The Scalp trading style.

By Prof @yohan2on

Home work:

"Using the finger-trap Scalp trading strategy, practically demonstrate the scalp trading style on at least 2 crypto asset pairs such as BTCUSD, ETHUSD, etc"

source

Scalp trading is a short period trading style where traders trade within an hour or less with the intention of making quick profits.

Scalp trading which is a junior sister to swing trading and long term trading/investing.

Swing Trading:

These are medium short term trades mostly lasting between the hour and 48 hours. These trades can be left overnight and involve longer time frames analysis.

Day Trading:

These trades are held for a day or two… these trades require the daily and weekly chart analysis.

Day traders need some fundamental and sentimental analysis to make sure they are not caught up in negative news.

Long Term Trading/Investing:

Long term traders are actually investors. They put their money on good crypto-stocks or cryptos currencies with the intention of making much profit after the while.

These trades are held from a month to six, maybe even a year.

The finger trap trading strategy invented by James Stanley of DailyFX is a scalp trading strategy which he relates to the children’s finger trap toy,

source

The finger trap toy originates from Asia, with a pull out trick where kids have to rather push their fingers in rather than pull out in other to release their fingers.

The finger trap strategy involves working with the 8 Exponential moving average as the entry signal indicator on the 5 minute chard, and the 8 and 34 exponential moving averages as the trend confirmation signal indicators on the hourly chart.

I will be using the ETORO broker for this homework. They trade crypto CFDs online and have a simple to use web trader.

Using the Ether coin on its rage to $4000 last week we will be searching for how to use the finger trap strategy and how it would have helped us.

Now the finger trap trading strategy works with trends, and finding the best trend. To do this we use the 8 EMA and the 34 EMA.

FOR UPTRENDS:

Searching for uptrends using the finger trap trading strategy involves looking for places where the price is above the 8EMA crossing over the 34EMA.

This kind of gives a double uptrend signal,

1.Being that the 8EMA has crossed the 34EMA upwards telling us that price is in a good uptrend

2.With price above both moving averages, this shows that the trend is strong enough, finding new highs.

For DOWNTRENDS:

For down trends, using the finger trap trading strategy invoves looking for places where the price is below the 8EMA and 34EMA.

This kind of signal gives us a double uptrend signal,

1.Being that the 8EMA crossed the 34 EMA downwards, telling us that price is in a good down trend.

2.With price below both moving averages, this shows that the tend is strong enough even finding new lows

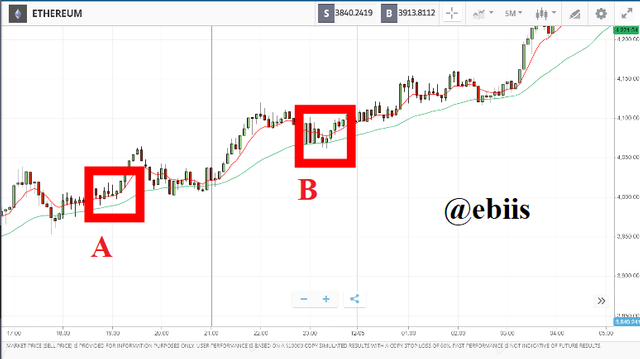

screenshot from ETORO webchart

From the chart above, we see that price is above the crossovers at a, b, c . we wil be taking C as our trend confirmation point and going to the 5 minutes time frame to check for a good entry point.

screenshot from ETORO webchart

On the 5 minutes chart we now search for retracements (where price goes behind the 8 EMA) so we can follow price till it bounces back making better profit. At a and b, we can make entry position, setting our stop loss 10 pips below incase price loses upward strength and starts reversing.

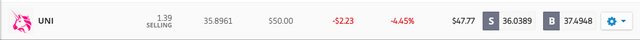

I will be using the Tron (TRX) coin and UNI swap (UNI) coin for this homework

The Tron Coin

The tron coin founded by Justin Sun of tron foundation which has the cheapest transfer rates among cryptos, is a coin that plans to link content creators directly to content consumers. It has seen great acceptance among exchanges, it trades with the TRC 20 token type coin. The coin has seen some uptrends, but recently it has been having some bad market demand so a reduction in price (downtrend).

screenshot from ETORO webchart

Now looking at the TRX hourly, we see price is currently in a downtrend. Price has shown good down trend patterns according to the finger trap trading strategy by moving below the 8 EMA and 34 EMA downward crossing at a, b, and now C.

We now go down to the five minutes to check for entry.

screenshot from ETORO webchart

On the five minutes we now start looking for retracements for entry. We see this at a, b, c and now d

This is a good position, we enter and sell the position and wait for price movement.

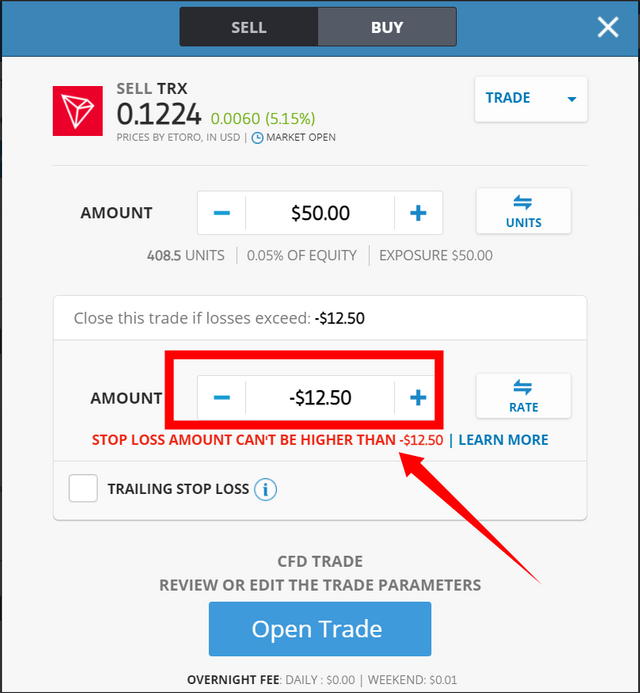

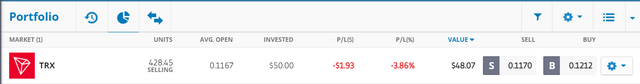

I made a sell trade on the TRX with $50 on the ETORO broker web trader, setting my stop-loss when price reaches - $12.5, which is the least stop loss my current broker will allow.

screenshot from ETORO webchart

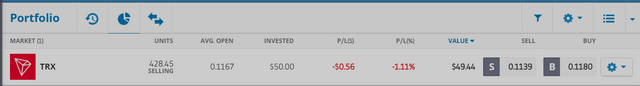

The UNI

The Uni swap which is the native coin of the UNI swap decentralized exchange is a great coin with market capital $21,967,115,263 and has good acceptance among decentralized exchanges and enthusiasts.

The Uniswap has seen some downtrend of recent, let us now check if we can finger trap trade on it.

screenshot from ETORO webchart

Looking at the hour charts, we see the UNI swap is just entering a downward trend, we must be cautious as to avoid price reversal on us.

Although price has shown some good downward trend action at a, and now b.

We now go down to the 5 minutes and wait for an entry.

screenshot from ETORO webchart

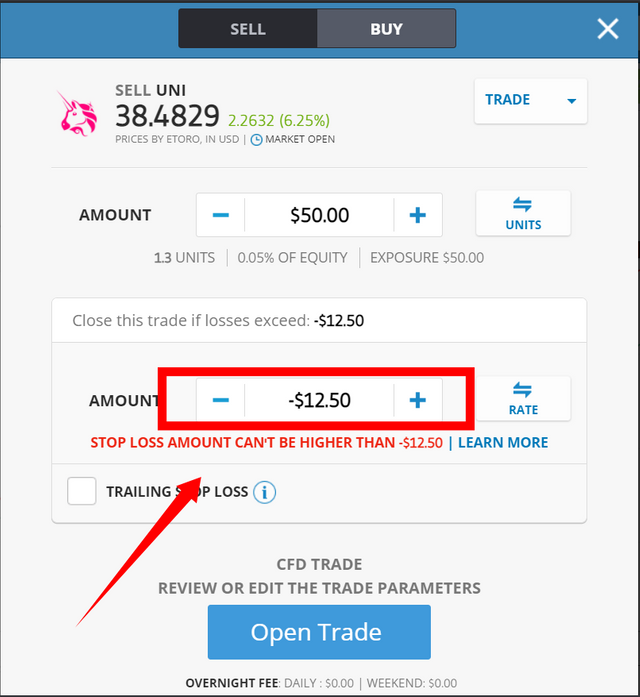

On the 5 minutes, we can see retracement points at a, b, c and now d. this should be a good entry point. We go in at d and make a sell trade for $50 worth of UNI putting our stop loss at -$12.5 which is the least stoploss I can set with my broker.

screenshot from ETORO webchart

We wait, and expect profit. While we wait let us talk about the advantages and disadvantages of finger trap trading strategy.

Advantages:

The finger trap trading strategy gives more trade entry positions, and if a trader enters these positions perfectly he can surmount much profit from just a single trend.

The finger trap trading strategy removes the risk of keeping a trade through the night. It lets one set quick trades with stop loss and make profit in short time frames.

Disadvantages:

The finger trap trading strategy lets one pay so much on trading fees. Making five trades for example on a long trend will mean paying five trading fees.

The finger trap trading although a scalp trading method can be time consuming. Awaiting for the perfect entry of price can be very time consuming. It is best to make such trades with automated systems.

After waiting a while I check my trades and I can see the trx has made less loss but still on a loss mostly because of the high trading fee of the etoro broker. I close trade at -0.56 dollars dollars shown below.

the Uni swap made more loss, it seems to be finding a reversal. I close trade at -6 dollars shown below.

The finger trap trading strategy has proven to be a great trading strategy. making short but profitable trades is a newbies dream. The finger trap strategy can also be edited to fit ones trading style and for different markets.

Lastly trading the finger trap should involve risk management. Setting a stop loss is ephemeral to this trading, short time frames are prone to retracements which may later turn into reversals, so risk management through appropriate stop loss is key to trading the finger trap trading strategy.

I am @ebiis. Thanks for reading my homework.

CC

@yohan2on

Hello @ebiis,

Thank you for participating in the 5th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 9/10 rating, according to the following scale:

My review :

A good explanation of the Finger trap strategy. You did a good job of research to submit such an article.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My twitter promotion :

Redirection link

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit