Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @cryptokraze that talking about Market Structure Break (MSB) Strategy to Trade Reversals. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it.

What do you understand about Market Structure?

Market structure is a state or pattern that gives an indication of rising, falling, or stabilizing cryptocurrency prices. Price volatility in the cryptocurrency market is the main factor that traders consider in buying or selling transactions. Market conditions will definitely change and are not always fixed from time to time. Where the market price will be above, below, or flat in a certain period of time. The market structure serves as a useful guide when it comes to cryptocurrency price analysis.

The movement or price change until it reaches a certain point can provide information about the support and resistance levels of a crypto chart. This is usually related to market trends which are usually categorized into 3 groups: uptrend, downtrend and sideways. This trend can be used by traders to determine the movement or action to be taken.

Market Structure for Uptrend

Based on the chart above, Uptrend shows movement or price changes that go up. There are various high and low points. The price continues to rise and fall slightly, price increases dominates the decline. This means that the previous resistance level turned into a support level and the current highest point is a resistance level.

Market Structure for Downtrend

Based on the chart above, Downtrend shows movement or price changes that go down. There are various low and high points. The price continues to fall and rise slightly, price decreases dominates the increase. This means that the previous support level turned into a resistance level and the current lowest point is the support level.

Market Structure for Sideways

Based on the chart above, Sideways shows a stable or fixed price movement or change. Prices continue to rise and fall but do not show significant movement or change. Price does not cross resistance or support levels. This means that the price fluctuates between support and resistance levels without any major ups and downs.

What do you understand about Lower High and Higher Low? Give Chart Examples from Crypto Assets?

Higher Low

When the market shows an uptrend, Higher Low is a low point that is formed higher than the previous low due to an increase in price. The simple thing is that based on the chart above there is a higher low when the price is showing an increase. This situation occurs when the price rises significantly and experiences a reversal or a slight decline in price. This is a pull back point. In chart analysis, it takes at least 2-3 higher lows to identify and confirm that the market is in an uptrend.

Lower High

When the market shows a downtrend, Lower High is a high point that is formed lower than the previous high due to a decline in price. The simple thing is that based on the chart above there are lower highs when the price is showing a decline. This situation occurs when the price drops significantly and experiences a reversal or a slight increase in price. This is a pull back point. In chart analysis, it takes at least 2-3 lower highs to identify and confirm that the market is in a downtrend.

How will you identify Trend Reversal early using Market Structure Break?

Identifying Trend Reversal early using MSB

In the world of cryptocurrencies, trend reversals will certainly occur within a certain period of time. Trend reversal early using market structure break can be used to gain profit and eliminate losses. It can be identified in the market when an uptrend starts to break then starts showing a downward reversal and vice versa. This can be seen and found by analyzing and reading the graph of a cryptocurrency.

Uptrend Reversal

In the cryptocurrency market there is no asset whose price will continue to rise forever. After experiencing a price increase in a certain period of time there will be a decrease. Uptrend reversal can be identified by traders and have indications such as based on the chart above.

- There is a lower high in an uptrend. This point will occur and can be seen after the higher high.

- An identifiable neckline created after the lower high.

- There is break of neckline.

The 3 factors and circumstances above are clear clues and indications to realize and assume early that the uptrend has ended.

Downtrend Reversal

In the cryptocurrency market there is price changes will definitely happen. After experiencing a price decrease in a certain period of time there will be an increase. Downtrend reversal can be identified by traders and have indications such as based on the chart above.

- There is a higher low in a downtrend. This point will occur and can be seen after the lower low.

- An identifiable neckline created after the higher low.

- There is break of neckline.

The 3 factors and circumstances above are clear clues and indications to realize and assume early that the downtrend has ended.

Explain Trade Entry and Exit Criteria on any Crypto Asset using any time frame of your choice

Trade Entry and Exit Criteria

In the world of cryptocurrency trading, the use of market structure break can be very useful for determining the right time and step to execute an entry and exit trade. Before doing so, it's good to do an analysis based on the right time frame and prevention or other rules. Several criteria and factors need to be considered in order to gain profit and reduce losses.

A. Sell Entry

Based on the chart above, the best time to make a sell entry is when the market is in an uptrend. Some of the criteria and steps that must be taken are:

- Select and define the right and suitable time frame on the chart.

- The market is in an uptrend.

- There is a lower high after higher high.

- The trend reversal has started.

- Define and identify the neckline.

- Break of the neckline. Market structure break has occurred.

- The candle indicates a downtrend or a bearish phase.

- The right time for sell entry.

B. Buy Entry

Based on the chart above, the best time to make a buy entry is when the market is in an downtrend. Some of the criteria and steps that must be taken are:

- Select and define the right and suitable time frame on the chart.

- The market is in a downtrend.

- There is a higher low after lower low.

- The trend reversal has started.

- Define and identify the neckline.

- Break of the neckline. Market structure break has occurred.

- The candle indicates an uptrend or a bullish phase.

- The right time for buy entry.

C. Take Profit and Stop Loss

In the world of cryptocurrency trading, the determination of take profit and stop loss has an important role and factor that can affect trading in terms of getting profit and reducing losses. In order to maintain and secure cryptocurrency assets while making a profit, the determination of the stop loss and take profit ratios depends on the risk of the trade. Usually traders use a 1:2 or 1:1 ratio as the best ratio.

Place 2 demo trades on crypto assets using Market Structure Break Strategy. You can use a lower timeframe for these demo trades

TRX/USDT (5 Minute Timeframe)

Here I can see and run the buy entry criteria. By providing a stop loss and take profit ratio of 1:2, relying on a 5 minute timeframe, determining the neckline and break market structure, I can predict a price increase that will be profitable.

| Trade | Price |

|---|---|

| Buy | 0.06186 |

| Take Profit | 0.06216 |

| Stop Loss | 0.06171 |

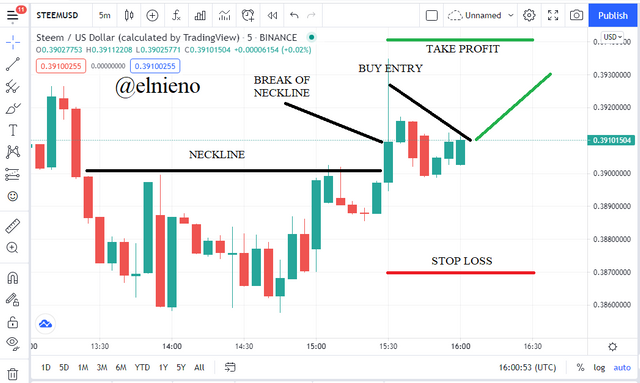

STEEM/USD (5 Minute Timeframe)

Here I can see and run the buy entry criteria. By providing a stop loss and take profit ratio of 1:2, relying on a 5 minute timeframe, determining the neckline and break market structure, I can predict a price increase that will be profitable.

| Trade | Price |

|---|---|

| Buy | 0.39101 |

| Take Profit | 0.39301 |

| Stop Loss | 0.39001 |

Conclusion

Market Structure Break (MSB) Strategy to Trade Reversals is very useful for traders in analyzing and reading price charts of a cryptocurrency. This is a very appropriate way and strategy to get profit and reduce losses. By relying on a combination of various indicators will provide satisfactory results for traders. The importance of seeing and understanding market trends is one of the keys. Determining the right time for entry and exit trades also requires the right criteria and steps. All of this is good knowledge to explore and apply to provide valuable experience.