Source

7 .How To Invest in Cryptocurrencies - A beginners Guide - Part 2 | Steemit Crypto Academy | Lesson 7 By: @electrodo

Hello everyone at steemit! from @electrodo de Margarita to the world.

Hello to the entire steemit community, here we are once again fulfilling task # 7 indicated by professor @besticofinder, very grateful for the opportunity that #steemit and the #cryptoacademy are providing to teach the community about the crypto world and everything related to the development and management of Blockchains, we know that technological advances take giant steps and not going hand in hand with them would be left in the dark, there is a future and surely in that future the cryptographic technology and the blockchain will occupy a great space in the entire environment from the simplest to the most complex and that is why acquiring this knowledge will make us arrive prepared to understand this new digital universe.

Now before giving way to the activity, I want to thank the friend @trafalgar for supporting the analysis of the Polkastarter project in task No. 6, if you have not read it, I will leave the link here. Well now passing the introductory part and thanks, we go to the objective of the following activity that consists of taking two similar projects and comparing taking into account parameters such as their capitalization, number of coins in circulation and maximum coins to be placed in the market, this alone to mention some of the indicators that we will take into account for the following analysis.

Well for this comparison I could have located a project similar to Polkastarter and compare it like this in this way I could already say that I had half the work done, but after thinking I realized that this prevented me from reading and investigating other options that could leave me more knowledge about other platforms and cryptocurrency projects so I decided the longest way thinking about my benefit when acquiring more knowledge of this world.

The projects I chose are very similar and coincide with the same Polkastarter, according to Yield Optimization Platform & Protocol (YOP) it unites them in a single site so that they are available to everyone on the same platform, their relationship is very large and they are TrustSawps and Dao Maker.

The research work will be carried out with a brief introduction to the project and then we turn to the comparative tables, this will help us to make a synthesis of each of the qualities and differences corresponding to the project and we begin as follows:

What is TrustSwap Coin (SWAP)?

Source

This company is relatively young that made its official launch on July 9, 2020 after some time of development it managed to reach the market, its protocol arrives with to make some adjustments in the crypto world and what decentralized finance represents DeFi, this platform wants to solve problems such as payments for services or subscriptions, multi-chain token exchange, a benefit that brings interoperability. You can also make smart contracts to raise funds that can be executed when meeting the agreed terms and in the agreed time this could help the grandmother's pension if her four children agree to spend an amount of money monthly it will be done effective when everyone has fulfilled their part of the agreement, another of the functions that I find interesting is that it will support emerging projects and through it, ICO launches can be made but let's remember the Boom of 2017 with those initial coin launches and the great A scam that many of them ended up damaging the economy of all those people who believed in their project, hence TrustSwap serves as an intermediary between the investor and the entrepreneur since through a smart contract this can agree to release the money in a fractional way allowing the use of it according to the progress achieved in this way protects the investment ista and to conclude since I will briefly mention the project there is a very interesting point and that is that through this company Tokens that work under the ERC-20 network can be wrapped, this means that this launched token can be managed in the network of ETH without any inconvenience since they make it convertible for commercialization, we can also find among their products that it is possible to carry out Staking and smart locks as investment support.

Source

What is DAO Maker?

This relatively young company began its first steps in Q3 of 2018 and according to its roadmap it concludes in Q3 of 2022, seeing it this way, we would be facing a project to be developed in 4 years, it is a platform with a great future. DAO Maker is a platform that plans to build a company where the common person with a small capital and the large investor can work with equity and balance, with respect to their tokens, it offers an opportunity for common people to grow safely its own capital and unlike Polkastarter this allows its loyal investors to have their coins by making Staking have the first option, something that in Polkastarter and other companies is not handled that way and they give everyone the opportunity to enter the purchase of the ICO leaving many people out or at a disadvantage. Keep in mind that the company in 2020 has attracted the interest of more than 70,000 retail entrepreneurs interested in investing in projects in their initial stage.

Dao Maker is a safe way of doing business thanks to the decentralization offered by the DeFi world, a tool to be evaluated by all those visionaries willing to undertake as startups, since they are literally described as a project that seeks to create a fundraising platform for both crowdfunding and tokens.

Speaking of social mining, what is that about social mining? Well, we would simply have to look at steemit and there we would have the answer, and if we still want to see further, then in all social networks it is monetized in some way, such as I create an art and I can take it to an auction, but be careful here is the difference I create a product and sell it in the currency I want but this cannot be seen as social mining since the remuneration does not correspond to the native currency of the platform if it ever existed.

Dao Maker offers practically the same benefits as TrustSwap with some differences regarding the KYC, the Staking, the opportunity for an entrepreneur to get financing for his project, the locks that guarantee the investment to the person who placed the money for it. development of the same, with one you can pay affiliations and services with the other we can see that they apply an offer of currency dynamics that is under this model that startups can acquire financing this model is called DYCO but in the end it ends up being the same service offered for both, so in short they are competitors in the market.

Source

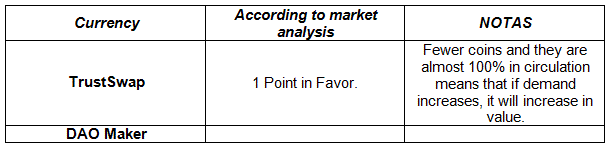

After having read each of the projects a little, see the differences and the similarities, knowing that the corporate of each of them are people with a background in the crypto world, if it were my criteria to choose a project, I would stay with TrustSwap for being easier to handle by offering practically the same and having the path more advanced and in a short time so in this first aspect I give my vote to:

)

Source: Electrodo

Now knowing a little about each one and the products they offer and if we want to invest our money in the best project that is presented in this analysis, the question would be which one to choose? Ok let's compare some parameters to make this decision:

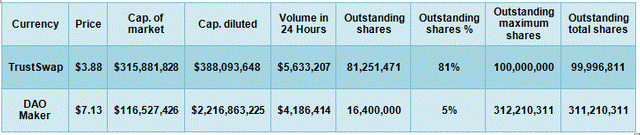

Source Electrodo based on information collected from Coinmarketcap.

Based on the market analysis we can see that TrustSwap is the project with the least time, its currency to date has a value of 3.88 USD with a market capitalization of 315,881,828 USD and a movement of money in 24 hours of 5,633,207 USD and the market currently has 81,251,471 (Swap) currencies in circulation, representing 81% of a total of 100,000,000 currencies. On the other hand we have DAO Marker with a coin value of 7.13 USD and a market capitalization that is around 116,527,426 USD and its market has had a movement in 24 hours of 4,186,414 USD this project has a maximum of coins 312,000,000 of which only 16,400,000 DAO are in circulation so far, this number representing 5% of its totality.

Now according to the table and the market analysis, at this point I would choose TrustSwap because it is a project with a lower maximum number of coins, there will only be 100,000,000 of which almost all are in circulation at an approximate of 81%, this means that If the project goes well and has acceptance, the amount of coins is less and for this reason it may have greater demand and its value may rise, while its competition is in an initial phase, its currency will be greater in number and perhaps its price will go down. the current value will also depend on how well the project is accepted by the community.

ANNEX IMPORTANT CONCEPTS TO UNDERSTAND THE MARKET TABLE:

Legend:

Price:Current cryptocurrency value in the market date 03-27-2021

Market capitalization: The total market value of the circulating supply of a cryptocurrency. It is analogous to the capitalization of free float in the stock market.

Market Cap = Current Price x Circulating Supply.

Fully diluted market capitalization: Market capitalization if the maximum offer was in circulation.

Fully-diluted market cap (FDMC) = price x max supply. If max supply is null, FDMC = price x total supply. if max supply and total supply are infinite or not available, fully-diluted market cap shows

24 hour volume: A measure of how much of a cryptocurrency has traded in the last 24 hours.

Outstanding shares: The amount of coins that circulate in the market and are in public hands. It is analogous to the flow of stocks in the stock market.

Shares outstanding in percentage: It corresponds to the ratio of maximum coins and how many are circulating in the market seen from the percentage.

Maximum shares: It corresponds to the maximum number of coins that will exist during the life of the cryptocurrency. It is analogous to fully diluted stocks on the stock market.

Total shares: It corresponds to the number of coins that have already been created, minus the coins that have been burned. It is analogous to shares outstanding on the stock market.

Source: Electrodo

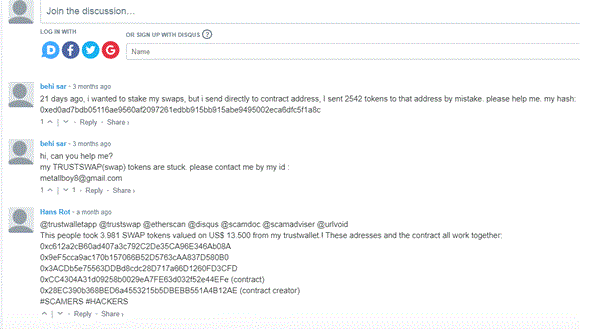

Continuing with the analysis we are going to review the movement of each one of them in etherscan and let's compare their behavior, let's start with TrustSwap and their smart contract is: 0xcc4304a31d09258b0029ea7fe63d032f52e44efe

Source

We can observe some users with problems regarding trapped coins and a hacking of a user without response, although we know that everyone is responsible for their keys and how they move their assets.

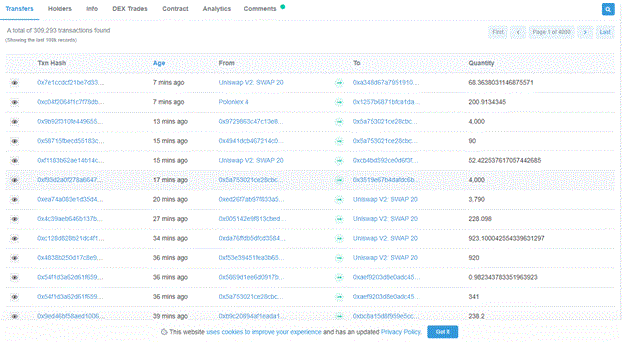

Source

A movement of 309,293 transactions being Uniswap the exchange with the most activity and with a number of holders 19,110 and its main holder has accumulated 198,615,364.78 (~ 116,264.2406 Eth) [50.9286%] possibly is an amount corresponding to the company, it would be necessary to investigate further and be able to determine that point.

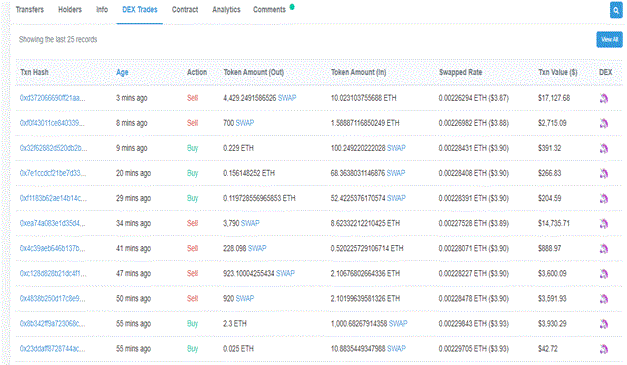

Source

Some transactions for the purchase and sale of the currency and its exchange houses:

Source

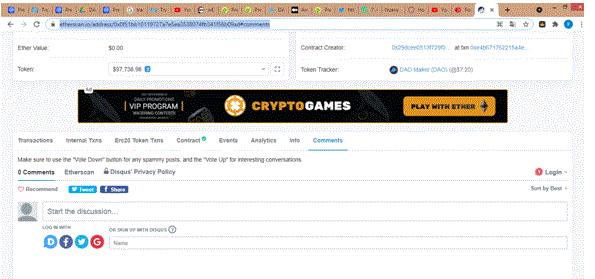

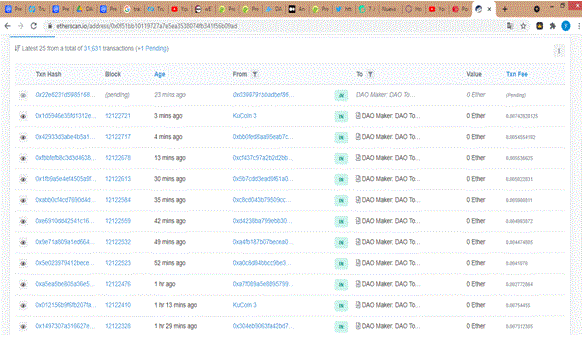

Continuing with the comparison, we now go on to analyze the behavior of DAO Maker in etherscan and its smart contract is as follows: 0x0f51bb10119727a7e5ea3538074fb341f56b09ad

Source

Checking some notes and comments regarding the project in etherscan we can see that to date no one has written anything good or bad is a positive point for the platform.

Source

A movement of 31,631 transactions being KuCoin 3 the exchange with the most activity apart from its own platform, although they have more time in the market and it is a project with a couple of years of experience, I do not see much relevant information in etherscan.

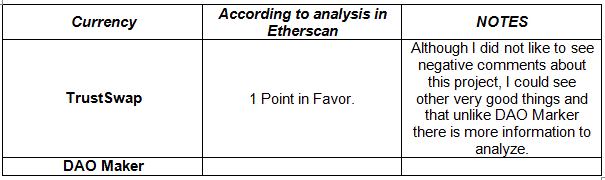

Source: Electrodo

Conclusion:

If I had to choose between one of the two projects obviously after analyzing each one in three points such as its objectives as a company mission, vision and scope, I could determine that TrustSwap is more advanced and with less time and in my opinion the option of being able to pay for services and subscriptions is something new in a crypto platform and is among its service package, on the other hand, all of its coins only represent a third of its competition in this analysis that means that TrustSwap will have fewer coins and almost complete its The maximum currently is 81% of its totality, for this reason this coin may be worth a little more and represent more profits for its owner and as a final point I must add that according to the analysis in etherscan in the first place I did not like to see bad comments from TrustSwap users but later I was able to see their transactions and their most used exchanges and other details that made me see the panorama better and gave me I am good about any project, people speak bad or good they will always say something and it is not so much only three messages but when I saw the DAO Maker information I saw how weak their movements and data were missing to complete for them that is not good since a company in The one that is thought to invest must have clear and precise information why it is talking about capital.

So undoubtedly the winner is TrustSwap and it would be the project where I would invest my money.

IMPORTANT NOTE: I AM NOT AN EXPERT IN CRYPTOCURRENCY IT IS NOT A RECOMMENDATION TO INVEST ONLY CORRESPONDS TO THE TASK OF THE TEACHERS AND IT LEADS AN EDUCATIONAL AND LEARNING PURPOSE FOR ME.

Project links and other annexes, Sources:

trustswap Coinmarketcap Pagina TrustSwap Dao Maker Coinmarketcap Whitepaper Dao maker Yield Optimization Platform & Protocol ¿QUÉ ES WETH? TrustSwap Twitter Pagina YOP-FINANCE

Blessings to all on this day @electrodo.

Thanks to: @steemcurator01 @steemitblog @xpilar @xeldal @enki @sultan-aceh @dobartim