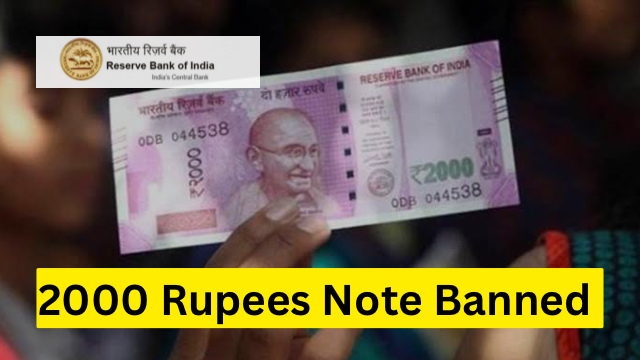

2000 Rupee Note Withdrawal in India

The Reserve Bank of India (RBI) announced on May 22, 2023 that it will be withdrawing the 2000 rupee note from circulation. The notes will continue to be legal tender, but they can only be deposited or exchanged at banks until September 30, 2023. After that date, the notes will no longer be valid.

The RBI said that the decision to withdraw the 2000 rupee note was taken in order to "simplify the currency system" and to "make it more convenient for the public to use." The central bank also said that the printing of 2000 rupee notes had been stopped in 2018-19, and that the stock of notes in circulation was "adequate to meet the currency requirement of the public."

The withdrawal of the 2000 rupee note has been met with mixed reactions. Some people have welcomed the move, saying that it will make it easier to track and trace cash transactions. Others have expressed concern that it will make it more difficult for people to make large purchases.

2000 Rupee Note Withdrawal in India

The RBI has said that it will provide more information about the withdrawal of the 2000 rupee note in the coming days. In the meantime, people who have 2000 rupee notes are advised to deposit or exchange them at banks as soon as possible.

Impact of the Withdrawal

The withdrawal of the 2000 rupee note is likely to have a number of impacts on the Indian economy.

- Reduced cash in circulation: The withdrawal of the 2000 rupee note will reduce the amount of cash in circulation. This could lead to a decrease in inflation, as there will be less money available to fuel price increases.

- Increased use of digital payments: The withdrawal of the 2000 rupee note could lead to an increase in the use of digital payments. This is because people will be less likely to carry large amounts of cash, and they will be more likely to use electronic methods of payment.

- Increased scrutiny of cash transactions: The withdrawal of the 2000 rupee note could lead to increased scrutiny of cash transactions. This is because the government will be able to track cash transactions more easily, and they will be able to identify any suspicious activity.

Overall, the withdrawal of the 2000 rupee note is likely to have a positive impact on the Indian economy. It is likely to lead to a decrease in inflation, an increase in the use of digital payments, and increased scrutiny of cash transactions.

2000 Rupee Note Withdrawal in India