Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @kouba01 that talking about Cryptocurrency Trading with Bollinger Bands. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it following 6 points.

Define the Bollinger Bands indicator by explaining its calculation method, how does it work? and what is the best Bollinger Band setup?

Bollinger Bands indicator is a very useful indicator for traders in conducting technical analysis. This is a tool in the form of 3 lines showing the upper line is called the upper band and the lower line is called the lower band and the middle line is called the middle band.

The 3 lines indicate a volatile market condition by providing an indication of a safe price in the middle, a resistance price above, and a support price below. Bollinger Bands indicator is best used with a 20-day moving average. This is very helpful for traders in analyzing all the possibilities that may occur in the crypto market.

How Bollinger Bands work is very simple and suitable to apply. The calculation method used aims to find the Moving Average.

Moving Average = Sum of prices over x days/number of days

Moving average calculation is the first step that must be done by traders. As per John Bollinger's instructions, the 20-day moving average is the best. Although traders can use a 10 to 50 day moving average for certain purposes. This is the right way and strategy to get Bollinger Bands by calculating the moving average of the security.

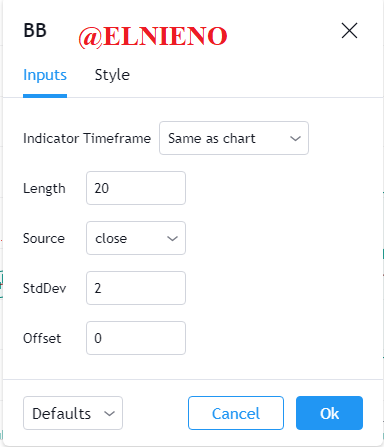

To support the analysis to be very accurate, the standard deviation parameter in Bollinger Bands is needed. The default is 2 standard deviations because it uses a 20-day moving average. However, this will be different if using a 10-day moving average, the standard deviation is 1.5. and if using a 50-day moving average, the standard deviation is 2.5.

To carry out the analysis according to plan, the best Bollinger Band settings are very influential. It is intended to add Bollinger Bands on the trading chart, set different periods, and choose the standard deviation.

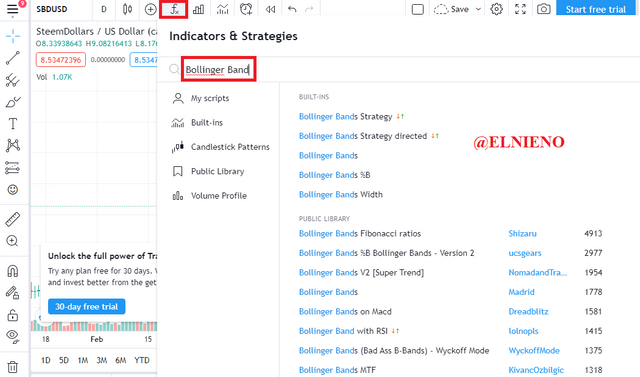

- Go to tradingview.com page and select a crypto you want to analyze.

- click "fx". Type "Bollinger Bands and select it.

- The chart shows the Bollinger Bands indicator.

- On the chart there are 3 lines showing the Upper Band (Green), Moving Average 20 (blue), and Lower Band (red).

- Click settings and select the period and standard deviation.

This Bollinger Bands setting is the best for traders. Where the use of 20-day moving average is followed by 2 standard deviations. The source is set close to use the closing price of the candle. The offset is 0 which indicates the number of candles in front of the chart.

What is a breakout and how do you determine it?

Technical analysis of a crypto is greatly helped by Bollinger Bands which are indicators of volatility. It has often happened in the crypto market that prices go up and down. With the Bollinger Bands indicator traders can know the state of the market when the band widens it indicates the volatility increases and when the band shrinks it indicates the volatility decreases.

On this occasion I will analyze SBD/USD pair. In a period of 5 months, the chart shows the price going up and down which shows the Bollinger Bands line to widen and shrink several times. This is evidenced by the marks I have given on the chart. Where in 5 months volatility is more often increased than decreased.

Breakout will occur when the candle exits the Bollinger Bands. This will occur after shrinkage or very thin bands. On the mark I have given on the chart, Breakout has occurred after 1-3 candles out of the Bollinger Bands which began to indicate a widening of the band and a bullish phase in the market. The breakout has occurred and will continue towards the high resistance price that may be reached.

Technical analysis must be carried out perfectly. Bollinger Bands can also help in analyzing trend reversals that occur in the market. Trend reversal occurs when more than one candle is outside the band. This is influenced by prices that rose significantly. Then the first candle that re-enters the Bollinger Bands indicates a possible trend reversal as the marks I have given on the chart.

How to use Bollinger bands with a trending market?

The main purpose of trading by traders is to make a profit. Crypto market trends are definitely connected to each other, namely uptrend and downtrend. This market trend is the key to determine when is the right time to buy and sell crypto. Bollinger bands can determine the price points of resistance and support so as to help traders in analyzing market trends.

On the mark I have given on the chart, I have determined the points that indicate the overbought market. Overbought market occurs when the price rises to the highest price due to low circulation and sellers sell SBD/USD for a large profit. The Bollinger bands line was at a temporary high which then dropped back down. This is because there has been a phase change from bullish to bearish. This is the right time to sell.

On the other hand, the points that indicate the oversold market. Oversold market occurs when the price drops to its lowest price due to high circulation and then buyers start buying SBD/USD. The Bollinger bands line was at a temporary low which then rose again. This is because there has been a phase change from bearish to bullish. This is the right time to buy.

Bollinger bands also function in providing bullish / uptrend and bearish / downtrend signals. These are phases and trends that are interconnected. The two of them followed each other. An overall analysis of market trends in the long or short term can help traders determine buying and selling prices at the right time. Traders are expected to enter the buy list when the resistance price is highest and enter the sell list when the support price is lowest.

What is the best indicator to use with Bollinger Bands to make your trade more meaningful?

Bollinger Bands which have been very helpful for traders in the trading process can still be supported by other indicators such as RSI. The goal is to make trading analysis more meaningful and perfect. With all the tools and features that can be added as much as possible will increase the chances of success and minimize failure.

I think RSI is very suitable for use with Bollinger Bands because RSI can provide detailed and close chart results. RSI is very helpful in showing the rise and fall of prices in the market in depth. It can provide excellent accuracy and clarity making it very useful for traders. This can support Bollinger Bands which are more focused on providing an outline and broad price area. Therefore, both have functions, characteristics, focus, and advantages that support each other.

On the mark I have given on the chart, it can be seen that where the price of SBD/USD with Bollinger Bands forms a straight line and is in the lower area. However, RSI shows more detail and is close where the price is showing an increase and is in the high area. And also when the Bollinger Bands are on high lines and areas, RSI actually shows a decreases in price.

What timeframe does the Bollinger Bands work best on?And why?

I think Bollinger Bands work very well on all time frames. It's just a matter of wants and needs. All selected time frames are very suitable and are helped by using Bollinger Bands. This is proven because Bollinger Bands are the best tool and indicator for technical analysis by providing 3 bands that show safe prices, support and resistance within a certain period.

For me the timeframe that really helps me in analyzing SBD/USD prices is the 1-4 hour time frame. This helps me in analyzing prices in detail. I can see the price change every hour. Crypto is very volatile which makes prices go up and down unexpectedly, Bollinger Bands are needed as an indicator that indicates the market trend in a short time.

On the mark I have given on the chart, it can be seen that there is a downtrend followed by an uptrend. The chart shows the price of SBD/USD in 6 days. In this short time there have been 2 interconnected trends. Price changes every 1 hour with Bollinger Bands has helped me in analyzing market trends in a short time. This gives me more detailed information and data about the price, making it easier for me to carry out the trading process that brings profit in the future.

Review the chart of any pair and present the various signals giving by the indicator Bollinger Bands

Here I show SBD/USD chart with Bollinger Bands which provide several signals that help and make it easier for me to do the analysis. This is a very useful tool in providing a wide variety of signals with different purposes and functions.

Very Thin Bands Followed by a Breakout which shows a breakout when the candle breakout of the Bollinger Bands and starts to show a widening of the bands and a bullish phase in the market.

Sudden Exit of Bands Followed by a Reversal which shows a trend reversal when more than one candle is outside the bands. Then the first candle that reenters the Bollinger Bands indicates a possible trend reversal.

Shrinking Bands Volatilty Decreases which shows SBD/USD price is not volatile and fairly stable over a short period of time.

Widening Bands Volatilty Increases which shows SBD/USD price is very volatile and has increased or decreased significantly.

Oversold Market which shows SBD/USD price dropped to the lowest price due to high circulation and then buyers started buying.

Overbought Market which shows SBD/USD price rose to the highest price due to low circulation and then sellers started selling.

Downtrend followed by Uptrend which shows SBD/USD market trend continues to change in a short and unpredictable time.

Note : All the images in this post are from my screenshots on https://www.tradingview.com

Thank you for reading my blog, hope it will be useful for all of you.

CC :

@kouba01

@steemcurator02

Hello @elnieno,

Thank you for participating in the 8th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve an 8.5/10 rating, according to the following scale:

My review :

It seems that you did not understand the question, you asked what are the best settings for the Bollinger Bands indicator.

In the remaining questions, your answer was accurate and methodologically clear. Also your analysis of the various aspects was convincing.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professorr!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit