Hello friends and family how are you foing, i am good. Today i am feeling immense pleasure while taking part in another contest and try to explain it upto my best knowledge the topic is Steemit Crypto Academy Contest / S15W2 - Stock to Flow Model.

1.- Explain in your own words the Stock to Flow Model, what is its function?

The most commonly used method to check the abundance of any definite resources called the stock to Flow method. It's commonly used for resources such as gold or silver and also for Bitcoin price estimation based on the methods of scarcity.

In simple words, it can be understood that if there is a higher value of stock to stock-to-flow ratio it means that particular Bitcoin has a better story., Moreover if the stock-to-flow ratio were lower it would be worse to store the value of particular assets.

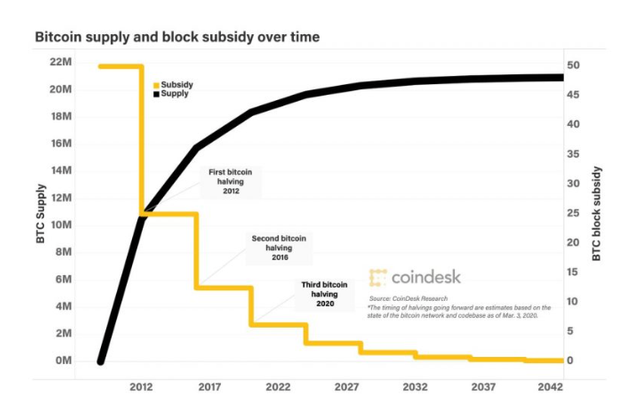

Similarly, analysts used the stock-to-flow method for the calculation of Bitcoin, which enables us the compare Bitcoin with other resources such as gold or silver. If we see in 2021 about 18,700,000 BTC had mined.

[Source](coindesk. com)

It's clear to us mining will decrease the amount of Bitcoin with every 4-year cycle. From the year 2017, the Bitcoin value was 25 which would be 121 stock-to-flow ratio by the year 2024 end, which means that Bitcoin is a more scarce asset in comparison to gold.

Hence, the stock-to-flow model become popular among Bitcoiners as it is widely utilized in the prediction of Bitcoin prices from time to time.

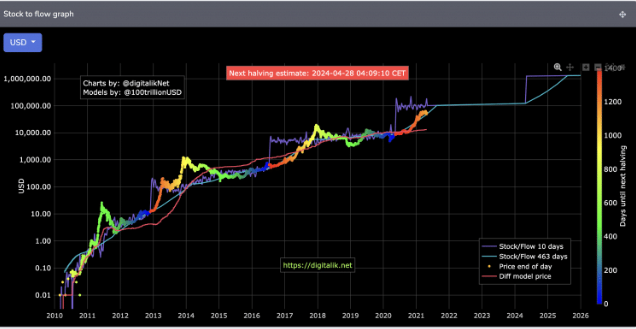

Furthermore the investor can easily predict Bitcoin price would be higher periodically through the stock-to-flow model, it can be as seen in the chart given below.

2.- What would be the advantages and disadvantages of the Stock to Flow Model?

Advantage of a stock to flow model is for the beginners investor trader who just start their business so this model is very easy for them to understand.

Shares a very easy to transfer because of transaction fees is very less and the other thing is it is in liquid so easily can be transferred.

It also protect all the investors from fraud so it is very secure.The price prediction is very easy and very accurate for the new investor and beginners because one and this model see the Bitcoin having and then give us the price prediction so it's easy for investors to invest.

And the scarcity of Bitcoin makes it more valuable and this is also place a very important role for the traders to invest.

But the disadvantage of it is that as the market keeps on changing so we can't hundred percent trust on the model and so there is a risk of loss sometime.

Transparency is not 100%

3.- Make an analysis of the Stock to Flow graph,

https://www.lookintobitcoin.com/charts/stock-to-flow-model

So this is basically representing the scarcity of Bitcoin and its price. Graph we are discussing three things the first one is Bitcoin price stock to flow model and the third dotted line is bitcoin halving.

So we are using a stock to flow model to see the Bitcoin price related to its scarcity. Like other assets like gold silver we need high scars. So this model is actually trying to give us the new supply of Bitcoin related to its already present supply and then calculate the price.

If we go in detail of stock it means the amount of Bitcoin which is present and flow means the circulating supply of the Bitcoin which is annually produced. So we can easily calculate the ratio of it by just calculating the current supply of Bitcoin and with comparison to and will annually produce Bitcoin. So this is really easy to understand whenever there is bitcoin Halving which is after every 4 years these stock to floor ratio increases substantially.

So this is very understand able from this chart that whenever does so this is very understand able from this chart that whenever the prices are beneath The stock to flow model line so for investor it is golden time to invest and whenever they see this graph the easy to understand when to do investment.

Source

And whenever we see that the prices are going up then the stock and flow model lines means that the prices are potentially touching the sky.

We can see the potential green and red area at the end of the column and where we can see that one this is green it means over extended prices. So this green area is basically time to accumulate.

So when we see the line just above the stock and flow line so this is the great time for the investors to so this is the great time for the investors to invest.

So if I sum up my discussion the stock to flow model actually treats the Bitcoin same as like gold platinum or silver and we called and this store of value where it is same as same like gold and silver but to increase their supply this is a very difficult thing because we need huge resources to mind gold and then find the resources and to save them for longer time so this need a lot of money and time.

Same like a gold and platinum it is very difficult to increase the supply of Bitcoin it is always in limited supply thats the reason that its price going up and up and the Bitcoin require a lot of electricity and a lot of mind to increase the coin price in millions so that's the reason of its limited supply.

But this indicator we used is to see the price of Bitcoin is very good and we can predicat the price of the Bitcoin because Bitcoin Halving and by comparing the events which occur before and after. We can assume when to invest and when we are at loss

4.- Can this model be applied to STEEM? Give reasons why this Stock to Flow graph model can or cannot be applied.

So can we apply the stock to flow model on the steem I think that's not possible because there are a lot of unique features which other cryptocurrencies have but the steem don't have

If we talk about the scarcity of Bitcoin which is a really unique feature unique characteristics of the Bitcoin but steem don't .

Another important thing is bitcoin having which is occur after every four years and this is also another uniqueness of Bitcoin and that's the reason we are applying this model to see the price of Bitcoin just because of its scarcity so steem also doesn't have.

And if we talk about both of these coins similarities yes both are cryptocurrency but if we see their rate of production it's entirely different although both have limited supply but steem is very less as compared to Bitcoin.

And the ecosystem of steem is also entirely different and a lot of factors which affecting the steem so I don't think so that we can apply this model to on the steem.

Its all about my today's post.

I would like to invite my friends @jannat12, @maryamnadeem and @iqrarana786 to participate in the contest.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well my dear friend you have wrote so well that when I see your post I think you have search a lot and answer of each question is so much detail and containing the key content and you are one of the best content creator I have seen and the hard work I have seen of your you are doing great and best of luck for your participation thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Los niveles de escasez de un producto es determinante en su precio dentro de un mercado donde priva la ley de la oferta y la demanda. Por lo tanto, el modelo S2F que se base en la escasez es aplicable con éxito al BTC para pronosticar su valor dada las características propias del BTC con oferta limitada (stock) y suministro fijo (flujo), ambos parámetros medibles.

La escasez es el fundamento del modelo y en BTC el halving se encarga de incentivarla cada 4 años por lo que el modelo se acopla bastante bien y lo podemos observar en la gráfica para el análisis. No es perfecto pero ningún modelo matemático lo es.

El halving ha jugado un papel fundamental en la determinación del precio del BTC por la escasez que produce y es una ventaja que no tiene otra criptomoneda.

Estoy de acuerdo en que este modelo no es aplicable a STEEM por tener características de tokens muy diferentes al BTC para el cual fue diseñado.

Gracias por compartir, ¡saludos y éxitos!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello friend it's really a pleasure coming across your article once again I must say you have really proven to be such a quality and very powerful contest creator on this ecosystem and I really appreciate your good job on our Blockchain.

That is one of the basic rules of this stock flow model this model is focused I'm using historical data to easily predict prize movement of scarce asset like that of Bitcoin and Gold

Thanks for going through remember starrchris cares ❤️. Please drop a comment on my post https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s15w2-stock-to-flow-model-or-or-modelo-stock-to-flow

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing your insights on this topic!

Considering these differences, it's essential to recognize that not all cryptocurrencies can be analyzed using the same models and methodologies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@drhira

Yes you are absolutely right stock to flow model methodology is used to calculate bitcoin and gold and silver and to estimate its shortfall so to speak what you He further calculated that there are 18.7 million BTC in existence, but after that, if you calculate from 2017 to 2024, then BTC had little growth before, but in 2023, 24 The price of the coin has continued to improve and if we talk now the current price is over 1 crore 2 million which means it is going to improve further as we know that the price of bitcoin will be halved in mid April. And if you talk about it, you have explained all the post in a promising way, it's really worth learning and I hope you get success in the competition, all the best to you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Stock to flow model is very well explained by you and you are right that this model should not be implemented due to several reasons at steem blockchain

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit