Assalam-o-Alaikum! |

|---|

Hello friends! I'm @drcypto1 from #pakistan and I warmly welcome all of you to my post. I hope that you all will be fine and will be enjoying your lives. Today I'm going to participate in the contest in SteemitCryptoAcademy The topic is "Trading Steem with the Wyckoff Method". There's lot to explore about this topic, Let's start the topic;

Question 1: The Three Fundamental Laws of the Wyckoff Method |

|---|

Wyckoff method was developed by Rechard D Wyckoff which enhance the trading ability of traders. This method is a set of different principles and techniques which is used to predict the behavior of market by analysing the volume and price movements in the market. Wyckoff method is proved to be very useful in trading the cryptocurrencies by analysing their next movements. This all is done by analysis their previous market history.

The Wyckoff method has three fundamental laws:

1. Law of supply and demand

2. Law of cause and effect

3. Law of effort vs result

Law of supply and demand |

|---|

Law of supply and demand is the fundamental law of analysing the market behavior. Supply and demand are reciprocal to each other which causes in the change of market trend in two ways:

Case 1: When the supply of specific coin is increase in the market as compared to demand than price will be down.

Case 2: When the coin is in demand and supply is low than the price will be high.

Application to steem:

By analysing the market trend of steem by using law of supply and demand the traders can check the selling pressure of steem making at sight at its supply and also check the buying pressure by making sight at its demand. And definitely by checking both supply and demand they can check which is dominating in the market whether the supply or demand.

For example if the price of steem in the market is high as happen in the early of this year, this mean the demand of steem is high in trading volume but alternatively if the price fall mean supply is overcoming the demand of steem.

Law of cause and effect |

|---|

The law of cause and effect in wyckoff method simply states that every cause will lead to an effect. In other words we can say that every action has a reaction. In cryptocurrency the cause is accumulation or distribution and the effect is uptrend and downtrend. Traders use the cause and effect law for analysing the upcoming uptrend or downtrend of crypto market.

Application to steem:

We can assume that steem token is accumulated by some big hands that's why it's price is will be high as supply of steem token will be low in market. The market will show uptrend in this case. When these accumulated steem tokens will be destributed it's upcoming price will be in downtrend.

Traders can make analysis of steem volume and price by using other's wyckoff principle to check whether the steem tokens are in accumulation zone or distribution zone. Thus they will be very careful before making their next move in trading.

Law of effort vs result |

|---|

This law highlights the relationship between effort and result. It compares the effort (trading action) with result (price movement). If the price the price is minimum with large trading volume than we expect a potential reversal. But if there's maximum price movement with little effort than we expect a strong trend.

Application to steem:

If the price of steem normal increase with no volume increasing of steem, it means this is a weak uptrend and price will decrease nearly. And if the price of steem decrease on high volume without dropping the price of steem significantly, it means steem market is absorbing the selling pressure and the price will be towards uptrend.

Question 2: Cause and Effect in the Wyckoff Method |

|---|

Law of cause and effect is crucial to understand in wyckoff method for analysing the market behavior. The cause refers to the accumulation and destribution phase, where the the tokens are actively buying or selling in the market. And the effect refers to the price movement in the market.

For identifying the cause we look at,

Accumulation: the period of quiet, sideways price movement, which is often happen with decreasing volume and this indicate the smart buying of token in the market.

Destribution:

When accumulated tokens are destributed in the market, the volume increases and by decreasing the demand the price indicate the downtrend.

Effect is happen after the cause, the effect of accumulation and destribution are reciprocal to each other. In case of accumulation the effect is in uptrend and in destribution it shows downtrend in the market.

Applying Cause and Effect to Steem’s Historical Price Data

We can apply cause and effect law of wyckoff method looking the steem price for early day.

Accumulation phase:

Date: January 17 2023

Open: $0.2080

High: $0.3486

Low: $0.2021

Close: $0.2973

Volume: $18.11M

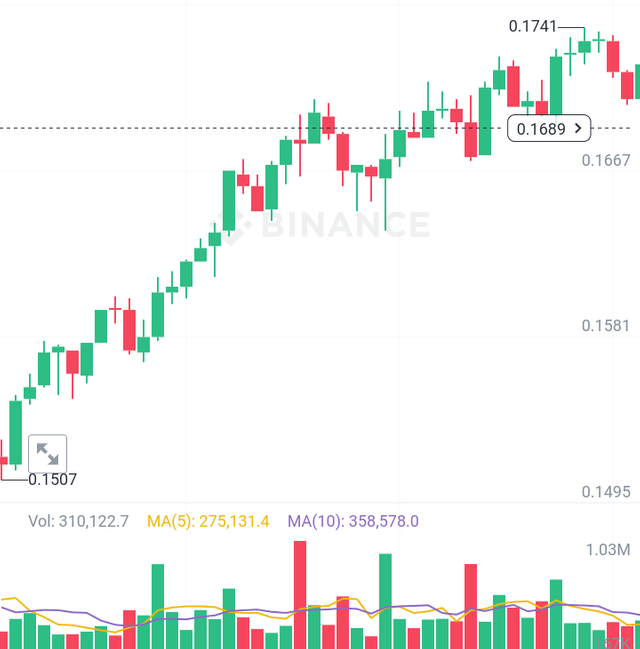

Here we assume that in January 2023 to April 2023 the steem price was between $0.20 to $0.30. This was the accumulation phase when big investors bought the steem coin and accumulate all for it's uptrend in the market. Than we see that steem price showed a high potential and price increased upto $0.34. We can apply it in recent situation as steem is showing a bearish trend and price is increasing now. Accumulation was the cause and it's high potential is effect. Look at chart 📉 below;

Destribution phase:

Date: April 15 2024

Open: $0.1647

High: $0.2291

Low: $0.1531

Close: $0.1716

Volume: $117.11M

In early months of 2024 the price of steem token is low as was in early months of 2023. It was occur when the investors or traders destributed the accumulated steem tokens. When the token destributed the steem shows the downtrend and price decrease to low ranges about $0.15 to $0.17. Here cause is destribution of tokens and it's effect is downtrend of steem price. See the chart 📈;

Question 3: The Law of Effort vs. Result |

|---|

The law of effort vs. result is also the key principles among other three laws. In this law trading volume (effort) is compared with the price movement (the results). If there's high effort but price movement is not significantly happen than it showing the signal that market is going to make a shift. If with minimum effort significant movement of price happened, it's showing the signal of weakening trend or false breakout.

Example of Effort vs. Result in Steem’s Historical Data

Let's check the actual price of steem for one day for checking that how the law of effort vs. result work;

1. Date: February 18 2024

Open: 0.2439

High: 0.2561

Low: 0.2332

Close: 0.2391

Volume: 11.5M

In this date we can see that market trend of steem is steadily moving. The market was open at 0.2439 but close at low price. This mean that trading volume was low and token was not get enough support by traders. There's little effort that's why the result was also uptrend.

2. Date: May 30 2024

Open: 0.3242

High: 0.3350

Low: 0.2877

Close: 0.2886

Volume: 41.32M

On May 30 same was happen, the price dropped to low but this was big movement. This is showing that there was low effort but there's a big price movement with low trading volume. In this situation traders should be very careful because price may be reversed soon.

understanding the Key Phases of the Wyckoff Methods in Steem Trading |

|---|

There are two unique phases of wyckoff methods, let's talk two these phases using steem token.

Accumulating phase:

When price is low big investors buy the currency also known as "smart money" and accumulate this money untill the price is trend to high. This is called accumulation phase. When big investors collect the money this cause the in decreasing the trading volume in market. After having low trading volume in the market, the price rise automatic.

Example from steem's historical data:

Date range: 11 September to 14 September 2024

Looking the price of steem during this that we examine that steem is gradually increased for last three days where price rise somewhat upto $0.18 from $0.16. This is the showing that steem is in accumulation phase. Investors are accumulating the token for it's gearing to uptrend in future.

Destribution phase:

This is the phase when accumulated tokens are destributed in the market. When this phase occur, the trading volume increases and this cause in the downtrend of the market. Before this stage investors sell all the smart money during mark up phase for preventing from any loss.

Example from steem history:

Date: June 2024

The month of June was turning point of steem price when the steem price rapidly decreased to low. Before this date steem was touching about $0.36 but than destribution phase occur and steem price decrease rapidly and reached at $0.19 in next month.

Applying the Wyckoff Method to Steem Trading: |

|---|

The Wyckoff method is a powerful method that enable the traders to understand the market cycle in the future. By using this method, below I'm sharing my knowledge about steem trading;

Step 1: First identify accumulation phase:

Before entering into the market for trading using steem token I will first identify the accumulation phase with the help of wyckoff method. This will make me enable to know about the market trend and I will be very careful about wether the price is gearing to rise or fall.

Supply and demand:

Getting knowledge about supply and demand of steem token in the market is also necessary as these two main strategies that helps traders to earn a handsome profit or getting loss in trading. Of I want to sell or buy my steem token than I will see the supply and demand, if the supply is low and demand is high O will selly token as at this stage I will get a high price.

Entry point:

After examined all the strategies about trading with the help of wyckoff method I will enter my assets in trading. As with the help of wyckoff methods I am already aware of market trend, than the chances of getting profit in trading will be high as compared to loss.

Exit point:

After that I will exit my assets in trading for selling or buying the certain currency. At the destribution phase I will exit my token for trading as at this phase the possibility of getting profit is high. This is how I will manage trading with the help of wyckoff method.

Conclusion |

|---|

So friends this is all about my knowledge about this topic. As a newcomer this topic was bit difficult for me. I have searched a lot for completing all the answers. No doubt there are many mistakes and points are miss iny content. I will doy best in next week. Hopefully admin will prove my entry. Thanks

I'm inviting @patjewell, @josepha and @aalirubab for participating in this contest.

Wyckoff is really important and interesting method. I have enjoyed writing about this method while understanding all its phases.

It was very interesting yo explore how each phase runs and how a new phase starts and how we can determine the current trend and the upcoming trend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This article is really important and informative, explaining the details of the Wyckoff method very well. The principles are explained and applied beautifully with Steem. Wyckoff is Three basic laws: The law of supply and demand, the law of cause and effect, and the law of effort versus result, are very clearly explained, giving examples of Steem in particular makes the post even more useful. The explanation of the article can be improved if more graphs and figures are included.

How has your experience been using this method in your trading? Did you make any significant profit this way?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit