Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @reminiscence01 that talking about Understanding Trends. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it.

What do you understand by a Trending Market?

The cryptocurrency market is known for its volatility which shows the movement and changes in asset prices over a certain period of time. The main factor that a trader can analyze and observe on a trading chart is the market trend which shows the current state of the asset. This can be proven by the term trending phase or a ranging phase. If the market is in an uptrend, this shows that the price of cryptocurrency assets is going up and if the market is downtrend, it shows that the price of cryptocurrency assets is going down. And if the market is ranging then this shows the price is at the bouncing limit between support and resistance levels.

A trending market is a movement in the price of a cryptocurrency asset that moves up or down within a certain period of time. Some indications can be analyzed by traders during an uptrend market by looking at the price closing higher than the previous high. On the other hand, during a downtrend, the price closes lower than the previous low. As a skilled trader, an understanding of market trends is very useful to place entry positions in the direction of the market and avoid going against the direction of the market. It will also assist the trader in identifying the end of the trend to place an exit position from the market.

Analysis of market trends is something that must be done by traders because this is one of the technical analysis that helps traders predict the price of a cryptocurrency. The market trend is an important factor that must be properly analyzed by looking at up and down price movements of assets that will indicate traders to place buy and sell orders at the right time. This will have a positive impact on the trading process so as to increase profits and minimize losses.

What is a Bullish and a Bearish Trend?

Bullish Trend

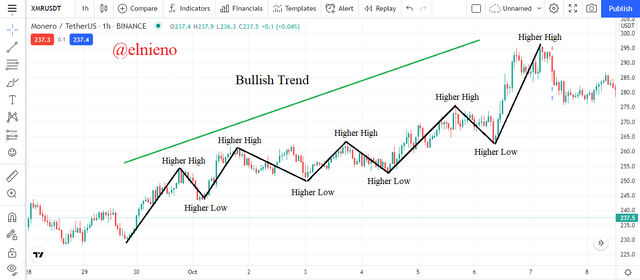

Based on the chart above, the XMR/USDT market is in a bullish trend which indicates that the price movement has been steadily rising for a certain period of time. One of the factors that influence the bullish trend is the increasing volume of XMR/USDT asset trading where many traders place buy orders in the market. In this case, the demand for the XMR/USDT asset increases as long as the market is in a bullish trend. During a bullish trend, traders can place buy or sell orders according to their respective trading strategies and specifically the XMR/USDT asset owner has a high level of profit and a low level of risk of loss.

Bearish Trend

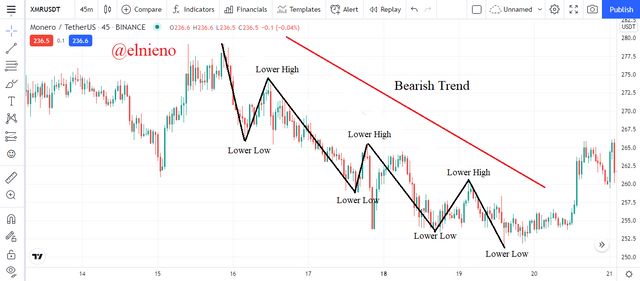

Based on the chart above, the XMR/USDT market is in a bearish trend which indicates that the price movement has been steadily falling for a certain period of time. One of the factors that influence the bearish trend is the increasing volume of XMR/USDT asset trading where many traders place sell orders in the market. In this case, the supply for the XMR/USDT asset increases as long as the market is in a bearish trend. During a bearish trend, traders can place buy or sell orders according to their respective trading strategies and specifically the XMR/USDT asset owner has a low level of profit and a high level of risk of loss.

Explain the Market Structure identification and give an example of each of them. Do this for a bullish and a bearish trend

Bullish Trend

Based on the chart above, the XMR/USDT market is in a bullish trend and traders can analyze it based on the market structure formed on the chart. The main indication is the price showing formation of Higher High and Higher Low. This formation is formed in the market because it is influenced by high trading volume where many buy orders are executed by traders so that they are able to push prices higher. The existence of a small pullback during a bullish trend is a retracement which indicates the price will continue to increase. The price movement of XMR/USDT increases gradually over time. During a bullish trend, traders can place entry positions and get profit. The market structure that is formed can be used as a reference by traders to determine the current market trend.

Bearish Trend

Based on the chart above, the XMR/USDT market is in a bearish trend and traders can analyze it based on the market structure formed on the chart. The main indication is the price showing formation of Lower High and Lower Low. This formation is formed in the market because it is influenced by high trading volume where many sell orders are executed by traders so that they are able to push prices lower. The existence of a small pullback during a bearish trend is a retracement which indicates the price will continue to decrease. The price movement of XMR/USDT decreases gradually over time. During a bearish trend, traders can place exit positions and eliminate loss. The market structure that is formed can be used as a reference by traders to determine the current market trend.

Sideways Trend

Based on the chart above, the XMR/USDT market is in a sideways trend and traders can analyze it based on the market structure formed on the chart. This indicates that there is no bullish or bearish trend for a certain period of time. The Ranging phase shows the price is at the bounce limit between support and resistance levels. The price movement of XMR/USDT, which tends to be stable, occurred before the price decline in the market.

Explain the Trendlines identification and give an example of each of them. Do this for a bullish and a bearish trend

Bullish Trend

Based on the chart above, the XMR/USDT market is in a bullish trend and traders can analyze it based on trendlines that can be made on the chart. The trend line shows the price movement based on the line drawn and combine the 2 low points formed on the chart. In this case, the XMR/USDT price is moving above the trendline and the price reaching the trendline can be used as a support level. When the price reaches the trendline or support level then the price will bounce again and here the trader can place an entry position to get profit until the price changes and breaks the trendline. The trendline created can be used as a reference by traders to determine the current market trend.

Bearish Trend

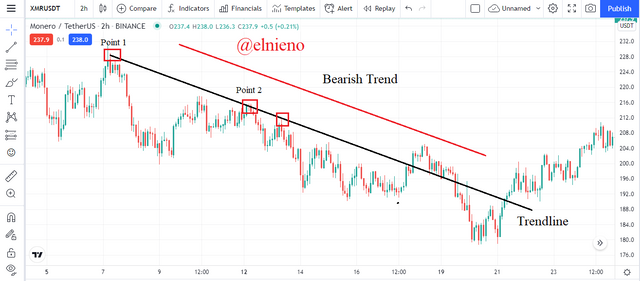

Based on the chart above, the XMR/USDT market is in a bearish trend and traders can analyze it based on trendlines that can be made on the chart. The trend line shows the price movement based on the line drawn and combine the 2 high points formed on the chart. In this case, the XMR/USDT price is moving below the trendline and the price reaching the trendline can be used as a resistance level. When the price reaches the trendline or resistance level then the price will bounce again and here the trader can place a exit position to eliminate loss until the price changes and breaks the trendline. The trendline created can be used as a reference by traders to determine the current market trend.

Explain trend continuation and how to spot them using market structure and trendlines. Do this for a bullish and bearish trend

A trend continuation can be identified by a trader by observing every movement and price change that occurs during a bullish or bearish trend. Market trends do not always up or down constantly without any fluctuations. If you look at the chart, the pattern that is formed does not always form a straight line, but the zig-zag pattern also often occurs. This is a retracement because there are traders who take profits during the trend. This is an indication of a strong trend continuation.

During a strong trend continuation, the presence of a pullback point can be a good time for traders to place entry positions in the market. For the bullish trend, the price movement will break the previous resistance and for the bearish trend, the price movement will break the previous support. Understanding and analyzing trend continuation is very helpful for traders to place orders to buy or sell cryptocurrency assets at the right time and know when a trend reversal will occur in the market.

Trend continuation using market structure

Based on the chart above, the continuation of the XMR/USDT market trend can be analyzed by observing the market structure during a bullish or bearish trend. During a bullish trend, the XMR/USDT price always creates a higher high and a higher low. A price retracement is also formed which indicates the continuation of the strong bullish trend. During a bearish trend, the price of XMR/USDT always creates a lower high and a lower low. A price retracement is also formed which indicates the continuation of the strong bearish trend.

The criteria for continuation of the bullish trend are as follows:

- The new low is not lower than the previous low.

- The new high is higher than the previous high.

The criteria for continuation of the bearish trend are as follows:

- The new low is not higher than the previous low.

- The new high is lower than the previous high.

Trend continuation using trendlines

Based on the chart above, the continuation of the XMR/USDT market trend can be analyzed by creating a trendline during a bullish or bearish trend. During a bullish trend, the trend line is drawn and combines the 2 lows formed on the chart. The XMR/USDT price is moving above the created trend line and the price reaching the trend line serves as a support level. During a bearish trend, the trend line is drawn and combines the 2 highs formed on the chart. The XMR/USDT price is moving below the created trend line and the price reaching the trend line serves as a resistance level.

Pick up any crypto-asset chart and Is the market trending and What is the current market trend?

DASH/USDT Chart

According to the chart above, the DASH/USDT market is showing a bearish trend. I can identify market trends based on the market structure formed on the chart. The DASH/USDT price shows Lower High and Lower Low which are important points and criteria for a bearish trend. The existence of an upward retracement or pullback that occurs during a bearish trend indicates that the price will continue to decline gradually from time to time. This indicates a continuation of the strong bearish trend in the DASH/USDT market.

Conclusion

In the world of cryptocurrencies, cryptocurrency asset price volatility always occurs in the market. Trading strategy and analysis are important factors to make good trading results. One of the technical analysis that can be done is market trend analysis which really helps traders in observing price movements and changes within a certain period of time. Analysis of market trends using market structures and trendlines is great for providing accurate analysis when the market is in a bullish or bearish trend. Market trend analysis is very helpful for traders to predict the price of cryptocurrency assets so that traders can place entry or exit positions to earn profits and minimize losses.

My Previous Homework Post Link :

https://steemit.com/hive-108451/@elnieno/understanding-trends-steemit-crypto-academy-s5w1-homework-post-for-reminiscence01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit