Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @imagen that talking about Exchange Coins. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it.

Perform a complete analysis of the currency of some exchange

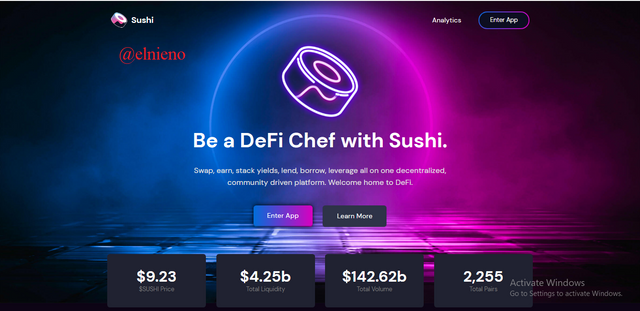

SushiSwap (SUSHI) is the native token of a decentralized exchange that has been very well known to cryptocurrency market participants. It is an Ethereum based smart contract platform. This platform allows users to carry out transactions in the form of swap, earn, stack, yield, lend, borrow, and leverage in decentralized exchange. This is one of the DeFi projects that aims to provide flexibility for users to control and develop their assets without any intermediaries or third parties. The presence of this platform certainly has a positive impact in the world of cryptocurrencies.

The presence of SushiSwap (SUSHI) in the cryptocurrency ecosystem is to improve the quality of another DeFi project that has been launched previously, namely UniSwap. This platform allows users to swap cryptocurrencies quickly and each user will get SUSHI for participating in donating their assets to the liquidity pool. The way this platform works can be seen from the transactions carried out by users where each transaction has a 0.3% fee. This 0.3% fee is divided into 2 of which 0.25% is for liquidity providers and 0.05% will be converted into SUSHI which will be distributed to all token holders. This is an advantage that SUSHI token holders have because the assets will continue to increase every time there is a transaction on the platform.

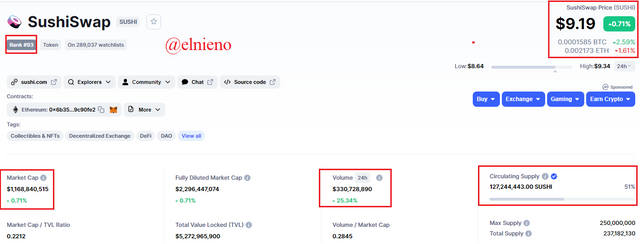

Based on the chart and data above, SushiSwap (SUSHI) has good fundamental analysis in cryptocurrency market. SUSHI is ranked 93th on the crypto market list. The price of the SUSHI is $9.19. Market cap is $1.168.840.515. Volume is $330.728.890. Circulating supply is 127.244.443 SUSHI. The SUSHI price chart shows significant growth and development since its launch until now. This shows that SUSHI has good potential to be used as investment assets and every SUSHI token holder will get a token distribution from every transaction that occurs on the platform.

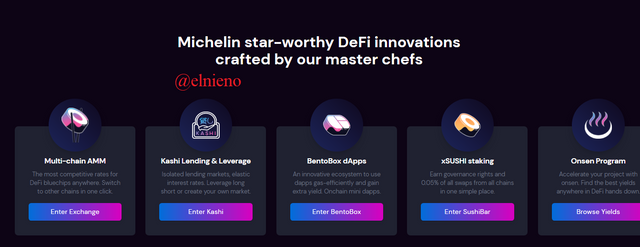

Based on the picture above, you can see that SushiSwap (SUSHI) has good functions and characteristics where all the developers or master chefs of this platform have made significant innovations and developments. This is evidenced by having Multi-Chain AMM, Kashi Lending & Leverage, BentoBox dApps, xSUSHI Staking and Onsen Programs. By relying on these various features, I think this is a very promising DeFi project because of its advantages that can compete with other DeFi projects that focus on different fields in the cryptocurrency ecosystem.

Make a purchase equivalent to at least 10 US dollars of the currency you explained above. You must make some move with that currency within the exchange that created that currency. State the reasons why you chose that option (operation) on that platform

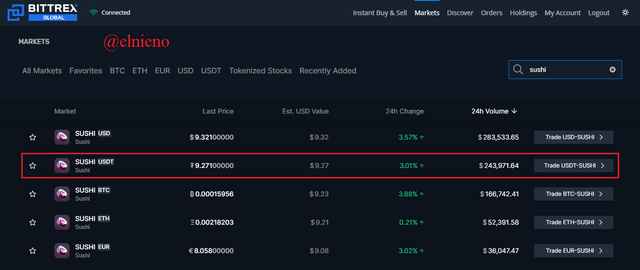

Here I will make a purchase SushiSwap (SUSHI) on Bittrex.

Here I select the Market feature. I fill in SUSHI on the search field. I choose the DOT/USDT.

Market Feature from Bittrex Here the SUSHI chart, buy and sell options display will appear. I choose the Buy option.

Buy Order from Bittrex Here I choose the Market order. I filled in the amount of 10 USDT. I click place buy order SUSHI.

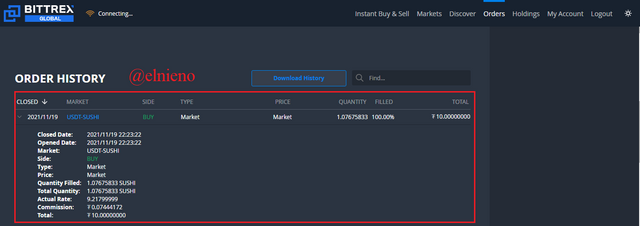

Buy Order from Bittrex Here order history and all the details of transactions is available.

Details of Transactions from Bittrex

The reason I did SushiSwap (SUSHI) buying operation is because I believe SushiSwap (SUSHI) has good fundamentals to be an investment asset. SushiSwap (SUSHI) is one of the good DeFi projects where I will benefit from the distribution of SUSHI tokens every time a user makes a transaction. Here I use Bittrex to buy SushiSwap (SUSHI) because Bittrex has a good reputation. I usually use Bittrex to store and manage my cryptocurrency assets. In my opinion, the functions, characteristics, features, security, appearance and liquidity on Bittrex have good qualities. At Bittrex I can increase my asset investment and carry out routine trading to earn profits.

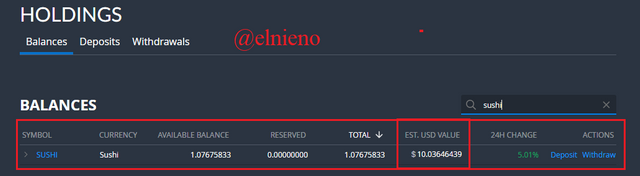

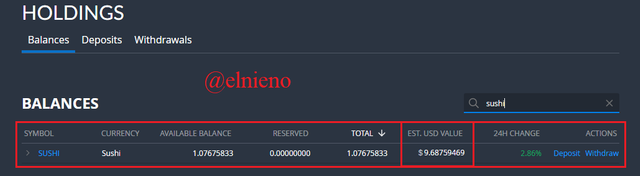

Show the return on investment in time spans of 0, 24, and 48 hours from the time you bought

After keeping SushiSwap (SUSHI) on the exchange for 24 hours after the buy order, I experienced a small loss of around $0.4. Based on the picture above, it can be seen that I have 1.07675833 SushiSwap (SUSHI) which is worth $10.03646439. After 24 hours with the same amount, SushiSwap (SUSHI) experienced a price drop in the market to $9.68759469. As long as the market is still not showing a bullish phase, I will continue to hold SushiSwap (SUSHI) for profit. Therefore I had to do a technical analysis to place a sell order at the right time.

Based on the chart above, the technical analysis that I did on Sushiswap (SUSHI) and Bitcoin (BTC) showed the price movement following the correlation with Bitcoin. This is already natural because Bitcoin has proven to be able to dominate the cryptocurrency market. When viewed broadly, you can see the prices movement of Sushiswap (SUSHI) and Bitcoin (BTC) almost the same. It is also proven by the 24-hour span after the order of buying Sushiswap (SUSHI), the bullish candle formed on the market after experiencing a bearish phase. Bitcoin domination can affect many other altcoins in the world of cryptocurrency.

What is Futures Trading?

Futures trading is one of the trading strategies carried out by traders by buying or selling cryptocurrency assets at a predetermined price. In this case, the trader must be able to predict the price in the hope of getting a big profit. Traders can place a buy order when the price is predicted to go up and can place a sell order when the price is predicted to go down. This trading strategy is carried out based on an agreed contract where the trader must win to make a profit and if loses the trader will suffer a loss. Traders must carry out technical and fundamental analysis and must have good risk and financial management.

Futures trading carries a very high risk because the invested cryptocurrency assets will be staked based on the trader's predictions. This type of trade is usually run for a short period of time due to the highly volatile nature of cryptocurrencies over time. Price movements and changes can go up and down very quickly. Here the trader must analyze the market and consider the best decision to be taken because large profits will be obtained if operations go according to plan and large losses will be obtained if operations go against plan.

What is the Margin Market?

Margin market is one of the trading strategies that traders can do if they have little capital and can rely on loans from third parties or exchange platforms for the trading process. Traders will enter the cryptocurrency market with a larger margin than their main capital. It aims to get a large profit if the market moves according to the operations carried out by the trader. On the other hand, the trader will get a big loss if the market moves against the trader's operation. This is a type of trading that has a high risk so that technical and fundamental analysis and trading experience in the market will be very helpful for traders.

Margin trading can be done with leverage based on the trader's capital to maximize profits. Traders can leverage 3x, 5x, 10x and 100x on the exchange platform according to the strategy and predictions of the cryptocurrency market. In the process of trading using the margin market, traders must first deposit and lock asstes or capital which will be multiplied according to the selected leverage ratio. In this case, loans and leverage are the keys that traders should consider well because the cryptocurrency market is very volatile and all assets or capital can be lost.

What happens to the cryptocurrencies of an exchange when they suffer from a hack or turn out to be a fraud?Present at least 2 real-life examples

Coincheck

Coincheck is one example of exchange hacking in the cryptocurrency world. This exchange was hacked by an unknown hacker in Japan on January 26, 2018. This exchange has been around since 2014 but after the hack its reputation has dropped a bit. The Coincheck team confirmed the theft of 58 billion yen or $533 million in a cryptocurrency asset called NEM. The error comes from Coinchcek because they ignored the use of smart contracts with multi-signature functionality. In the world of cryptocurrencies, exchanges should have a good security system and follow all procedures concerning cryptocurrencies.

As a result of the Coincheck hack, all those involved with it suffered unavoidable consequences. This is evidenced by the accounts of all users being frozen for more than a week. The good news is that after the hack, the Coincheck team said they would compensate $400 from their own funds. This will indirectly benefit users who have lost their investment assets. Based on the cryptocurrencies market, the NEM value also experienced an influence although it was not significant.

Kucoin

Kucoin is one example of exchange hacking in the cryptocurrency world. This exchange was hacked on September 25 for a total theft of $285 million. This is a huge theft for this exchange which has such a good reputation. After exploring the problem and finding the best solution, they provide good news for all users. The Kucoin team managed to recover $240 million of stolen funds. This amount was obtained thanks to the efforts of the Kucoin team and its exchange partners who managed to raise $222 million and $17.45 million raised from law enforcement and security agencies. The remaining $45.55 million is with KuCoin hackers.

As a result of the Kucoin hack, everyone involved with it suffered unavoidable consequences. This is evidenced by the decline in the price of Kucoin (KCS) in the cryptocurrency market. This hack had a negative impact on the market in a period of about 4 months. All users also suffered losses even though a lot of funds had been compensated by the Kucoin team. Indirectly, Kucoin(KCS) investment will decline due to loss of confidence and make traders think again and again to invest.

Conclusion

In the world of cryptocurrency, exchanges play an important role in providing a place for investors and traders to invest and trade cryptocurrency assets. The use and adoption of exchange is very high so that there are many exchanges that are present in the ecosystem with different functions and characteristics. One of the exchanges I discuss here is SushiSwap (SUSHI) which is the native token of a decentralized exchange that runs on Ethereum-based blockchain with good smart contracts. The platform provides services for users to swap, earn, stack, yield, lend, borrow and leverage cryptocurrencies.

The exchange allows users to execute futures and margin trading strategies to maximize profits. Any trader can use the leverage feature to increase cryptocurrency assets by by predicting prices and markets. Futures and margin have a high risk because large profits will be obtained if operations go according to plan and large losses will be obtained if operations do not go according to plan. Therefore, several factors such as analysis and asset management need to be carried out by traders to support trading process in the cryptocurrency market.