Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @abdu.navi03 that talking about Crypto Trading Strategy with Median Indicator. Actually I have very little knowledge about this, but on this occasion I will try to discuss it to improve my writing skills.

Explain your understanding with the Median indicator

In the world of cryptocurrency, every trader always performs technical analysis to carry out trading strategies and execute trades well. In this case, the Median indicator is one of the technical indicators that serves to identify and determine market trends. This indicator shows the median bands that move according to price movements so that traders can determine price volatility and the uptrend or downtrend in the market within a certain period of time.

The median indicator has a very good calculation where this indicator works with mathematical calculations based on Average True Range (ATR) and Exponential Moving Average (EMA). This indicator will give an indication of market trends with median bands that has green and purple colors in the middle or around the candlestick that is formed on the chart based on price movements. The indications given by this indicator can be used as a reference by traders to place buy or sell signals when the market trend is confirmed to continue the trend or trend reversal.

The focus of this indicator is the color of the median band where the price movement up or down will determine the color which shows the true direction of the market trend. The uptrend in the market is indicated by the green band that forms when the median band crosses and is above the EMA and the downtrend in the market is indicated by the purple band that forms when the median band crosses and below the EMA. End of trend and possible trend reversal can be identified when a change in the color of the median band occurs on the chart.

Parameters and Calculations of Median indicator

Parameters

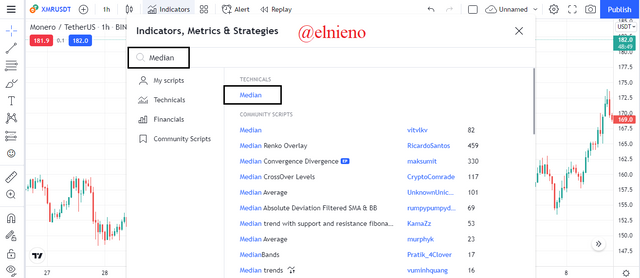

Every trader can use and add the Median indicator on the Tradingview platform to carry out technical analysis and execute trading strategies well. This can be done by visiting the Tradingview platform and selecting the chart feature. Next select the indicator feature and and write Median. Next Select the Median indicator and it will be added to the chart. This is shown in the chart as follows:

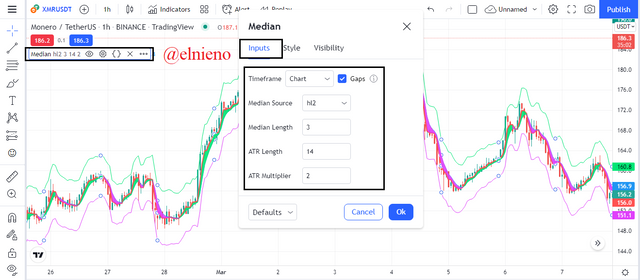

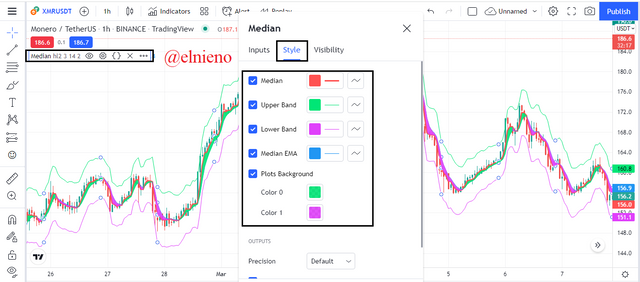

The Median indicator can be configured by selecting the indicator setting feature on the chart. Here the parameters on the input and style tabs can be configured or modified according to each trader's strategy. On the input tab, there are parameters such as timeframe, median source, median length, ATR length, and ATR multiplier that can be configured. The median length and ATR length are parameters that play an important role in generating the analysis. In the style tab, there are parameters such as median, upper band, lower band, median EMA which can be configured. This is shown in the chart as follows:

Calculations

The Median indicator works with mathematical calculations based on price movement data and involves ATR and EMA. Data such as the opening price of each candle, the closing price of each candle, the highest price and the lowest price within a certain time period are calculated and show the median band, upper and lower bands. The calculation is as follows:

- Median Length = The amount of price movement data configured to calculate the median band

- ATR Length = The number of periods configured to calculate the median ATR

- ATR Multiplier = The number of ATR values multiplied to form the upper and lower bands

- Upper Band = Median length + (2 ATR)

- Lower Band = Median length - (2 ATR)

Uptrend from Median indicator

The Median indicator can be used by traders to identify an uptrend in the market. This indicator focuses on predicting market trends where market trends are an important factor that must be analyzed. This indicator shows the median band of green color which indicates the market trend is uptrend. This happens because the price movement crosses and above the median band. At this moment, the trader can place a buy order because the green band provides a buy signal for the trader within a certain period of time. An uptrend indicates that buyers are controlling the price so the price is showing an increase.

Based on the chart above, the XMR/USDT market shows an upward price movement over a certain period of time. The Median indicator shows a green median band which indicates the market is in an uptrend. This happens because the price movement crosses and above the median band. Traders can place buy orders as long as the uptrend is confirmed within a certain range as I have marked. There is no fixed reference for setting SL and TP, but the trader can set a stop loss before the end of the trend when the median band color changes from green to purple.

Downtrend from Median Indicator

The Median indicator can be used by traders to identify a downtrend in the market. This indicator focuses on predicting market trends where market trends are an important factor that must be analyzed. This indicator shows the median band of purple color which indicates the market trend is downtrend. This happens because the price movement crosses and below the median band. At this moment, the trader can place a sell order because the purple band provides a sell signal for the trader within a certain period of time. A downtrend indicates that sellers are controlling the price so the price is showing a decrease.

Based on the chart above, the XMR/USDT market shows a downward price movement over a certain period of time. The Median indicator shows a purple median band which indicates the market is in a downtrend. This happens because the price movement crosses and below the median band. Traders can place sell orders as long as the downtrend is confirmed within a certain range as I have marked. There is no fixed reference for setting SL and TP, but the trader can set a stop loss before the end of the trend when the median band color changes from purple to green.

Identifying fake signals with Median indicator

In the world of cryptocurrencies, technical indicators do not provide 100% correct or accurate analysis because every technical indicator has false signals. The median indicator can be relied on by traders to filter out false signals by combining it with other indicators such as the RSI. The combination of the Median and RSI indicators will increase the accuracy of the analysis where indications of trend reversal from the RSI indicator can be avoided by confirmation the market trend that shows an uptrend or downtrend by the Median indicator.

The RSI indicator is a momentum indicator that serves to show the current market situation is overbought or oversold. An RSI value above 70 indicates an overbought moment and gives traders a sell signal because an indication of a downtrend reversal. An RSI value below 30 indicates an oversold moment and provides a buy signal to traders because an indication of an uptrend reversal. The Median indicator can be relied on by traders to filter out false signals from the RSI indicator where the overbought or oversold moment is false if the Median indicator confirms an uptrend or downtrend based on the green or purple median band.

Based on the chart above, the XMR/USDT market shows an upward price movement over a certain period of time. The RSI indicator shows a value above 70 or overbought which indicates sell signal because an indication of a downtrend reversal. The Median indicator shows a green median band which indicates the market is in an uptrend. In this case, the median indicator filters out false signals from the RSI indicator because there is no trend reversal and the price movement still shows an increase.

Open two demo trades, long and short, with the help of a median indicator or combination that includes a median indicator

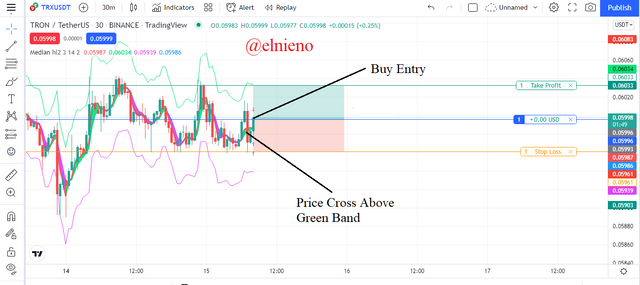

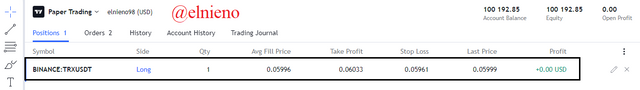

Buy Trade TRX/USDT

Based on the chart above, the TRX/USDT market shows an upward price movement and a possible uptrend. Here I use the Median indicator with a 30m timeframe. This indicator shows the green median band that changes color after the purple median band. This indicates that the downtrend has ended and indicates the beginning of the uptrend. This happens because the price movement crosses and above the median band.

I placed a buy entry at $0.0599 on the next bullish candle. I set stop loss level at $0.05987 and take profit level at $0.06033 with a 1:1 ratio even though there is no fixed reference for setting SL and TP because trend reversal is confirmed when the median band color changes. Here I predict the market will experience an uptrend reversal and show continued upward price movements because buyers are controlling the current price. I executed the TRX/USDT trade on the tradingview platform and the details of the transaction are as follows:

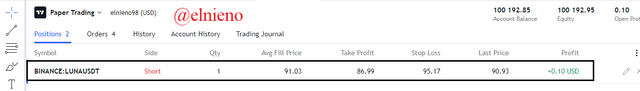

Sell Trade LUNA/USDT

Based on the chart above, the LUNA/USDT market shows a downward price movement and a possible downtrend. Here I use the Median indicator with a 1h timeframe. This indicator shows the purple median band that changes color after the green median band. This indicates that the uptrend has ended and indicates the beginning of the downtrend. This happens because the price movement crosses and below the median band.

I placed a sell entry at $91.08 on the next bearish candle. I set stop loss level at $95.13 and take profit level at $87.03 with a 1:1 ratio even though there is no fixed reference for setting SL and TP because trend reversal is confirmed when the median band color changes. Here I predict the market will experience a downtrend reversal and show continued downward price movements because sellers are controlling the current price. I executed the LUNA/USDT trade on the tradingview platform and the details of the transaction are as follows:

Conclusion

The Median indicator is one of the technical indicators that traders can use and rely on to analyze market trends. The market trend is a very important factor so analysis of uptrend and downtrend will help traders in carrying out a good trading strategy. The Median indicator shows an uptrend or buy signal with a green median band and a downtrend or sell signal with a purple median band. A trend reversal can be identified when a change in the color of the median band occurs on the chart. This indicator can also be combined with other indicators to filter out false signals. This will help every trader to provide trading signals and execute profitable trades.