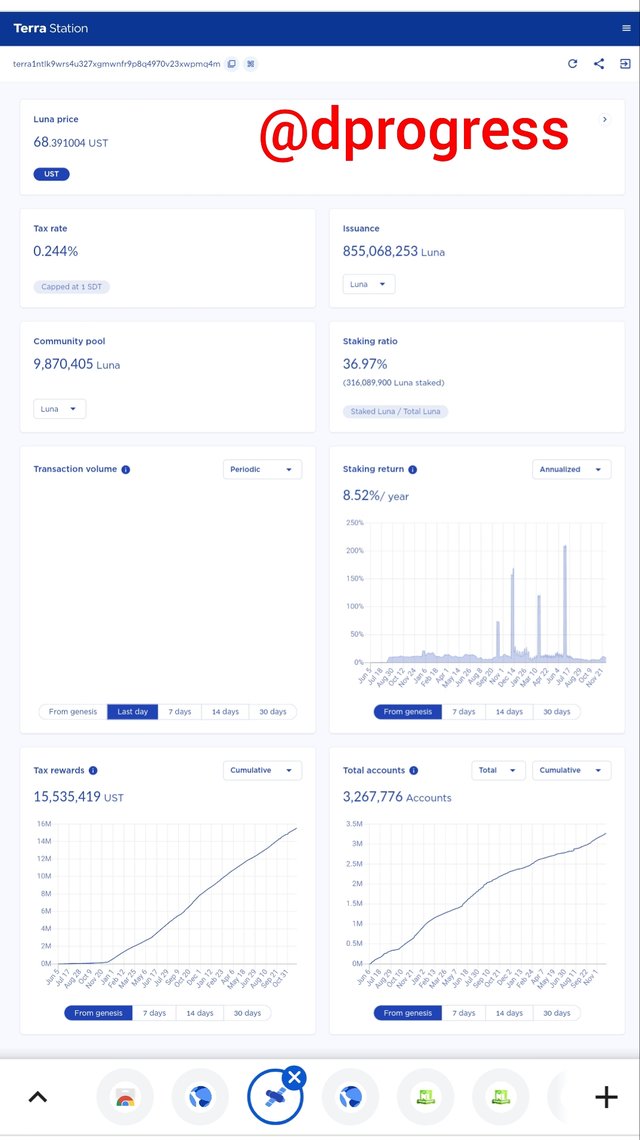

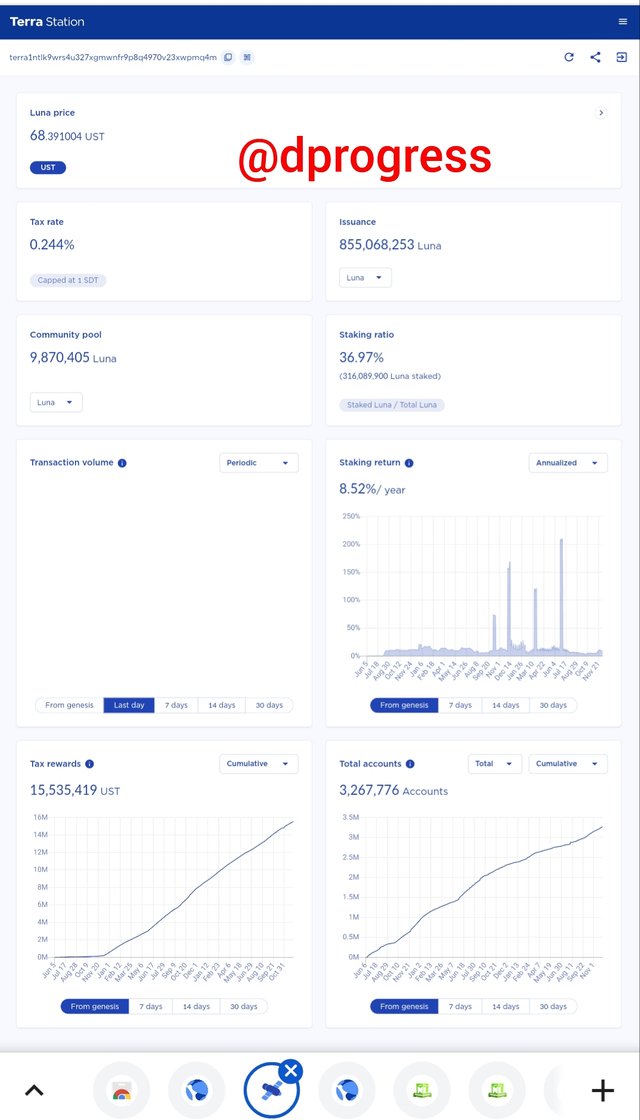

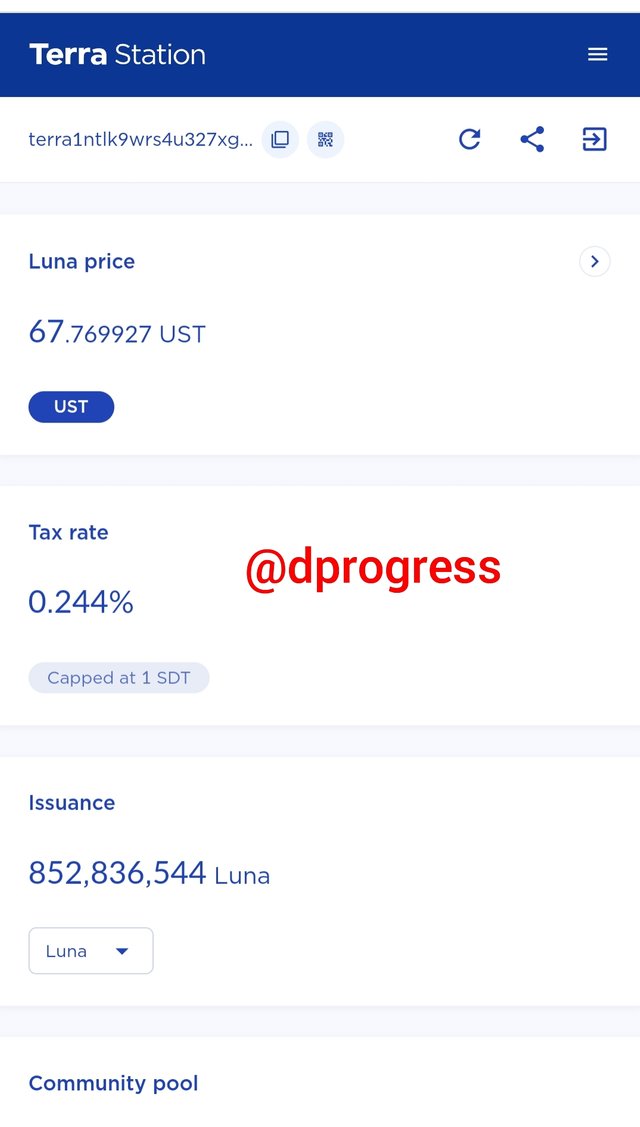

(1). Dashboard: network dashboard shows a variety of on-chain information, such as the tax rate, transaction volume, staking ratio and return, total account, and so on.

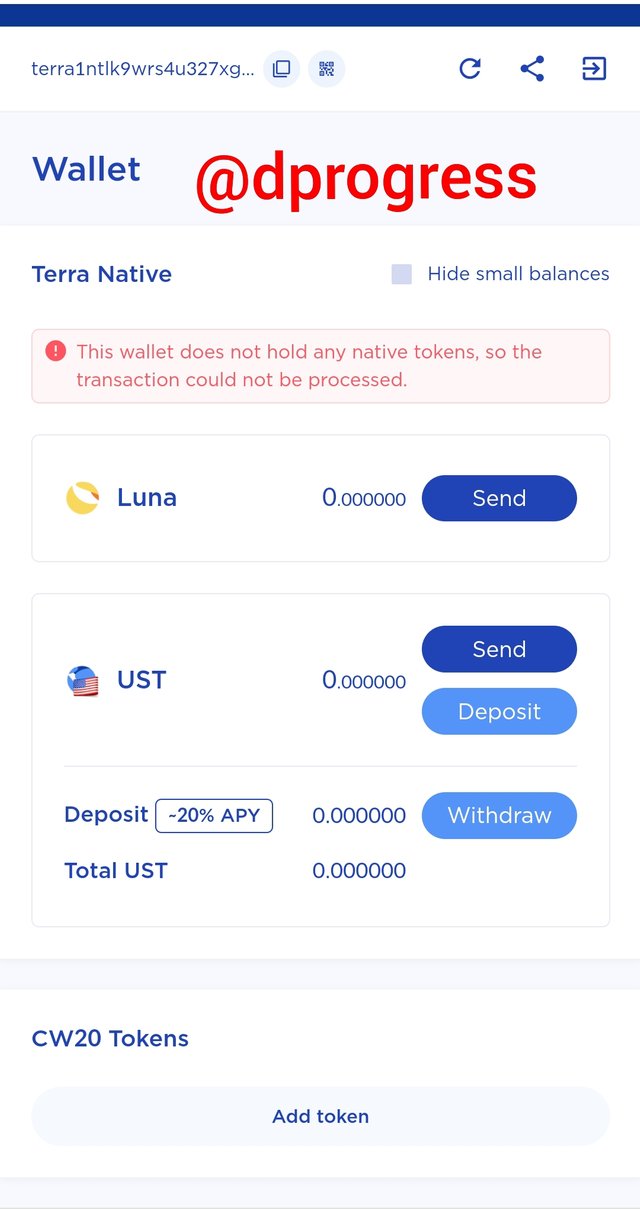

(2). Wallets: The network employs non-custodial wallets, in which only the user has access to private keys. There is no way to get your cash back if he or she loses it or gives it to someone who steals them, thus it is always a good idea to keep your private keys secure. The seed phrases are the private keys (random words you copied)

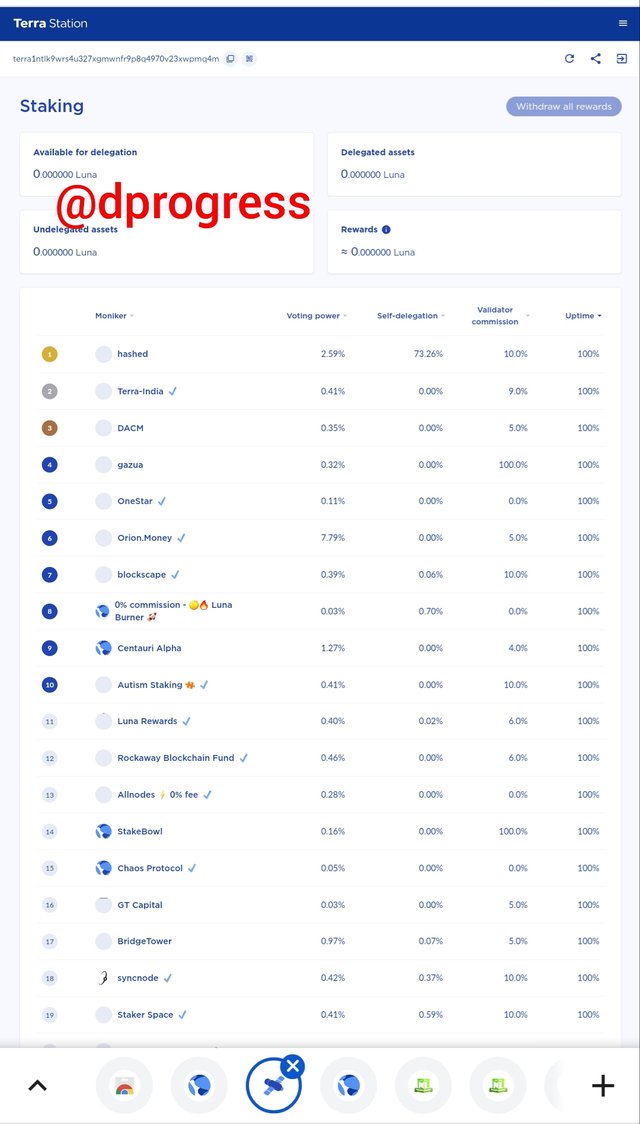

(3). Staking: This is where you stake LUNA to earn network rewards, as well as monitor your rewards, delegate your assets, and so on.

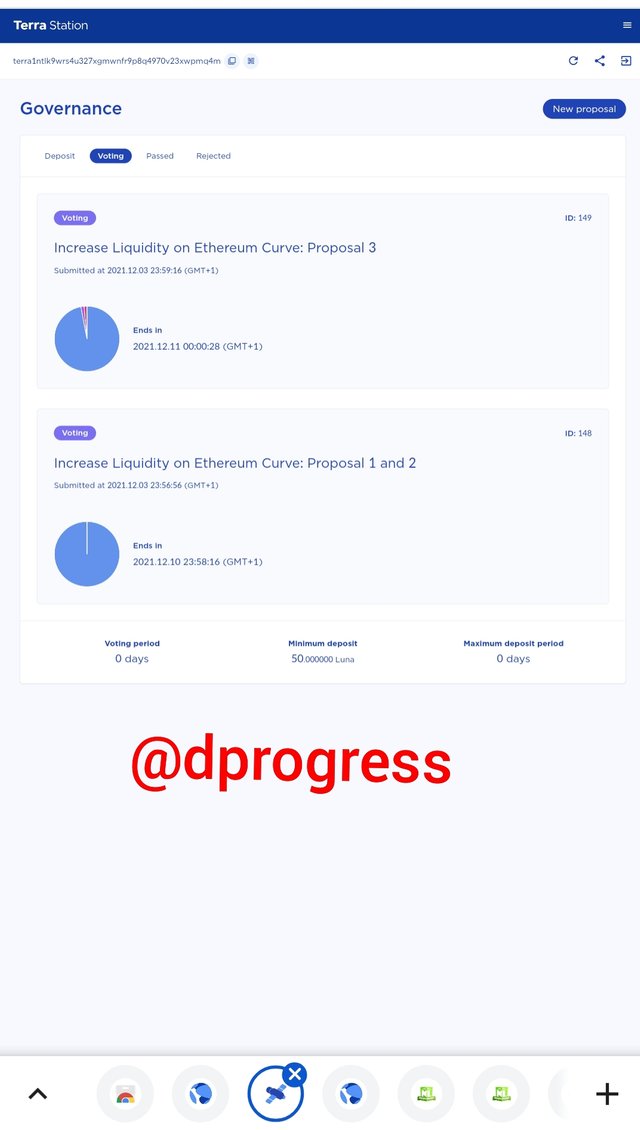

(4). Governance: In this section, you can participate in the network's governance process by making proposals and voting on network-related topics.

(5). Swap: This is the area of the network where you can swap coins.

(6). History: This part contains a record of all the transactions you've made on the network.

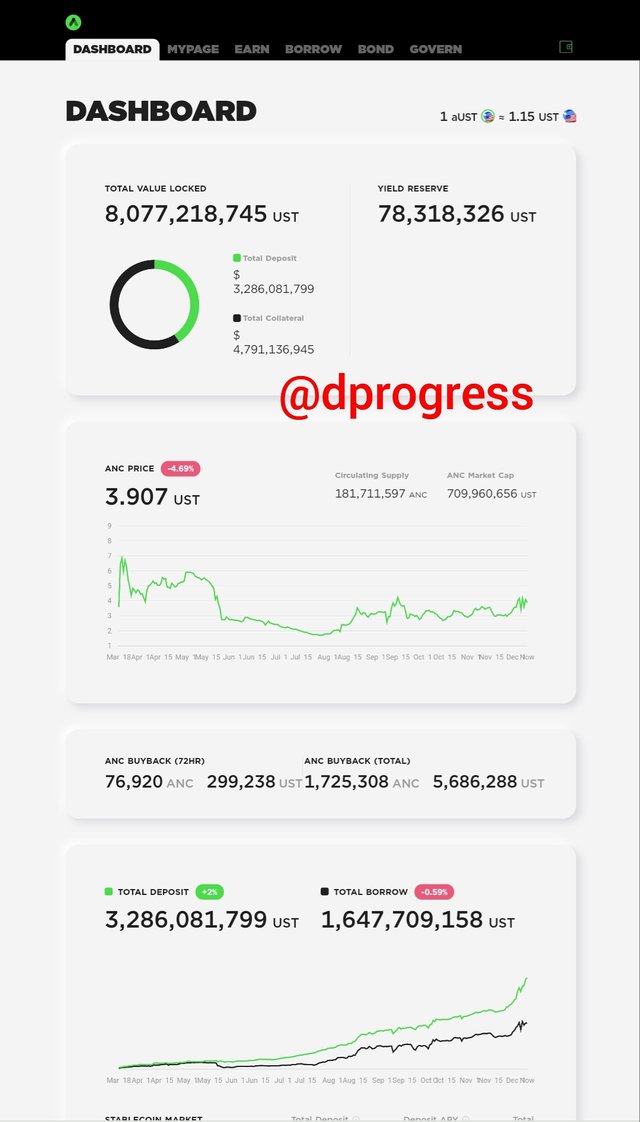

Question 2: Explain Anchor Protocol, explore the application and connect the Terra Station wallet. Show screenshots.

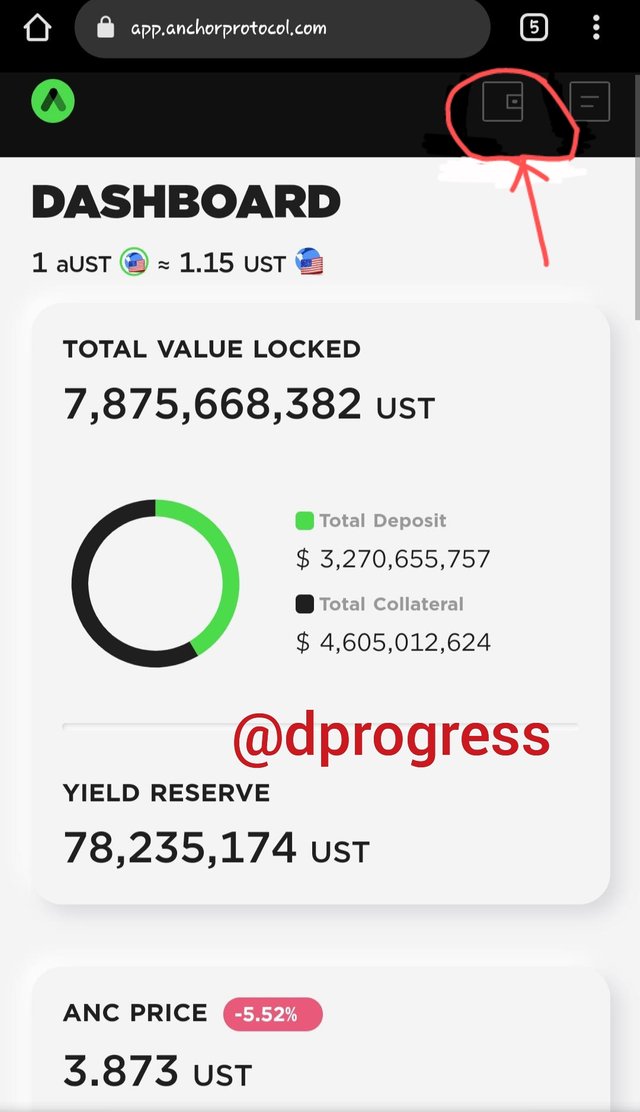

The Anchor protocol is a new savings protocol developed by Terraform Labs. It takes TerraUSD (UST) deposits from investors and pays them with high-yielding, low-volatility interest rates, resulting in stable and high-yielding savings. The network entices investors with high interest rates and the use of stablecoins to reduce exposure to crypto fluctuation.To borrow stablecoins, the borrower must first secure Bonded Assets (bAssets) as collateral before borrowing stablecoins based on the protocol-defined Loan To Value ratio.

Anchor Terra represents the stablecoins put on the network (aTerra). aTerra tokens can be redeemed for the initial deposit as well as earned interest, allowing interest to be collected just by keeping them.Anchor protocol is accessible to everyone, anybody can join and earn rewards from any third-party network.

Many people believe that anchor protocol will be the next big thing in savings since it is changing the savings process to a more decentralized structure, something that traditional financial institutions are unable to do. Investors in the Anchor protocol are rewarded with a high apy of up to 20%, compared to the 1% apy offered by banks. Investors can also make immediate withdrawals of their funds.

The governance token on the network is $ANC. The ANC token can be used to recommend how the community pool should be spent, to make network proposals, to vote on network matters, and so on.

Anc Stakers in the Anchor protocol receive 10% of network excess reserve and 1% of liquidated collateral. The protocol converts the UST gained to ANC. Anchor divides fees for all ANC stakers proportionally to their investment.

ANC is also employed as a means of bootstrapping borrow demand and ensuring the stability of initial deposit rates. Every block, the system distributes ANC tokens proportional to the amount borrowed to stablecoin borrowers.

In anchor protocol, there are five important players who are responsible for the survival of the protocol, these players are : Borrowers, Depositors, liquidators, Oracle feeder and ANC liquidity providers.

The next steps will show you how to link anchor protocol to Terra Station. Go to https://www.terra.money/ to access the Terra Station website.

To access the dapps available on the network, click to discover the ecosystem (the circled portion) after clicking the link, then click anchor protocol (circled).

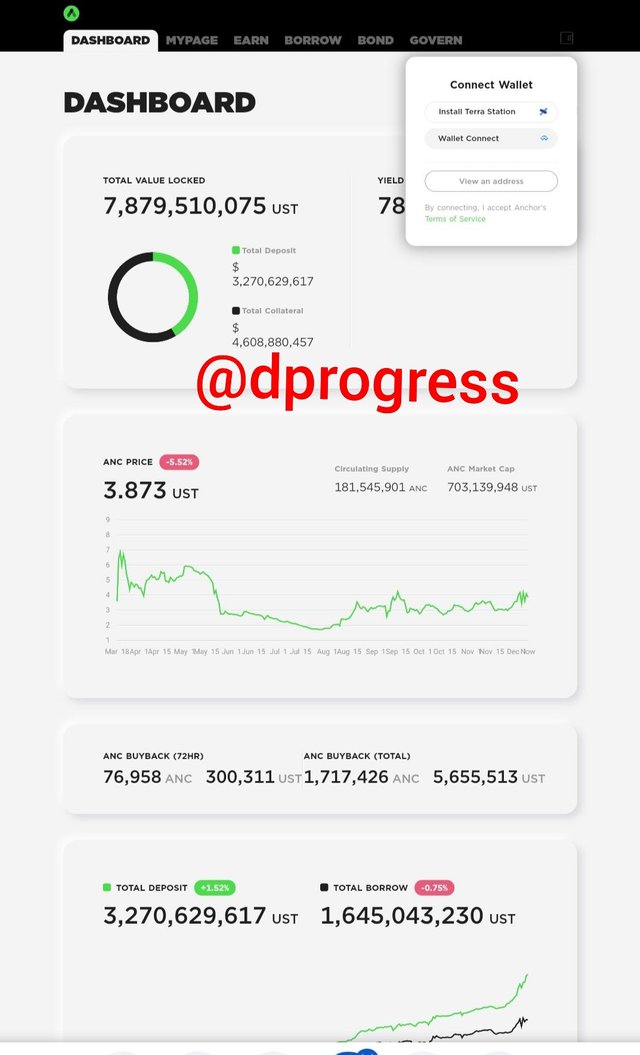

The protocol's homepage will appear; at the top of the page, click the connect button (circled).

You can connect using one of two methods: wallet connect or terra station wallet. Because I already have the Terra Station app on my phone, I'll use Terra Station Wallet.

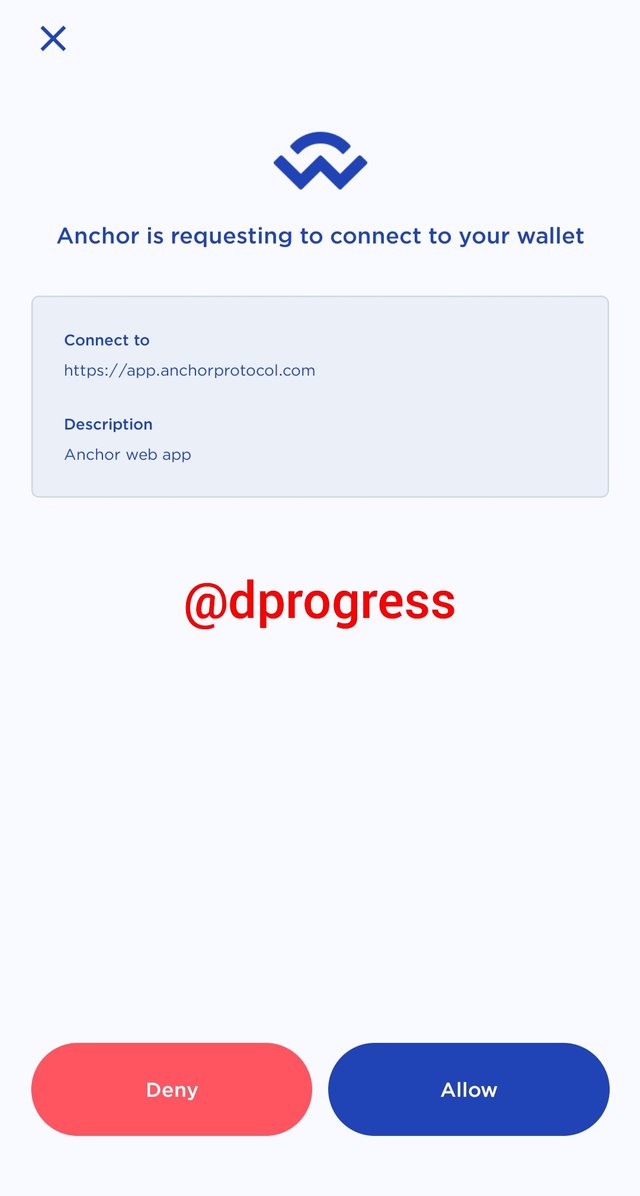

Wait for the site to switch to the Terra Station app, then click Allow when requested for permission to connect.

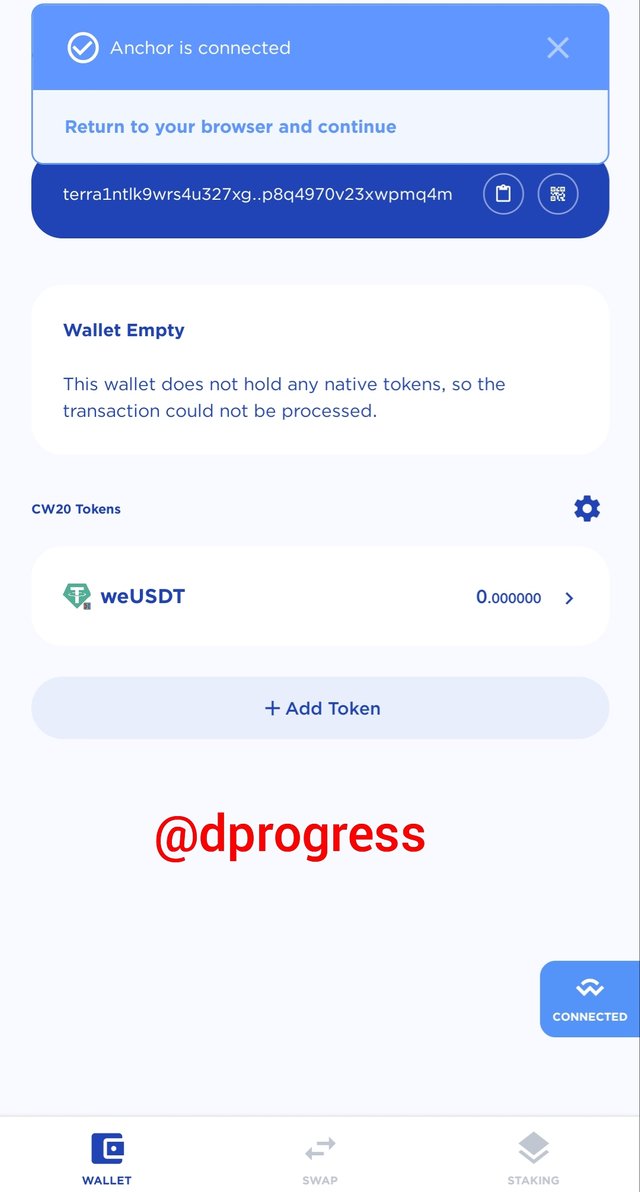

Your terra station wallet would be able to connect to the anchor protocol successfully.

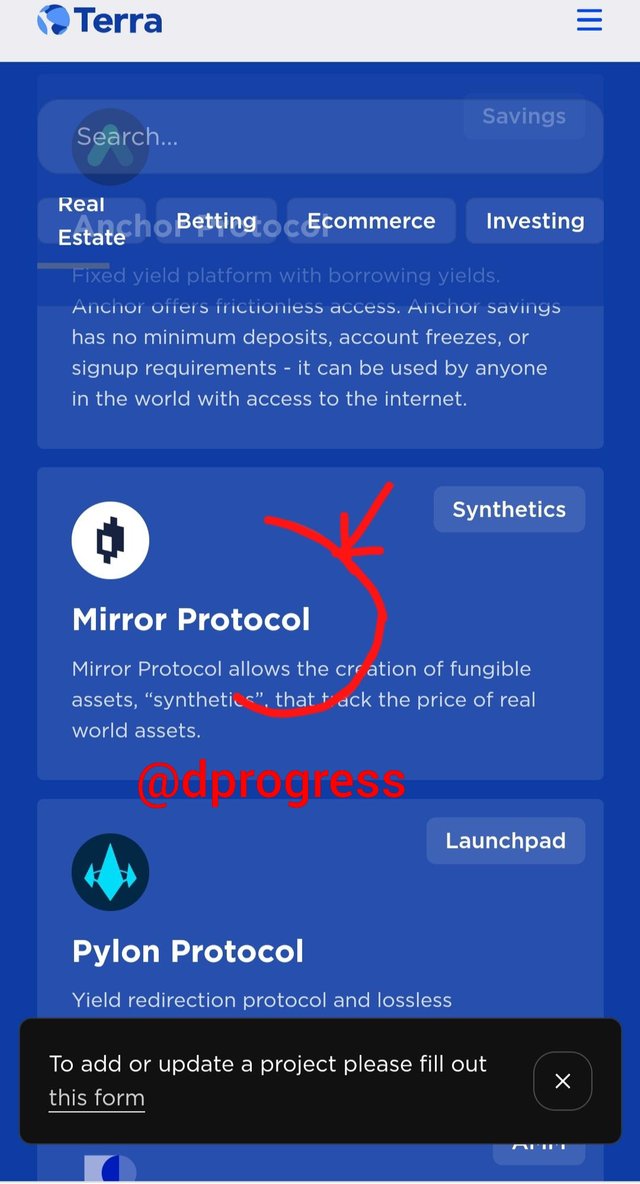

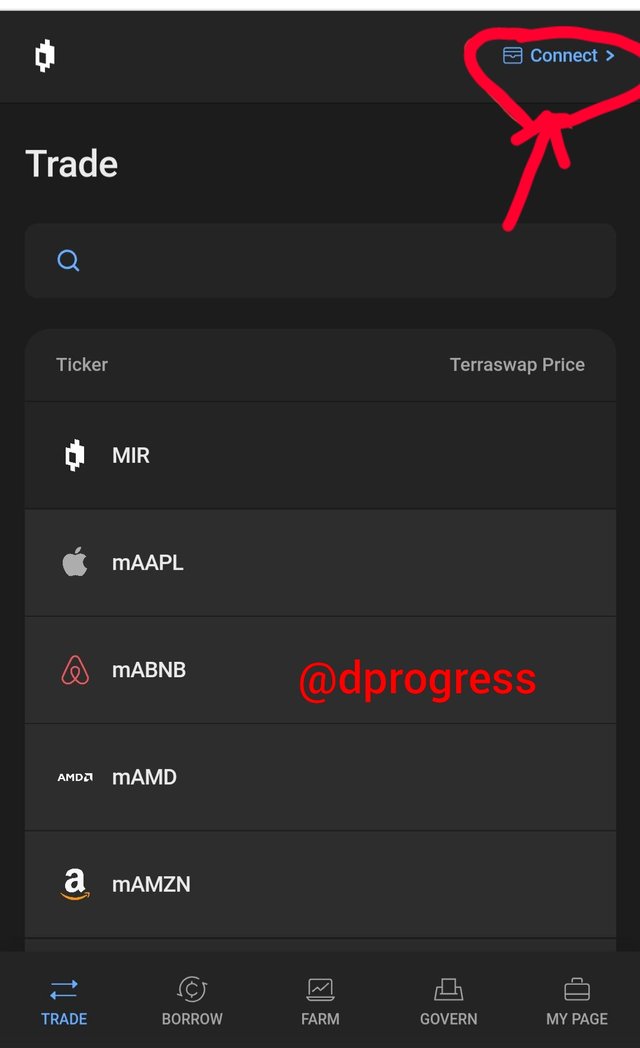

Question 3: Explain Mirror Protocol, connect Terra Station and explore the Mirror Protocol application. Show screenshots.

Mirror protocol is a Decentralized Finance protocol on the Terra network backed by smart contracts that allows the production of artificial assets known as Mirrored Assets or mAssets. mAssets imitate the price movement of actual assets and provide easy accessibility to price exposure without the need to possess or exchange actual assets. For example, without owning a single UBA share, you can have mirrored UBA shares. MIR is the governance token utilized on the network. Users must deposit MIR as a stake in the protocol in order to submit proposals and vote on them. Mirror Liquidity Providers and MIR Stakeholders Token holders are paid with MIR tokens, which are financed according to the MIR inflation rate.

Mirrored Assets are created by depositing a proportional amount of UST stablecoins and another digital asset as collateral.

A minimal 150 percent value ratio of collateral held in a CDP and the corresponding mAssets must be maintained by the depositor. The depositor must add a corresponding number of their collateral tokens when the price of the minted mAssets rises. The generated mAssets have the same price as the underlying asset without requiring ownership of the underlying. To receive a consistent data feed of the underlying asset's price, these synthetic assets require a decentralized smart contract, or oracle. mAssets are available for purchase on decentralized exchanges such as Terraswap and Uniswap.

To perform trades without pairing buyers and sellers, decentralized exchanges use asset pair pools. Mirror's mAssets and MIR tokens can be traded against UST stablecoins on decentralized exchanges. Liquidity providers supply asset pools on the DEX in order to obtain trading fees from completed orders based on their pool share. Liquidity pool deposits on Terraswap are redeemed in LP Tokens. Users can stake their LP Tokens on Mirror protocol to earn MIR inflating rewards as an enticement to generate enough liquidity to keep the mAsset value stable without relying on centralized market makers.

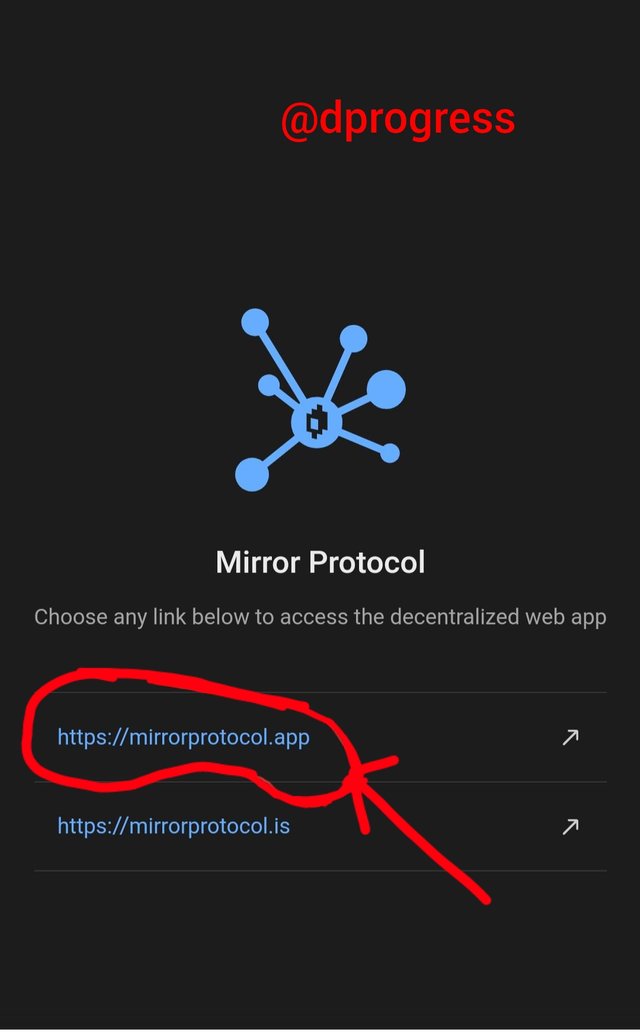

Let's discuss how to add mirror protocol to terra station wallet.

Connect to terra protocol site link, the official site is https://www.terra.money/(web browsing).

After clicking the link, go to discover the ecosystem (the circled part) to see the projects and dapps available on the network, then click on mirror protocol (circled).

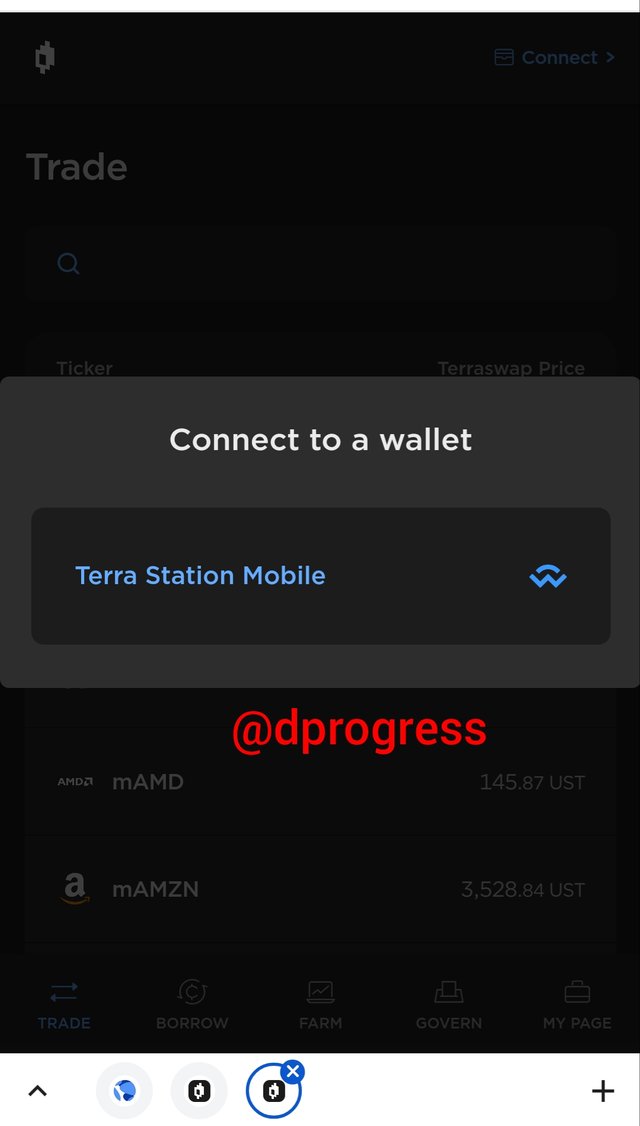

The protocol's homepage will appear; click the circled link to connect to the site.

To connect terra station to your web page, click on connect (circled).

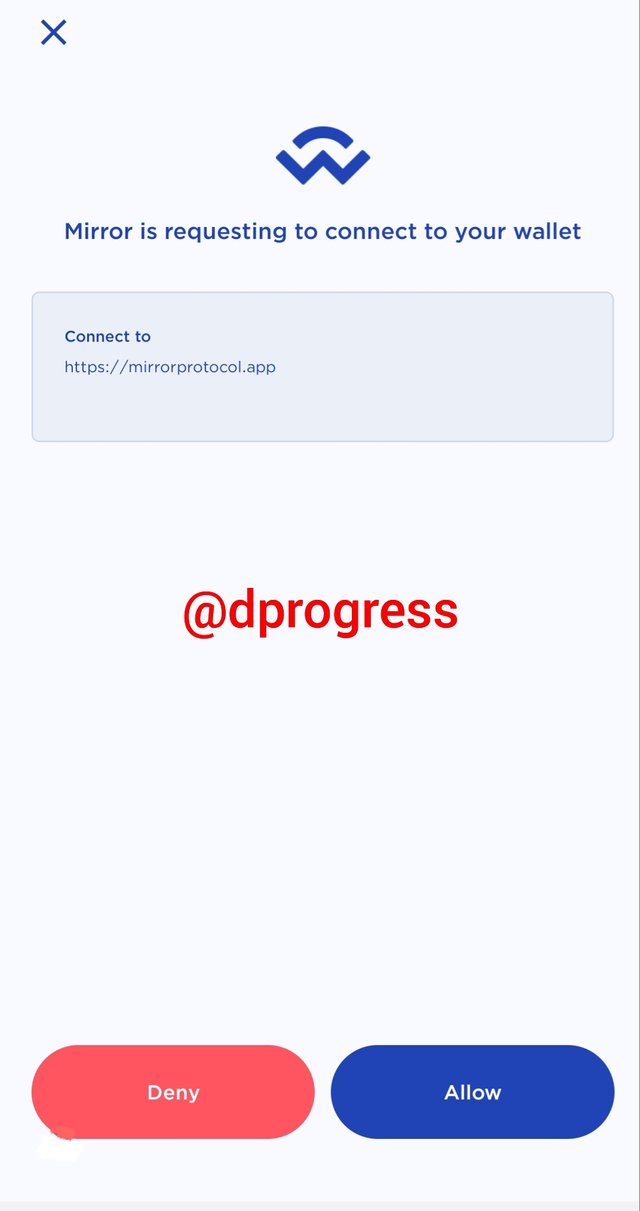

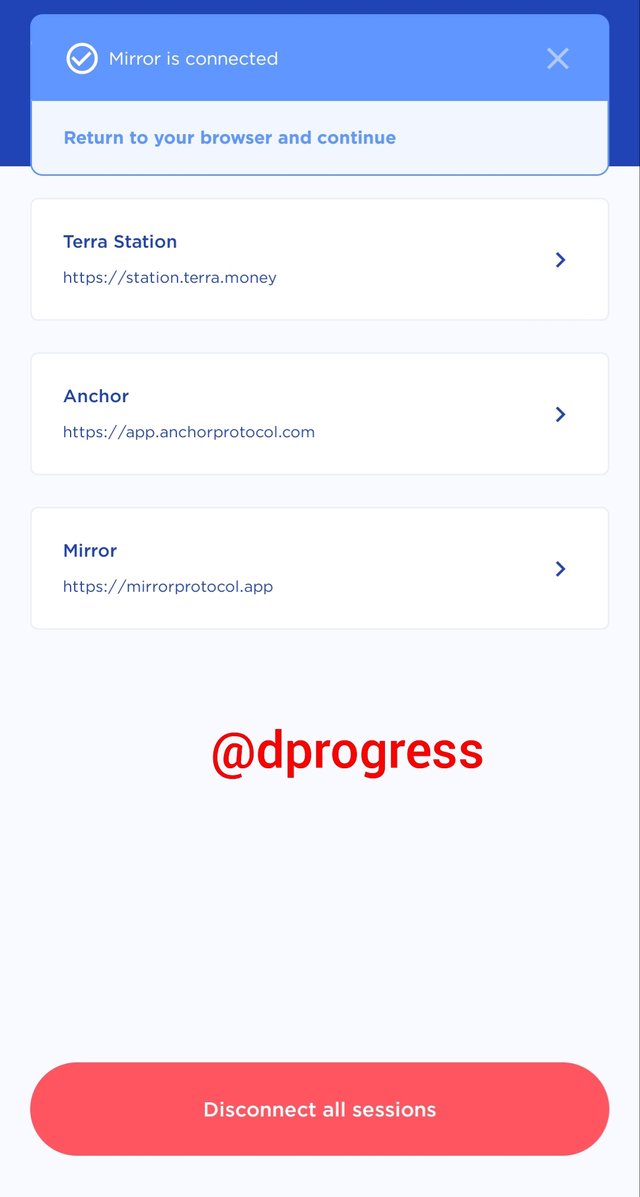

Click terra station mobile, Wait patiently for the site to switch to the app and also prepare the connection, then click Allow when it asks for your permission to connect. Mirror protocol would be successfully connected to your terra wallet.

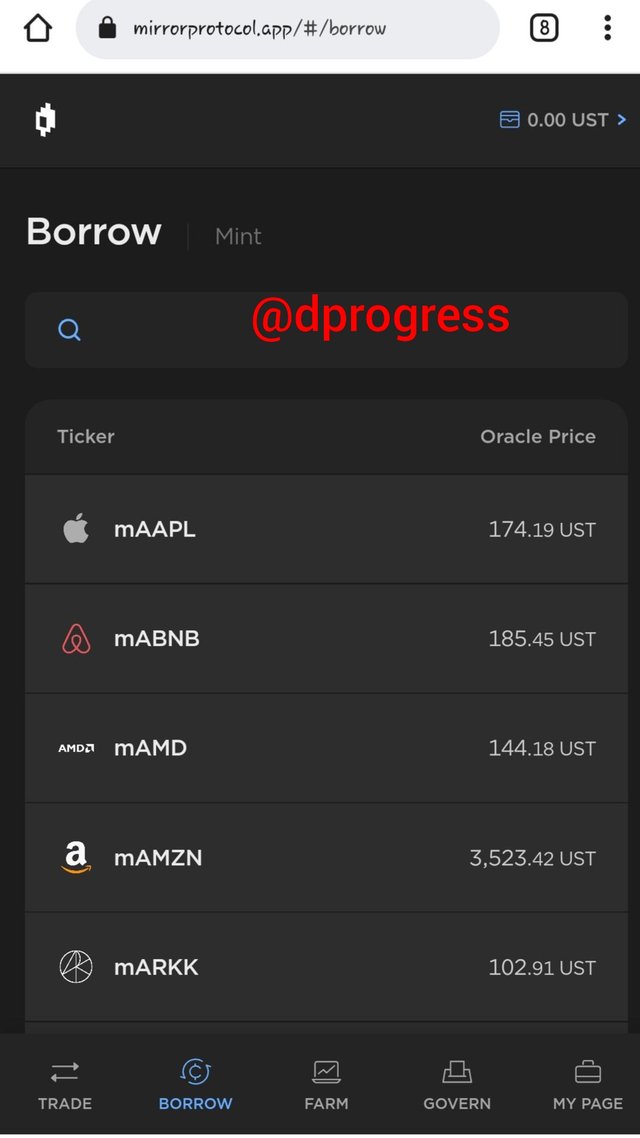

There are hundreds of artificial assets on the network, pick on any one you wish to trade.

Question 4: What is the Terra bridge? Explain, show screenshots.

Terra Bridge is a web based application designed to facilitate cross-chain transfers of all terra ecosystem coins. When a cross-chain transfer is requested, Terra Bridge generates a transaction in the structured format, encoding all of the essential data for the transfer.

A user must have compatible wallets like terra station installed in order to connect the Terra Bridge WebApp with the user-owned account on the source chain in order to sign transactions created using Terra Bridge. Also Before transferring a token, the user must provide information such as the asset type, source chain from which the transfer will be made, destination chain from which the token will be received, amount of token you want to send (you must have more than this amount in your wallet), and receiving account address.

Terra bridge is compatible with wallets such as terra bridge, Binance Chain Wallet, and Wallet Connect, among others.

Follow these procedures to link Terra Bridge to Terra Station:

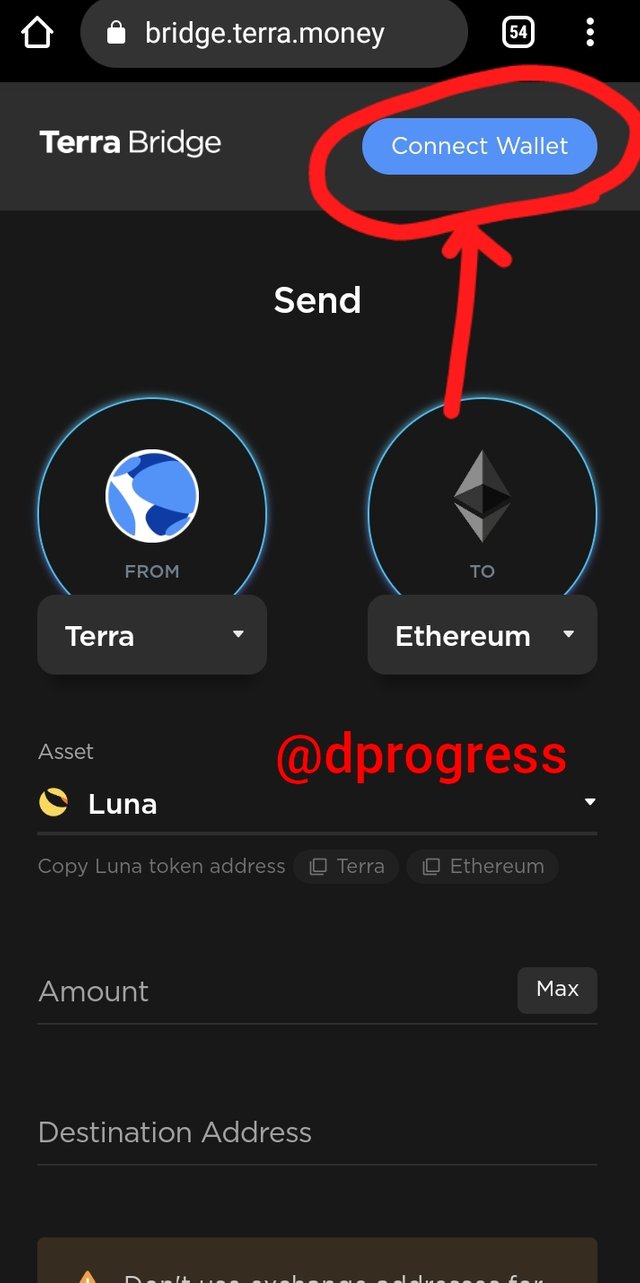

Click https://bridge.terra.money/ to go to the site's address.

When the page loads, tap Connect Wallet. Terra Station Wallet is the only wallet it links to.

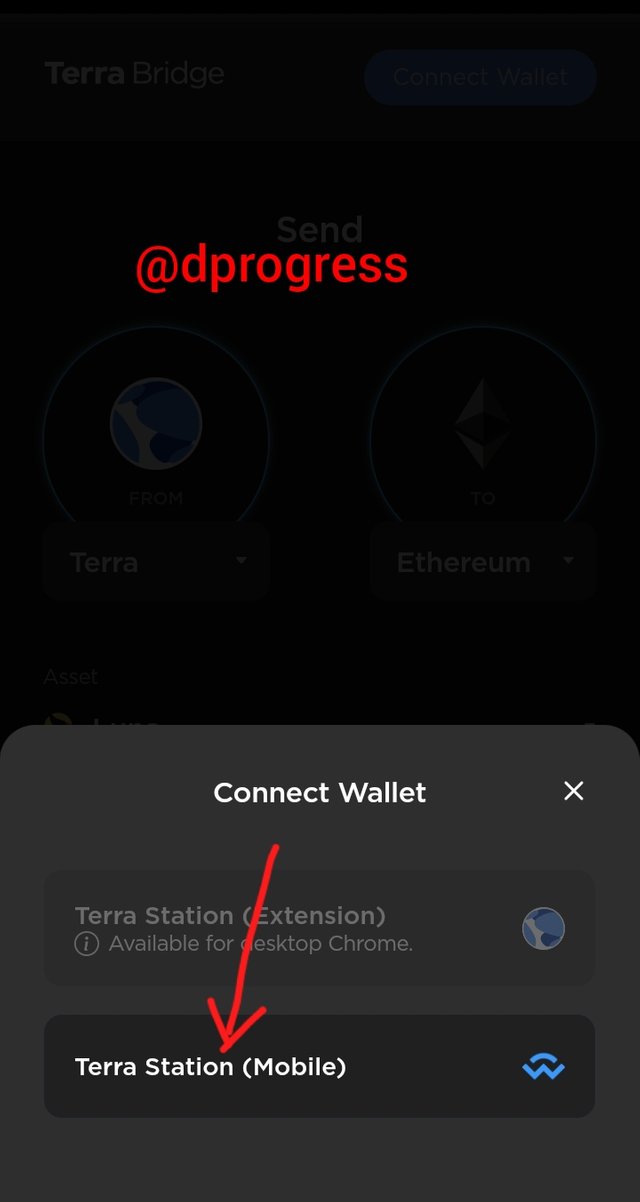

Click terra station mobile from the drop-down menu. Allow the site to connect to the app and prepare the connection while you wait.

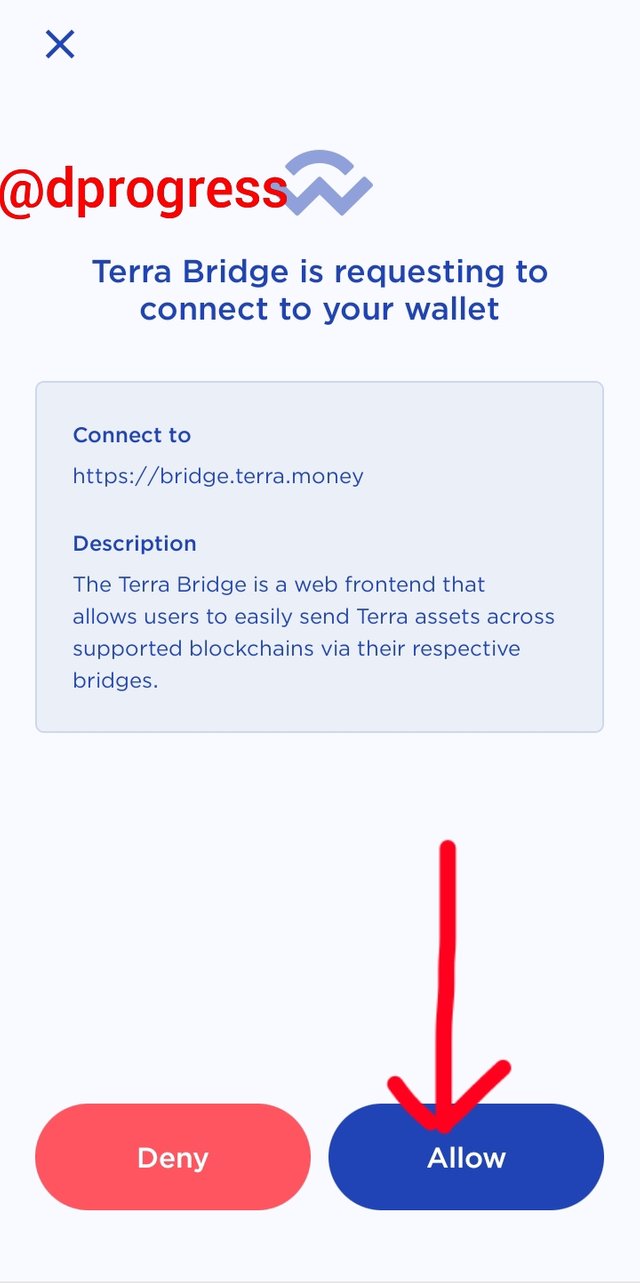

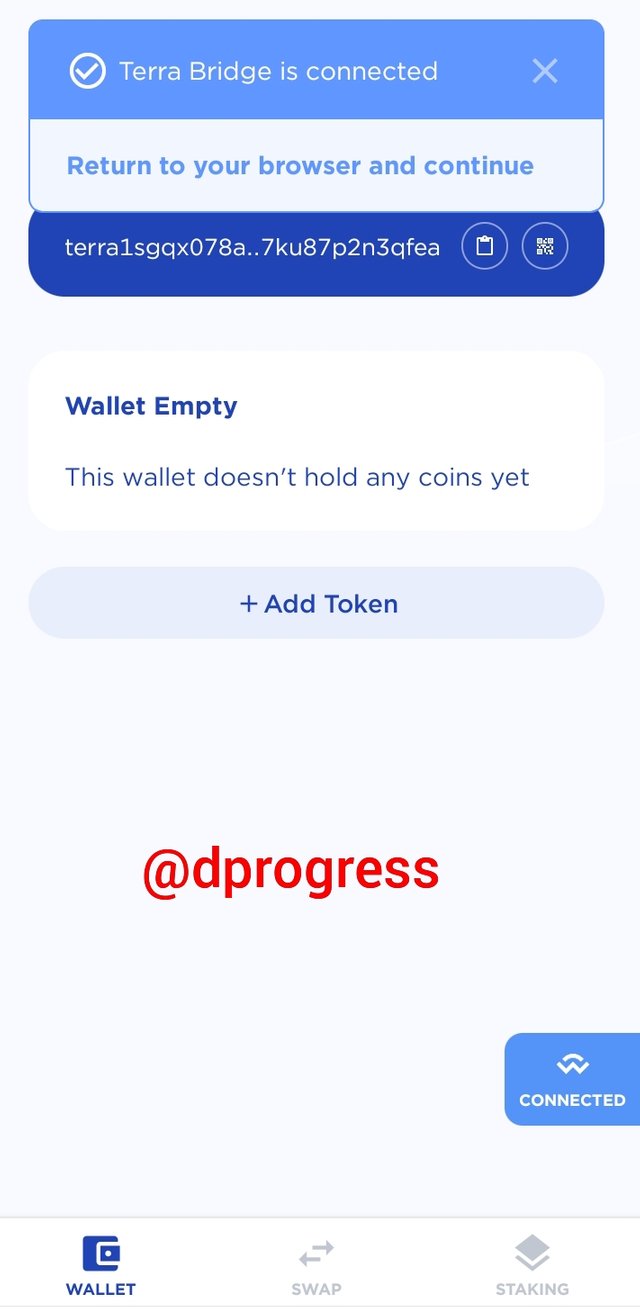

Click Allow when it asks for your permission to connect. Terra station wallet would be successfully connected to Terra bridge.

Question 5: Explain how it works and what the Terra Stablecoin are.

Stablecoins are smart contract-enabled cryptographic representations of fiat currencies designed to mitigate the risk linked with digital assets. TerraUSD (UST), TerraCNY, TerraJPY, TerraGBP, TerraKRW, TerraEUR, and others are among the stablecoins supported by the Terra system.

On the Terra network, fiat-pegged stablecoins and crypto-pegged stablecoins are collateralized in different ways. The holder of a collateralized stablecoin can usually trade it for an equivalent quantity of money or crypto.

The supply of Terra's stablecoins is controlled via algorithmic methods. Each stablecoin can be exchanged for the LUNA utility and governance token. Terra serves as a middleman for anyone wishing to exchange their stablecoin for LUNA or vice versa, affecting the supply of both tokens.

Let's look at an example. Let's say you want to mint $1000 worth of UST, which is equal to 1000 UST at the peg. To be able to mint the UST, you must convert an equivalent monetary worth of LUNA tokens. The tokens you supply would be burned by the Terra protocol. So, if LUNA costs $50 a coin, the system necessitates you to burn 20 LUNA to create 1000 UST.

Terra tokens can also be used to create LUNA. 1000 UST must be burned in order to generate $1000 in LUNA. Even if the price of UST isn't $1 per token, the minting exchange mechanism treats 1 UST as $1. This exchange process is essential because it is what ensures the price consistency of TerraUST. For example, if the price of 1 UST falls to $0.90, it will be $0.10 below the pegged value. However, for all Terra stablecoin to LUNA conversions, 1 UST is always equivalent to $1. Anyone looking to make money would purchase 1000 UST for $900 and then convert it to $1000 in LUNA.

The investor would profit $100 from the exchange and have the option of keeping the token or converting it to cash.

Seigniorage is the difference between the cost of minting the tokens and the value of the tokens.

This seigneurage is what keeps the token's value at $1 stable. We all know how demand affects pricing; an increase in demand will almost always result in an increase in price, therefore an increase in demand for UST will result in an increase in UST price.

UST will be burned during the Terra protocol's conversion to LUNA, reducing supply and raising UST's price, bringing the token back to $1 = 1UST.

Traders or investors can still profit from 1UST if the price is higher than $1. They can do so by buying LUNA and converting it to UST. For example, if 1ust is $1.01, an investor can buy $100 of luna and convert it to UST for $101. Because of the low demand for UST, the price will return to normal.

We can now see the importance of LUNA on the network.

Question 6: You have 1,500 USD and you want to transform it into UST. Explain in detail and take the price of the updated LUNA token.

I have $1500 and I want UST, the first thing to do is to look at the value of LUNA, the value of LUNA is $67.77 so converting $1500 to LUNA would give me 22.13 luna. This 22.13 LUNA would then be burned to give me 1500UST. We already know $1 equals 1 UST.

Question 7: Now you have those 1,500 USD and you want to make a profit, since 1 UST = 1.07 USD. Explain in detail and take the price of the updated LUNA token.

Seigneurage is what makes an arbitrageur invest in terra stablecoin, as an arbitrageur who's interested in making profit, this is how I'll do it with my $1500. The price of UST is already $0.7 above its normal pegged value. To make profits, I would buy $1500 luna at $67.77 per unit of LUNA which makes it 22.13 LUNA, then I'll convert it to UST, that is 1500UST. This UST monetary value would be $1605 instead of $1500 so I would make $105 profits.

Conclusion

Terra Protocol is a fantastic decentralized finance service provider in the crypto world; their stablecoins payment is excellent, and their service contributes to the global development of Blockchain. On the network's ecosystem, there are several projects that provide various roles, such as savings, betting, and owning synthetic assets. The Terra Station wallet, Terra Bridge, the straightforward method to apps and blockchain building, and the cross-chain asset transfer capabilities provided by Cosmos' interoperable IBC system all combine to create a top-notch blockchain ecosystem.