Hello guys, hope you are all doing well. We are probably in last week of season 5 and it has been very fruitful like other seasons. Today I am writing homework task for professor @fredquantum which is about Dark Pools in Cryptocurrency.

Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Dark pools also know as dark pools of liquidity are actually the private exchanges that facilitate large volume trades placed by Institutional investors without displaying these orders on the order book. The word dark in dark pools point towards the anonymous nature of these trades or we can say, for lack of transparency as these orders are not accessible to vast majority of public investors.

The purpose of creation of dark pools is multifold. Let me enumerate and explain some of the benefits below :

Dark pools prevent wild swing in price of securities because large volume trades can otherwise trigger panic or euphoria in the market and cause price to surge up or down. Such large volume trades are known as block trades.

Secondary gain accrued out of block trades is the selling or purchase of assets on better price than block traders would get otherwise.

Block traders would get block orders fulfilled rapidly as these dark pools are especially dedicated for institutional investors.

The identity of the investor is totally anonymous for rest of the investing community.

Working of Dark Pools.

The block traders place sizeable amount of orders in the market at a fixed price. Such orders are known as limit orders. Limit orders are useful as they are fulfilled at a particular price that is predetermined by investors. So investors are not subjected to slippage risk. However, the execution of limit orders is not guaranteed. The order is fulfilled if limit price is reached and may remain open, if limit price is not reached. As dark pools don't have order book to list the orders, so wild swings are prevented.

Suppose an investor A want to place a sell order worth 1 million US dollar for any cryptocurrency X. If the order is recorded on a publicly accessible order book, it would trigger panic in the market and cause significant decline in the price of X . Reverse can be seen on buy orders. Such price fluctuations are prevented by dark pools.

Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

We are going to talk about Kraken exchange. Kraken is a US based securities exchange that has been serving traders fo4 more than a decade now. Since its launch in 2011 , Kraken has been performing outstanding. It was the first US exchange to receive state-chartered banking license. The poineer service that Kraken was able to offer includes margin, index and derrivative trading.

The dark pools of Kraken started with BTC and was soon extended to include ETH. Since than Kraken has become a hub for institutional investors who are involved in BTC and ETH block trades. The different trading pairs shall be discussed in next section. Kraken dark pools are not visible to all the investors but are seen by only those who meet the requirements . So these pools are anonymous order books that are not visible to others and are not going to impact the market psychology.

Limit orders are placed by financial institutions on Kraken which are than matched with orders of counter parties. As these pools are used by large cap investors, they faciltate execution of trades between like minded investors without significant fluctuations in price of assets involved.

What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

Kraken Exchange Dark pools

As mentioned above , Kraken supports Ethereum and Bitcoin based dark pools. we will mention different trading pairs of BTC and ETH with other coins or Fiat. It is noteworthy that, in addition to the different trading pairs of Bitcoin and Ethereum, there is also BTC/ETH pool available.

BTC based pools

- BTC/CAD

- BTC/EUR

- BTC/GBP

- BTC/JPY

- BTC/USD

ETH based pools

- ETH/CAD

- ETH/EUR

- ETH/GBP

- ETH/JPY

- ETH/USD

Requirement of Kraken

- The block traders are anonymous which means that nobody knows which is market maker and which is market taker but for exchange a trader has to be verified up to Pro level before being able to start dark pool trading on Kraken.

- The dark pools trading also known as blcok orders are so called because of their large trading volume. The minimum amount for BTC is approximately $100,000. orders less than 1lakh dollars are not going to open.

The minimum amount for an ETH based pools is approximately $50,000. A trader has to place orders worth $50 000 for any trading pair.

The orders placed are limit orders and therefore one must be aware of all pros and cons of limit orders before taking part.

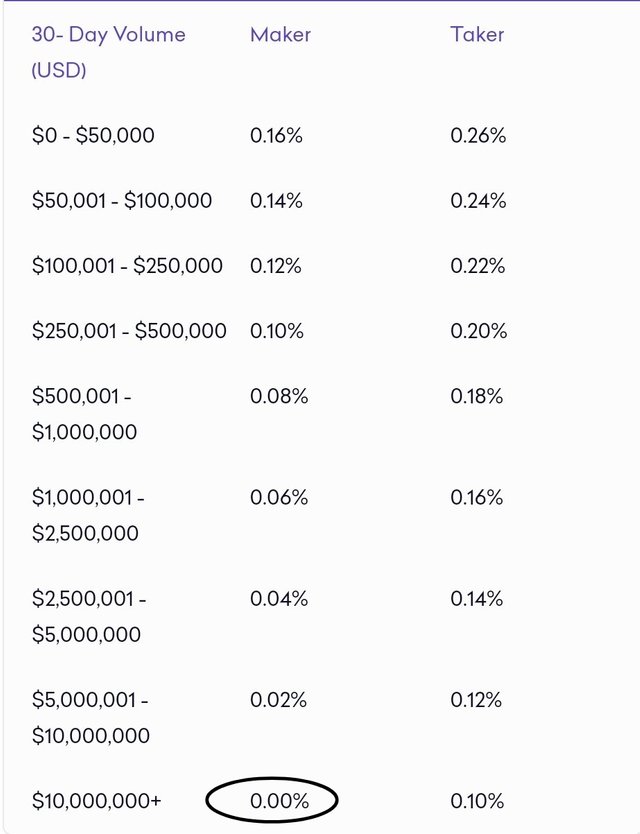

Fees Attracted

source

The fees range from 0.20% to 0.36%. Discounted rates are available for large volume traders. . Market mamer fee tends to zero for orders above $10 000 000 .

For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

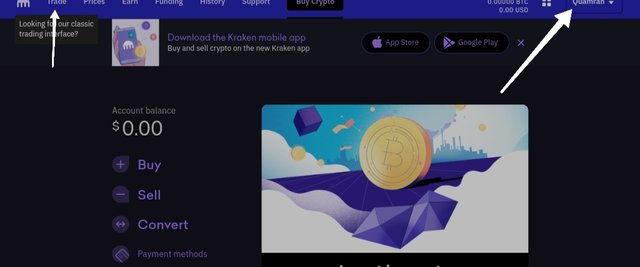

For performing block trading , a trader must have KYC verified account ( pro level) .

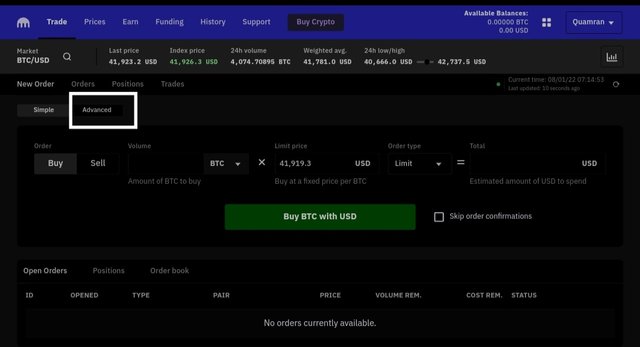

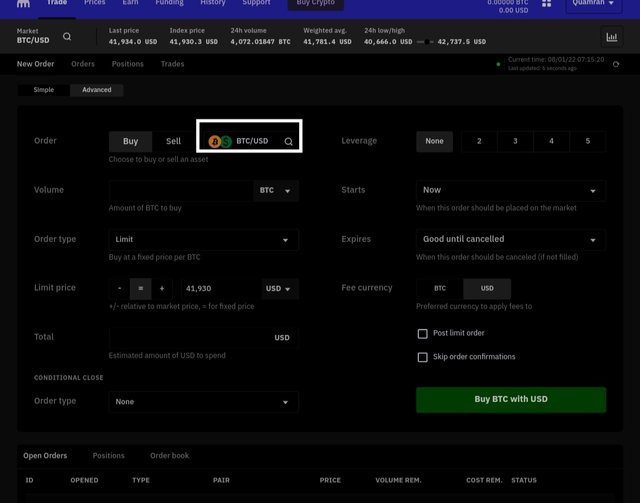

Once done, than from the main page of Kraken click on "Trades" And than select "Advanced" option and we will land into "New orders" Tab.

Dark pool trading pairs will open They are tagged with extension "d".

Select any trading pair from available dark pools and place limit order.

Orders must match, minimum amount criteria to be opened on the Kraken dark pools.

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

Having already said that, dark pools are so called because they lack transparency as order book is not visible to general public but is known to broker. The decentralised dark pools go one step further into the anonymity of dark pools and make decentralised dark pools as anonymous to the broker as they are to the investing public. Decentralised pools are completely free of any control by any third party. It seems quite similar to defi trades but it is worth mentioning that it differs from regular defi operations in being independent of regular AMM liquidity pools . Instead the operation of these pools is governed by zero knowledge proof and executed through process of Atomic Swaps.

Atomic swaps involve breaking of block order into multiple small sized orders and their independent execution by nodes followed by final integration to yoeld exactly the same results as anticipated but at significantly better yield in terms of time and monetary value. The problem of liquidity is tackled alongside slippage with atomic swap.

Zero Knowledge Protocol (ZKP)

Zero knowledge proof is a cryptographic protocol which involves two parties named prover and verifier. The prover needs to import onliy that much of knowledge to the verifier which is necessary for verification of the statement or information or transaction. No additional information than that required for verification of the transaction is shared. Sharing of any additional information would disrupt the sanctity of the protocol. The verifier must be satisfied beyond any doubt about the possession of details of the statement or transaction by the prower upto the extent that verifier can convince others but doesn't have any additional information to share with others as that would mount to leakge of information.

ZKP is categorised into two types like interactive and Non-interacrve ZKP. They are further subcategorised into four types and they are, SNARK, STARK, SNARG and VPD. These subcategorised ZKPs are vast subjects in itself and sre beyond scope of this topic.

State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

image.png](

One well known decentralised dark pool protocol known as Ren protocol was founded in 2017 Taiyang Zhang and Loong Wan . Actually protocol was launched with the name of Republic Protocol but was renamed in 2019 to its present name as "Ren Protocol*.

The Ren darkoool supports BTC, ETH and ERC 20 tokens. This DeFI dark pools incorporate atomic swaps to execute block orders. As mentioned above, atmoic swap involve fragmentation of orders into multiple small orders and distributea them across multiple Darknodes. Technically, republic protocol call it as Shemir secret sharing scheme as orders are shared anonymously by the darknodes. As mentionsd earlier, darkpools make use of proof of Zero knowledge and the two parties corresponding to prover and verifier are known here as "Registrar" and "judge"

Following principle are upheld during the whole process:

The identity of the investors is kept anonymous through out.

No information is available regarding liquidity of Ren protocol during any phase.

Minimum details are shared between trading parties after successful execution of trades but the details do not compromise sanctity of pools anyways.

Trading parties have no role in order execution once order is placed. They can disconnect from the network after placement of trade. Order execution is done by matching computational power of darknodes.

Darknode participants are incentived for their honesty. any malicious attempt spotted is disadvantageous for partisans as reward mechanism is set in that way. These nodes recieve incentives in REN token. Nothing more than amount of REN that a node is going to recieve after matchimg the order is known to participating nodes.

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

Crypto centralised dark pools

These exchanges require KYC verification by investors. Although identity is anonymous to trading parties but is known to brokers.

Orders are facilitated by third parties or brokers on centralised pools.

Orders are executed as a whole unlike decentralised pools.

Orders are fulfilled from liquidity pools not AMM or smart contracts.

Centralised pools have considerably higher user base and have better liquidity.

Decentralised pools

No third parties or intermediaries are involved .

Atomic phenomenon of trade execution is in place and therefore involve multiple nodes. No liquidity pool or AMM based execution is in place.

Smart contract based trade execution is in place to ensure elemination of third parties.

Decentralised pools are more anonymous than centralised pools.

The issue of liquidity on decentralised exchanges is tackled by splitting of orders.

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

We are going to talk about sale of BTC that was done on 3rd November 2021 by some financial institutions or whale on coinbase . A market order worth 254 BTC was placed on coinbase which amounted to about 15 million USD at that time. The price of BTC was around $62.5K . With this block order the price dropped by about 2.5k$ per BTC . Athough the dip was transient but caused significant drop in price of BTC.

So we have noticed the impact of large cap orders on the price of assets. It is obvious that the Whale Or financial institutions that placed such a large volume order would have got their order fulfilled over various prices because of price dip and nature of order ( market).

Had rhe financial institution or whakes placed a dark pool order, they would have got their order executed at a fixed and better price. They wouldn't have had to encounter sloppage loss as they did in market order. Moreover, there wouldn't have been such a noticeable crash in the price of BTc.

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

Market price of assets is dependent upon and driven supply - demand dynamics. When demand increases , price increase and vice versa Since dark pools do not reflect the orders on order book, they are not able to arouse the sentiments in the market and therefore despite being large cap in nature, dark pools do not significantly change market price.

Let's presume a buy order is placed worth 1 million dollar for any asset on an exchange publicly accessible to all. When such orders are seen by other investors all will plunge the market and therefotre demand will increase and cause sudden upsurge in the price of asset. On the contrary, if the above order is of sell type, it will trigger panic in the market and investoes will resort tk mass selling and increaae supply and thereby distort supply demand dynamics of asset and push price of asset down.

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages of Dark pools

Significant fluctuations in price of traded securities are prevented. It is possible because of anonymity of orders on dark pools.

Block orders are facilitated because these pools are meant for institutional investors. It is easier to get block orders executed on dark pools than on other exchanges.

Traders are not subjected to slippage risk .

Investors are likely to get better and predetermined prices because of anonymous nature of trades.

Dark pools trades are not subjected to exchange fee and therefore lower transaction fee.

Disadvantages of dark pools

Dark pools lack transparency and may at times result in manipulationof orders by brokers.

At times, Investors may get better price otherwise but not within the dark pools.

Conclusion

Cryptocurrency dark pools are private exchanges aimed to facilitate block trades anonymously so that there is no significant variation in price of asset. The dark pools being heavy volume trades have potential to cause significant fluctuation in the price of asset if these orders were visible to investing public . Since these block orders are not visible, they are executed by darknodes on predetermined prices.