1. Explain Spot Trading and Margin Trading:

Trading as explained by my professor @besticofinder from week 1 and 2 and now 3, is the act of analyzing the market from both a fundamental and technical perspective and making very rational decisions considering highly risk and reward ratio.

Talking of risk and reward ratio I will be explaining two major trading types which are:

Spot Trading and Margin Trading.

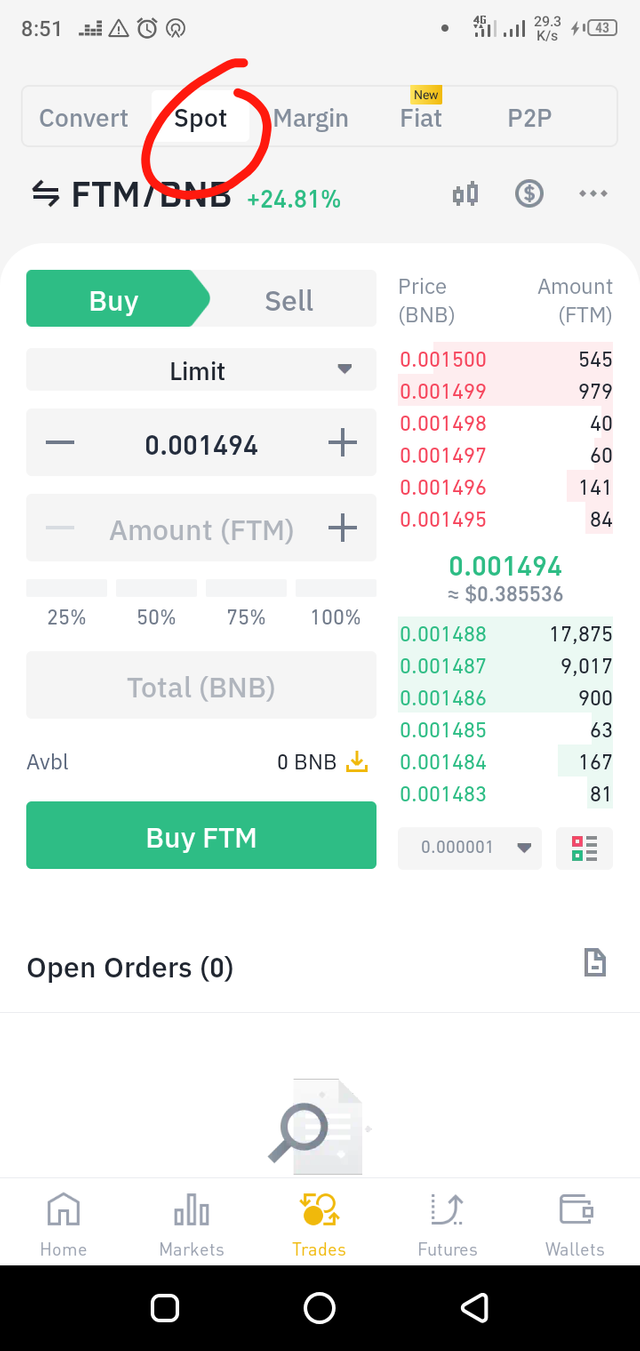

Spot Trading:

source

As the name sounds, “spot” synonymous to “dot” meaning on the "point" trading.

On the point referring to the price at that specific “point in time”. Spot trading are trades made to execute at the specific price on that specific currency pair.

Spot trading defined professionally is

Now spot trading has either Market order, Limit order, Stop limit orders. These which depend if you either want to trade at the current market price or at a specific market price.

Spot trade defined by investopedia is also known as a spot transaction which refers to the purchase or sale of a foreign or cypto currency, financial instrument, or commodity for instant delivery on a specified spot date/time and price. source

Major things to note about spot trading are:

- You are trading with the amount of money U have on your wallet on the exchange platform.

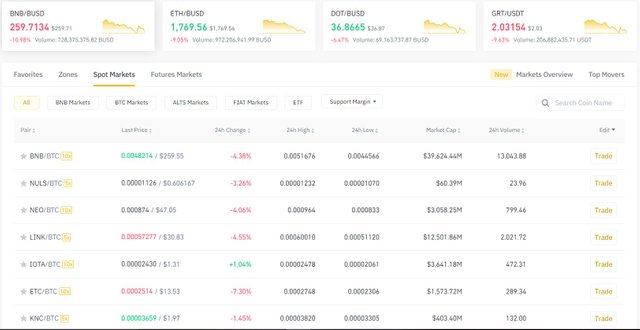

- To trade a currency pair, you have to have some of your money on the base currency to be able to buy the qoute currency.

- Risk is only dependent on the volume(amount) of currency you buy.

Spot trading is good trade for beginners who have learnt good technical and fundamental trading techniques as you understand how change is prices is directly related to profit or loss percentage of the currency bought.

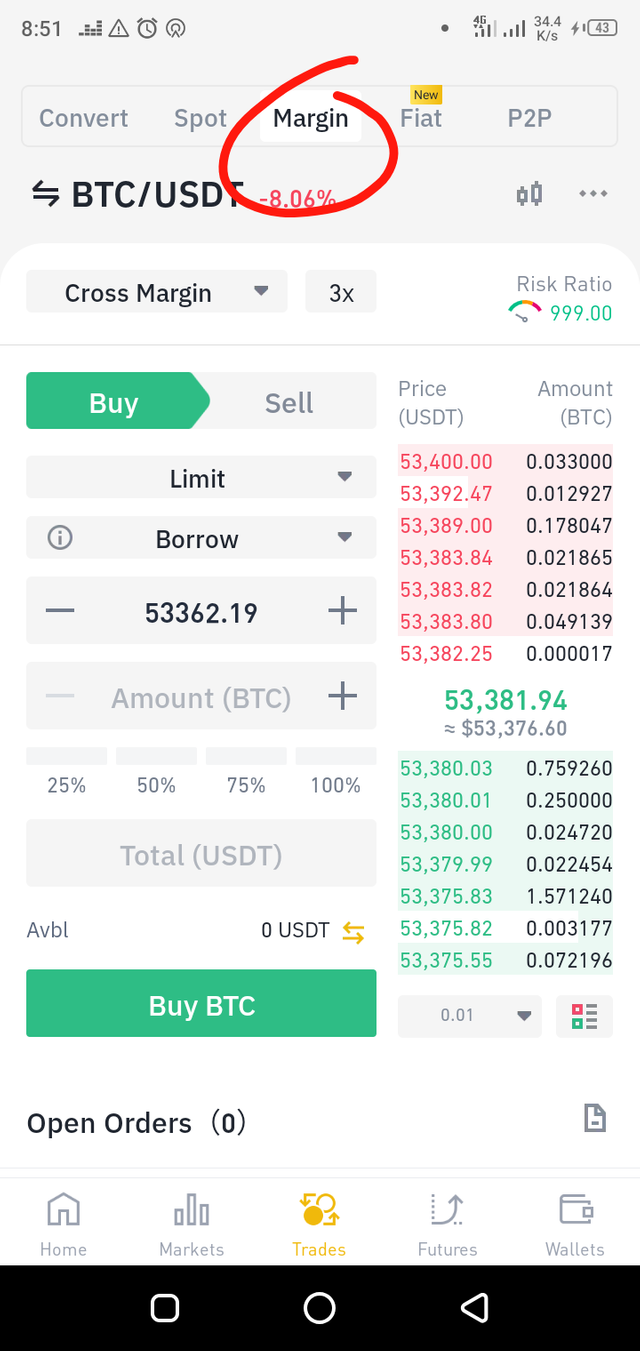

Margin Trading:

source

Margin trading also known as leveraged trading is the act taking more funds from either the broker or other investors to increase profiting with little funds.

As much as it sounds sweet and interesting to hear about, one must be very careful before going further.

Margin trading involves a contract between the trader or either the broker or an external investor in which the trader will be required to commit a percentage of the total order value. This initial investment is known as the margin which is closely related to the term leverage. In other words, margin trading accounts are used to create leveraged trading, and the leverage describes the ratio of borrowed funds to the margin.source

Let me explain in more understandable terms, say your broker has a leverage ratio of 10:1

It means that you can make a $5000 trade with just $500, but he will hold this $500 till after you make profit. On the good side you make a profit much more than what a spot $500 dollar trade will get you on successful trade. But caution should be of priority as if trades go against you, you may be margin called and on failure to do so the broker has the right and may liquidate(sell off) your held assets ($500).

2. Discuss the Advantages and Disadvantages of Spot Trading and Margin Trading:

As I discussed above we should already be able to see the advantages and disadvantages of these two trading types, but I will explain and elaborate further.

Spot Trading Advantages and Disadvantages:

Advantages:

The advantages of spot trading which are majorly from the fact that it has a lower risk level are:

1.Low risk level: trading spot means you only risk the money you put on that currency, and you could always put in more money on other currencies from your wallet.

2.Easy understanding of proportional profit to loss ratio: Spot trading makes one see how many percentage of money is gained or lost proportionally and easily, so U can be well informed of your balance and profit, making it easy to calculate on what more trades to make.

3.Best trading option for newbies in the trading platform: Any one who just comes into the trading and crypto community newly and hopes to trade would not be confused when trading spot because of the ease in proportional profiting or loss.

Disadvantages:

1.Missing big opportunities because of low capital: they say opportunities come but once, and sometimes its best to leverage on such opportunities to make it big as we all hope to in crypto.

2.Having to move funds from one currency to the other in other to make a trade: Unlike margin trading where one just has to submit a certain amount of fund then be able to make different trades within that margin level, spot trading involves moving funds from one base coin to another in other to buy a quote currency.

Margin Trading Advantages and Disadvantages:

Advantages:

1.Taking advantages of opportunities: As a disadvantage to spot trading an major advantage of margin trading is taking advantage of opportunities such as important news and changes in maybe government or institution policies.

2.Multiple trading: Secondly Margin trading helps the trader able to trade different pairs within that margin limit, unlike in spot trading where one will have to purchase each base currency before trading quote currency.

Disadvantages:

1.One of the major disadvantages of margin trading is the risk involved. Risk is a major criteria one should consider before making any trades, and so margin trading should be threaded carefully to avoid bankruptcy.

2.More complex Calculations in calculating profit and loss: Margin trading involves leverage of which different brokers have different leverage ratios, so being able to calculate the leverage ratio and amount to deposit as margin makes trading more complex especially to newbies in the crypto world.

Conclusion:

As a conclusion I say trading is a great business and everyone should or have done it directly or indirectly, trading crypto isn’t so different from everyday trading only that it involves a 24/7 open market and virtual coins we will never lay physically on our palms. But nevertheless one should always “master the ways of the sword” before going into battle, so also one should fully understand how crypto trading works before trading whether spot or even more margin.

Cc @steemitblog

@steemcurator01

@steemcurator02

@besticofinder

Hello @ebiis ,

You have done nice work ! I love the way you have discussed the topic explaining clearly. Keep up the good work ! [8]

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor, I really do appreciate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit