Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @allbert that talking about Psychology and Market Cycle. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it.

Explain FOMO, Wherein the Cycle and Why

FOMO (Fear Of Missing Out) is a situation that involves the feelings and emotions of a trader who is afraid not to participate and is afraid of losing momentum when he wants to invest and buy crypto assets. Usually this situation occurs when the price of crypto assets rises significantly and is in an uptrend in the crypto market. Often traders only see the positive things that have been experienced by other traders so they try to get the positive impact as well.

These feelings and emotions arise only to encourage traders to make investment and buying decisions without clear calculation and analysis. This is because traders are afraid of missing the train that has been followed by many other traders and participants who have made profits. This actually causes traders to make bad or detrimental decisions because they have made investments and purchases at a late and inappropriate time.

Generally, FOMO occurs and is carried out by many new traders who are new to and involved in the crypto world. Of course, beginner traders are much different from professional traders who still really need a lot of experience in terms of making profits and minimizing losses. New traders often make investments for reasons and emotions that lead only to profits and the price of crypto assets goes up, so they get caught up in uncontrollable emotions and immature thoughts.

This can be proven by the mistakes of new traders who make investments at the wrong time where the asset price has been high in a certain period of time and the end of the bullish phase is near. At the same time experienced traders have taken advantage so that the price of these crypto assets has decreased.

As an illustration and example from the chart above, a new trader gets information about the price of BTC/USD which continues to rise and is in an uptrend in the crypto market. But a sense of disbelief is still in the mind of this trader when the price is around $28.000. Over time the price of BTC/USD continued to rise significantly and made this trader have hope and start to believe when the price was around $40.000 - 50.000. In the belief phase, this trader has already been considered FOMO.

Then when the price of BTC / USD experiences price volatility which shows the price goes down and rises again to a higher area, then emotion occurs when the price reaches around 55.000. This is because many other traders have made profits and these new traders are encouraged to invest and buy BTC/USD at a time that is too late and not right. The price of BTC/USD continued to rise until it reached a high of around $64.000 which made this trader feel euphoric in investing in crypto assets. FOMO has left some traders with a negative impact in the crypto world.

Explain FUD, Wherein the Cycle and Why

FUD (Fear, Uncertainty, Doubt) is a situation involving the feelings and emotions of a trader who is afraid of losing big profits and has lost momentum when the price of a crypto asset market conditions move in the opposite or unwanted direction. Usually this situation occurs when the price of a crypto asset drops significantly and is in a downtrend in the crypto market. Often traders are feel negative things in the form of uncertainty and doubt from investing in crypto assets so that they make losses.

These feelings and emotions appear late after price changes occur within a certain period of time. Traders do not do a good analysis and reading of price changes on a crypto asset in the market. This causes them to make bad and detrimental decisions because the selling price of crypto assets has definitely decreased dearly and can be said to be cheap. Traders will feel panicked as crypto asset prices spiral out of control due to persistent doubts.

Generally, FUD occurs because of opinions and information submitted by some people who have influence in the crypto world. Submission of information regarding a crypto asset indicating the price will fall and discussing the percentage of its feasibility not to develop are factors that affect the emergence of fear, uncertainty and doubt about the potential of the crypto asset to develop. This makes many traders sell crypto assets at the same time which makes the price drop significantly.

As an illustration and example from the chart above, a new trader is experiencing satisfaction when the price of BTC/USD hits a high of around $60.000. Over time the price volatility occurred and resulted in a decrease in the price of BTC/USD in the near future after many experienced traders secured profits at the end of the bullish phase. Then this new trader felt anxiety and denied the price of BTC/USD which fell significantly when the price was around $50.000 - 40.000. In the anxiety phase, this trader has already been considered FUD.

Then this new trader panicked because the price of BTC/USD had gone out of control when it was around $35.000. FUD causes this trader to lose selling momentum at a good time and feel the loss. Then this trader experiencing depression when the BTC/USD price drops to a low of around $33.000. FUD has left some traders with a negative impact in the crypto world.

Choose Two crypto-asset, Explain in Which Emotional Phase of the Cycle and Why

SHIB/USDT

Based on the chart above, you can see that FOMO occurs and is followed by some traders because of the spread of the booming SHIB/USDT crypto asset, which is being discussed by many people and is believed to have good potential in the crypto world. About 3 months ago we all learned that SHIB/USDT is gaining popularity and is known by many people so the price has increased significantly. There are some traders who are trapped in FOMO due to seeing other people who have made profits within a certain period of time.

When the SHIB/USDT price started to show an increase, some traders were still in a phase of disbelief at the potential for this crypto asset to grow when the price was still around $0.0000061650. Over time, the price continued to rise until it experienced price volatility which made some traders in the hope phase when the price was around $0.0000150000. Then when the price managed to rise again after experiencing temporary volatility, some traders have entered the belief phase of the potential for this crypto asset to be better when the price is around $0.0000200000. In this phase, this trader has already been considered FOMO.

When the price of SHIB/USDT shows a significant increase in the market and sees that some other traders have made profits when the price is $0.0000300000, this is where some traders are in an emotional phase that makes them make investment decisions and buy at a late and inappropriate time. And when the price reaches its highest point, that's where some traders are in a euphoric phase that makes them happy about their investment when the price is $0.0000350000. But at the same time the bullish phase is about to end.

DOGE/USD

Based on the chart above, you can see that FUD occurs and is followed by some traders because the price of the DOGE/USD crypto asset dropped significantly from the highest it ever hit. Previously the price had gone up because DOGE/USD was reported and discussed by several social media due to a tweet from Elon Musk. But after a few months the price started to fall because DOGE/USD didn't have good fundamentals and people started to lose faith in the potential for this crypto asset to grow. There are some traders who get stuck in FUD because they are late and lose momentum when they want to sell the asset.

When the DOGE/USD price began to show a decline, some traders were still in the satisfaction phase because the assumption of crypto price volatility was common when the price was still in the $0.50000 range. Over time, the price continued to fall in the market so that some traders were in an anxiety phase when the price was around $0.45000. In this phase, this trader has already been considered FUD. Then when the price managed to go up a little but fell back down, some traders are in a denial phase because they are afraid and don't believe the price can go down continuously when the price is around $0.35000.

When the DOGE/USD price showed a significant decline in the market when the price was $0.25000, this is where some traders are in a panic phase which makes them make bad decisions and sell crypto assets at a late and inopportune time. And when the price reaches its lowest point, that's where some traders are in a depression phase that makes them despair and feel a loss when the price is $0.20000. This is a situation that can no longer be avoided by some traders.

Purchase of 1 Cryptocurrency in the Correct Market Cycle

In the current market situation, I chose the DOGE crypto asset. Based on DOGE's analysis, it has the potential to increase in price along with other crypto assets which are also in a bullish phase in the crypto market. That's why I chose to invest in DOGE.

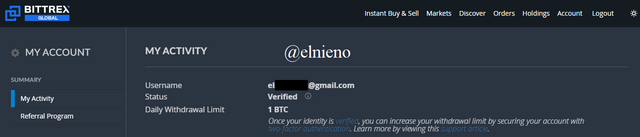

This is my verified Bittrex account.

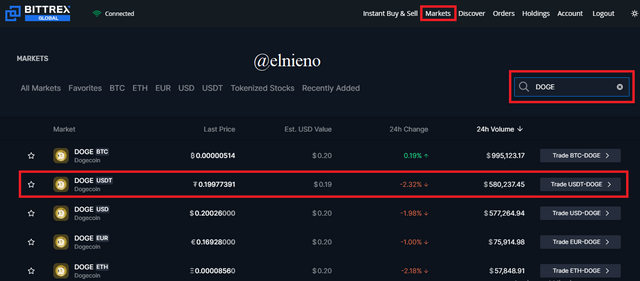

Select the market to buy DOGE . Then Type DOGE in the cryptocurrency search field. Here I choose the pair DOGE/USDT.

The DOGE graph display will appear. On the right side of the screen, there are Buy and Sell options. Here I choose the Buy option. Then I choose the market price for the buying process.

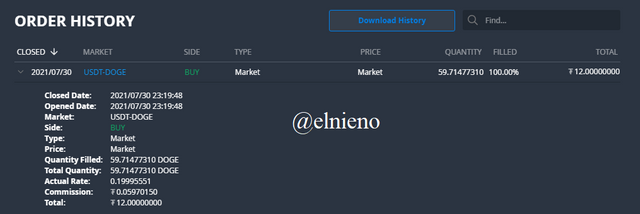

I filled in the amount of 12 USDT that I wanted to trade. After placing a buy place order, the system will ask for further market buy confirmation. Here I can see purchase details. Then I chose to confirm buy order.

The purchase of DOGE has been successful. Purchase details can be seen in the image below.

Conclusion

Psychology and Market Cycles are deeply embedded in the psyche of cryptocurrency traders. This is a very important factor and has a big influence on the success of investing and trading. All positive impacts that are on the crypto market should be accepted and all positive impacts should be avoided. Situations and time must be maximized properly in order to reap profits and minimize losses. FOMO and FUD are emotions some traders may experience. Good experience and analysis are needed in the cryptocurrency world.

Hello, @ Thank you for participating in Steemit Crypto Academy season 3 week 5.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professoorr!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit