Describe the psychological progression of investors through the stages of optimism, excitement, euphoria, anxiety, denial, fear, despair and hope. How does each step influence investor behavior?

The concept of market psychology in the context of the market cycle is one of the fundamental components to understand for becoming a successful investor. Before discussing the best picks of the task, let's understand the concept of market psychology and the market cycle. Market psychology refers to the aggregate sentiment of all market participants at any particular point in time. The aggregation of individual trader psychology leads to the formation of market psychology.

We know that the market cycle of a particular asset goes through cyclical price changes that compose the bullish phase and the bearish phase of the market cycle. We also know that the market neither always goes straight from bottom to top nor comes straight down from top to bottom but follows some sort of zigzag pattern while going up as well as coming down. Each of these phases of the market cycle is driven by the participation of traders or investors in the buying and selling process, which are influenced by the psychology of the traders.

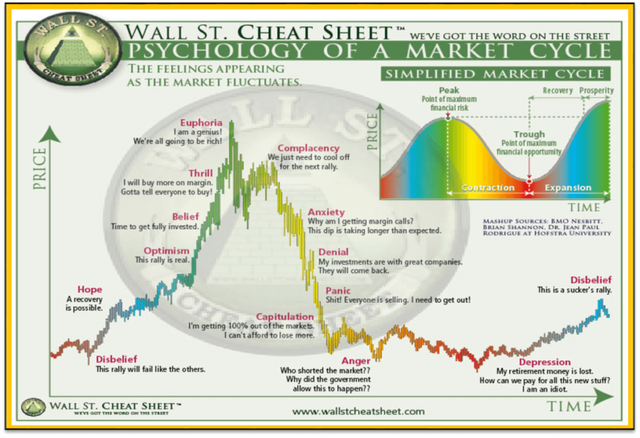

Now I will explain different emotions that arise within the trader's mind during the bullish and bearish phases of the market cycle. Let's carefully look at the image below. We can see that different emotions are associated with different periods of the bullish and bearish cycle, and it is the interplay of these emotions that constitutes the psychology of the traders, which determines the market movement. To form the concept properly, let me explain each of these emotions as depicted in the image to solidify the concept and better understand it. Let's start from Hope.

Hope: This phase occurs at the beginning of a bullish rally and marks the start of the positive phase of the market cycle or the end of a long bearish rally. During this phase, we begin to witness signs of recovery in the market.

Optimism: During this phase, our hope turns into reality as signs of recovery become more certain, marked by the progression of the price in the upward direction.

Belief: During this phase, people start believing that the bull market has set in and begin to invest their money with the hope of gaining substantial returns. Consequently, investors invest their funds in bulk, triggering positive sentiment in the market to capitalize on their returns.

Thrill: This phase represents the time when people become overly obsessed with their investments. They may go to great lengths, such as taking loans or selling possessions like gold or cars. I have personally experienced this phase during the previous bull run of cryptocurrencies. During this phase, people believe that their investment decisions will make them rich.

Euphoria: This is the peak of the cycle where people believe they are invincible and are driven by a single emotion: greed. At this point, it usually marks the moment when whales and large institutions begin to withdraw their profits, starting the bearish phase. It is the overflow of the emotions like Thrill and Euphoria that FOMO comes into play and people bid for prices and pay inflated prices willingly.

Complacency: This occurs during a normal price retracement at the beginning of the bearish phase. At this point, the whales usually withdraw their profits. Contrary to this, most people believe that the price will recover and therefore hold their positions.

Anxiety: As whales have already booked their profits during the complacency phase, smaller investors lose hope of a retracement and exit their positions in fear, further driving the price down.

Denial: During this phase, people find their investments at significant losses but are unable to accept this fact easily. They start consoling themselves with statements that it is part of the market cycle or that their investment is in safe hands. We can see that during this phase, people justify their losses.

Panic: Because of significant losses, people realize that everyone is exiting their positions, and they sell their assets at a loss due to panic triggered by the market's bearish trend.

Anger: Disillusioned and frustrated investors begin to take out their anger by blaming the government and other authorities. People feel justified in demanding regulatory authorities to prevent their hard-earned money from being wasted in this way.

Depression: When the market remains in a dip for a prolonged period, investors become depressed and hopeless about market recovery. They begin to accept that their investment is lost and start looking for alternative means to pay off their liabilities.

Disbelief: This is the phase of sudden spikes in the price of an asset after a deep bearish rally and a prolonged phase of consolidation at lower values. During this phase, the majority of retail investors are so disheartened that they view every movement with suspicion, perceiving it as a trap. This will be followed by the hope phase as mentioned at the beginning.

Using a chart showing a recent movement in the price of a cryptocurrency (without date/time), identify which emotional stage of the market cycle the chart likely represents. Justify your answer by discussing behavioral signs that investors might exhibit at this stage.

For this section, let's analyze Bitcoin's chart on a weekly time frame.

BTC/USDT chart on a weekly timeframe

From the chart above, we can see that the market is somewhere between the boom stage. The core characteristics of the boom stage are rapid growth and investor optimism. The rapid growth of Bitcoin can be clearly seen from the green or bullish rally of the price, and the optimism of traders is evident because it is only due to their optimism that Bitcoin has been able to break the previous high. Moreover, the positive environment created by the approval of the Bitcoin ETF earlier and the Ethereum ETF recently is likely to push the price of Bitcoin to the next level. The price predictions for Bitcoin made by some giant fund houses have also contributed positively.

The behavioral changes that are dominant during the boom stage are optimism and belief in the project under consideration. I believe the thrill phase of emotions will surface in the market shortly when Bitcoin breaks the recent high and starts making new all-time high prices. It is worth mentioning that we are yet to witness the three stages of Euphoria in Bitcoin's growth. Therefore, Bitcoin still has a long journey ahead. It is also important to mention that Bitcoin has already given more than 4x profit from the bottom, so any entry into Bitcoin at this stage, in euphoria or thrill, is not likely to give multifold returns. However, I believe that in the long run, Bitcoin still has the potential to give 2x profit. I am of the opinion that in this bull run, Bitcoin will go somewhere between 100,000 to 120,000 dollars. However, a sensible strategy would be to wait for some correction to occur and then make an entry.

Examine a specific incident where significant FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) impacted the price of the STEEM token. Discuss how this sentiment influenced trading behaviors and the price of the STEEM token. Also suggest strategies that STEEM investors could use to avoid making decisions driven by these emotions

Discuss how an incorrect mindset, such as the belief that "this time it's different," can affect an investor's decisions and potential returns. How does this mentality typically affect a person's performance in the market during volatile phases?

I have myself been the victim of this belief that "this time it is different" and found my data and assumptions to be incorrect. As a result, I faced potential losses during a volatile market phase. Let me share why I incurred these losses with this mentality and what are the probable causes that can lead to such losses.

I remember during one particular episode in 2021 when there were speculations about the burning of crypto in the Indian market, I held the mentality that this time it was going to be different. I entered the market believing I had uncovered some hidden secret that would allow me to lead the market. Therefore, I completely ignored the risk-reward strategy and failed to diversify. To simplify, I invested all my capital in one token, which resulted in massive losses when the market turned against me. My position was liquidated, and I lost half my capital in one trade, effectively being kicked out of the market. The lesson I learned is to never be overconfident and to always adhere to a risk-reward strategy while diversifying the portfolio.

When I introspected into my mistakes, I realized that during similar episodes of "this time it's different," I followed my emotions instead of the market cycle or pattern. In a state of euphoria and FOMO (fear of missing out), I entered the market without a proper trading plan and resorted to panic selling. The lesson learned is that once we are in the market, we should keep our emotions aside, follow chart patterns, historical data, and apply our knowledge and skills to execute trades.

I have noted that sometimes such a mindset is provoked by market bubbles and the news or rumors circulating. However, we often fail to understand that by the time such speculations or news reach us, it is too late. We often enter too late and exit too early, leading to misjudging the trend and booking losses.

It is clear from the above discussion that the long-term impact of a mentality that "this time it's going to be different" results in significant losses and sometimes suboptimal gains. In either circumstance, we end up regretting our decisions. In conclusion, we can say that such a mindset compromises the rational and informed decision-making process of investors.

In market psychology, FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) play significant roles, especially for new traders who are more susceptible to these emotions. Even in the history of the STEEM token, there have been several notable events influenced by FOMO and FUD, such as the hard fork of Steem and Hive, and the integration of Steem with the Telos blockchain. Here, I will discuss a specific incident from April 2023, when significant FOMO and FUD impacted the price of STEEM.

FOMO and FUD are part of market psychology because the market is composed of a collection of old and new players. While old players may have the experience to navigate these dynamics, new traders, who are part and parcel of the market, often fall prey to these market tactics. As far as the history of the STEEM token is concerned, FOMO and FUD have impacted its price from time to time. Some noteworthy events include the hard fork of Steem and Hive, the integration of Steem with the Telos blockchain, etc. These were some notable events of the past, but I am discussing one recent episode that took place in April 2023 when FOMO and FUD were noticed subsequent to a rumor in the market

STEEM/USDT- April 2023 (within box)

In April 2023, on one day the price of STEEM saw a sharp increase from its opening price of 0.22$ to a new high 0.35$, driven by a rumor about the integration of the Steem blockchain with the well-known social media platform, Twitter (nowadays X). This news, had it been true, would have been monumental for followers of the Steem blockchain due to Twitter's significant influence in the social media world. The rumor led to a significant appreciation in the price of STEEM, as FOMO took hold and more investors bought into the token, resulting in a surge in trading volume.

However, the lack of official confirmation from either platform soon revealed the news to be a rumor. This realization triggered a sharp decline in the price of STEEM, exacerbated by FUD and panic selling in the market. Consequently, the price of STEEM fell back to its previous levels.

This incident highlights the impact of market sentiment. Initially, the rumor triggered positive sentiment and optimism, leading to FOMO and a subsequent increase in price and trading volume. Once the rumor was debunked, the market sentiment turned negative, causing FUD and a rapid decline in the price.

Strategies to Avoid FOMO and FUD-Driven Investments

Verify Authenticity: Always verify the authenticity of news before making investment decisions. Rumors and unverified news are common in financial markets, and it is prudent to confirm information from reliable sources.

Proper Trading or Investment Plan: Develop a trading or investment plan with preset goals, including stop-loss and take-profit levels. Having a structured plan helps maintain discipline and reduces the likelihood of making impulsive decisions driven by FOMO or FUD.

Portfolio Diversification: Diversify your portfolio by investing in multiple tokens. This strategy spreads risk and reduces the impact of any single investment's poor performance, as losses in one asset can be offset by gains in others.

Skill and Knowledge: Continuously improve your trading skills and market knowledge. Stay informed about market developments and cultivate reliable sources of information. Being well-informed helps in making rational decisions and avoiding the pitfalls of rumors and market manipulations.

By implementing these strategies, investors can mitigate the influence of FOMO and FUD on their investment decisions, leading to more stable and informed trading behavior.

Explain the logic behind the “buy red and sell green” strategy. Create a hypothetical scenario in which this strategy could be applied effectively and discuss the psychological challenges an investor might face when trying to implement this strategy amid an actual market downturn and subsequent recovery.

"Buy red and sell green" is synonymous with the concept of "buying the dip." It means that we should buy when the market is red or bearish and sell when the market is green or bullish. Warren Buffett has said, "Be fearful when others are greedy, and greedy when others are fearful." Most retail investors buy when they see a bull rally in the market and later regret it when the market turns the other way. They act greedily along with other greedy people, unlike Buffett's advice. The ideal scenario is to be greedy when others are fearful, meaning we should buy when others are distressed. As seen in market cycles, people are typically fearful during the bearish phase, which is when the market is red.

Another wise saying by Baron Rothschild is, "The time to buy is when there's blood in the streets." This means we should buy when the market is red and people are in denial mode.

BTC/USDT chart on monthly time frame

Let's consider a hypothetical situation: taking a long position in the BTC market in October 2023 when the price of BTC was around $31,000. This decision would not have been made blindly; technical analysis would have supported this move. There was a strong resistance around $30,875. If we entered at the breakout of this resistance in October, we would currently be seeing more than 2x profit, meaning our investment would have doubled.

The psychological challenges an investor would face when making an investment at that point include feelings of depression and denial. Investors who had seen the market falling for the last two years would have been depressed and in denial because their earlier investments were likely in loss. However, when considering the bottom made by BTC in the last bear season, which was around $15,500, one should remain hopeful, as suggested by the chart.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a discussion that traders should really pay attention to, often newcomers with great optimism and enthusiasm come without good knowledge so they rush into analysis and end up regretting it.

When I first got into crypto, I also got the feedback “sell when it's green and buy when it's red”, and when I tried it on Tradingview, it worked.

Regarding your experience in the world of trading, it is very unfortunate, but I am sure that this point is also the starting point for you to be successful because you are getting more experienced and trying to progress.

The world of crypto is very tempting, but don't be too greedy 1:2, because this world can change direction in a few seconds...

Analysis and knowledge and emotions are required to be stable, and with good trading knowledge I am sure that trading will be successful and losses can be minimized...

Experience is a good teacher, always success for you and good luck friends.... 👍👍👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

New traders often rush in without enough knowledge. "Sell when it's green and buy when it's red" can work, but understanding the market is crucial. Learn from mistakes, avoid greed, stay disciplined, and manage emotions. Continuous learning and stability are key to success in crypto trading. Good luck!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@drqamu hello Its fascinating to see how emotions like hope fear and greed drive market movements. Your explanation of the stages from optimism to despair really helps in understanding why investors behave the way they do. The Bitcoin and STEEM examples were spot-on in showing realworld impacts of FOMO and FUD. good luck with the contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm glad to hear that you found my explanation on the emotional drivers of market movements insightful. Thanks for your feedback .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

| Warren Buffett has said, "Be fearful when others are greedy, and greedy when others are fearful."

Warren Buffett is true investor, he explained the entire market and investment concept in just one line.

| invested all my capital in one token

This happened with mosts due to lack of knowledge, at begining most new investor think about the quantity and ignore money management.

| Portfolio Diversification

Agreed. Must needed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for stopping by and dropping your insightful feedback .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

Your entry is like a treasure chest full of smart ideas about how our minds work when we trade stocks and tips on how to handle the ups and downs of the market. Whether you're just starting out or you're already a pro looking to learn more about how people think in the market, this post is a goldmine.

Thank you for sharing such a great knowledge with all of us and I say congratulations in advance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the compliment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings dear . Indeed Invested all my capital in one token"—ouch! We've all been there. Diversifying is key to avoiding those big losses.

All the best in the contest, success for you 👍.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are right . Thank you .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pleasure is mine bro .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey dear friend indeed all you said in your articles are truth and he deserve the good grading from the professor, one of the reason why people experience psychological emotions is because the lack sufficient knowledge and skills which would help them build confidence in every investment step they make

Thank you so much friend for sharing sword high quality article at your free time you can also check my through the link belowhttps://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s18w3-psychology-and-market-cycle

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your valuable feedback. I have already shared my feedback on your post yesterday.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

El ciclo de las emociones es un análisis obligado para los traders en formación, tener experiencias en el trading sin manejar adecuadamente las emociones en un mercado tan volátil puede generar grandes pérdidas por decisiones fundamentadas en los sentimientos o emociones.

Gracias por compartir tu excelente contenido.

Saludos y bendiciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your kind words. I'm glad you found the content helpful. Managing emotions is indeed crucial for successful trading, and it's great to see you emphasizing its importance.

Best regards and blessings.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit