Thanks to @kouba01 for let us know about "Cryptocurrency Contracts For Difference (CFDs) Trading". Your post was amazing and informative. I think everyone will take benefit from your courses. Now, I will answer your questions one by one and completed my homework. Lets get started:

Question: What is a cryptocurrency CFD?

CFD stands for Contract for Difference. You do not have to buy any asset in CFD. Trading is done on the basis of whether the price of an asset can go up or down. Here the whole process is done through the broker. If you want to trade in CFD, you have two options. If you think the price of an asset may increase in the future, then you can take a buy position there. If the price of that asset increases then you will benefit. And if the price goes down, there will be a loss. However, another feature of CFD is that it is not possible to make a profit just by buying. Here you can buy or sell profit. If you think the price of an asset may go down in the future, then you can take a sell position there. If the price of that asset goes down in the future, you can make a profit. In this way, you can make a profit even if the price goes down and you can make a profit even if the price goes up. You do not need to buy any asset.

Hopefully, we understand CFD better now. Now I will try to explain what is cryptocurrency CFD. First, we should know what is cryptocurrency. Cryptocurrency is a virtual currency. To give an example, BTC, LTC, BNB, XRP, and ADA are cryptocurrencies.

In cryptocurrency CFD, we have to predict the price of a certain cryptocurrency. In cryptocurrency CFD you can trade and earn in both ways either the price goes uptrend or downtrend. Example- If you think the price of BNB can go up then you can make a profit with the Buy position. Again, if the price of BNB seems to be declining, then the sale position can be improved.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

To understand whether cryptocurrency CFDs are suitable for my trading strategy, I first need to know if I have the following:

In cryptocurrency, there is a possibility of profit as well as loss. So you must have an idea about this.

More leverage means more profit. So if you want to make more profit, it can be the opposite. So you have to have a clear idea of how leverage works.

Must have a very good idea about price forecasting.

Need to know how to use different indicators.

If I have these issues in mind, I think the cryptocurrency CFDs trading strategy is suitable for me.

Are CFDs risky financial products?

Obviously, CFDs are very risky financial products. Many price fluctuations here have made it very risky. Also, if you trade with leverage, you can make more profit and there is a possibility of more loss. So I think you have to trade here with capital that will not be lost. Because there is enough risk here.

Do all brokers offer cryptocurrency CFDs?

No, actually not. There are many brokers but some of them deal with cryptocurrency CFDs. We have to find the best and secure broker. I can mention here some popular and trusted brokers list which are good for cryptocurrency CFDs.

- eToro

- XTB

- HYCM

- Swissquote

- IG

- AvaTrade

- City Index

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

Though there are a lot of ways. But I will follow my professors way.

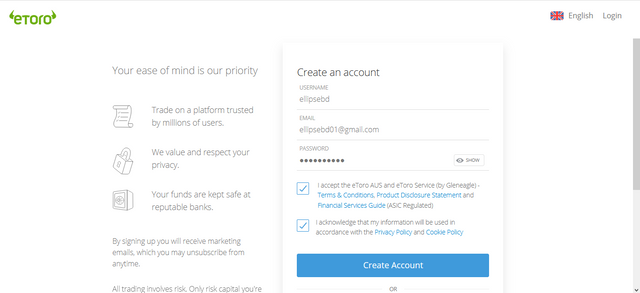

First I will go https://www.etoro.com/ and create my account.

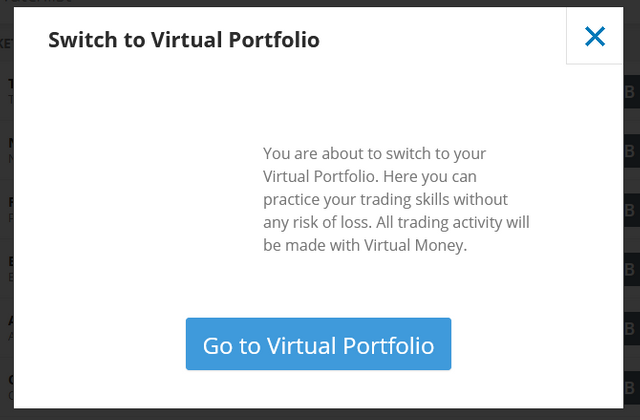

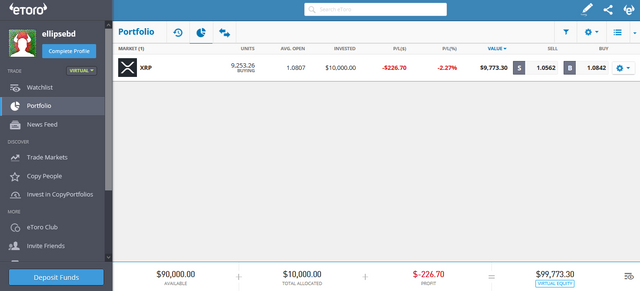

Then I will select my virtual portfolio.

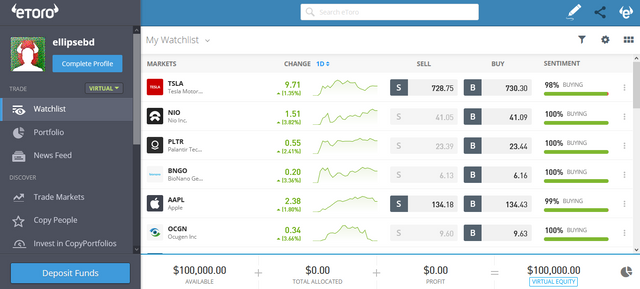

Then I will select market trade and find my crypto for trade.

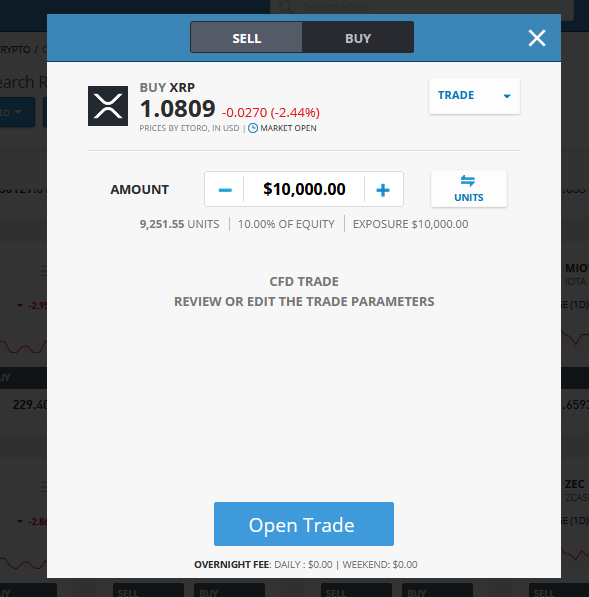

In this case I found XRP and I invest $10000. My entry price was at 1.0809. Now I have to wait for the right time.

By this way I will trade. If the price of XRP cross 1.0809 I will be profitable.

Conclusion:

Cryptocurrency CFD trading is very risky so it would not be right to come here without knowing. The cryptocurrency market fluctuates a lot so there is a possibility of profit and big loss. So you have to trade at your own risk.

Hi @ellipsebd

Thanks for your participation in the Steemit Crypto Academy

Feedback

This is fairly done. Kindly put more effort into your work.

Homework task

6

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Professor. Next time, I will try to do better.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit